NBFC Takeover Services in India – End-to-End Regulatory & Legal Support

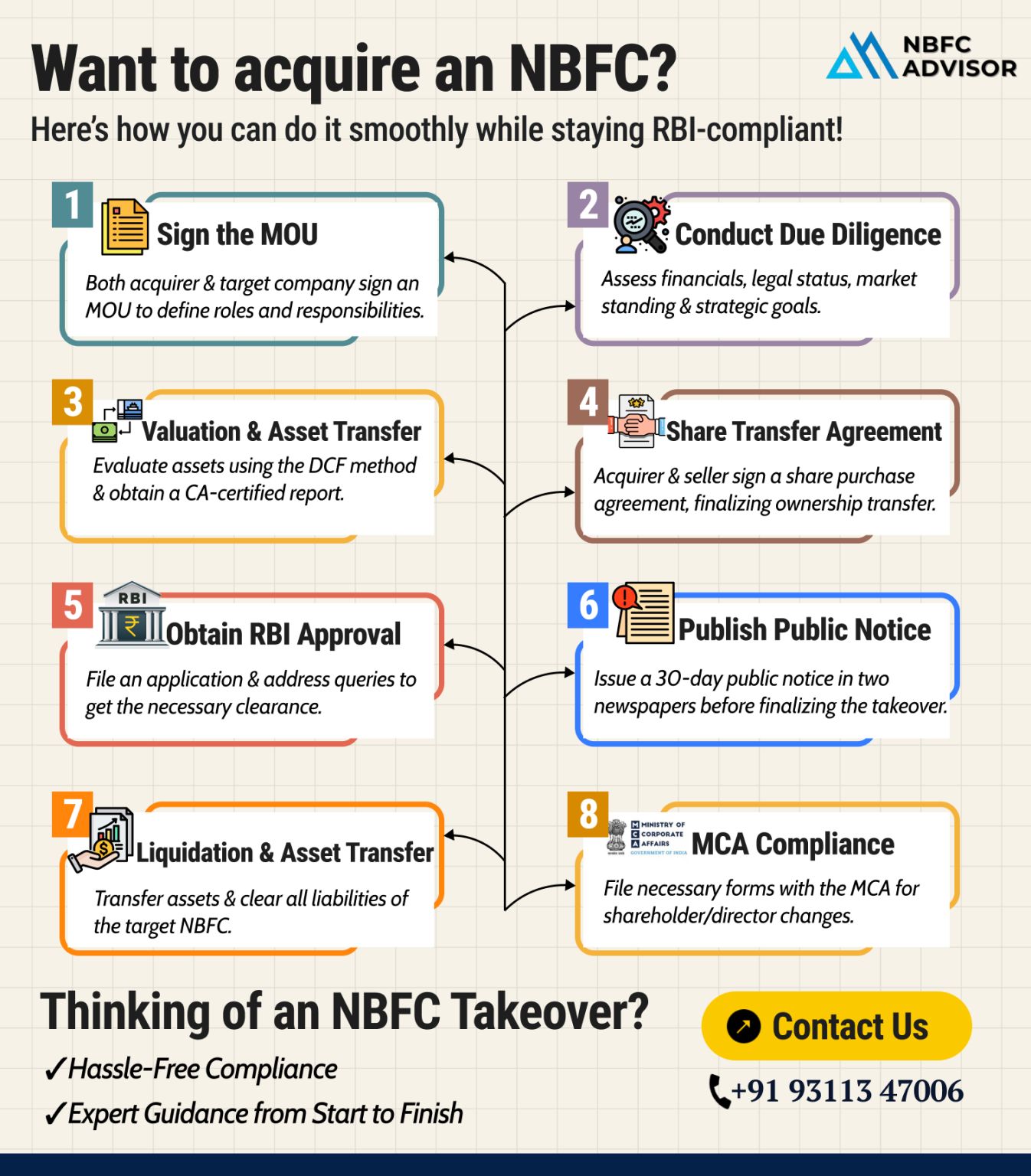

With rapid consolidation in India’s financial sector, NBFC takeover services have become essential for investors, corporates, and financial institutions looking to acquire an existing NBFC. A takeover offers faster market entry, an existing RBI license, and an operational financial structure—but only when handled with complete regulatory compliance.

Our NBFC Takeover Services provide end-to-end assistance, ensuring a smooth, RBI-compliant, and legally sound transition of ownership and control.

What Are NBFC Takeover Services?

NBFC takeover services include professional advisory and execution support for acquiring control or ownership of an existing Non-Banking Financial Company. These services cover every stage—from feasibility assessment to post-takeover compliances—under strict Reserve Bank of India (RBI) regulations.

Who Needs NBFC Takeover Services?

Our services are ideal for:

-

Corporates entering the financial services sector

-

Investors acquiring an operational NBFC

-

Foreign entities (via compliant structures)

-

Promoters planning exit or restructuring

-

NBFCs planning mergers or management transfers

Scope of Our NBFC Takeover Services

🔍 1. Feasibility & Strategic Advisory

We assess:

-

RBI eligibility of the acquirer

-

Structure of takeover (share acquisition / management change)

-

Capital adequacy and net worth requirements

📊 2. Due Diligence Services

Comprehensive review of:

-

Financial statements and asset quality

-

RBI and ROC compliances

-

Loan portfolio, NPA exposure

-

Litigation and contingent liabilities

📰 3. Public Notice & Disclosure

-

Drafting and publication of RBI-mandated public notices

-

Coordination with newspapers

-

Compliance with 30-day notice requirements

🏦 4. RBI Approval & Liaison

-

Preparation of RBI takeover application

-

Drafting of declarations, undertakings, and business plans

-

Regular follow-ups and query resolution with RBI

📝 5. Legal Documentation & Execution

-

Share Purchase Agreement (SPA)

-

Shareholders’ and board resolutions

-

Management transfer documentation

-

Regulatory filings and registers

🔄 6. Post-Takeover Compliances

-

RBI intimation and record updates

-

ROC filings (MCA)

-

Director and shareholding updates

-

Stakeholder and bank intimation

Why Choose Professional NBFC Takeover Services?

✔ RBI-compliant takeover execution

✔ Reduced regulatory risks

✔ Faster approval timelines

✔ Complete legal and financial coverage

✔ Single-point coordination

Key Advantages of NBFC Takeover

-

Immediate access to RBI-registered NBFC

-

Operational business continuity

-

Existing loan portfolio and clients

-

Cost-effective alternative to new NBFC registration

Estimated Timeline

⏳ 3 to 6 months, depending on:

-

RBI scrutiny

-

Transaction structure

-

Document readiness

Common Risks Without Expert Support

-

Rejection or delay in RBI approval

-

Non-compliant public notices

-

Incomplete due diligence

-

Post-takeover regulatory penalties

Professional NBFC takeover services eliminate these challenges.

Conclusion

An NBFC takeover is a highly regulated transaction requiring precise documentation, RBI coordination, and legal expertise. With our NBFC Takeover Services, you get a seamless, transparent, and fully compliant takeover—allowing you to focus on growth while we handle the regulatory complexities.

📞 Contact Us for a Free Consultation

Let our experts guide you through a safe and RBI-approved NBFC takeover process.