The Growth of AIFs: How India’s Startup Boom Is Creating New Opportunities

India’s startup ecosystem is witnessing an unprecedented surge.

With 1.59 lakh+ startups and over 110 unicorns, India has emerged as the third-largest startup ...

Why Do Many NBFCs Fail to Scale? The Real Issue Is Financial Clarity

When NBFCs struggle to scale, the first assumption is often lack of funds.

But in reality, capital is only part of the story.

The real bottleneck is financial clarity.

Wit...

Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

Why NBFCs Are Adding Factoring to Their Portfolio

India’s MSMEs are the backbone of the economy, contributing significantly to employment and GDP. Yet, one persistent challenge continues to limit their growth—cash flow gaps caused by d...

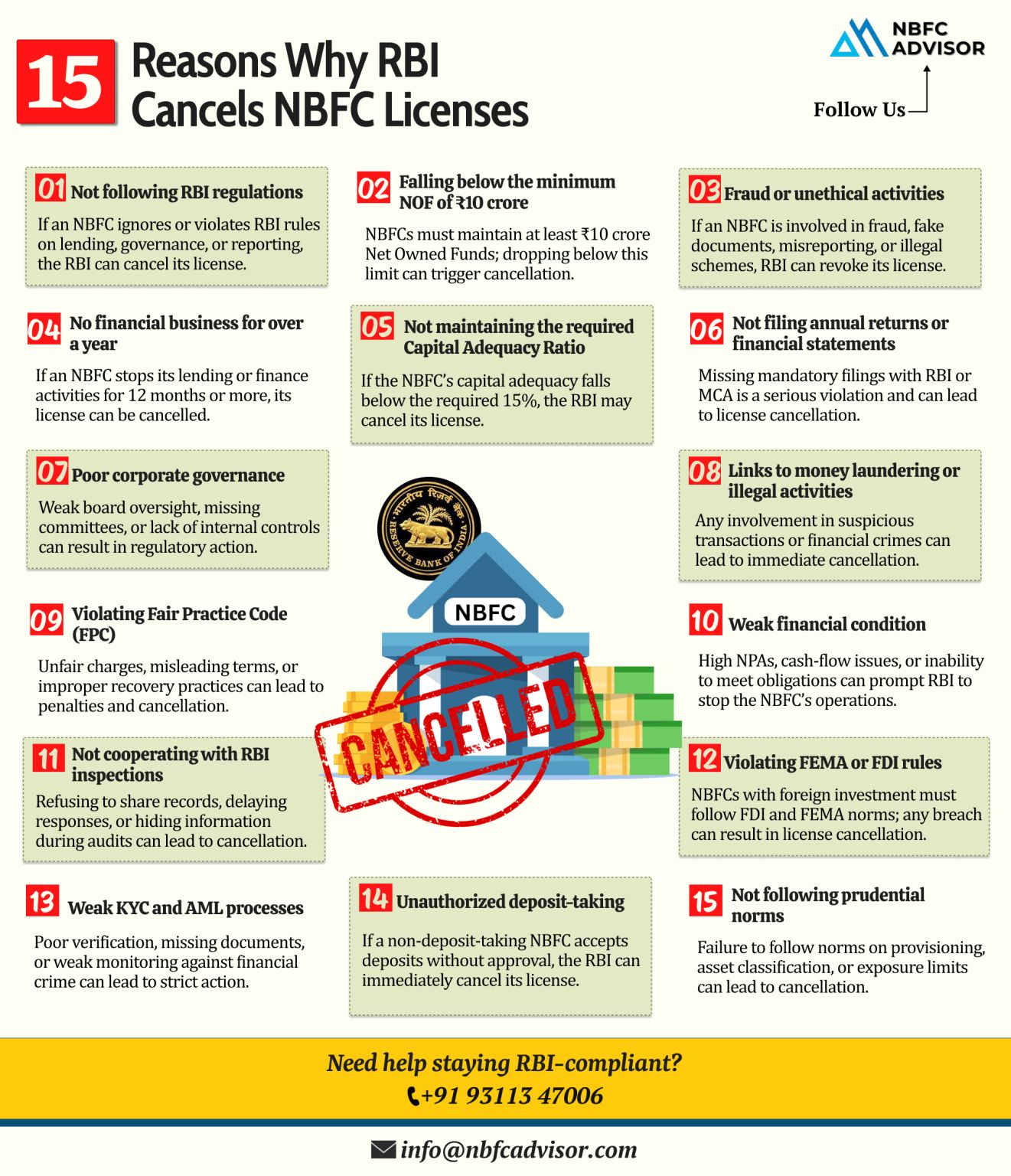

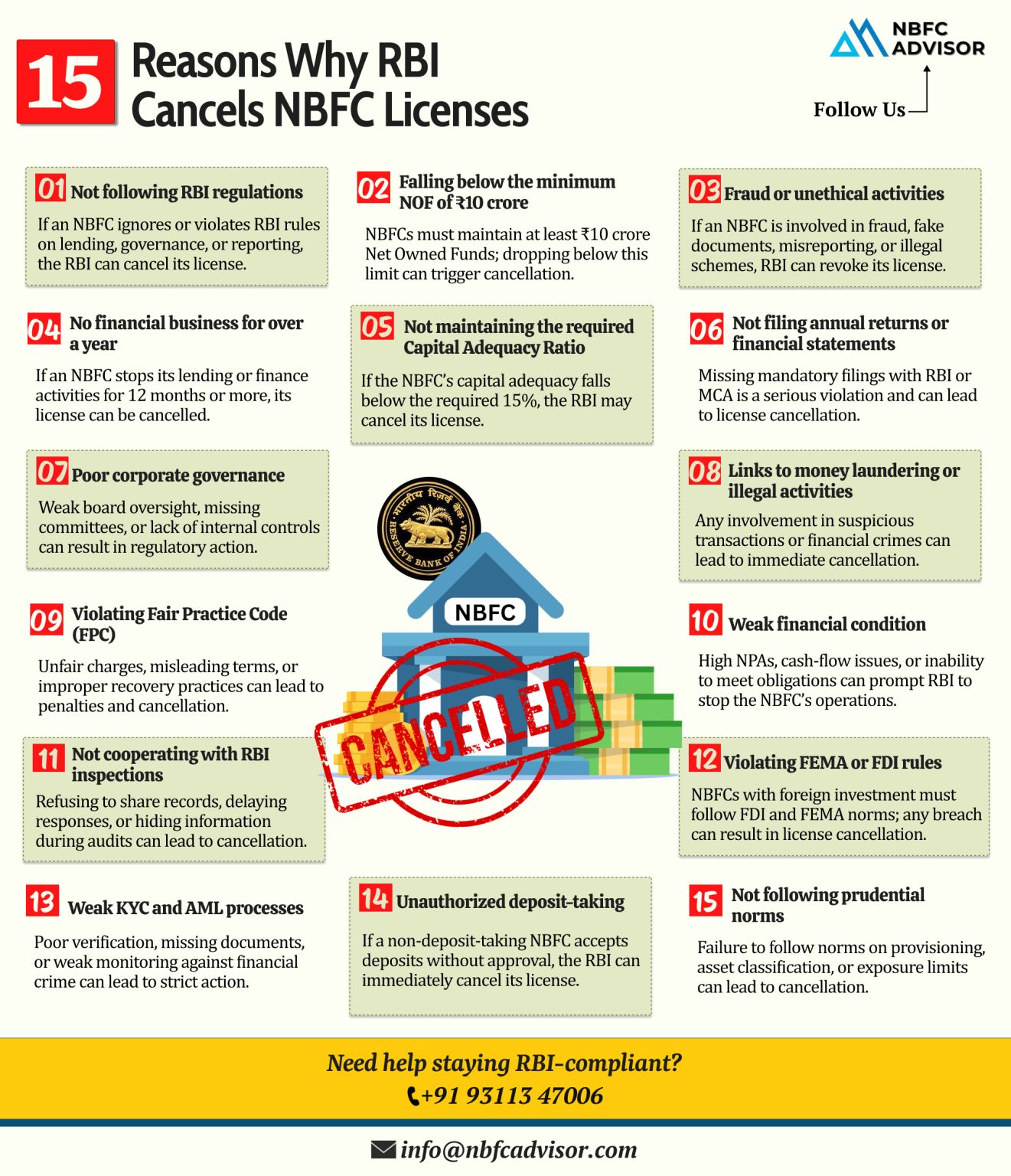

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

Reserve Bank of India (RBI) just slapped HDFC Bankwith a Rs 91 lakh penalty (order dated Nov 18, 2025) for outsourcing KYC compliance to third parties—a core function that’s strictly off-limits under RBI’s ironclad guidelines for ba...

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny!

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several NBFCs — not for fraud or mismanagement — but for missing critical compliance steps.

