The Growth of AIFs: How India’s Startup Boom Is Creating New Opportunities

India’s startup ecosystem is witnessing an unprecedented surge.

With 1.59 lakh+ startups and over 110 unicorns, India has emerged as the third-largest startup ...

Why Do Many NBFCs Fail to Scale? The Real Issue Is Financial Clarity

When NBFCs struggle to scale, the first assumption is often lack of funds.

But in reality, capital is only part of the story.

The real bottleneck is financial clarity.

Wit...

Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

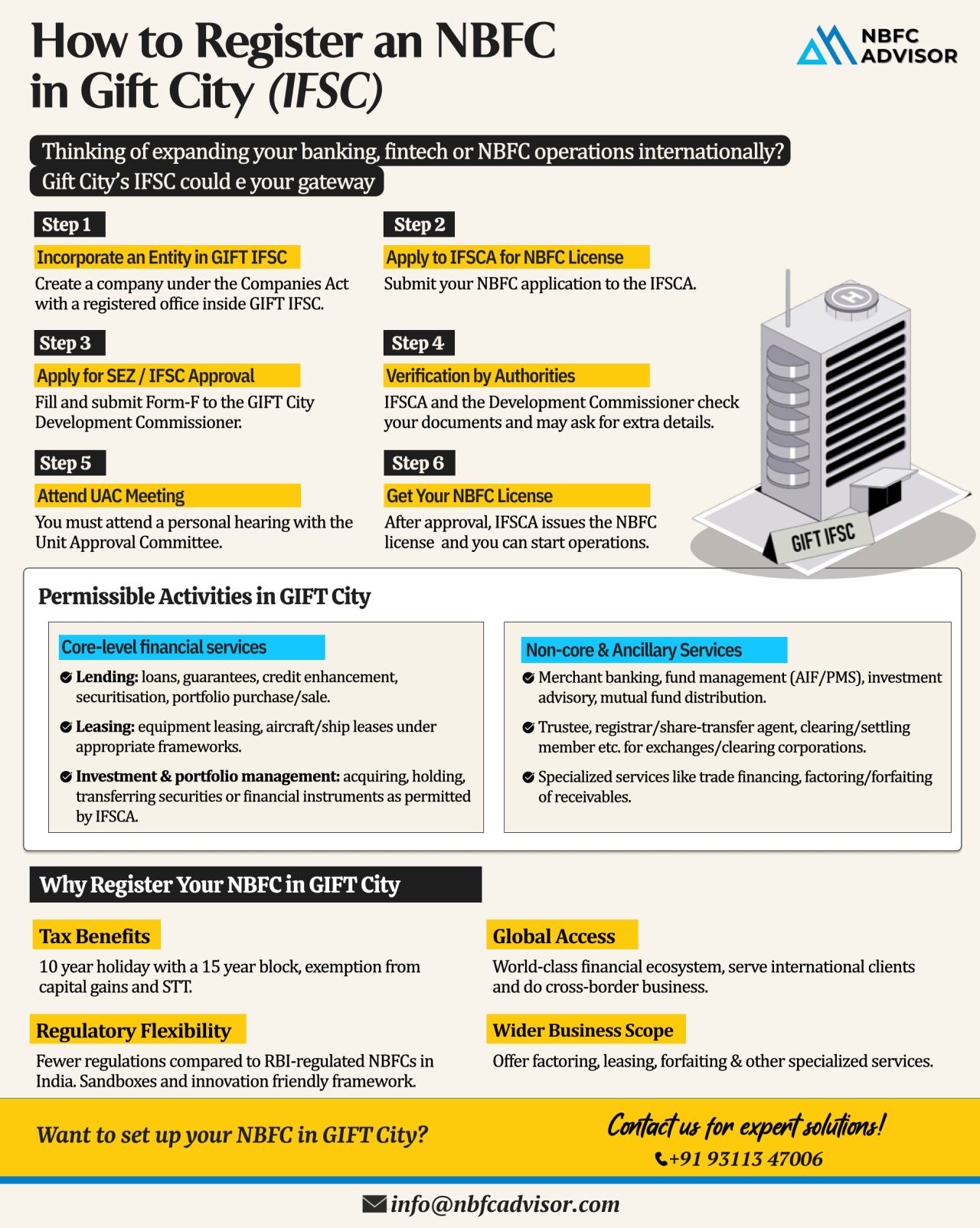

Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (...

Starting an NBFC vs. Buying One – What’s Smarter?

