The Growth of AIFs: How India’s Startup Boom Is Creating New Opportunities

India’s startup ecosystem is witnessing an unprecedented surge.

With 1.59 lakh+ startups and over 110 unicorns, India has emerged as the third-largest startup ...

Why Do Many NBFCs Fail to Scale? The Real Issue Is Financial Clarity

When NBFCs struggle to scale, the first assumption is often lack of funds.

But in reality, capital is only part of the story.

The real bottleneck is financial clarity.

Wit...

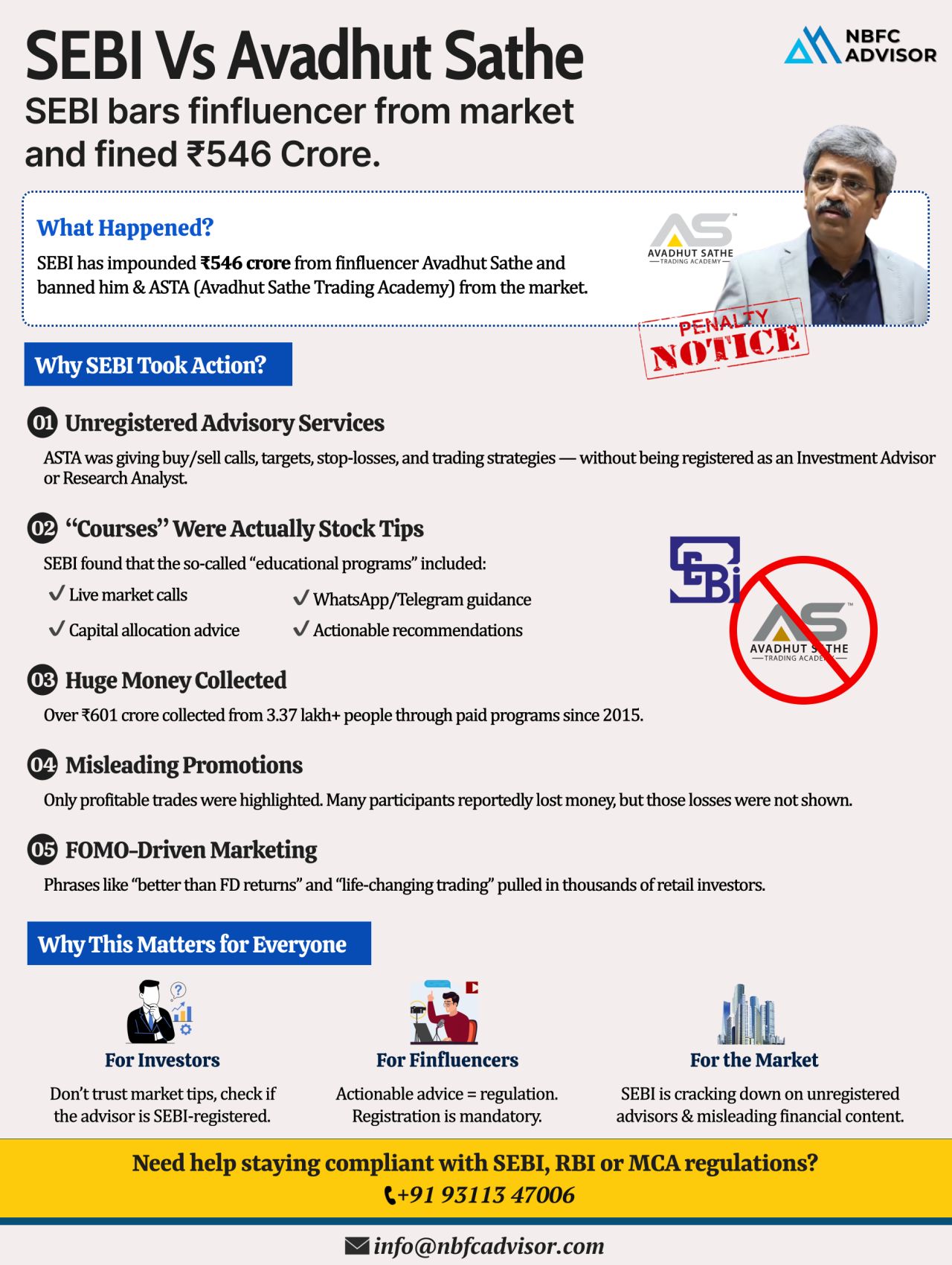

SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut S...

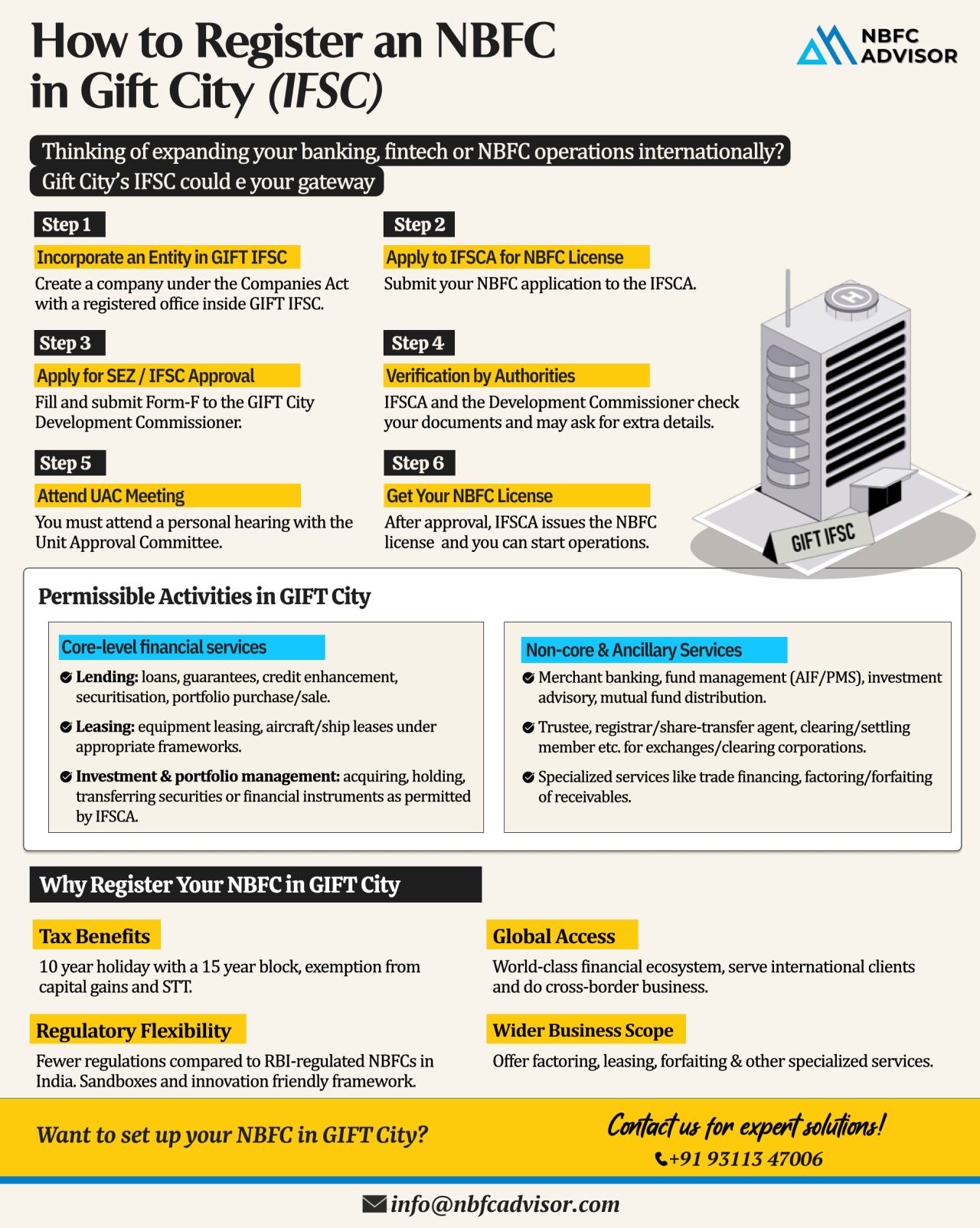

Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

Reserve Bank of India (RBI) just slapped HDFC Bankwith a Rs 91 lakh penalty (order dated Nov 18, 2025) for outsourcing KYC compliance to third parties—a core function that’s strictly off-limits under RBI’s ironclad guidelines for ba...