As...

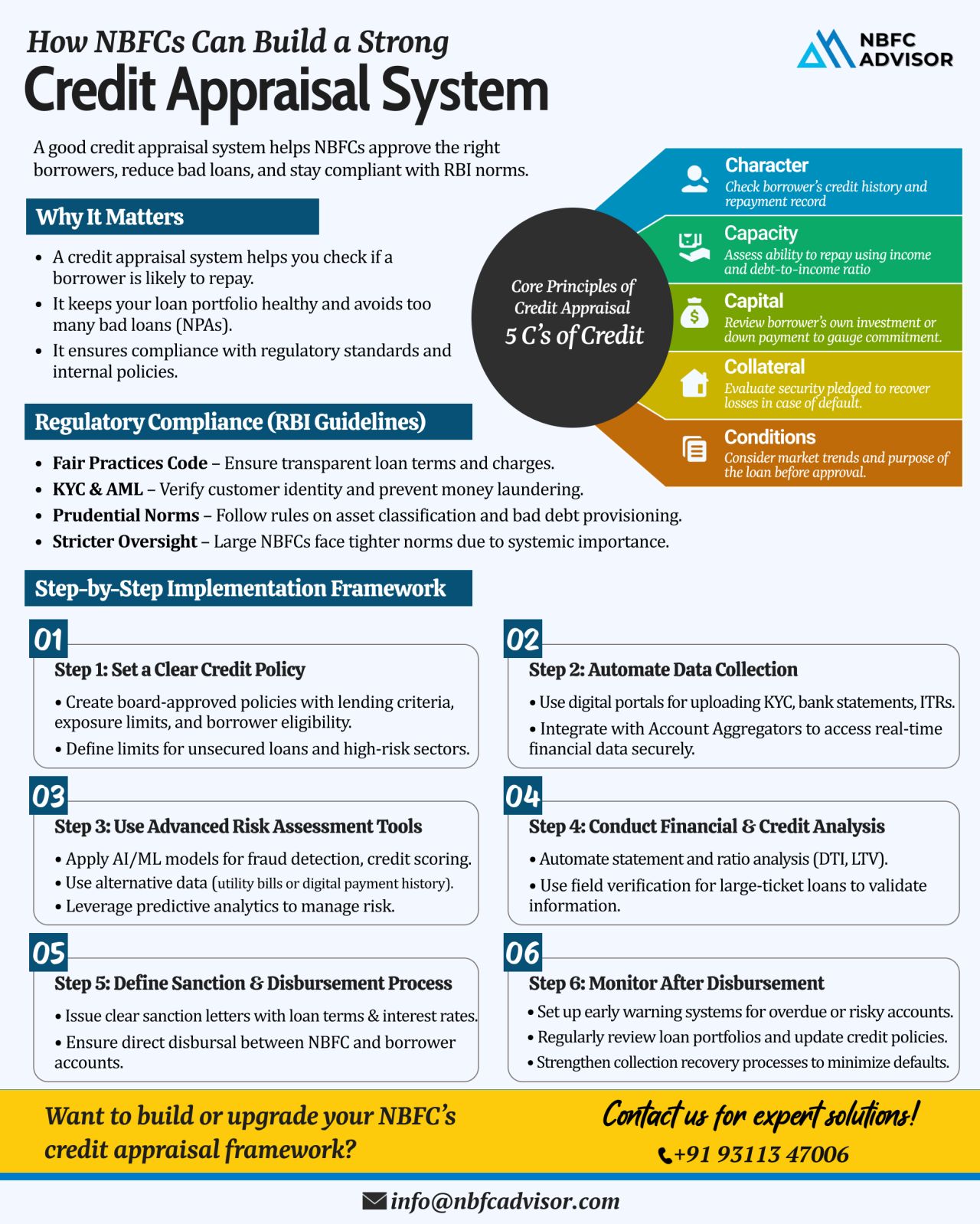

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

Many NBFC Applications Get Rejected by the RBI — Here’s Why! ⚠️

Avoid Costly Mistakes Before You Apply

Every year, the Reserve Bank of India (RBI) receives hundreds of applications for NBFC (Non-Banking Financial Company) registrati...

Cheques Clear Within Hours – Starting October 2025!

Big news is on the horizon for India’s banking ecosystem! The Reserve Bank of India (RBI) is set to transform the way cheques are cleared, reducing the waiting time from days to just ...

