𝘉𝘪𝘨 𝘊𝘩𝘢𝘯𝘨𝘦𝘴 𝘈𝘩𝘦𝘢𝘥 𝘧𝘰𝘳 𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥𝘴 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

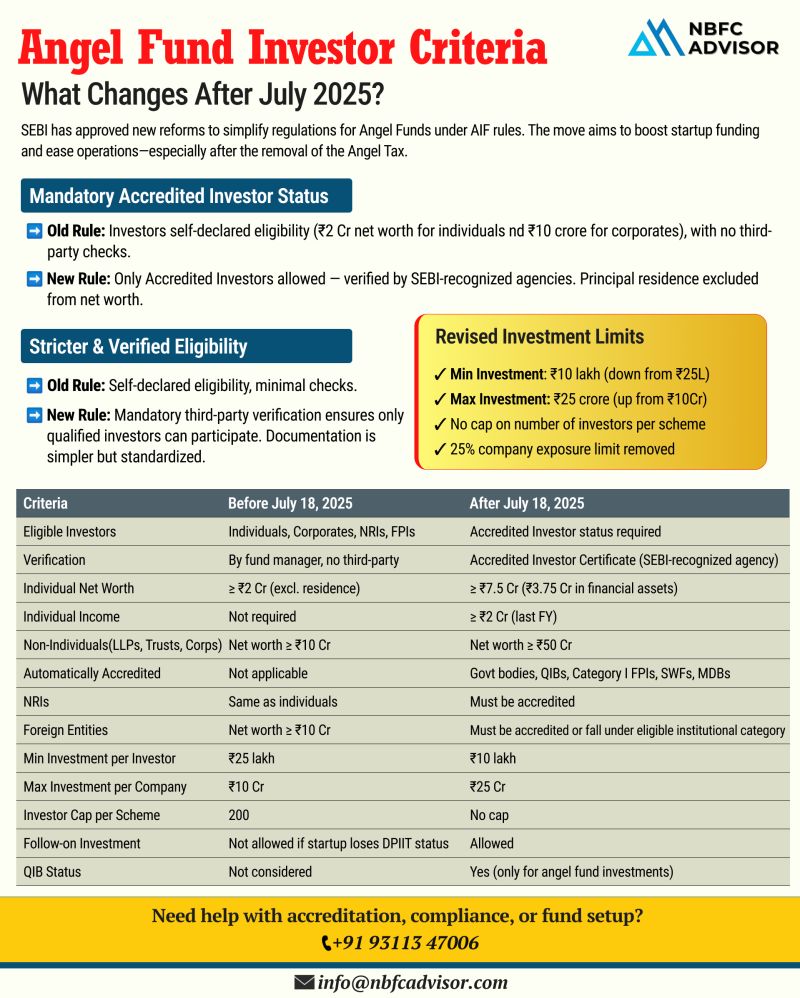

From July 2025, Angel Funds in India will function under a revamped SEBI framework, bringing clarity, credibility, and new opportunities to early-stage investing.

Whether you’re an investor, a fund manager, or a startup founder, these changes will affect how you participate in the angel investing ecosystem. The most critical update? Only SEBI-Accredited Investors will be allowed to invest in Angel Funds.

Here’s what you need to know.

🔄 What’s New in the Angel Fund Landscape?

👤 1. Accredited Investors Only

SEBI has introduced stricter entry criteria. Only investors accredited by SEBI will be permitted to participate in Angel Funds, helping ensure higher quality and more experienced participants in the ecosystem.

💸 2. Minimum Investment Reduced

The minimum investment amount has been lowered to ₹10 lakh (from the previous ₹25 lakh), making it easier for accredited individuals to get involved in early-stage investments.

👥 3. No Investor Limit per Scheme

SEBI has removed the 200-investor cap per scheme, enabling wider participation and deeper pools of capital for each deal.

🔄 4. Continued Support for Startups

Angel Funds can now make follow-on investments in startups even if they lose their DPIIT-recognized status, ensuring continued support through multiple funding stages.

⚖️ 5. Transparent Deal Flow

All investment deals must now be shared fairly with every investor in the scheme. This brings more transparency, reduces insider deals, and ensures everyone has equal access.

📈 6. QIB Status for Angel Investors

Accredited investors in Angel Funds will be recognized as Qualified Institutional Buyers (QIBs) — a status that comes with added benefits and recognition in capital markets.

🚀 What This Means for the Startup Ecosystem

If you’re:

-

An early-stage investor, this opens more structured and credible opportunities

-

A startup founder, this changes how you engage with angel funds

-

A fund manager, this reshapes how you build and manage your fund

These changes mark a bold shift towards a more professional and transparent investment environment.

🧭 Are You Ready for What’s Next?

Now is the time to ask:

-

✅ Are you accredited as per SEBI’s new norms?

-

✅ Is your Angel Fund structure compliant with the latest guidelines?

-

✅ Do you have the right setup for fair deal allocation and investor transparency?

If you need help navigating the transition, we’re here to support you.

🤝 Let’s Make This Easy for You

We offer full support for:

-

Investor Accreditation Process

-

Angel Fund Setup & SEBI Registration

-

QIB Advisory & Documentation

-

Compliance Management & Ongoing Support

📞 Reach out for a free consultation

+91 93113 47006