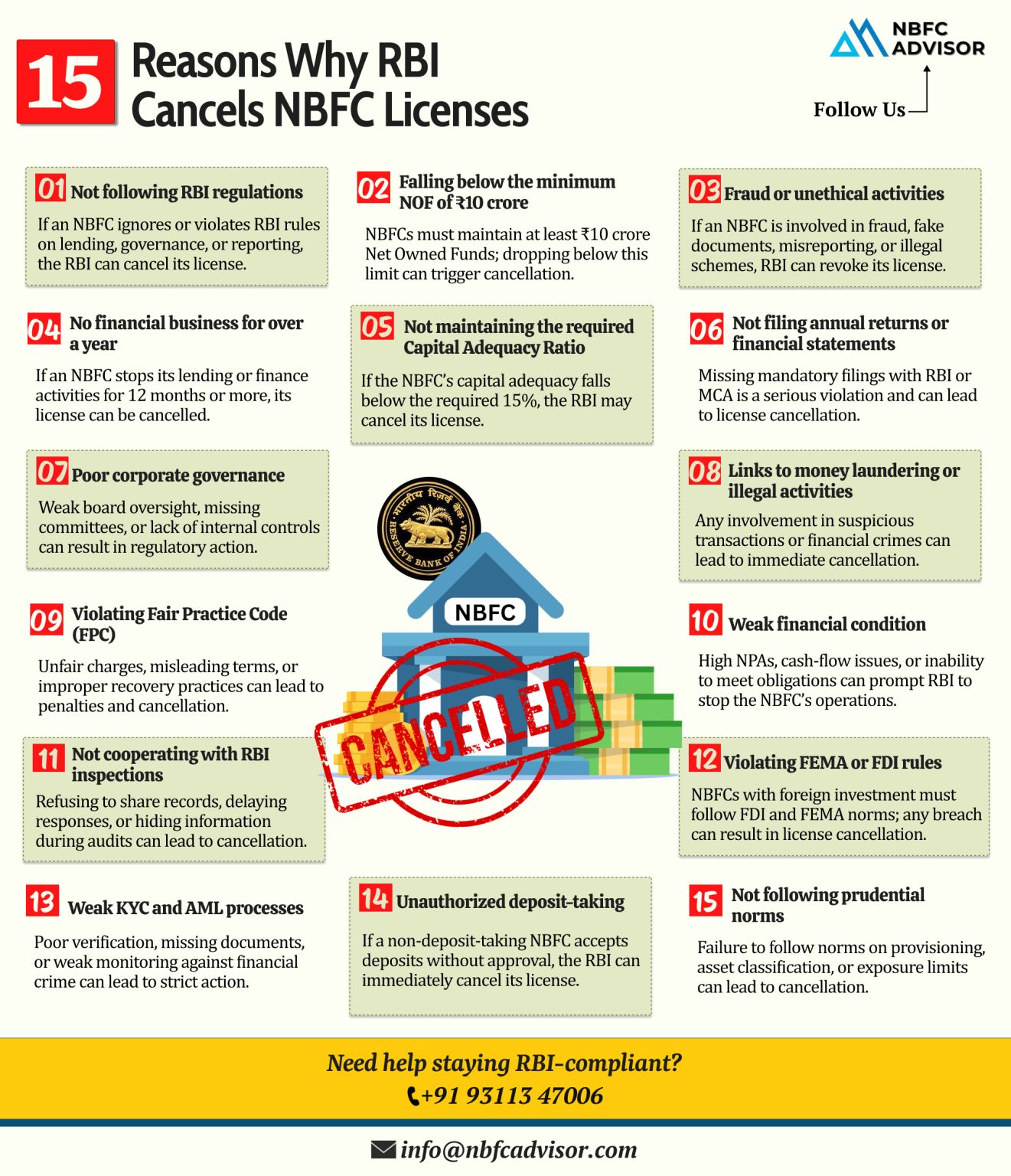

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

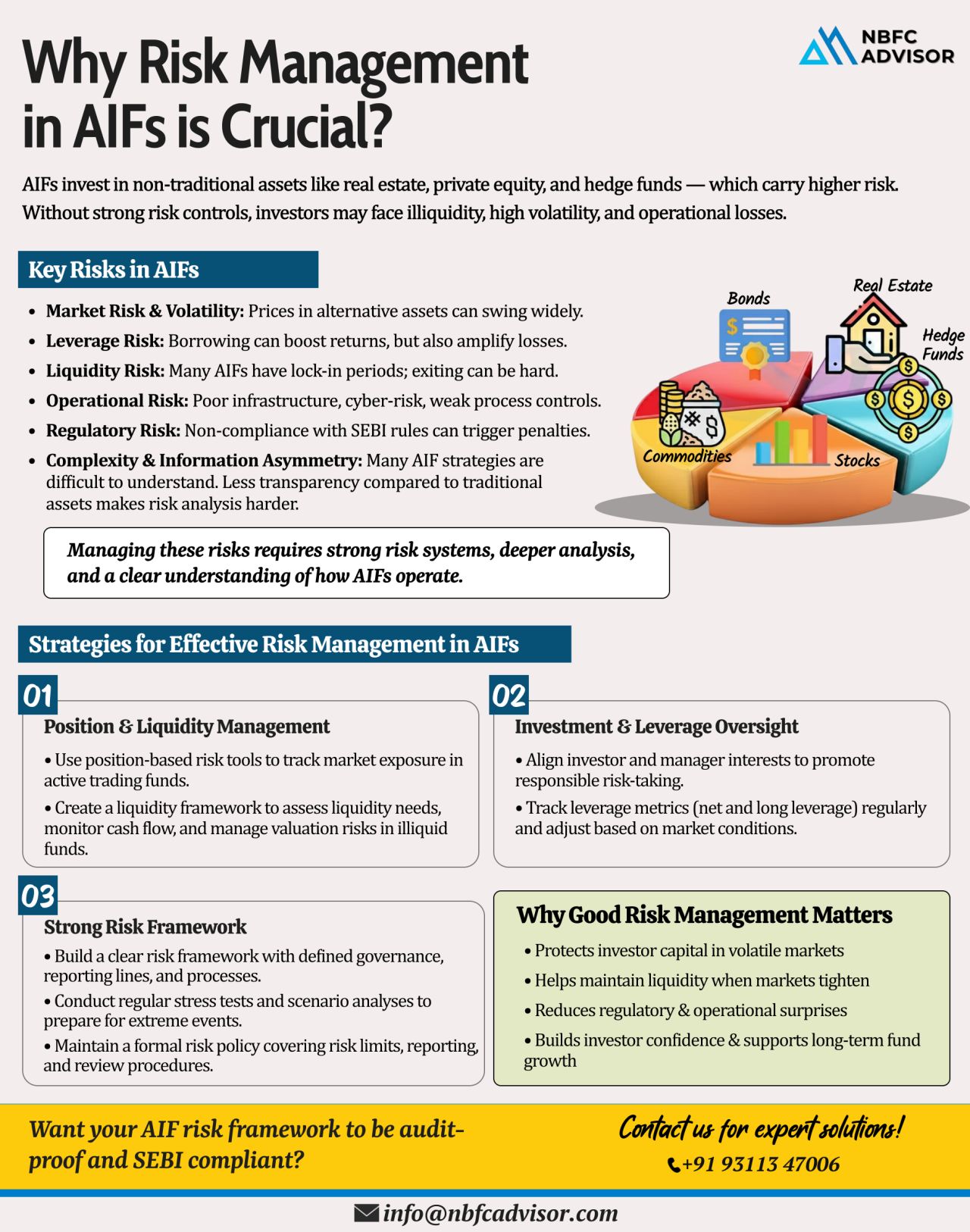

Ignoring Risk in AIFs? Even a Small Market Shift Can Trigger Major Losses

Alternative Investment Funds (AIFs) are growing rapidly in India — from private equity and venture capital to hedge-style Category III funds. But with higher returns c...

