NBFC Takeover Procedure in India – Step-by-Step Guide

Non-Banking Financial Companies (NBFCs) play a vital role in India’s financial ecosystem by providing credit, investments, and financial services outside traditional banking. With consolidation increasing in the financial sector, NBFC takeovers have become a common strategic move for expansion, restructuring, or market entry.

This blog explains the NBFC takeover procedure in India, covering regulatory approvals, documentation, timelines, and key compliance requirements.

What is an NBFC Takeover?

An NBFC takeover refers to the transfer of ownership and management control of an existing NBFC from one entity to another. This can happen through:

-

Share acquisition

-

Management transfer

-

Merger or amalgamation

-

Change in controlling stake

All NBFC takeovers are governed by Reserve Bank of India (RBI) regulations and must strictly comply with applicable laws.

When is RBI Approval Required?

RBI approval is mandatory in the following cases:

-

Acquisition of 26% or more of paid-up equity capital

-

Any change in control of the NBFC

-

Transfer of management through agreement or arrangement

-

Merger or amalgamation involving an NBFC

Without RBI approval, the takeover is considered invalid and non-compliant.

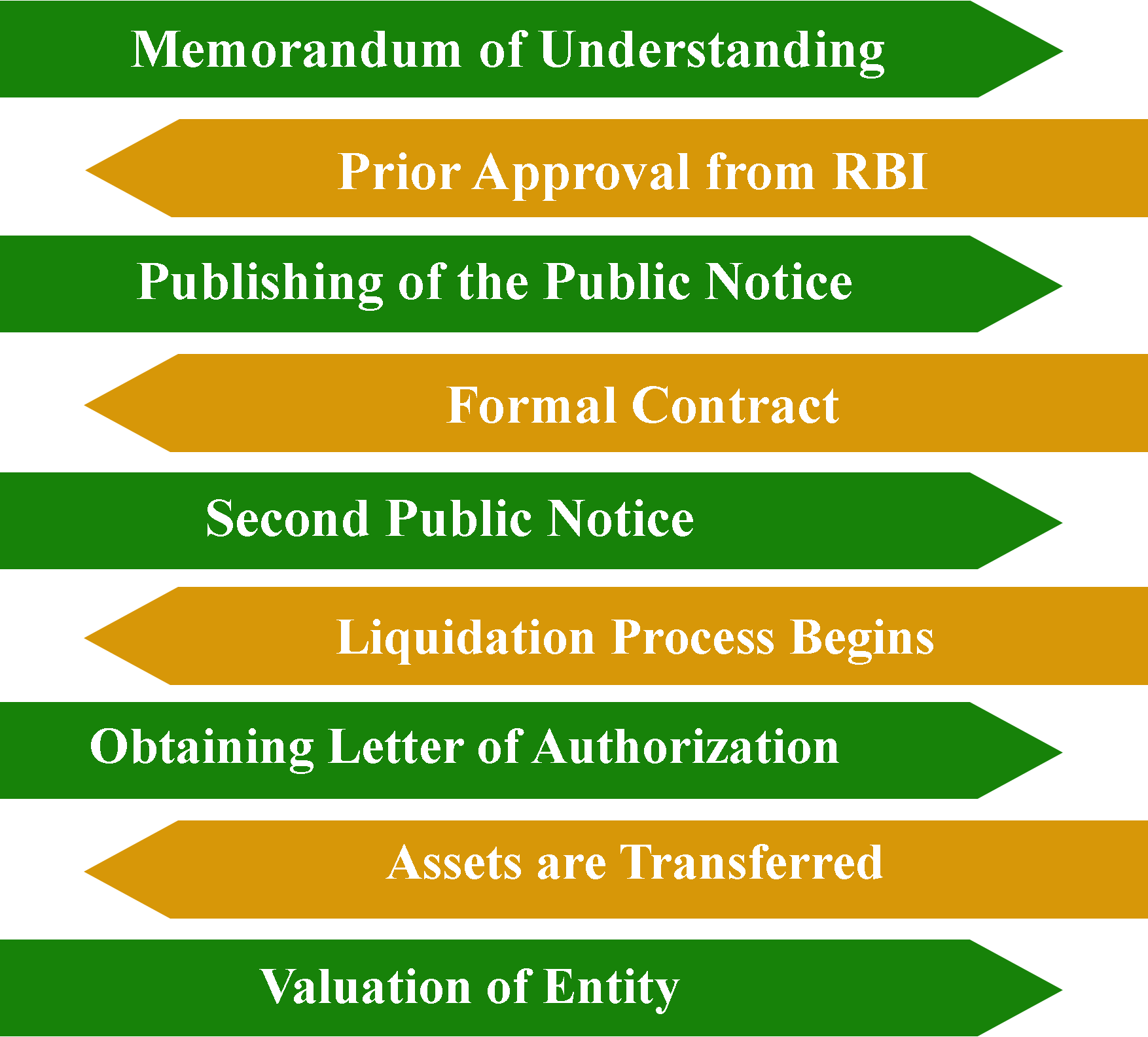

Step-by-Step NBFC Takeover Procedure

1️⃣ Board Meeting & In-Principle Approval

Both the acquirer NBFC/company and the target NBFC must pass board resolutions approving the takeover and authorizing representatives to proceed.

2️⃣ Due Diligence of the NBFC

A comprehensive due diligence is conducted covering:

-

Financial statements

-

Loan portfolio quality

-

Statutory compliances

-

RBI filings and inspections

-

Pending litigations or defaults

This step helps identify risks before proceeding.

3️⃣ Public Notice Requirement

As per RBI guidelines, a public notice must be published:

-

In one national English newspaper

-

In one vernacular newspaper of the registered office state

-

At least 30 days before the proposed takeover

The notice must disclose:

-

Details of proposed transfer

-

Names of incoming and outgoing promoters

-

