The Growth of AIFs: How India’s Startup Boom Is Creating New Opportunities

India’s startup ecosystem is witnessing an unprecedented surge.

With 1.59 lakh+ startups and over 110 unicorns, India has emerged as the third-largest startup ...

Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

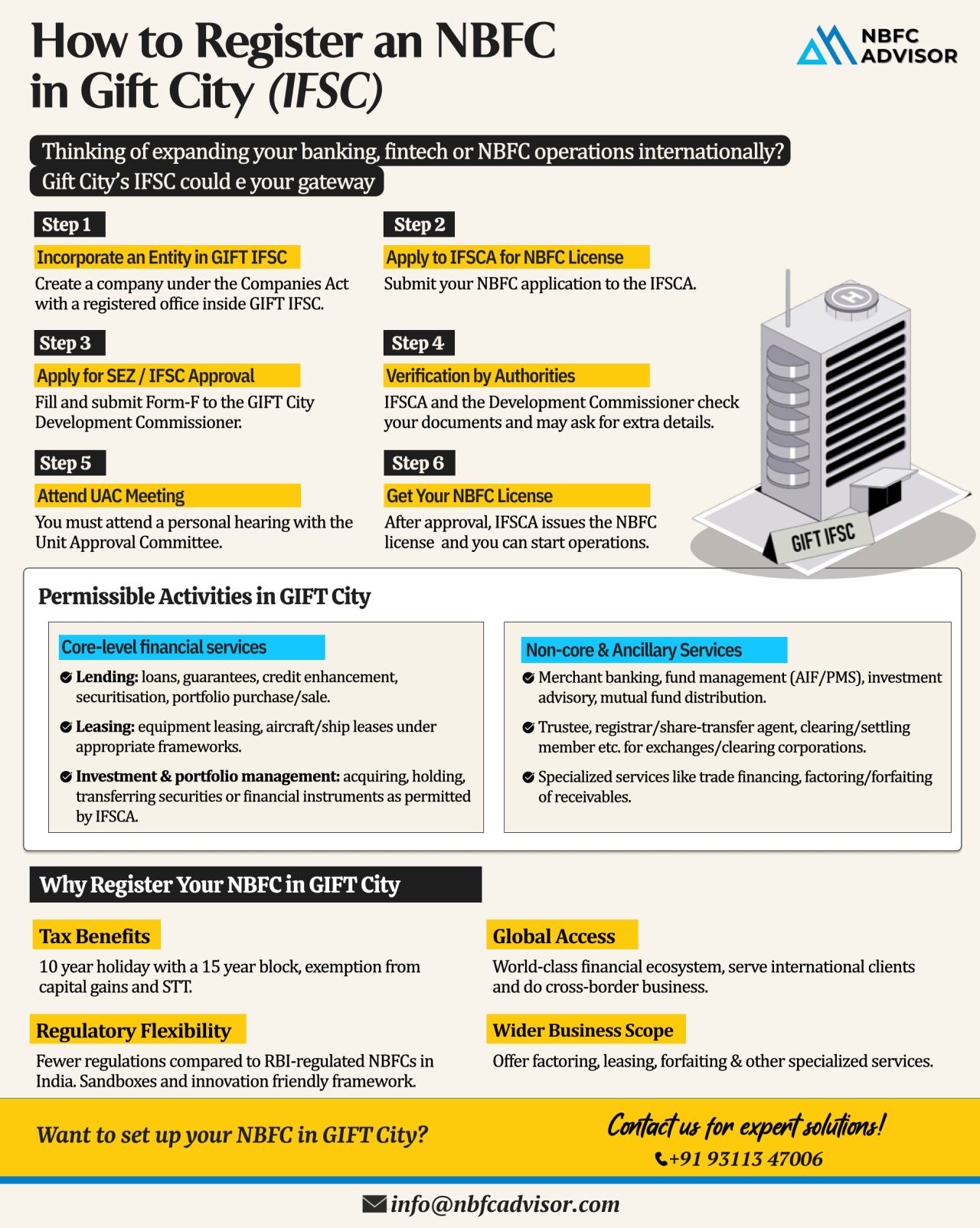

Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (...