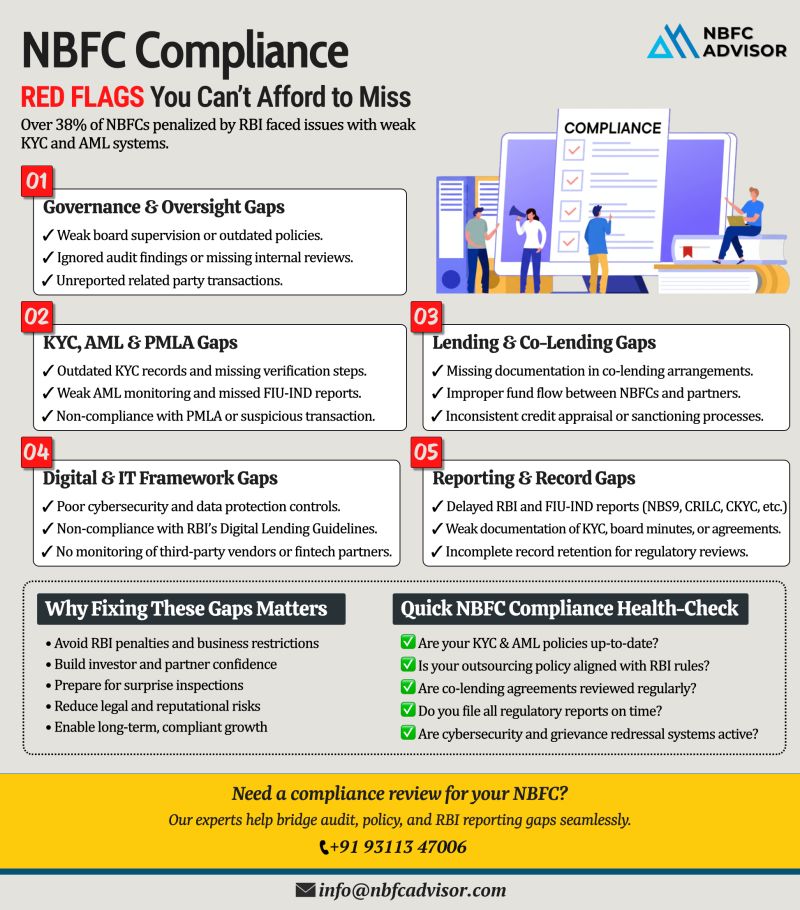

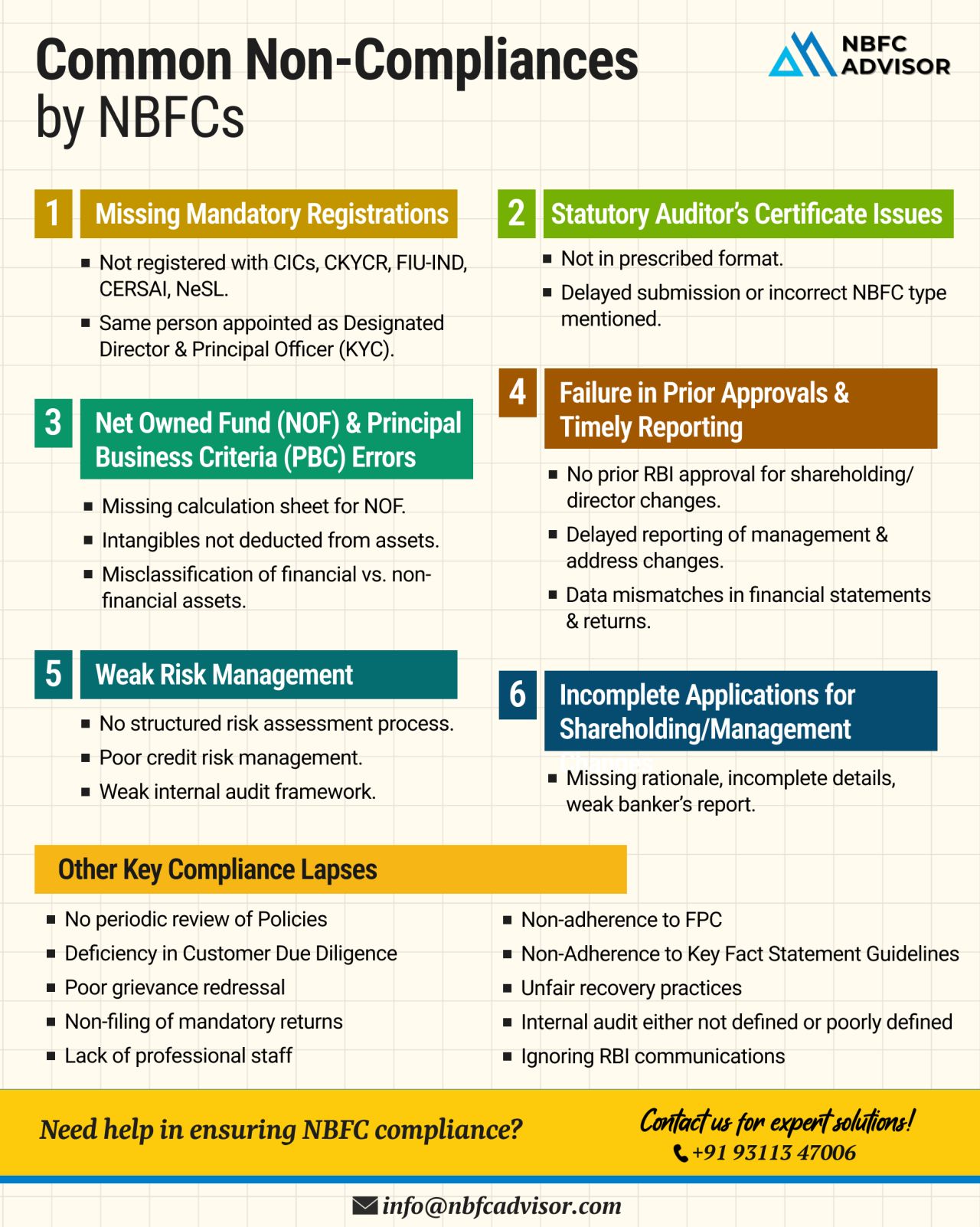

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny!

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several NBFCs — not for fraud or mismanagement — but for missing critical compliance steps.

As...

