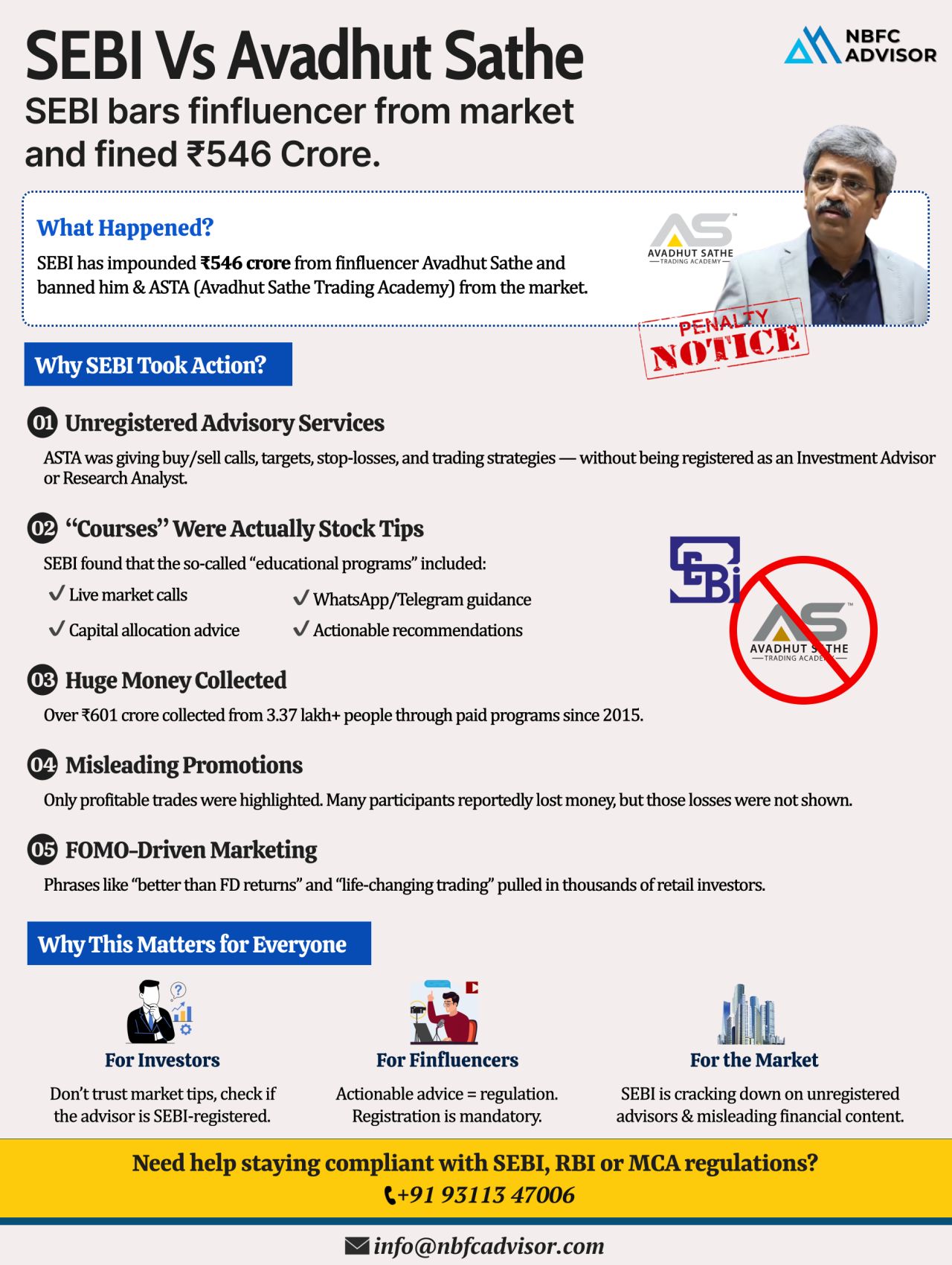

SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut S...