Reserve Bank of India (RBI) just slapped HDFC Bankwith a Rs 91 lakh penalty (order dated Nov 18, 2025) for outsourcing KYC compliance to third parties—a core function that’s strictly off-limits under RBI’s ironclad guidelines for ba...

Not Sure What License Your Fintech Needs? 🤔

India’s fintech ecosystem — from digital lending apps and payment gateways to neobanks and wealthtech platforms — is expanding faster than ever. But as innovation accelerates, RBI and ...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny!

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several NBFCs — not for fraud or mismanagement — but for missing critical compliance steps.

As...

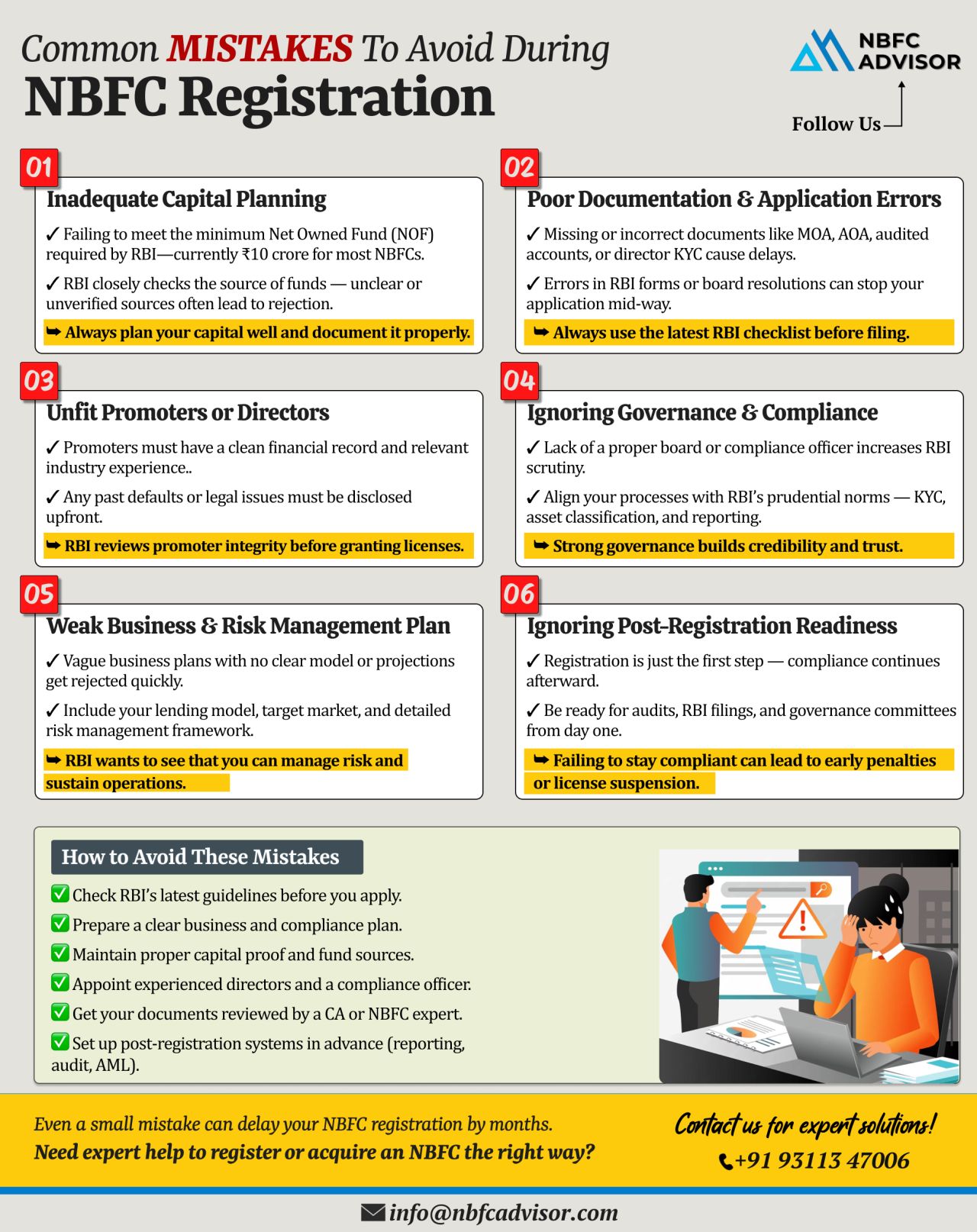

Many NBFC Applications Get Rejected by the RBI — Here’s Why! ⚠️

Avoid Costly Mistakes Before You Apply

Every year, the Reserve Bank of India (RBI) receives hundreds of applications for NBFC (Non-Banking Financial Company) registrati...

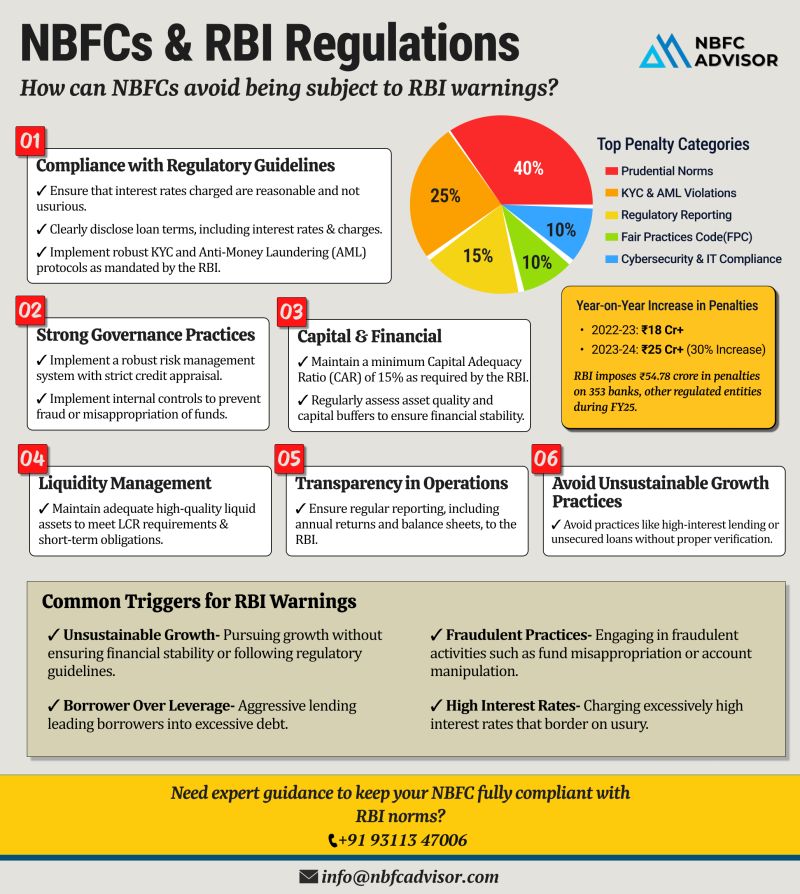

RBI Penalties on NBFCs Jumped 30% in Just One Year — Is Your NBFC at Risk?

The Reserve Bank of India (RBI) has intensified its oversight on financial institutions — and the numbers speak for themselves.

In FY 2022–23, RBI impo...