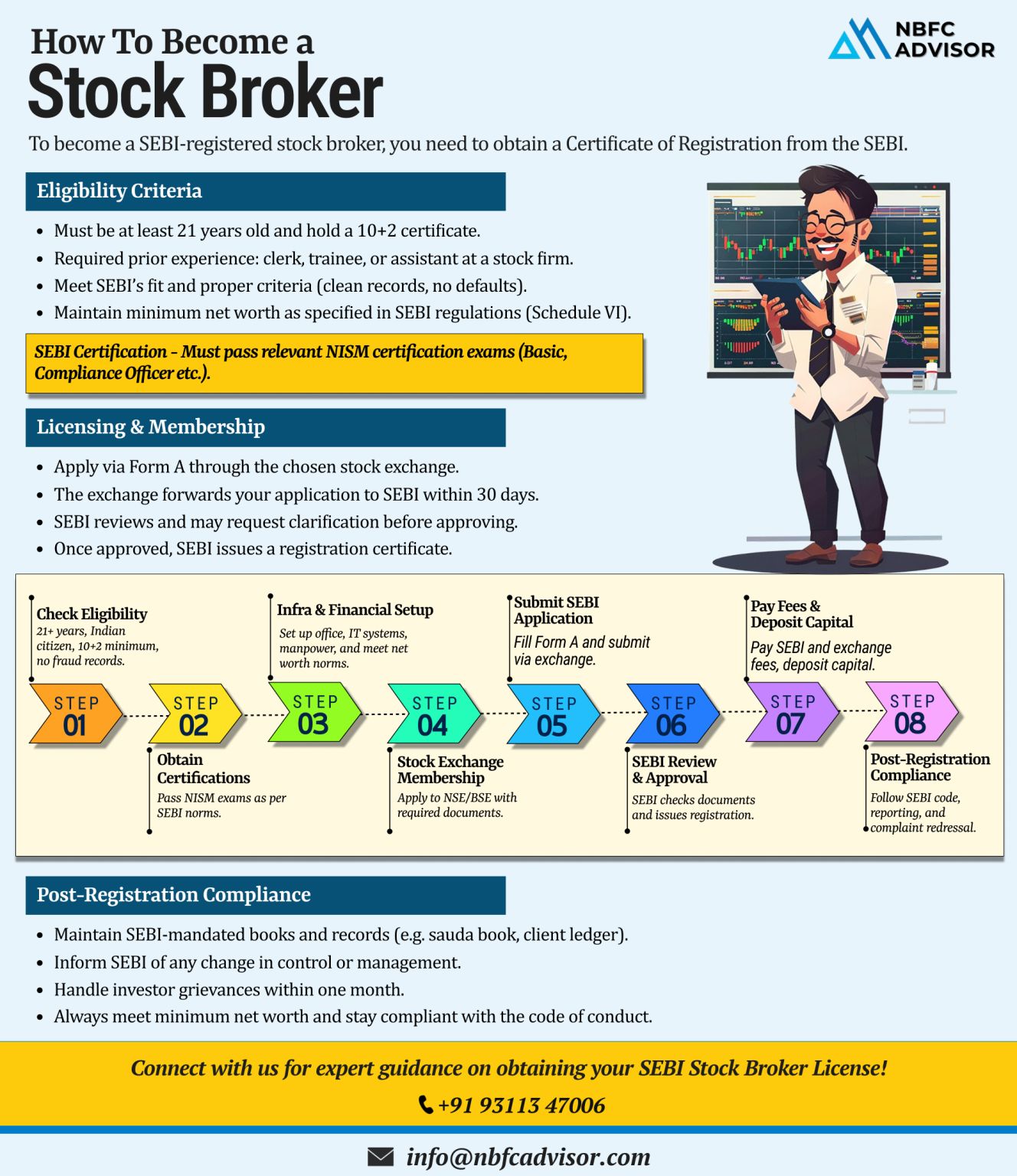

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI-registered stock broker license opens the door to operating legally in India’s capital markets. Whether you plan to trade in equities, derivatives, or other securities, you must mee...

Is Your NBFC Aligned with the Latest RBI Updates?

The Reserve Bank of India (RBI) is taking decisive steps to tighten the compliance framework for Non-Banking Financial Companies (NBFCs), ensuring transparency, customer protection, and responsible...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

❌ Top Reasons Why NBFC License Applications Get Rejected

1. Weak Business Plan and Unrealistic Projections

The RBI expects applicants to submit a well-defined, sector-focused business plan backed by in-depth market research and practical financia...