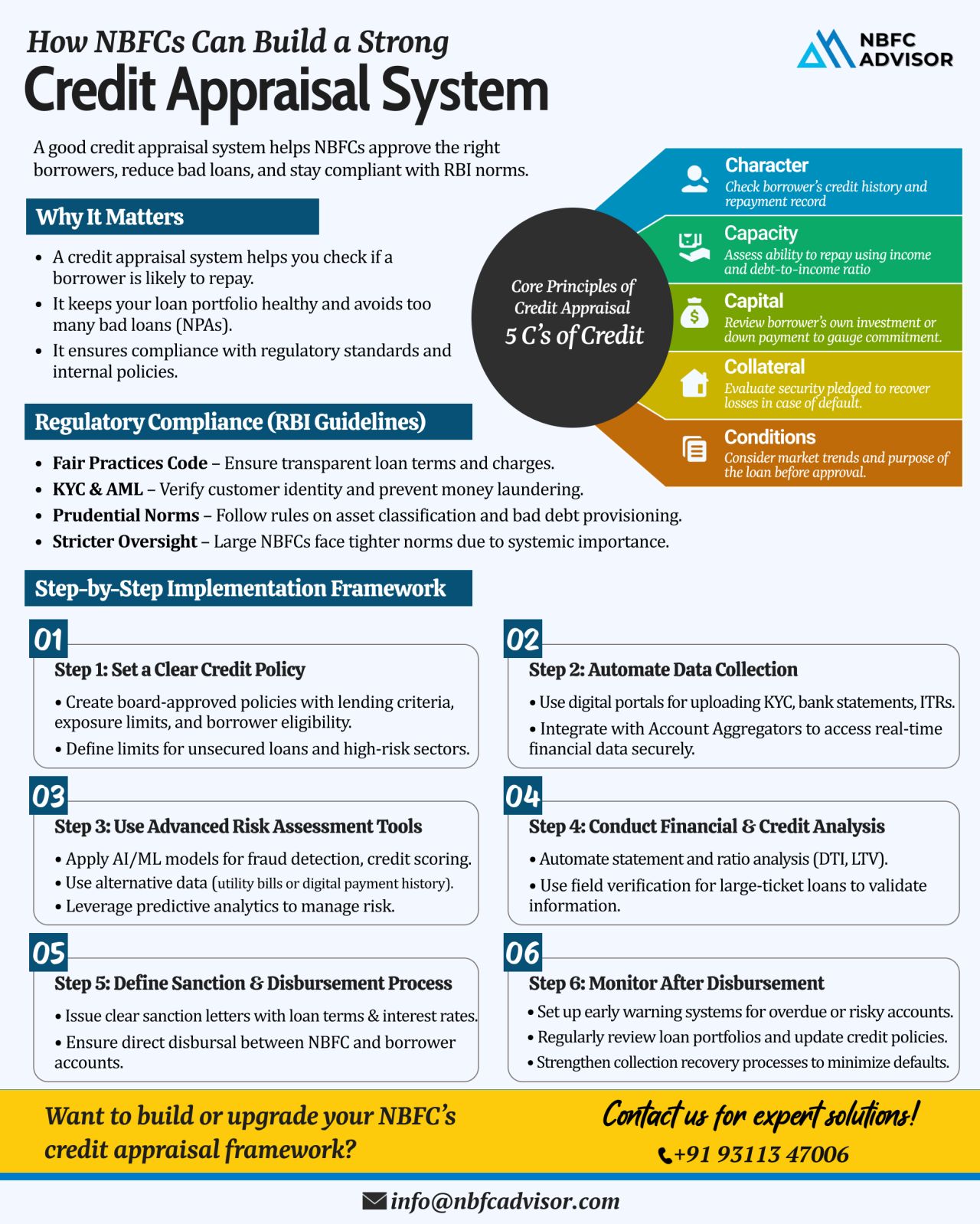

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

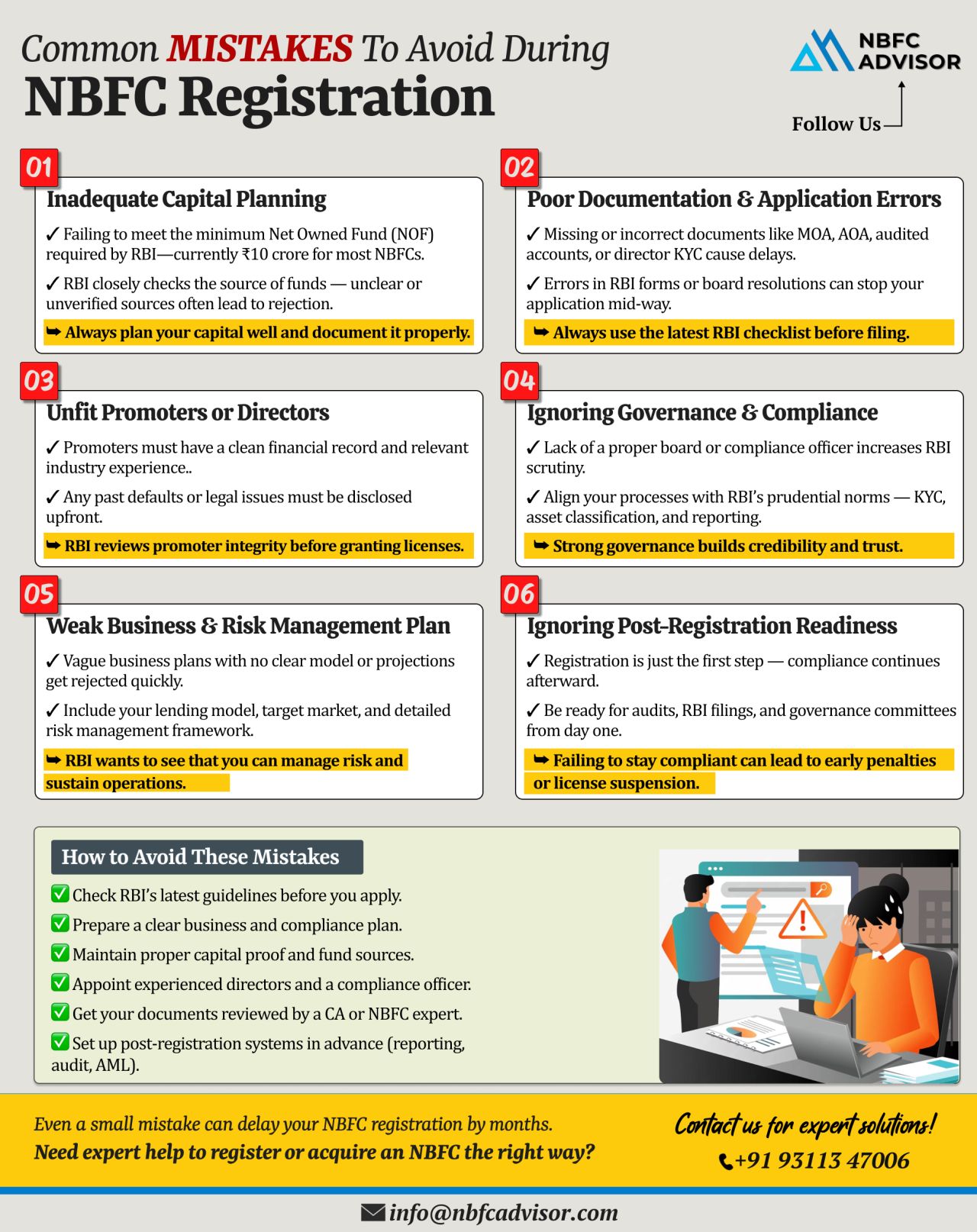

Many NBFC Applications Get Rejected by the RBI — Here’s Why! ⚠️

Avoid Costly Mistakes Before You Apply

Every year, the Reserve Bank of India (RBI) receives hundreds of applications for NBFC (Non-Banking Financial Company) registrati...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

