Is Your NBFC Making These Costly Mistakes?

In recent years, the Non-Banking Financial Company (NBFC) sector in India has witnessed rapid growth—but also increased regulatory scrutiny. From RBI license cancellations to skyrocketing NPAs, many NBFCs are finding themselves in trouble. Surprisingly, it's often not due to malpractices, but operational lapses and lack of strategic oversight.

Let’s explore the most common mistakes NBFCs make, and how to avoid them before they become a threat to your business.

🚨 Common Mistakes That Can Derail Your NBFC’s Growth

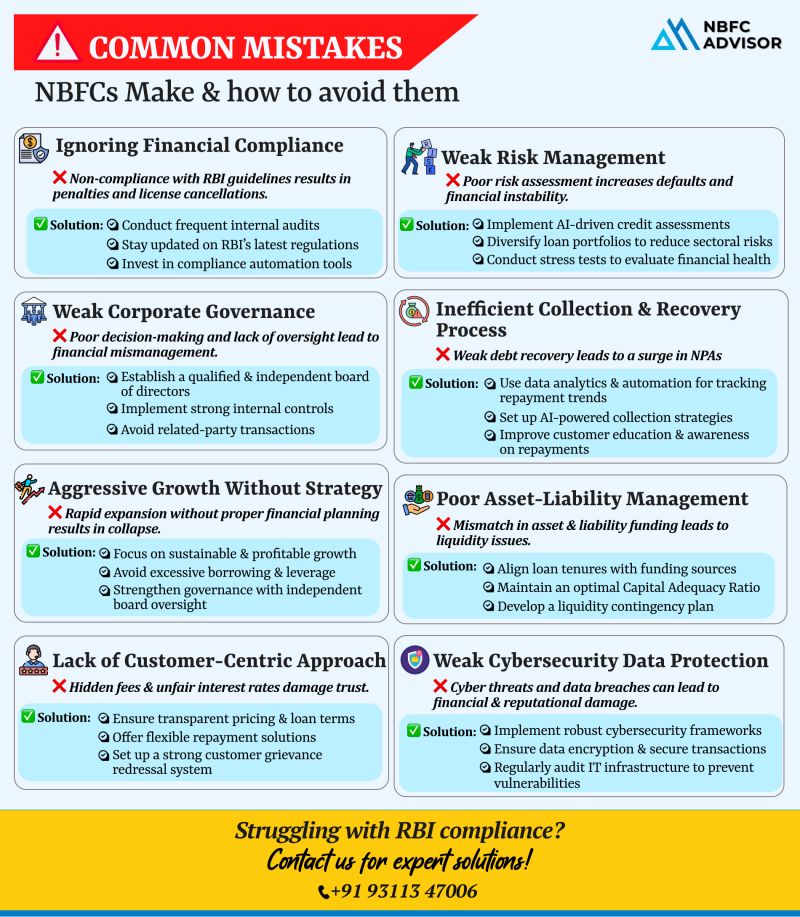

1. Ignoring Financial Compliance

Compliance with RBI norms isn’t optional. Overlooking periodic filings, capital adequacy requirements, or audit submissions can lead to penalties, restrictions, or even license cancellation.

2. Weak Risk Management Practices

A fragile or poorly defined risk management framework makes your NBFC vulnerable to rising defaults, credit risk, and market shocks. An effective risk assessment policy is non-negotiable for long-term stability.

3. Poor Corporate Governance

Lack of transparency, internal controls, or accountability in decision-making can shake investor and customer confidence. Strong governance builds a trustworthy, sustainable NBFC.

4. Inefficient Loan Recovery Process

A sluggish or outdated recovery strategy leads directly to increasing Non-Performing Assets (NPAs). Without timely intervention, this can quickly erode your financial health.

5. Aggressive Growth Without Strategic Planning

Uncontrolled expansion—whether through rapid loan disbursement, entering new markets, or hiring—without proper risk and operational planning often leads to collapse.

6. Asset-Liability Mismatch (ALM)

When your short-term liabilities outweigh long-term assets, it results in severe liquidity crunches. A sound ALM policy is essential to maintain cash flow and solvency.

7. Lack of Customer-Centric Approach

Ignoring customer service, feedback, or borrower experience can hurt your brand and retention. In today’s fintech-driven world, customer trust is your biggest asset.

8. Inadequate Cybersecurity Measures

Data breaches and digital frauds are rising. Weak IT infrastructure or poor cybersecurity protocols can lead to financial losses and legal consequences.

✅ How to Safeguard Your NBFC

The solution doesn’t lie in shortcuts—but in strengthening your foundation:

-

Conduct timely internal and external audits

-

Build a robust compliance and governance framework

-

Adopt smart technologies for automation and analytics

-

Implement clear policies for risk, recovery, and customer service

-

Ensure RBI and regulatory compliance is monitored regularly

📞 Need Expert Help?

If your NBFC is facing compliance challenges, regulatory risks, or struggling with growth strategy, we’re here to help.

👉 Contact us today for a free consultation.

📞 +91 93113 47006

#NBFCAdvisor #RBICompliance #NBFCAudit #NBFCConsulting #Fintech #RiskManagement #NBFCStrategy #Governance #NBFCRegulations