Entering India’s Non-Banking Financial Company (NBFC) sector is an attractive opportunity for investors, fintech founders, and financial institutions. The big question most invest...

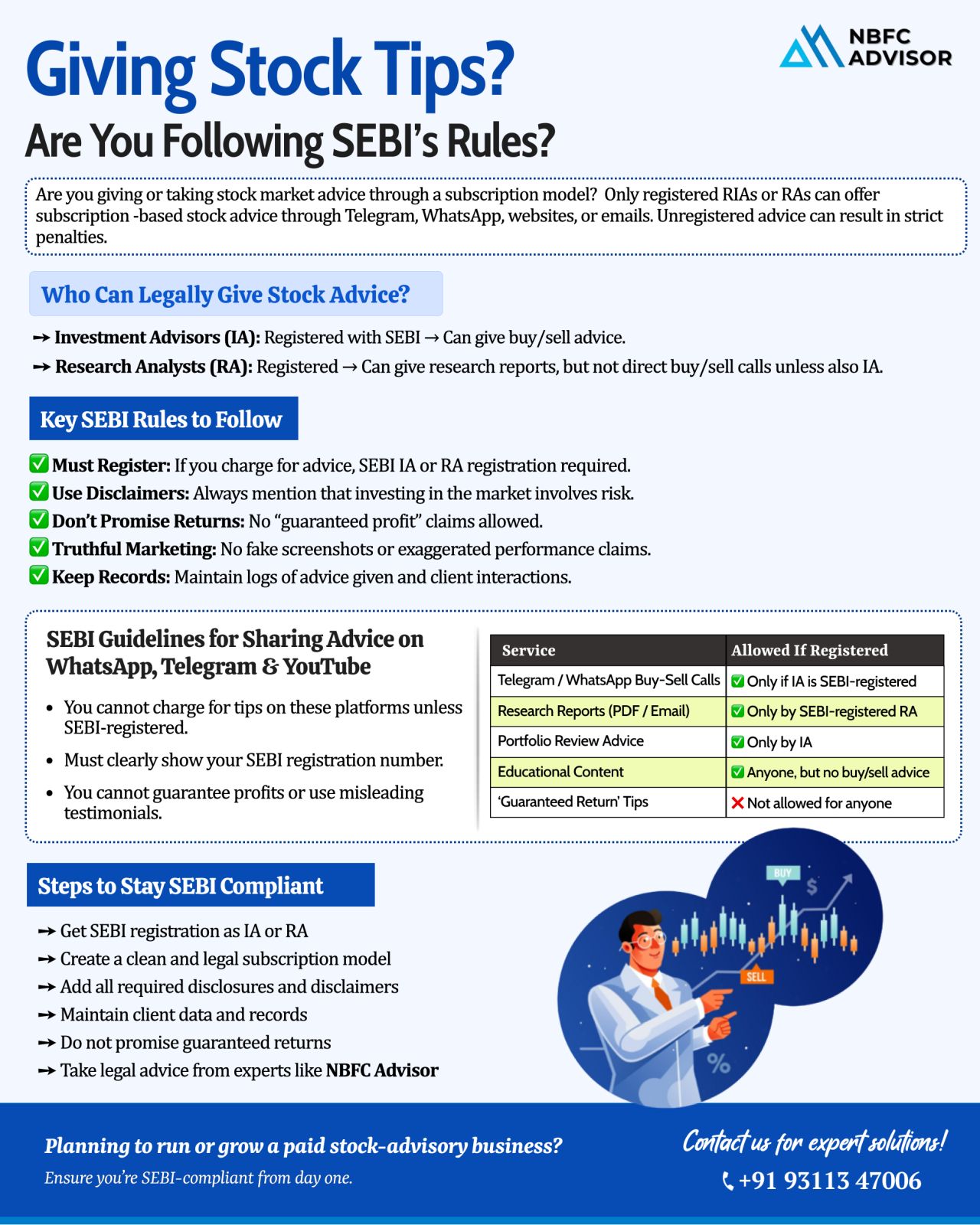

Selling Stock Tips on Telegram, WhatsApp, or Instagram? Read This Before You Start.

Social media is full of stock tips, buy/sell calls, and paid subscription groups. But many people don’t realise that SEBI has strict rules for anyone offerin...