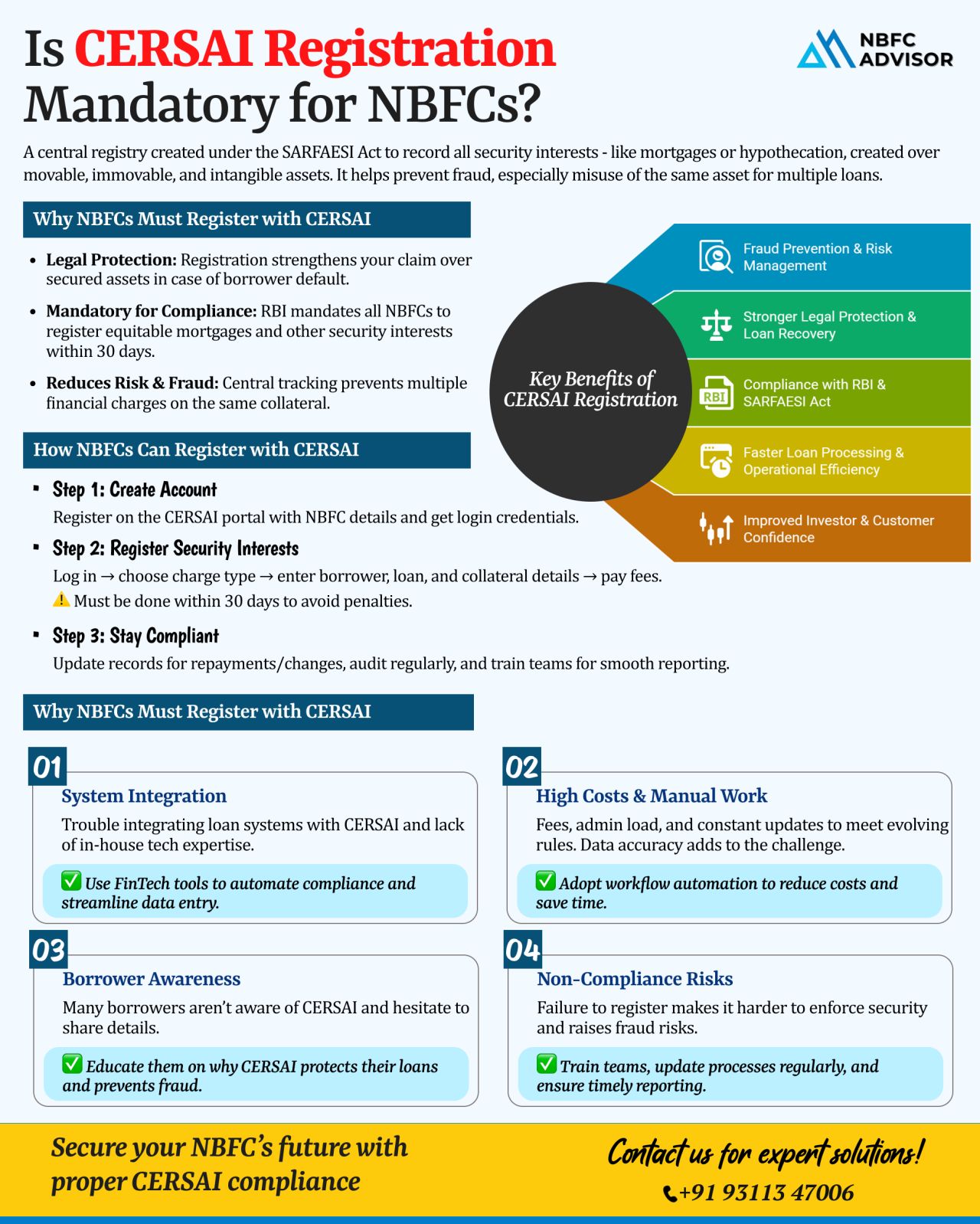

Is CERSAI Registration Mandatory for NBFCs?

One of the most common mistakes many NBFCs make is overlooking CERSAI registration. While compliance with RBI guidelines and customer onboarding processes get due attention, CERSAI often slips under the ...

Is Your NBFC Aligned with the Latest RBI Updates?

The Reserve Bank of India (RBI) is taking decisive steps to tighten the compliance framework for Non-Banking Financial Companies (NBFCs), ensuring transparency, customer protection, and responsible...

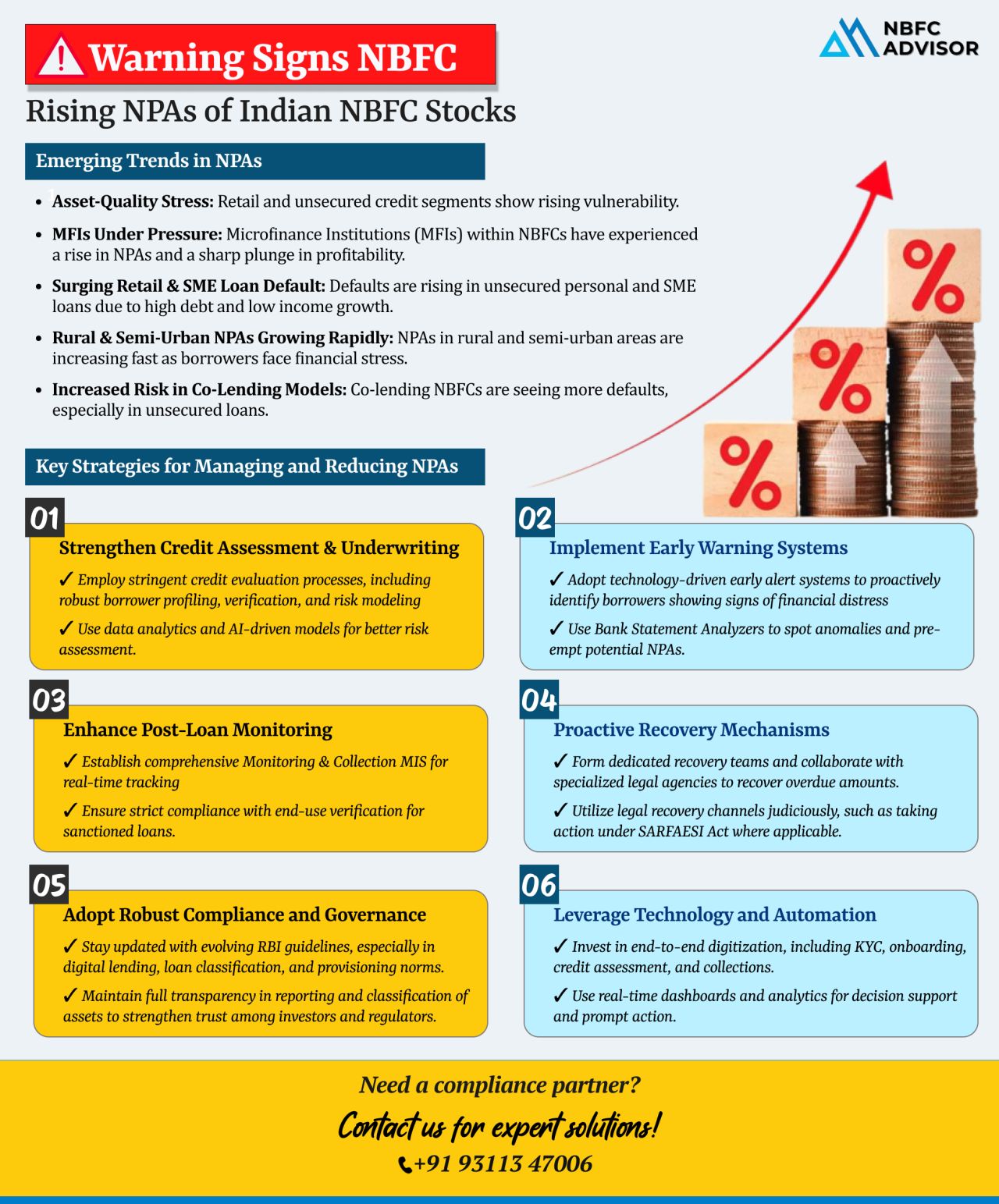

Rising NPAs Are a Wake-Up Call for NBFCs

India’s NBFC sector is under pressure. The alarming rise in Non-Performing Assets (NPAs) is sending a clear signal—NBFCs need to act now.

From unsecured personal loans to SME and rural lendin...

Avoid These 10 Common Mistakes When Registering an AIF

Registering an Alternative Investment Fund (AIF) with SEBI is a crucial step for fund managers and institutions looking to enter India’s alternative investment space. However, the regist...

