⚠️ Is Your NBFC Prepared for RBI Scrutiny?

The Reserve Bank of India (RBI) has intensified its oversight of Non-Banking Financial Companies (NBFCs), and non-compliance—whether intentional or not—can lead to serious repercussions.

From monetary penalties to license revocation, the risks are real. What’s more concerning is that many NBFCs unknowingly fall short of compliance requirements until it’s too late.

🔍 Are You Making These Common Mistakes?

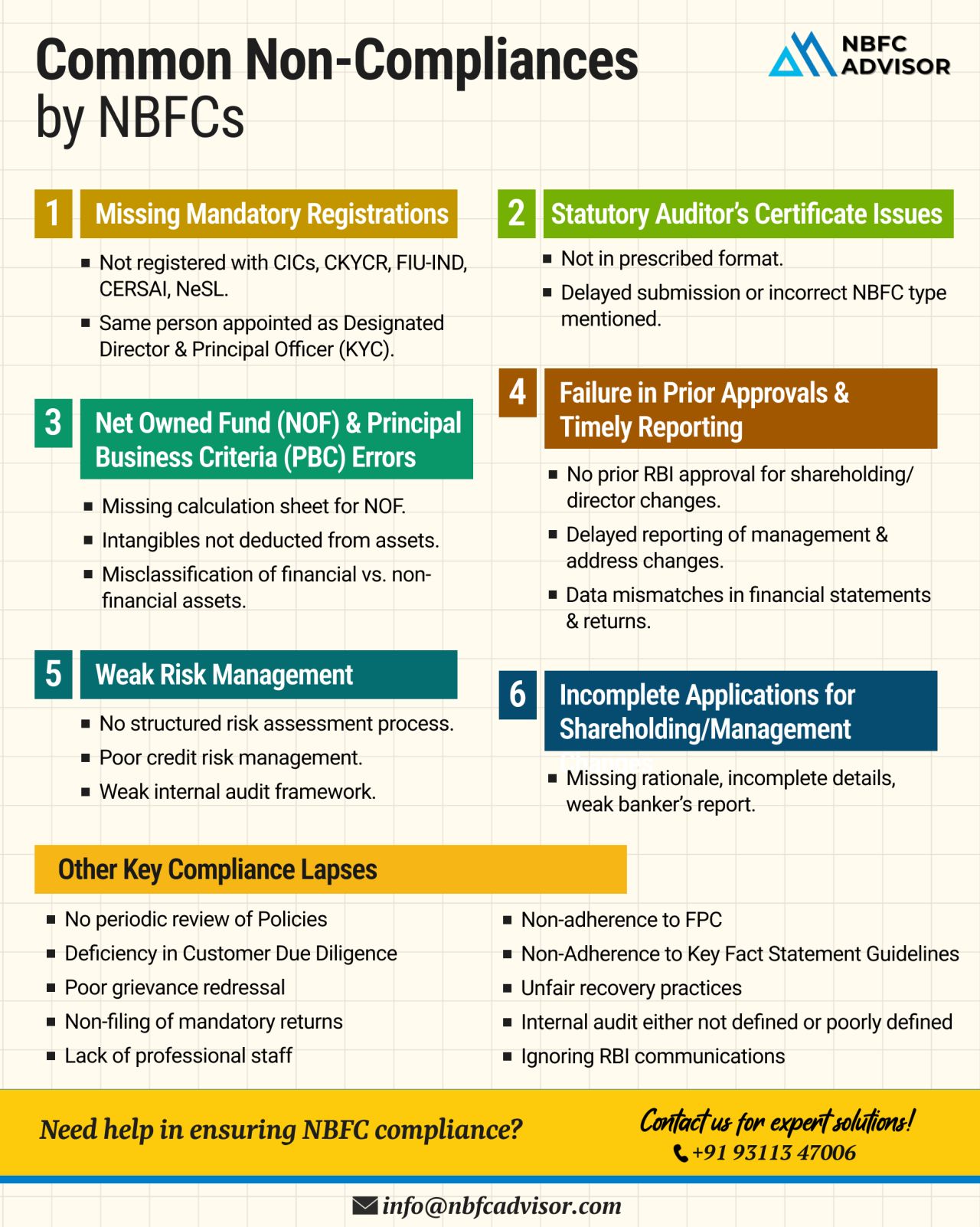

Even well-managed NBFCs may overlook critical regulatory responsibilities. Here are some common missteps that could put your business in jeopardy:

🔹 Missing essential registrations

Such as CKYCR, FIU-IND, Credit Information Companies (CICs), etc.

🔹 Outdated or ineffective risk management frameworks

Failing to properly assess and mitigate financial and operational risks.

🔹 Delayed submissions and approval processes

Late filing of statutory reports like NBS returns, CRILC, and others.

🔹 Lack of robust internal audits

Weak oversight and internal control systems often go unnoticed until an inspection.

These issues can result in:

✔ RBI investigations and penalties

✔ Reputational damage

✔ Investor mistrust

✔ License suspension or cancellation

✅ Proactive Compliance Support for NBFCs

At Aishwaraya Lakshya Advisory, we empower NBFCs to stay fully compliant and audit-ready by offering:

✔ End-to-end compliance health checks

✔ Gap analysis and corrective action plans

✔ Strengthening of audit and governance frameworks

✔ Real-time alignment with the latest RBI regulations

✔ Ongoing support to maintain readiness for inspections

🔐 Safeguard Your NBFC’s Future

Don’t let a minor compliance lapse become a major business disruption. Let us help you stay ahead of the curve.

📞 Schedule your free compliance consultation today

+91 93113 47006

#NBFCAdvisor #RBICompliance #NBFCRegulations #FintechIndia #RiskManagement #AuditReady #ComplianceExperts