Newly Registered as an NBFC? Here’s What You Need to Know About Compliance

Getting your RBI license is a milestone worth celebrating—but it’s only the beginning of your NBFC journey. The real challenge starts with regulatory compliance, which is crucial for building trust, avoiding penalties, and ensuring long-term growth.

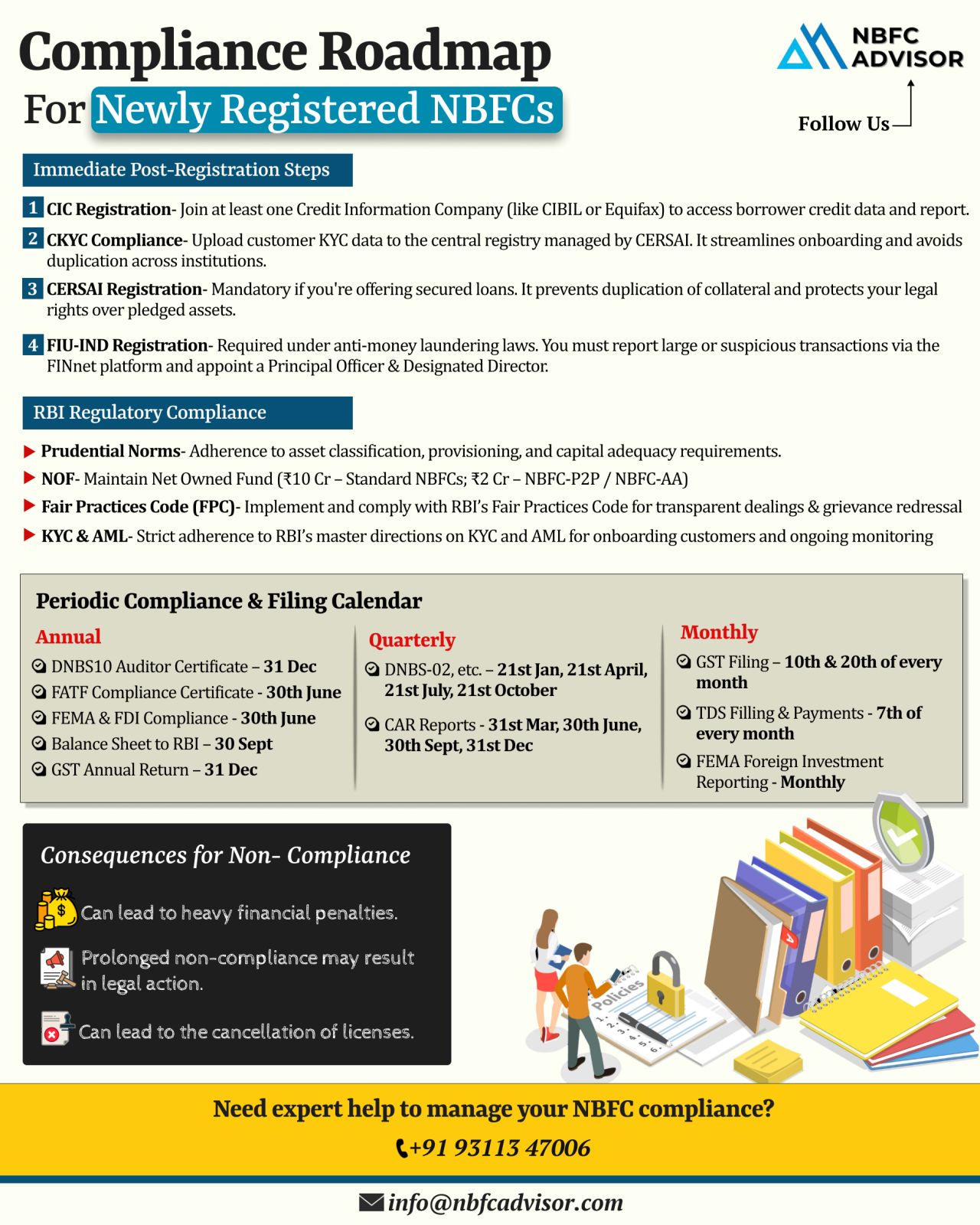

Immediate Compliance Requirements for New NBFCs

Once you’ve received your license, several registrations and filings become mandatory right away:

- CIC Registration – Access credit history from Credit Information Companies.

- CKYC Uploads – Submit customer data to the Central KYC Registry.

- CERSAI Registration – Record details of secured assets to prevent fraud.

- FIU-IND Reporting – Comply with Anti-Money Laundering (AML) rules by filing reports to the Financial Intelligence Unit.

Ongoing Compliance Obligations

Compliance isn’t a one-time task—it’s a continuous responsibility. NBFCs must ensure:

- Adherence to prudential norms and the Fair Practices Code.

- Maintenance of the minimum Net Owned Funds (NOF) requirement.

- Strong KYC and AML frameworks to prevent financial crimes.

- Timely filing of returns and certificates on a monthly, quarterly, and annual basis.

Why Compliance Matters

Non-compliance is risky. Missing filings or ignoring regulations can lead to:

- Heavy penalties

- Legal action from regulators

- Even cancellation of your RBI license

That’s why having the right compliance partner is essential.

How We Help NBFCs

We specialize in helping NBFCs manage their regulatory obligations seamlessly—so you can focus on scaling your business, building trust, and driving financial inclusion.

Contact us for a free consultation: +91 93113 47006

#NBFCAdvisor #Compliance #RBI #FinancialServices #RiskManagement #DigitalLending #NBFCRegistration #AMLCompliance #Fintech #NBFC