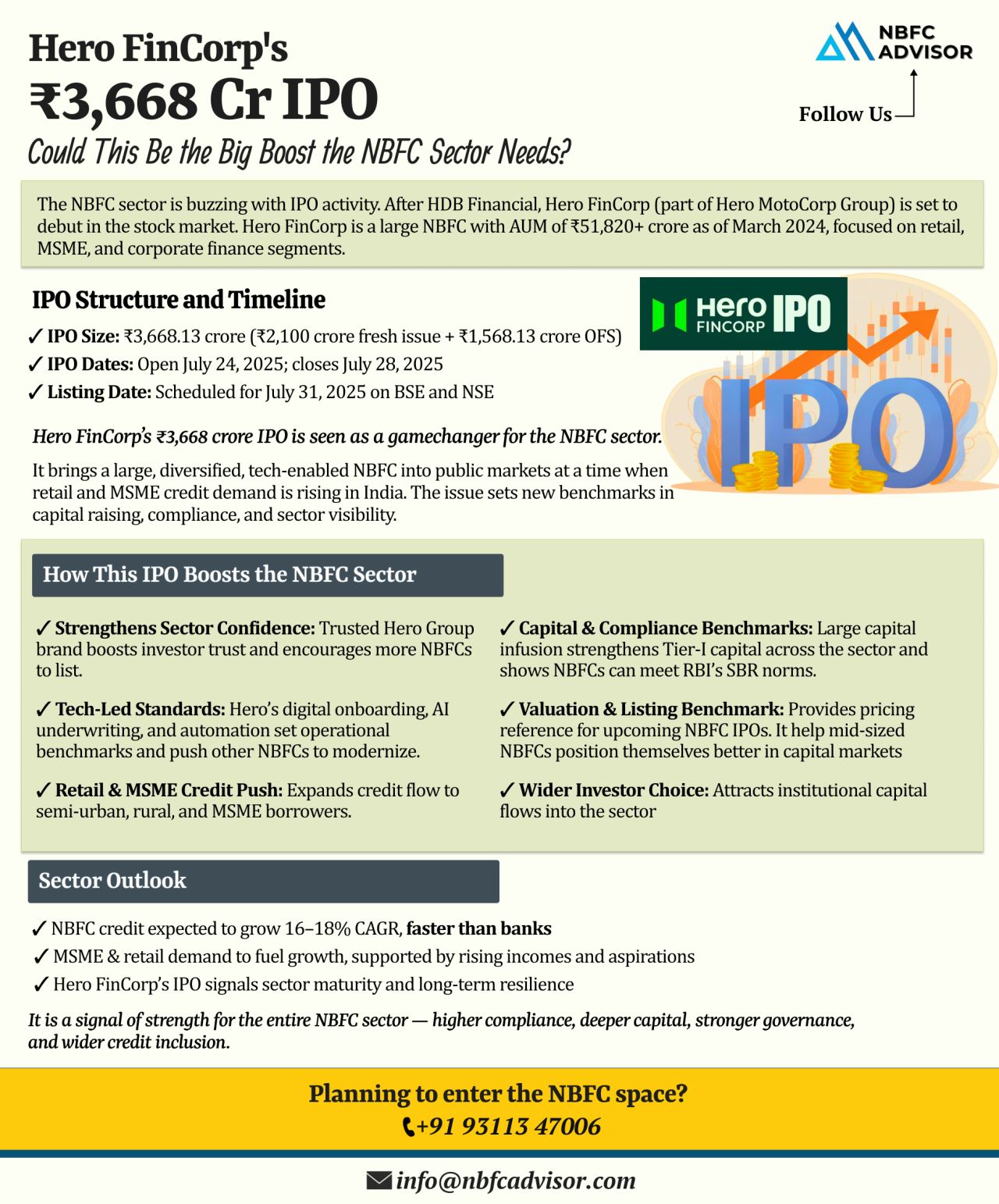

Hero FinCorp’s ₹3,668 Cr IPO: What It Means for NBFCs

The Indian NBFC sector is witnessing a wave of IPOs, signaling strong growth and investor confidence. After HDB Financial Services, Hero FinCorp is now preparing to debut on the stock mar...

Cheques Clear Within Hours – Starting October 2025!