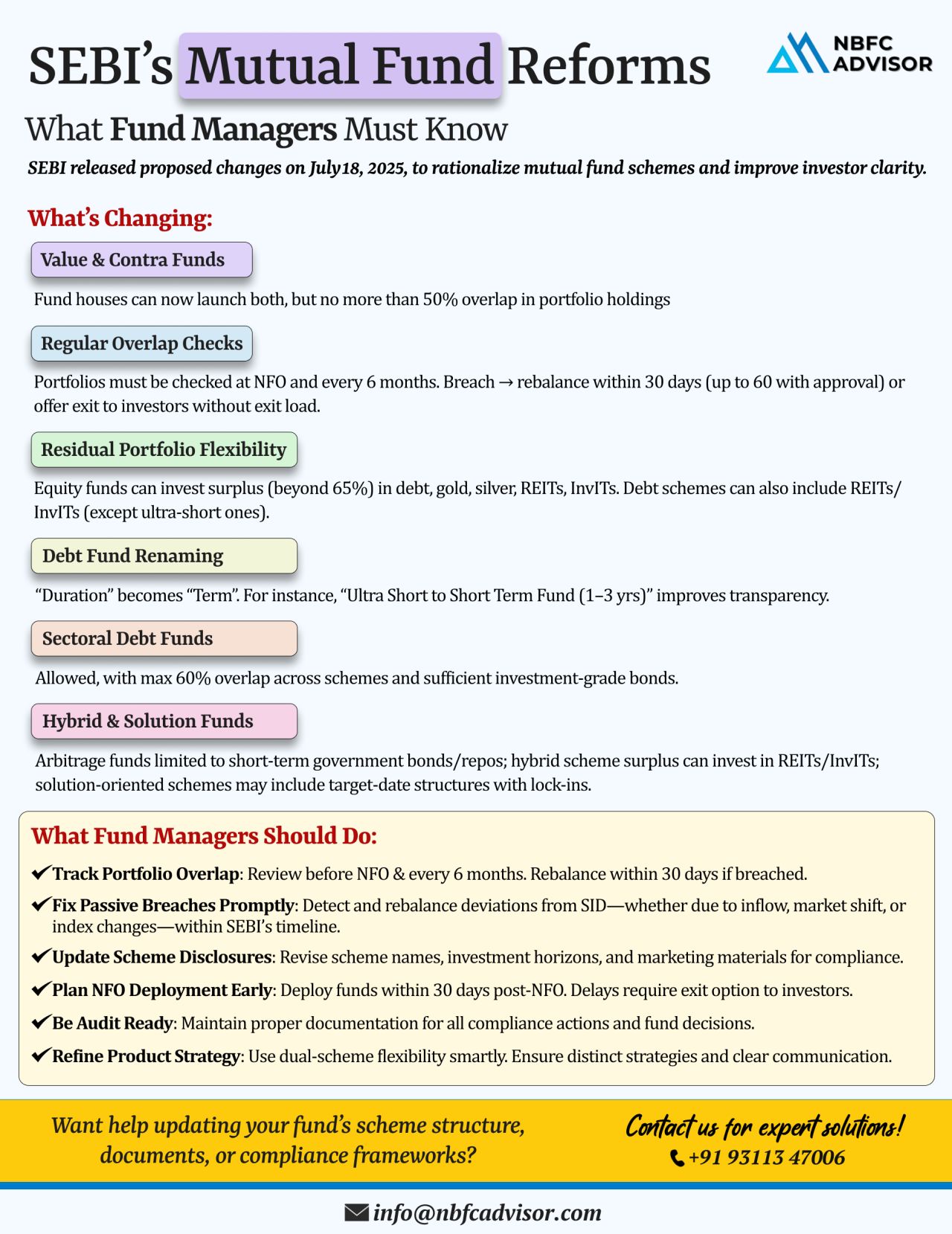

🧭 Enhancing Clarity, Transparency & Flexibility: SEBI’s New Era of Mutual Fund Reforms

In a move to simplify mutual fund structures and protect investor interests, the Securities and Exchange Board of India (SEBI) has proposed a set of ...

📰 SEBI’s New Mutual Fund Reforms: What Investors & Fund Managers Need to Know

The Securities and Exchange Board of India (SEBI) has proposed sweeping changes to the mutual fund framework to enhance transparency, reduce overlap, and ensu...

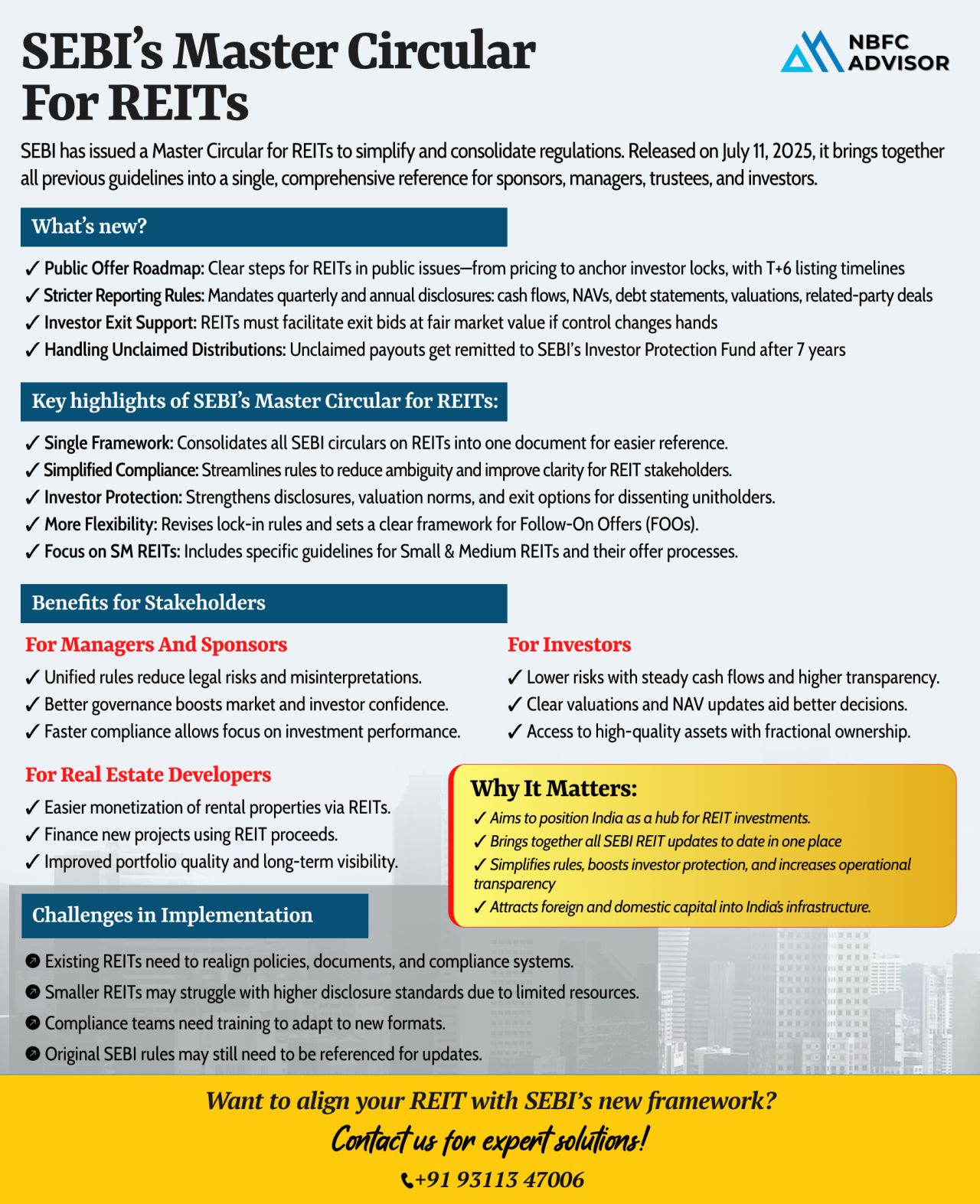

SEBI’s Master Circular for REITs: Transparency, Simplicity & Growth in One Framework

The Securities and Exchange Board of India (SEBI) has taken a bold step to reshape the future of Real Estate Investment Trusts (REITs) in India. With it...

The Reserve Bank of India (RBI) is actively preparing for the future of finance with a strategic officer training program at its Hyderabad campus. This initiative is laser-focused on emerging areas such as:

✅ Digital Banking

✅ Fintec...

⚠️ Is Your NBFC Prepared for RBI Scrutiny?

