RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory requirements are not met.

What’s concerning is that most licence cancellations do not happen due to fraud, but because of avoidable compliance failures—missed filings, weak governance, or failure to meet financial thresholds.

Once an NBFC licence is cancelled, operations must stop immediately, and revival becomes extremely difficult.

Understanding the key risks is the first step to prevention.

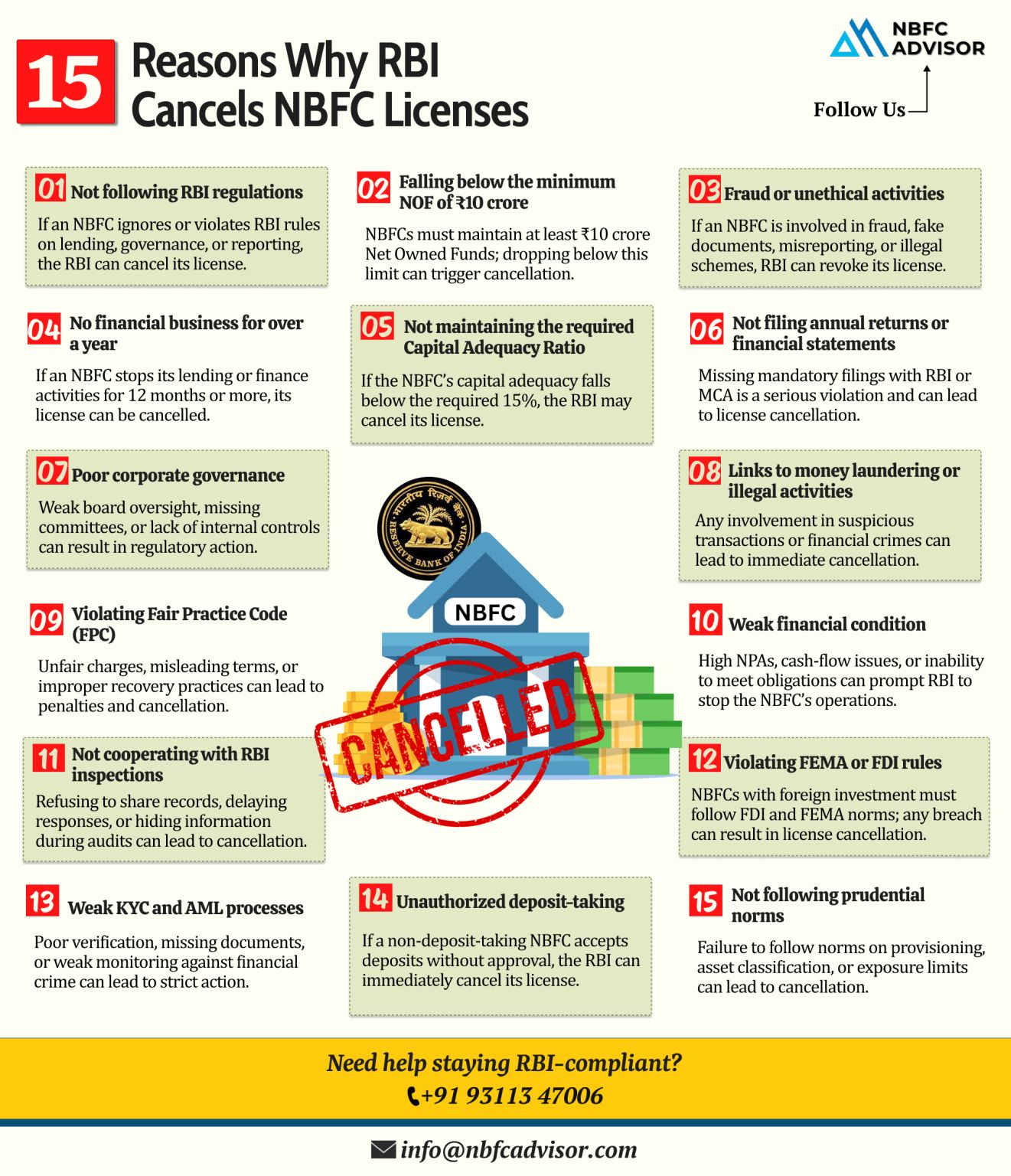

Common Reasons RBI Cancels NBFC Licences

Below are 15 major risks that frequently trigger RBI action against NBFCs:

1. Failure to Maintain Minimum Net Owned Funds (NOF)

Not meeting the prescribed NOF requirement is one of the fastest ways to invite cancellation.

2. Non-Filing of Statutory Returns

Missed or delayed filings such as NBS returns, statutory auditor certificates, or annual submissions raise immediate red flags.

3. Prolonged Inactive Operations

NBFCs that remain inactive or fail to conduct financial business for extended periods risk losing their licence.

4. Weak KYC and AML Framework

Inadequate customer due diligence, poor AML controls, or non-compliance with KYC norms attracts strict scrutiny.

5. Poor Corporate Governance

Lack of independent directors, improper board oversight, or non-functional committees weaken regulatory confidence.

6. Misuse of Public or Borrowed Funds

Deviation from approved business activities or misuse of funds is a serious violation.

7. Adverse Audit Observations

Repeated or unresolved qualifications in statutory or RBI inspection reports can trigger enforcement action.

8. Failure to Follow RBI Directions

Ignoring circulars, master directions, or supervisory instructions is viewed as willful non-compliance.

9. Inadequate Risk Management Systems

Absence of proper credit, liquidity, and operational risk frameworks increases regulatory concern.

10. Incorrect or Misleading Disclosures

Submitting inaccurate data or suppressing material information can lead to severe penalties.

11. Change in Control Without Approval

Any change in shareholding or management without RBI’s prior approval is a major violation.

12. Non-Compliance with Fair Practices Code

Failure to follow customer protection norms can lead to complaints and regulatory action.

13. Regulatory Capital Erosion

Continuous losses reducing capital below acceptable levels signal financial instability.

14. Failure to Appoint Key Managerial Personnel

Vacancies or non-compliant appointments in senior management roles weaken governance.

15. Repeated Customer Complaints

High grievance levels, especially unresolved ones, often invite supervisory inspections.

Why Licence Cancellation Is So Serious

Once RBI cancels an NBFC licence:

- The NBFC must cease all financial activities immediately

- Loan recovery becomes legally and operationally complex

- Raising capital or selling the NBFC becomes extremely difficult

- Reputation damage is often irreversible

In most cases, revival is far more expensive than staying compliant.

Compliance Is a Continuous Process

NBFC compliance is not a one-time exercise. It requires:

-

Regular internal audits

-

Periodic compliance reviews

-

Strong governance and documentation

-

Proactive response to RBI updates

Understanding and managing these risks can protect your licence and your business.

How NBFC Advisor Can Help

NBFC Advisor provides end-to-end compliance support, including:

- RBI compliance health checks

- Statutory and internal audit support

- NOF and capital adequacy reviews

- Governance and KYC framework strengthening

- Regulatory gap identification and correction

📩 DM us to get your NBFC compliance checked and safeguard your licence.

Hashtags

#NBFCAdvisor #RBI #Compliance #Audit #Governance

#FinancialServices #RegulatoryCompliance #RiskManagement #NBFC