SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

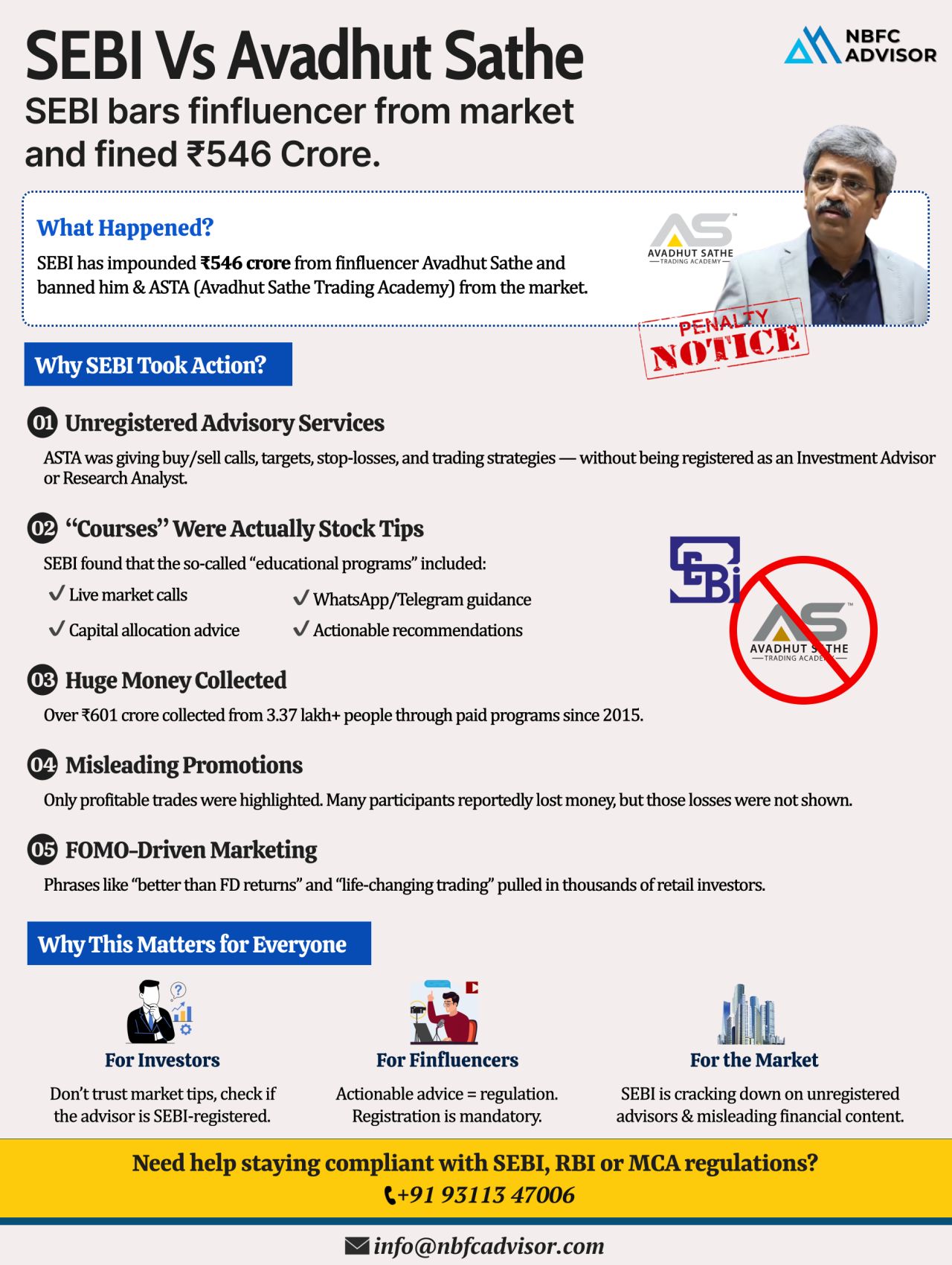

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut Sathe and his academy, ASTA.

This action has sent shockwaves across the financial education, fintech, and advisory ecosystem.

The case clearly draws a hard line between education and unregistered investment advice—and the consequences of crossing it.

What Triggered SEBI’s Action?

SEBI’s investigation revealed that ASTA was not merely providing education, but was effectively running an unregistered investment advisory business for years.

SEBI’s Key Findings

-

₹600+ crore collected from 3.37 lakh+ individuals since 2015

-

“Courses” allegedly included:

-

Live trading tips

-

Buy/sell recommendations

-

WhatsApp and real-time trading guidance

-

-

No SEBI registration as an Investment Adviser or Research Analyst

-

Selective marketing showing only profitable trades

-

A large number of investors reportedly suffered financial losses

SEBI concluded that this activity violated securities laws, as it went far beyond permissible financial education.

SEBI’s Immediate Actions

-

₹546 crore frozen and impounded

-

Complete ban on trading and advisory activities

-

Prohibition on accessing the securities market

-

21 days granted to submit explanations and responses

This is among the largest crackdowns on a finfluencer-led operation in India.

The Core Legal Message from SEBI

Education is allowed.

Unregistered investment advice is not.

This case reinforces that:

-

Teaching financial concepts is legal

-

Giving stock-specific advice, trade calls, or live recommendations without registration is illegal

-

Marketing selective success stories can be treated as misleading conduct

-

Large digital reach does not exempt compliance

Why This Matters for Finance Academies, Finfluencers & Fintechs

If you are:

-

Running a finance academy

-

Operating a finfluencer platform

-

Providing market insights, courses, or trading guidance

-

Managing a fintech, NBFC, or advisory business

You are squarely under SEBI’s regulatory lens.

Non-compliance can result in:

-

Fund freezing

-

Market bans

-

Heavy penalties

-

Long-term reputational damage

Compliance Is No Longer Optional

SEBI is clearly signaling that:

-

Scale + influence = higher accountability

-

Digital platforms are not outside regulatory oversight

-

“Course” or “education” labels won’t shield advisory violations

Early compliance is far cheaper than enforcement action.

Need a Compliance Check?

If you operate in financial education, advisory, fintech, NBFC, or capital markets, a proactive compliance review can help you:

-

Structure offerings legally

-

Identify regulatory risks

-

Avoid penalties and bans

-

Align with SEBI, RBI, and IFSCA frameworks

📩 DM us for a quick compliance check and regulatory guidance.

Final Takeaway

The SEBI ₹546 crore freeze is not just about one finfluencer—it’s a warning to the entire finance ecosystem.

Grow fast. Market smart. But stay compliant.

#NBFCAdvisor #FinancialEducation #Compliance #SEBIRegulations #Fintech #InvestmentAdvice #NBFC #RBI #CapitalMarkets