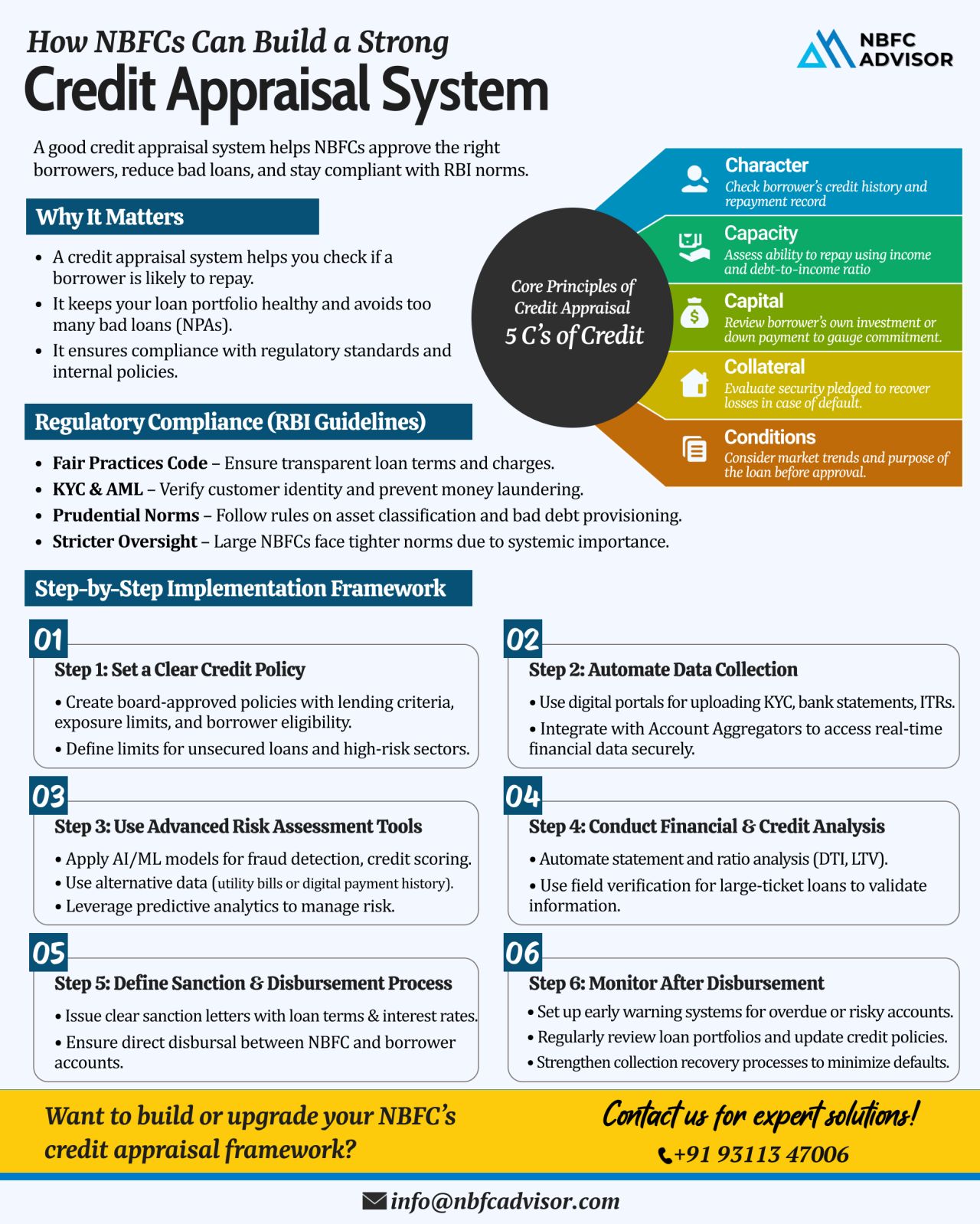

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

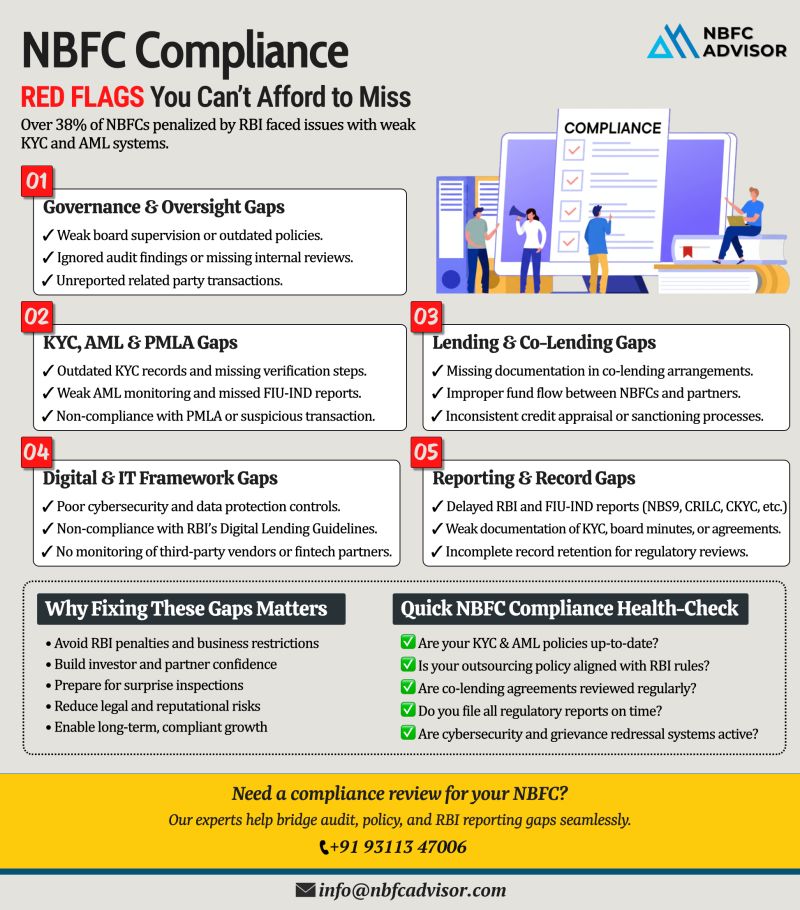

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

🧭 Enhancing Clarity, Transparency & Flexibility: SEBI’s New Era of Mutual Fund Reforms

In a move to simplify mutual fund structures and protect investor interests, the Securities and Exchange Board of India (SEBI) has proposed a set of ...