Reasons for takeover

4️⃣ Application to RBI

An application is submitted to the RBI along with:

-

Detailed takeover proposal

-

Shareholding pattern (before & after takeover)

-

KYC of incoming directors/shareholders

-

Source of funds declaration

-

Business plan post-takeover

5️⃣ RBI Review & Approval

RBI examines:

-

Financial soundness of the acquirer

-

Track record and integrity of new promoters

-

Compliance history of the NBFC

-

Impact on depositors and customers

If satisfied, RBI grants prior written approval.

6️⃣ Execution of Share Transfer & Agreements

Post RBI approval:

-

Share Purchase Agreement (SPA) is executed

-

Share transfer forms are filed

-

Consideration is paid

-

Management control is transferred

7️⃣ Post-Takeover Compliances

After completion, the NBFC must:

-

Update RBI records

-

File ROC forms (DIR-12, MGT-7, etc.)

-

Update statutory registers

-

Inform banks, financial institutions, and stakeholders

Documents Required for NBFC Takeover

-

Certificate of Registration (CoR)

-

Memorandum & Articles of Association

-

Board and shareholder resolutions

-

Audited financials (last 3 years)

-

KYC of incoming promoters/directors

-

Net worth and source of funds proof

Timeline for NBFC Takeover

⏳ Approximate timeline:

3 to 6 months, depending on:

-

RBI scrutiny

-

Completeness of documents

-

Complexity of ownership change

Key Benefits of NBFC Takeover

-

Faster market entry

-

Existing RBI license

-

Operational NBFC with assets

-

Established customer base

-

Cost and time efficiency

Common Challenges

-

RBI compliance delays

-

Incomplete documentation

-

Weak financials of target NBFC

-

Regulatory observations

Professional handling significantly reduces these risks.

Conclusion

An NBFC takeover is a high-value, regulation-intensive process that requires careful planning, RBI coordination, and legal expertise. From due diligence to post-takeover compliances, every step must align with RBI norms to ensure a smooth and legally valid transfer.

If you are planning an NBFC takeover, professional guidance can help you save time, avoid regulatory hurdles, and ensure end-to-end compliance.