Thinking of Buying an NBFC? Here’s How to Do It Right

Acquiring a Non-Banking Financial Company (NBFC) can be a strategic move that opens doors to new business opportunities, especially in lending, fintech, and microfinance sectors. But here’s the truth — one small compliance error can delay the process, invite RBI scrutiny, lead to hefty penalties, or even cause your acquisition to be rejected altogether.

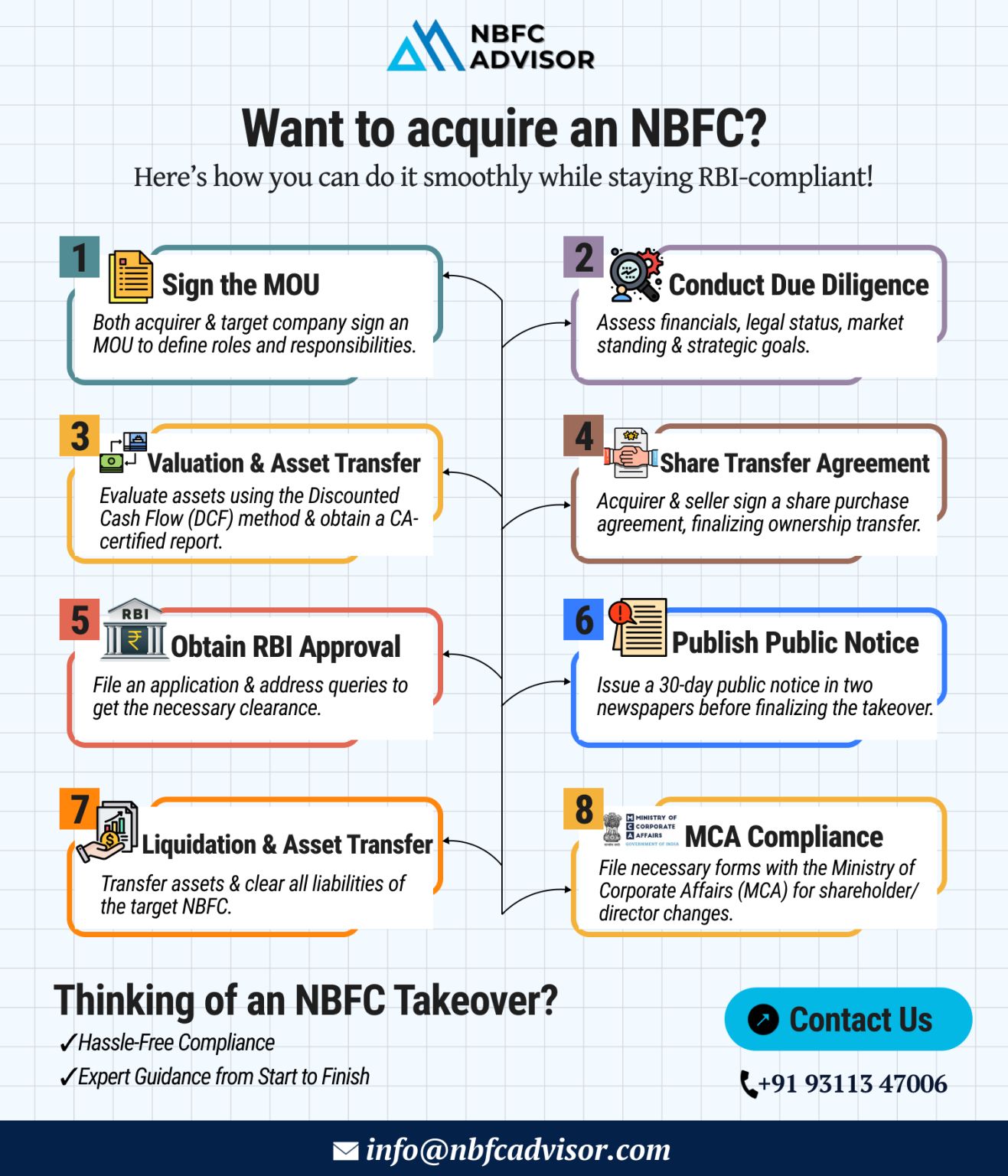

To ensure a smooth and successful NBFC takeover, here’s a step-by-step guide to doing it the right way:

✅ 1. Sign a Memorandum of Understanding (MoU)

Start by clearly defining the terms, roles, and responsibilities between the buyer and seller. This sets the foundation for a transparent transaction and helps avoid future misunderstandings.

✅ 2. Conduct Full Due Diligence

Before you proceed, assess the NBFC's financial health, legal history, tax records, regulatory compliance, and any undisclosed liabilities. Due diligence protects you from surprises that could hurt your investment.

✅ 3. Get a Valuation & Asset Transfer Report

Have a Chartered Accountant perform a valuation of the NBFC. This CA-certified report is crucial for negotiations and for submission to regulatory authorities.

✅ 4. Execute the Share Transfer Agreement

Legally transfer the NBFC’s ownership through a properly drafted and executed Share Transfer Agreement. This ensures a lawful change of control.

✅ 5. Seek RBI Approval

Apply to the Reserve Bank of India (RBI) for approval of the change in management and ownership. Be ready to respond promptly to any clarifications or objections from the regulator.

✅ 6. Publish Public Notice

Issue a 30-day public notice in two newspapers (one English and one vernacular) informing stakeholders of the ownership change. This is a mandatory step before final closure.

✅ 7. Complete MCA Filings

Update shareholder and director changes with the Ministry of Corporate Affairs (MCA). Ensure all ROC filings are accurate and up to date.

✅ 8. Final Settlement

Complete the final asset transfer and settle any outstanding liabilities of the NBFC. Once this is done, the acquisition is officially complete.

⚠️ One Wrong Step Can Be Costly

NBFC takeovers involve RBI compliance, legal documentation, and financial due diligence. Skipping or mismanaging any step can lead to time delays, financial loss, or regulatory rejection.

✅ Need a Hassle-Free NBFC Acquisition?

Let the experts handle it.

📞 Contact us for a FREE consultation: +91 93113 47006

#NBFCAdvisor #NBFC #NBFCTakeover #RBICompliance #FinancialServices #MergersAndAcquisitions #BuyNBFC