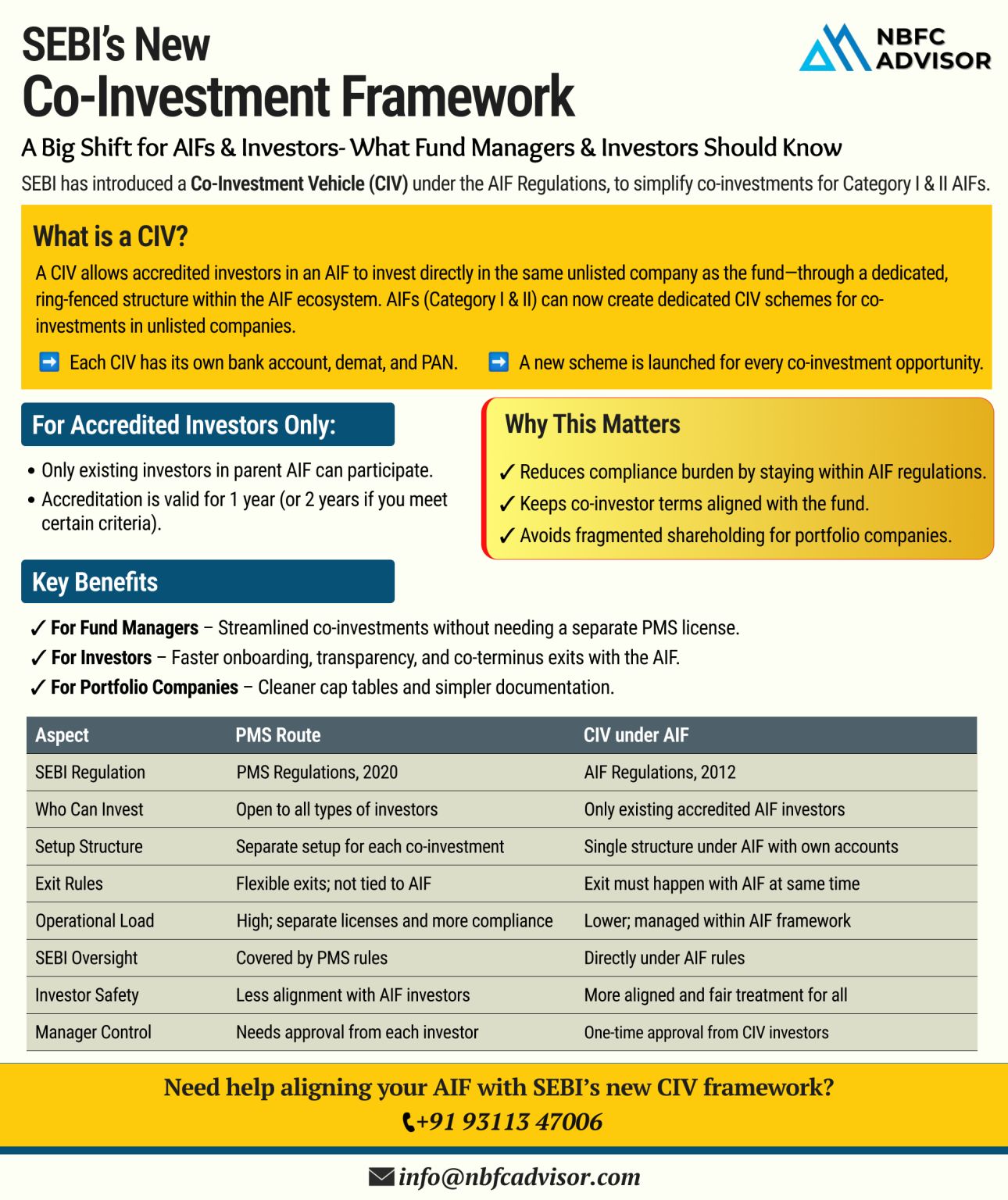

SEBI’s New Co-Investment Framework: A Big Boost for India’s Private Capital Market

India’s alternative investment ecosystem just got a major regulatory upgrade.

The Securities and Exchange Board of India (SEBI) has introduced ...