Big news is on the horizon for India’s banking ecosystem! The Reserve Bank of India (RBI) is set to transform the way cheques are cleared, reducing the waiting time from days to just ...

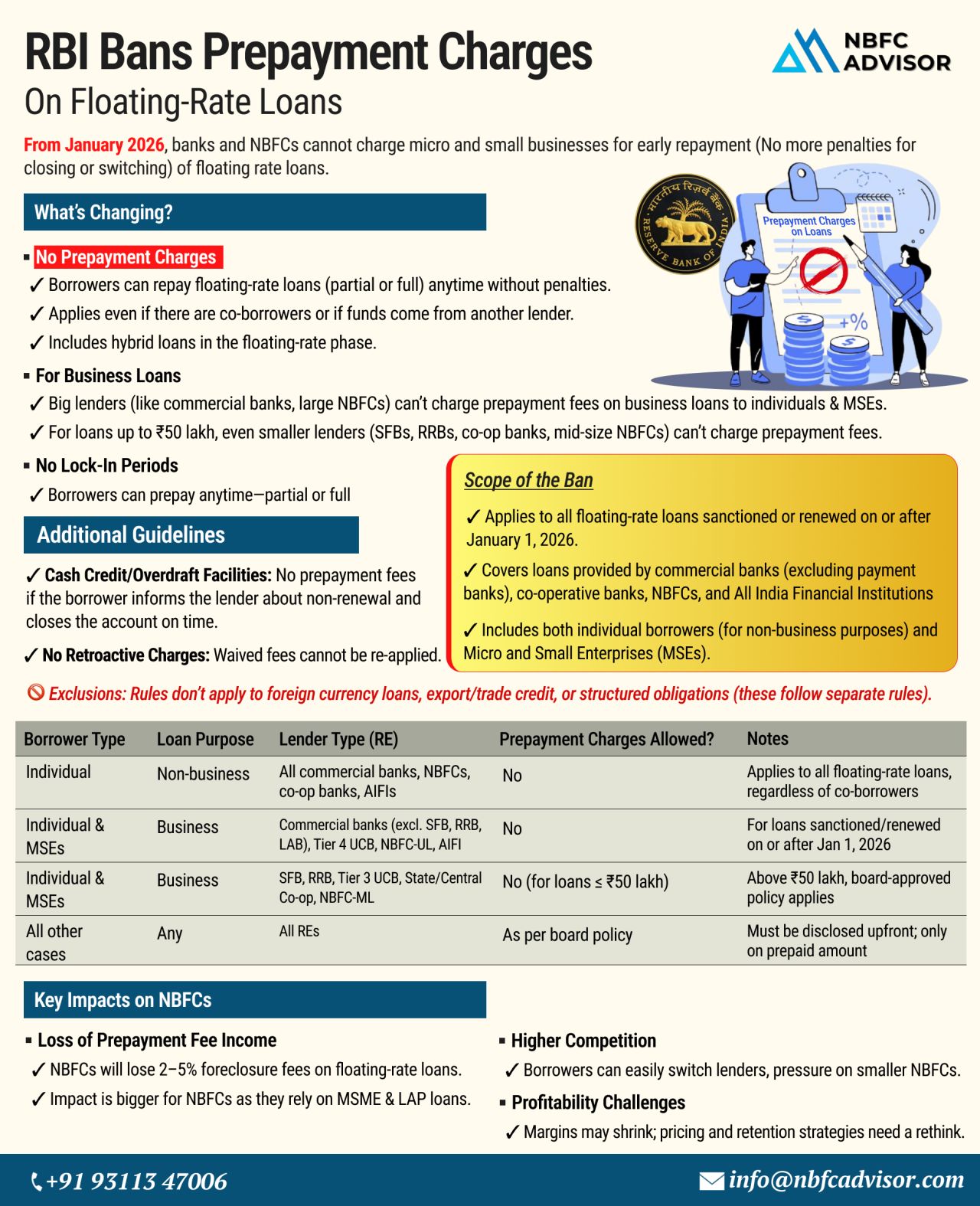

RBI Bans Prepayment Charges on Floating-Rate Loans

What It Means for NBFCs Starting January 2026

The Reserve Bank of India (RBI) has rolled out a major regulatory change aimed at giving borrowers more freedom. From January 1, 2026, no prepaymen...

