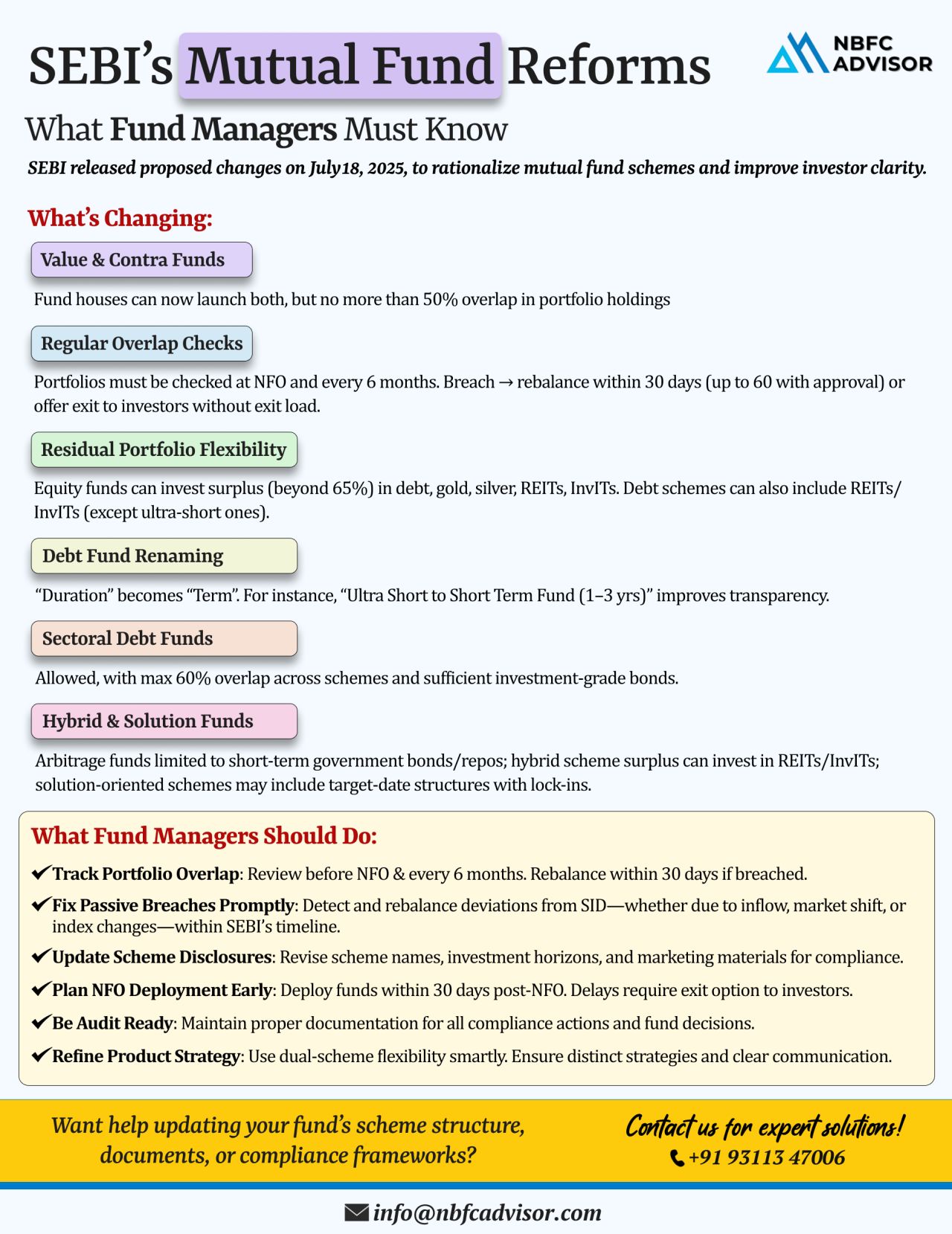

📰 SEBI’s New Mutual Fund Reforms: What Investors & Fund Managers Need to Know

The Securities and Exchange Board of India (SEBI) has proposed sweeping changes to the mutual fund framework to enhance transparency, reduce overlap, and ensure better risk management. These changes are aimed at making mutual funds more investor-friendly while tightening compliance for asset management companies (AMCs).

🔍 Key Highlights of the New SEBI Mutual Fund Guidelines

1. Value and Contra Funds – Allowed with Portfolio Caps

SEBI has permitted both value and contra funds to coexist within a fund house, but with one key condition:

🔹 Portfolio overlap must not exceed 50%, ensuring true diversification and strategy distinction.

2. Mandatory Portfolio Overlap Checks

🔍 Overlap reviews must now be conducted:

-

At the time of New Fund Offer (NFO)

-

Every 6 months thereafter

This ensures that funds remain aligned with their original investment thesis and avoid unnecessary duplication.

3. Residual Investments Now Permitted

Equity and debt schemes can now invest unutilized funds into alternative assets like:

-

REITs (Real Estate Investment Trusts)

-

InvITs (Infrastructure Investment Trusts)

-

Gold and other permissible instruments

This brings flexibility in managing short-term surplus funds.

4. Clearer Naming for Debt Funds

To avoid confusion, the word “Duration” will be replaced with “Term” (e.g., 1–3 years, 3–5 years), providing more clarity for investors about expected investment horizons.

5. Sectoral Debt Funds – New Entry with Conditions

SEBI has opened the doors to sector-specific debt funds, but with strict risk controls and disclosures, to avoid mis-selling and overexposure to specific industries.

6. Hybrid & Solution-Oriented Funds – Clearer Structures

Rules for hybrid and solution-based funds are being tightened with:

-

Defined lock-in periods

-

Better asset allocation clarity

-

More consistent product structuring

💡 Why These Changes Matter for Investors

✅ Avoids unintentional portfolio duplication

✅ Helps in better fund comparison

✅ Provides more clarity on fund objectives

✅ Improves transparency and accountability from AMCs

🧩 What Fund Managers Should Do Next

✔ Regularly monitor portfolio overlaps and rebalance where needed

✔ Address unintentional breaches caused by market movements

✔ Align scheme names with the updated investment horizons

✔ Ensure funds raised via NFOs are deployed within 30 days

✔ Keep internal documentation audit-ready at all times

✔ Use the flexibility in value-contra schemes wisely, without crossing limits

📣 Need Help Navigating the New Norms?

Whether you're a fund house, distributor, or compliance officer, adapting to these SEBI reforms may require expert guidance. From portfolio review systems to documentation compliance—we’ve got you covered.

📞 Contact us for a FREE consultation

+91 93113 47006

📌 Hashtags:

#SEBI #MutualFunds #FundManagers #InvestmentStrategy #NBFCAdvisor #SEBIGuidelines #InvestorAwareness #Compliance #AssetManagement