The Reserve Bank of India (RBI) has intensified its oversight of Non-Banking Financial Companies (NBFCs), and non-compliance—whether intentional or not—can lead to serious repercussions.

Fr...

RBI Tightens the Reins on NBFCs — Is Your Company Ready for Compliance Scrutiny?

India’s financial watchdog, the Reserve Bank of India (RBI), is stepping up its enforcement measures against Non-Banking Financial Companies (NBFCs). Rece...

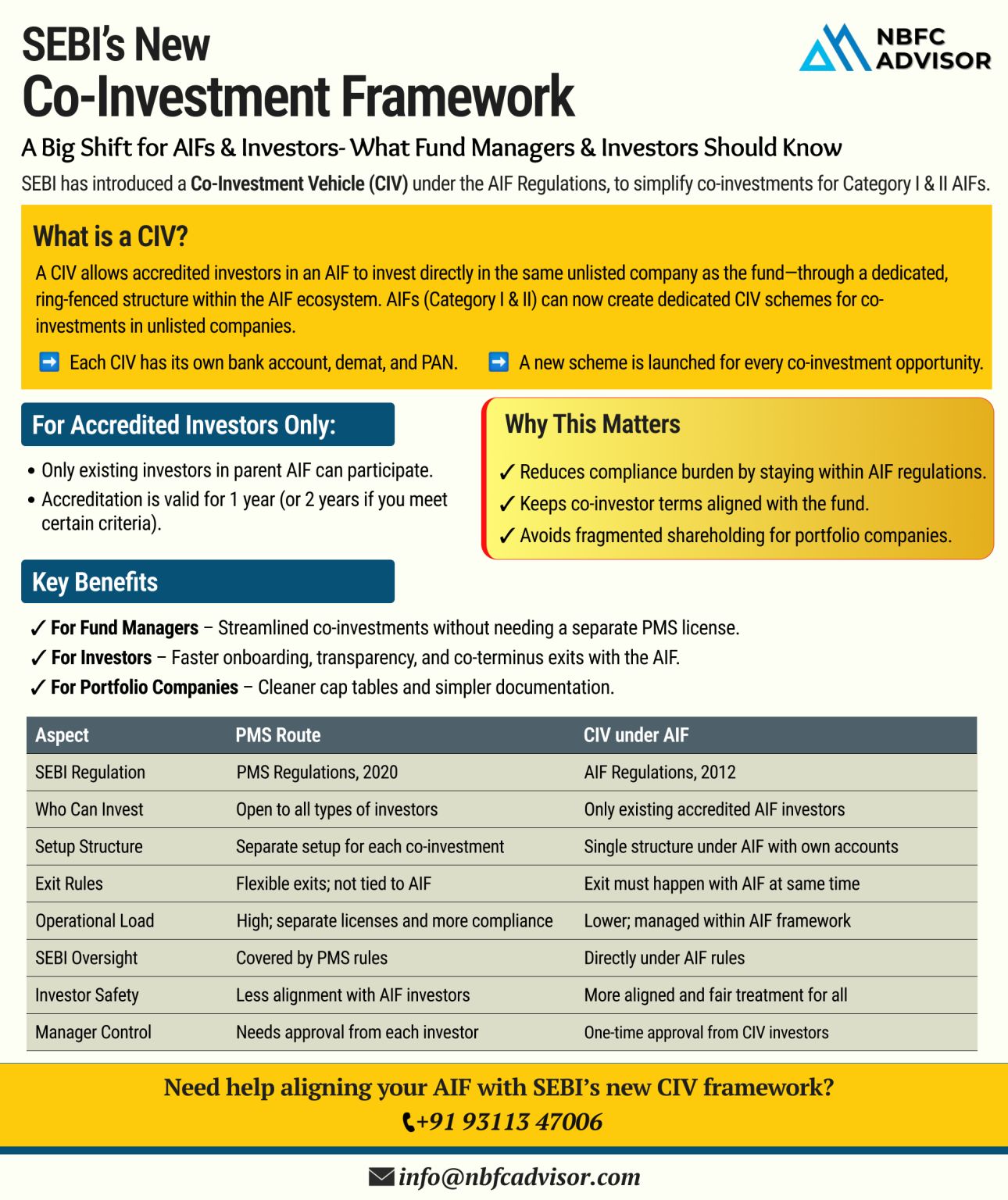

SEBI’s New Co-Investment Framework: A Big Boost for India’s Private Capital Market

India’s alternative investment ecosystem just got a major regulatory upgrade.

The Securities and Exchange Board of India (SEBI) has introduced ...

