𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐆𝐫𝐢𝐩 𝐨𝐧 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐎𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

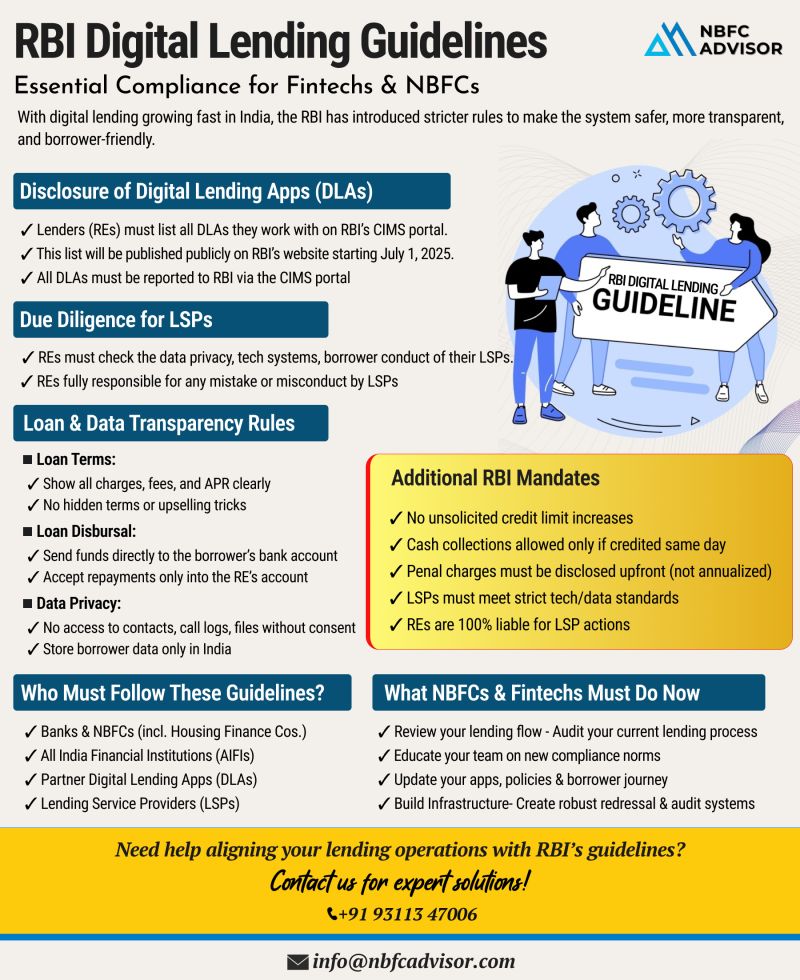

India's digital lending sector has seen exponential growth—but so have regulatory concerns. In a move to make lending more transparent and borrower-friendly, the Reserve Bank of India (RBI) has released revised Digital Lending Guidelines applicable to NBFCs, fintech platforms, and banks.

These changes are designed to enhance consumer protection, ensure data privacy, and bring greater accountability across the digital lending ecosystem.

🔄 Major Updates You Need to Know

📲 1. Compulsory Registration of Lending Apps

All Digital Lending Apps (DLAs) must now be declared and registered via RBI’s CIMS portal, ensuring traceability and regulatory oversight.

📋 2. Transparent Loan Structures

Lenders are now required to clearly disclose all loan terms — including interest rates, fees, and repayment schedules. Hidden charges are strictly prohibited.

💳 3. Bank Account-Based Transactions

Loan disbursements and repayments must happen only through bank accounts of regulated entities. Wallets or unregulated third parties can no longer be used.

🔐 4. Borrower Data Requires Consent

Customer data cannot be accessed or stored without explicit permission. Borrowers must give informed consent before any personal information is collected.

🚫 5. No Automatic Credit Increases

Any increase in credit limits must be approved by the borrower. Automatic enhancements are no longer permitted.

🧾 6. Stricter Audit Trails & LSP Governance

Lenders must maintain detailed audit trails and closely monitor their Lending Service Providers (LSPs) to ensure compliance with RBI norms.

📌 What Should You Be Doing Now?

These regulatory shifts require immediate operational updates. Here's what to prioritize:

-

🔍 Review your entire digital lending framework

-

🔧 Update your mobile apps, documentation, and disclosures

-

🧑🏫 Train teams on new RBI compliance requirements

-

📈 Build robust systems for audits, reporting, and customer grievance redressal

Failing to comply could lead to penalties or restrictions—so don’t wait.

✅ Need Expert Assistance?

We help NBFCs, fintech startups, and financial institutions align with RBI’s digital lending framework—from audit preparation and app compliance to team training and documentation.

📞 Schedule your FREE consultation today

+91 93113 47006

#NBFCAdvisor #RBI #DigitalLending #FintechCompliance #DLAGuidelines #NBFCCompliance #RBIUpdate #LendingApps #Fintech