🚀 The NBFC Sector in India is Experiencing Unmatched Growth! 🚀

Are You Ready to Seize the Opportunity?

India’s Non-Banking Financial Company (NBFC) sector is growing at an extraordinary pace, driven by rising demand for digital lending,...

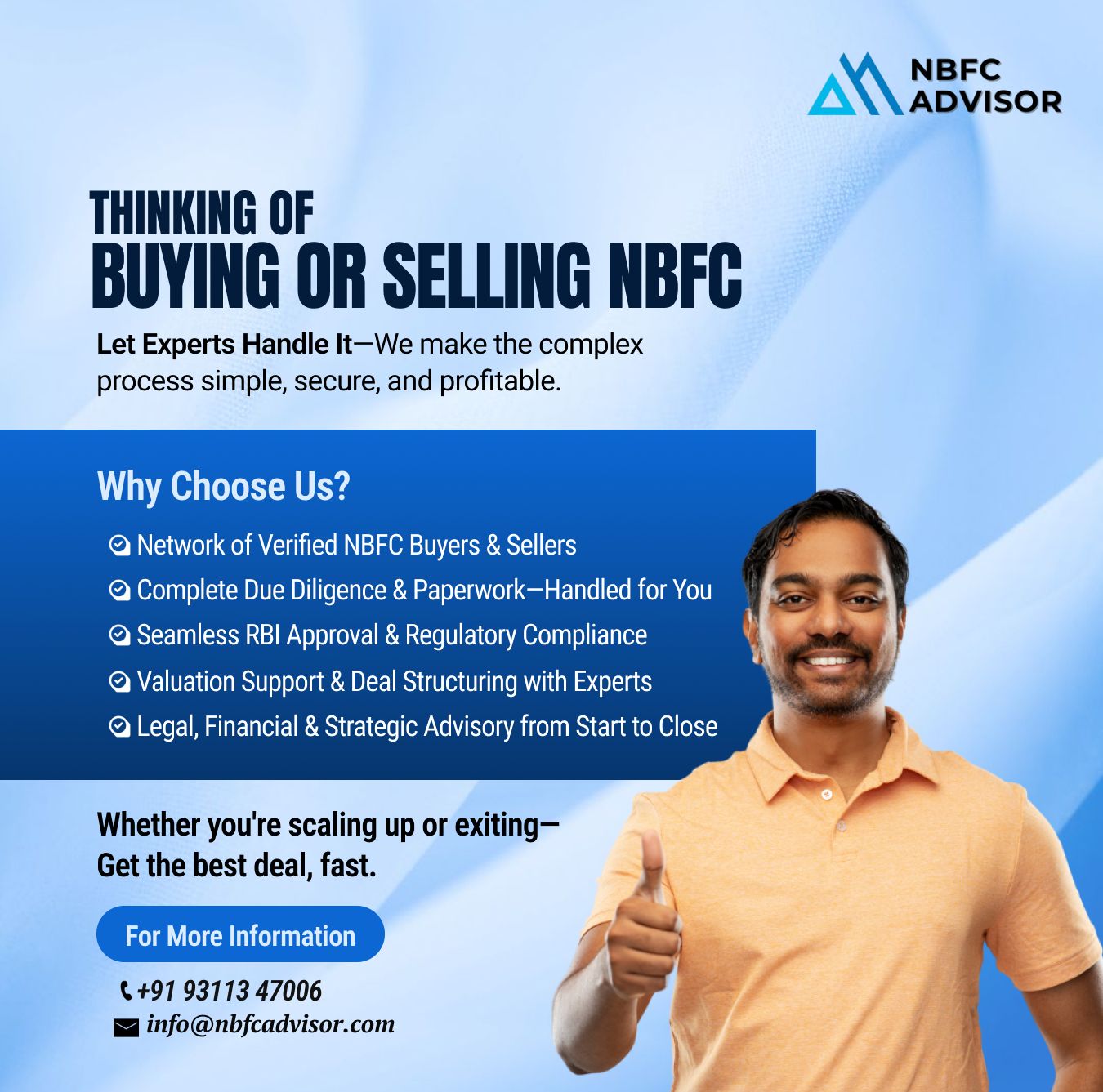

In recent years, the Non-Banking Financial Companies (NBFC) sector in India has experienced considerable growth, playing a critical role in providing financial services such as loans, credit and investment. As a result, NBFC takeovers have become inc...