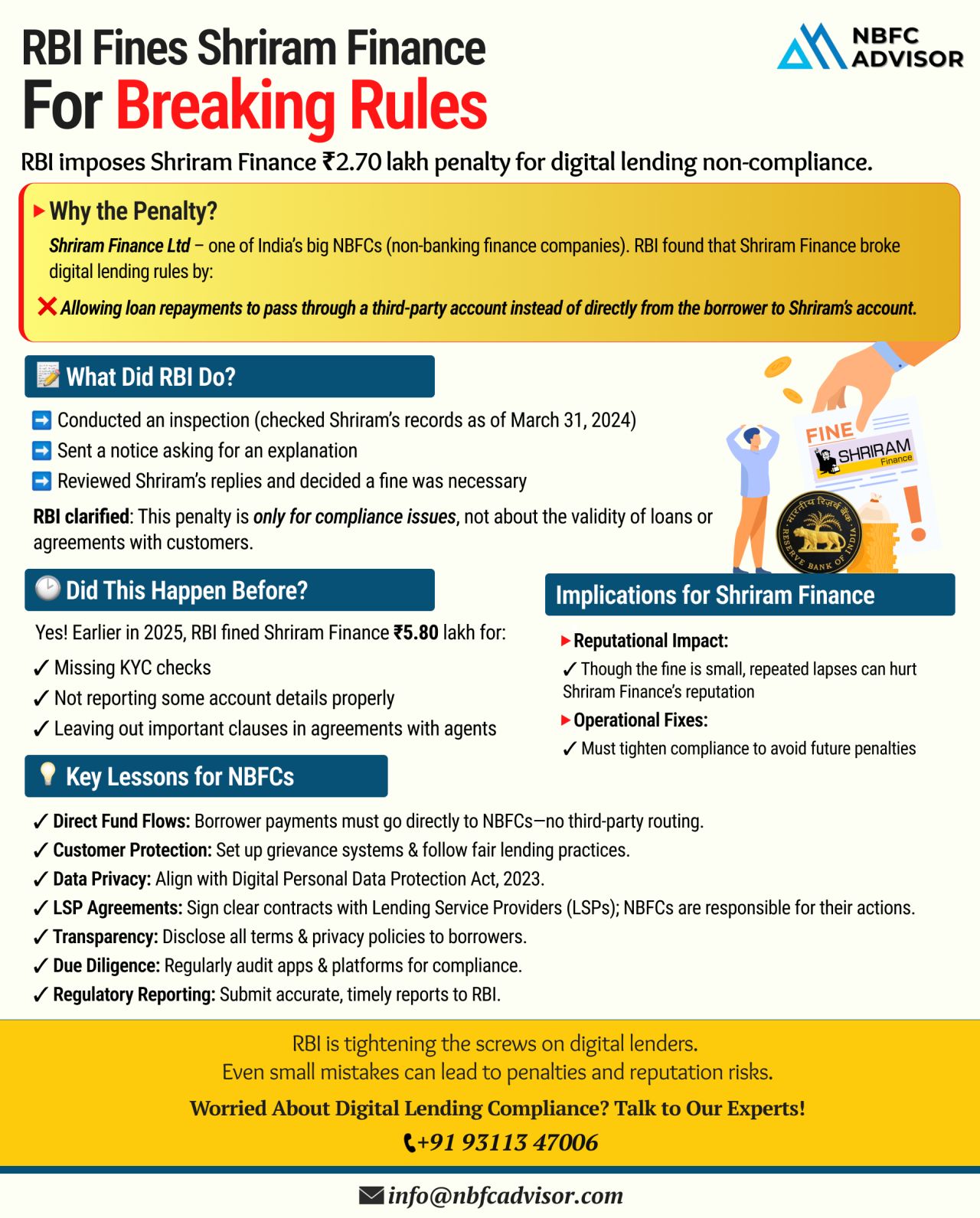

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

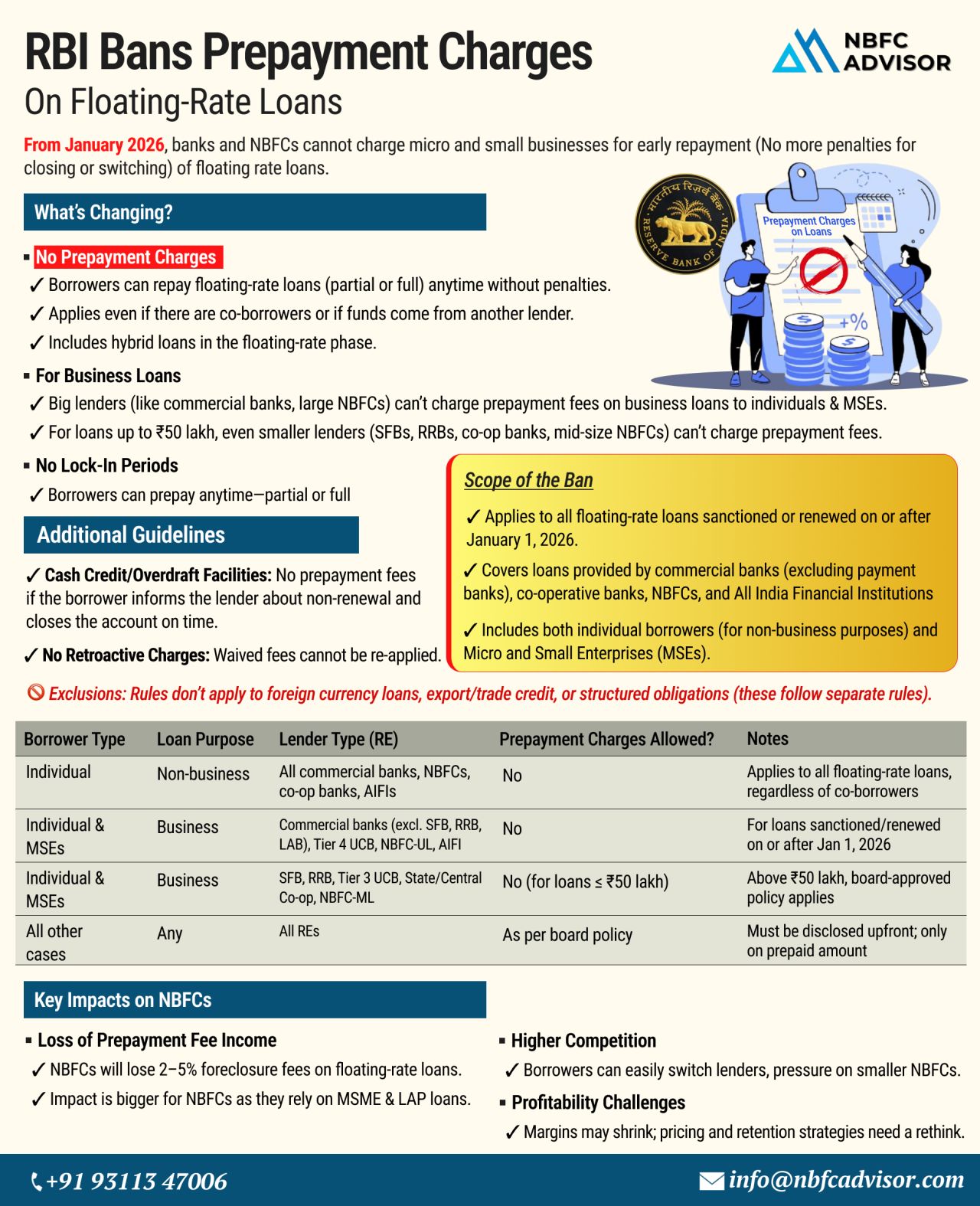

RBI Bans Prepayment Charges on Floating-Rate Loans

What It Means for NBFCs Starting January 2026

The Reserve Bank of India (RBI) has rolled out a major regulatory change aimed at giving borrowers more freedom. From January 1, 2026, no prepaymen...

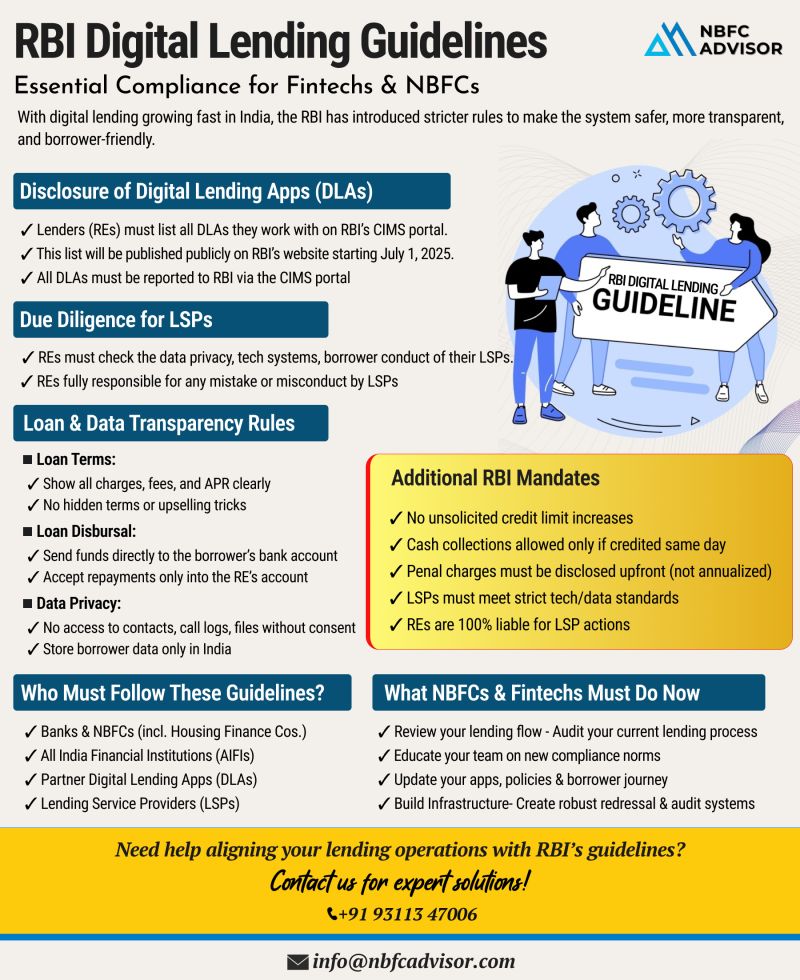

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐆𝐫𝐢𝐩 𝐨𝐧 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐎𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

India's digital lending sector has seen exponential growth—but so have regulatory concerns. In a move ...

❌ Top Reasons Why NBFC License Applications Get Rejected

1. Weak Business Plan and Unrealistic Projections

The RBI expects applicants to submit a well-defined, sector-focused business plan backed by in-depth market research and practical financia...

Non-Banking Financial Companies (NBFCs) are essential players in India's financial ecosystem. They provide crucial financial services such as loans, credit facilities, asset financing and investment services, often reaching segments of the popula...

The financial services sector in India is vast and multifaceted, with Non-Banking Financial Companies (NBFCs) playing a crucial role in providing credit and investment solutions. With their increasing presence and significance in the economy, NBFC ta...

In recent years, the Non-Banking Financial Companies (NBFC) sector in India has experienced considerable growth, playing a critical role in providing financial services such as loans, credit and investment. As a result, NBFC takeovers have become inc...