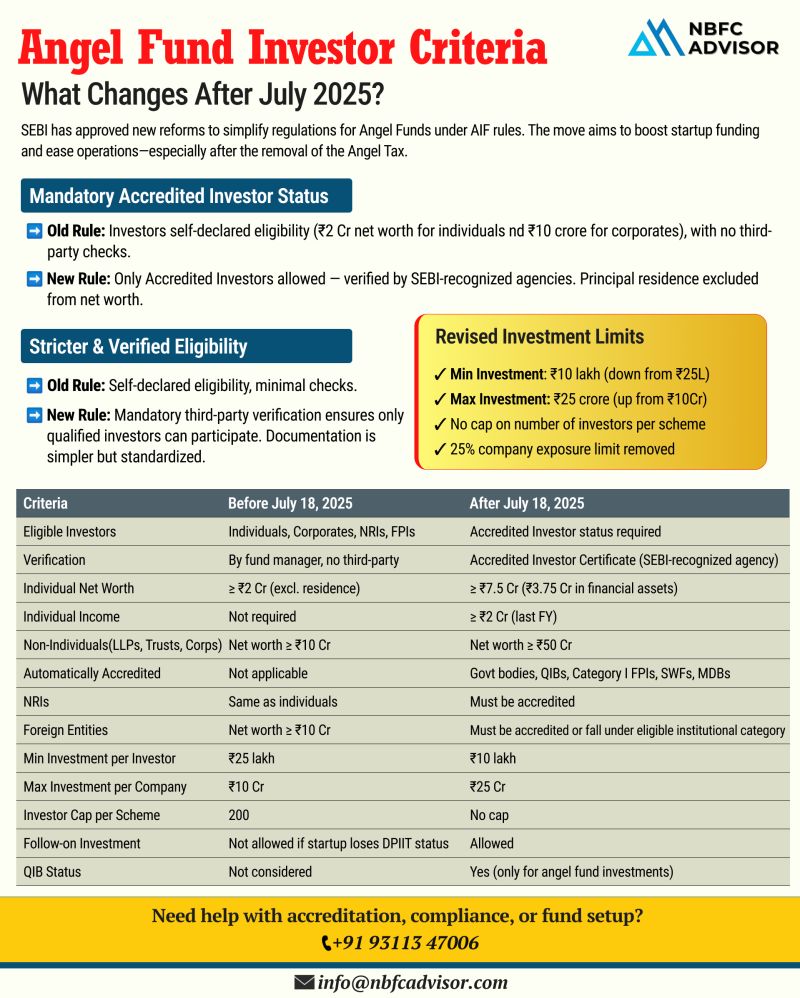

𝘉𝘪𝘨 𝘊𝘩𝘢𝘯𝘨𝘦𝘴 𝘈𝘩𝘦𝘢𝘥 𝘧𝘰𝘳 𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥𝘴 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under a revamped SEBI framework, bringing clarity, credibility, and new opportunities to early-stage...