Ignoring Risk in AIFs? Even a Small Market Shift Can Trigger Major Losses

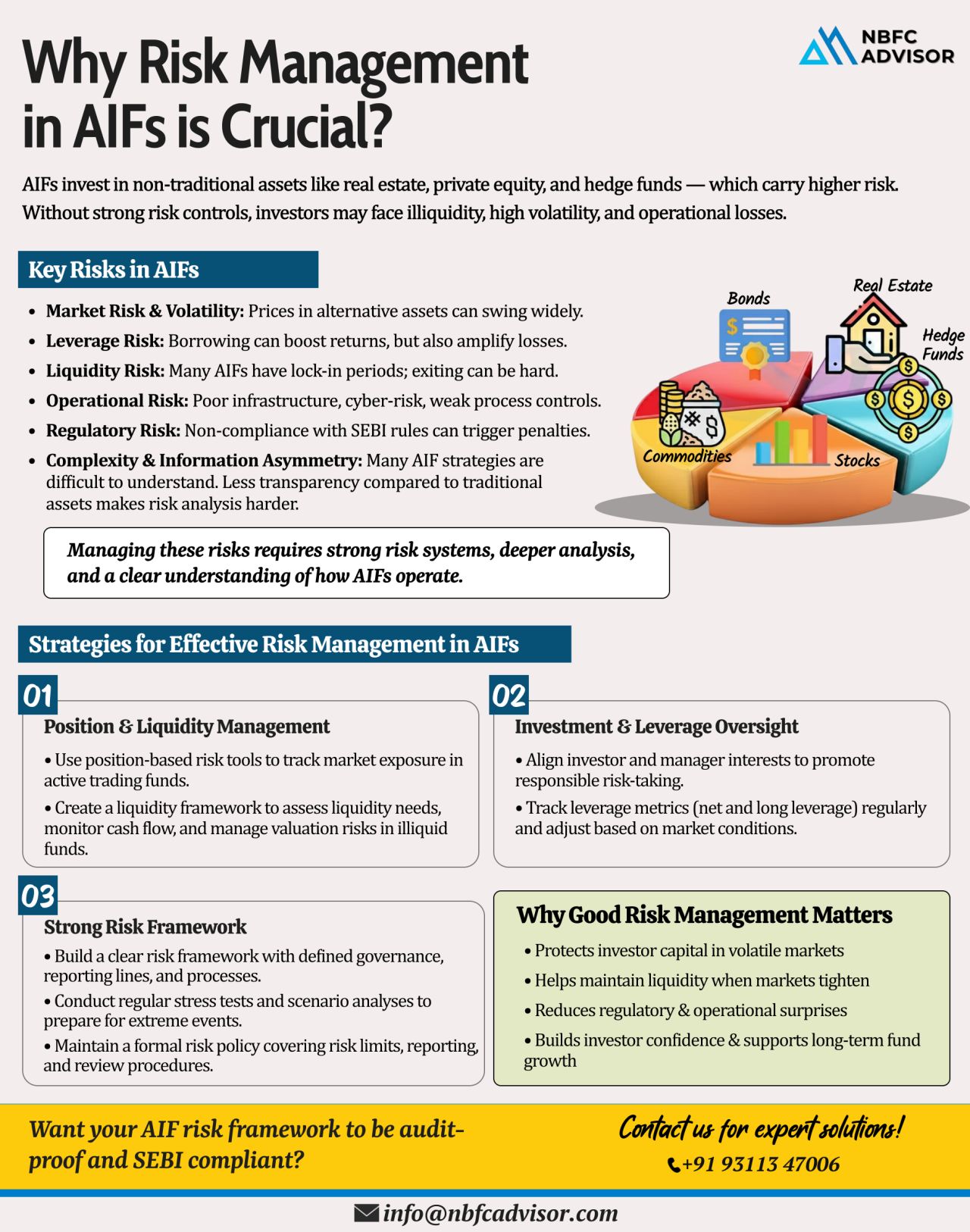

Alternative Investment Funds (AIFs) are growing rapidly in India — from private equity and venture capital to hedge-style Category III funds. But with higher returns comes higher risk, and ignoring these risks can quickly lead to severe financial loss, regulatory action, and investor dissatisfaction.

In a volatile market, even a small shift can disrupt performance. That’s why strong risk management isn’t optional — it’s essential.

Biggest Risk Challenges in AIFs

1. Sharp Market Swings

AIFs often invest in high-beta, concentrated, or illiquid assets that react sharply to market volatility.

Without real-time monitoring, funds can suffer steep drawdowns.

2. High Leverage Exposure

Some AIF categories use leverage to boost returns.

While leverage amplifies gains, it also magnifies losses, making risk buffers and stress testing critical.

3. Lock-ins & Liquidity Gaps

Investors may face long lock-ins while underlying assets are not always liquid.

This mismatch creates redemption pressure, cash-flow issues, and operational risk.

4. Weak Internal Controls

Gaps in operations, valuation processes, or portfolio monitoring can result in:

-

Misreported NAVs

-

Overstated returns

-

Compliance breaches

-

Regulatory penalties

5. Low Transparency & Complex Structures

Layered SPVs, cross-holdings, and alternative deal structures make it difficult for investors to understand real risks.

Low transparency is one of the biggest concerns flagged by SEBI.

Why Strong Risk Management Matters

A robust risk management system helps AIFs:

-

✔ Protect investor capital

-

✔ Maintain SEBI compliance

-

✔ Improve portfolio resilience

-

✔ Build long-term investor trust

-

✔ Ensure audit readiness

-

✔ Strengthen governance

Risk management is not just a safeguard — it is a competitive advantage.

Simple Strategies to Manage AIF Risks Effectively

This is what every AIF should implement:

1. Dynamic Market & Portfolio Monitoring

Real-time analytics, stress testing, and scenario modelling.

2. Leverage Controls & Exposure Limits

Clear policies for maximum leverage and risk concentration.

3. Liquidity Management Framework

Redemption planning, liquidity buffers, and asset-liability alignment.

4. Strong Internal Audits & Valuation Policies

Independent audits, valuation oversight committees, and strict documentation.

5. Investor Transparency & Reporting

Clear disclosures, periodic reporting, and governance best practices.

A well-designed risk framework not only prevents losses — it enhances investor confidence.

Need Help Making Your AIF Risk Systems Audit-Ready & SEBI Compliant?

Our experts help AIFs strengthen risk management frameworks, internal controls, reporting systems, and governance policies.

📞 +91 93113 47006

Contact us for a free consultation.

Hashtags

#NBFCAdvisor #AIF #RiskManagement #Compliance #FundManagement #AlternativeInvestments #PrivateEquity #VC #SEBI