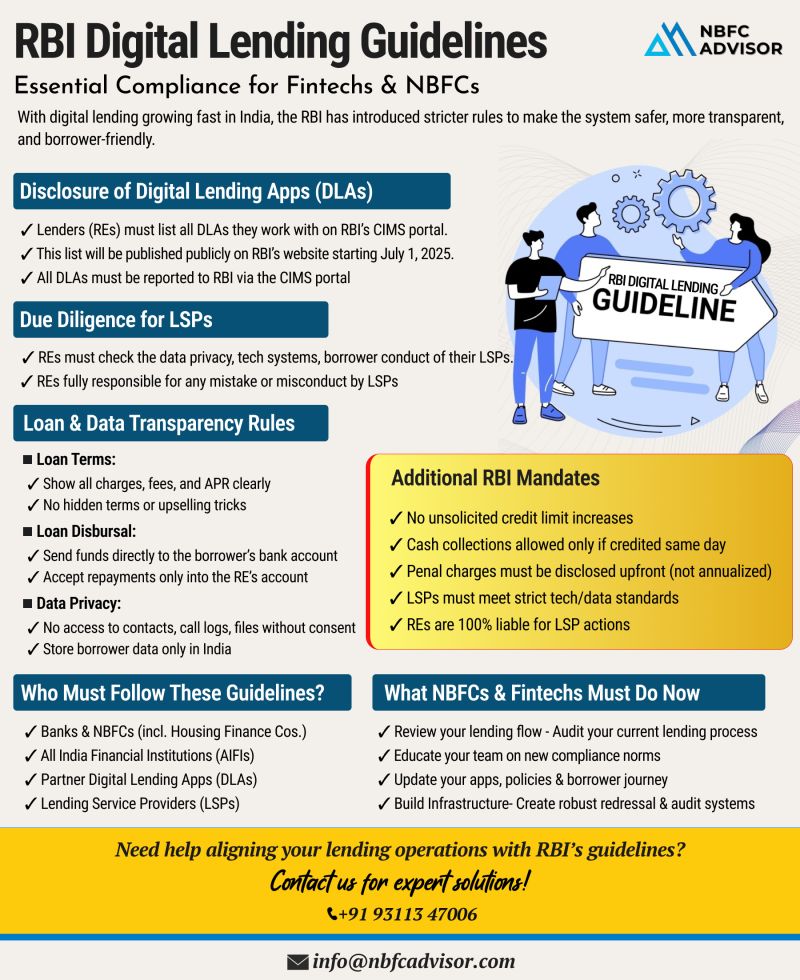

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐆𝐫𝐢𝐩 𝐨𝐧 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐎𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

India's digital lending sector has seen exponential growth—but so have regulatory concerns. In a move ...

A Landmark Deal Reshaping India’s NBFC Landscape

In a decisive move that signals the rising consolidation in India’s NBFC sector, UGRO Capital has announced the acquisition of Profectus Capital Pvt. Ltd. for ₹1,400 crore. This strategi...

🚀 The NBFC Sector in India is Experiencing Unmatched Growth! 🚀

Are You Ready to Seize the Opportunity?

India’s Non-Banking Financial Company (NBFC) sector is growing at an extraordinary pace, driven by rising demand for digital lending,...

Non-Banking Financial Companies (NBFCs) are essential players in India's financial ecosystem. They provide crucial financial services such as loans, credit facilities, asset financing and investment services, often reaching segments of the popula...

Non-Banking Financial Companies (NBFCs) have carved a niche for themselves in the Indian financial ecosystem, offering a wide range of services that cater to individuals, businesses and the economy as a whole. While their name might suggest a resembl...