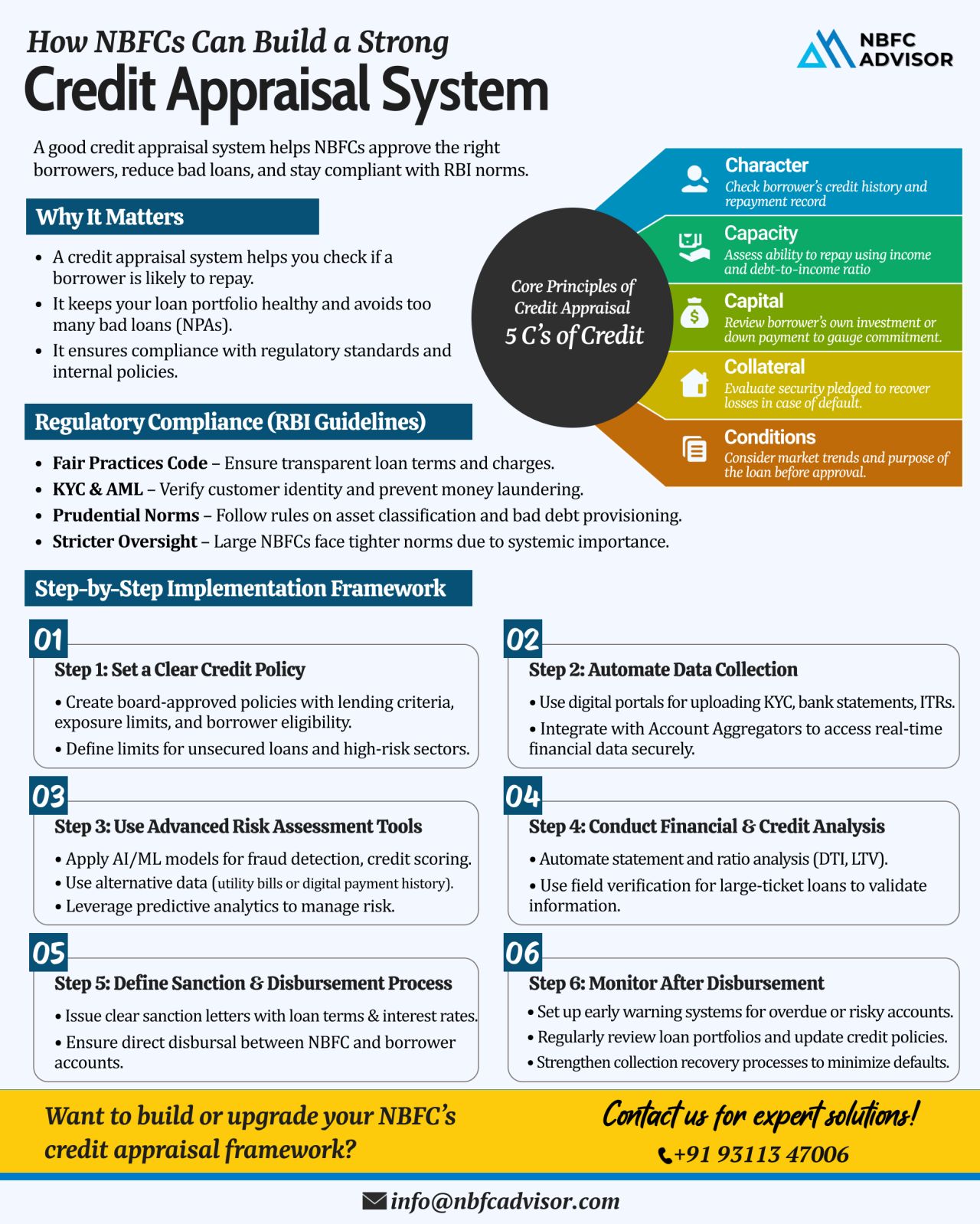

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

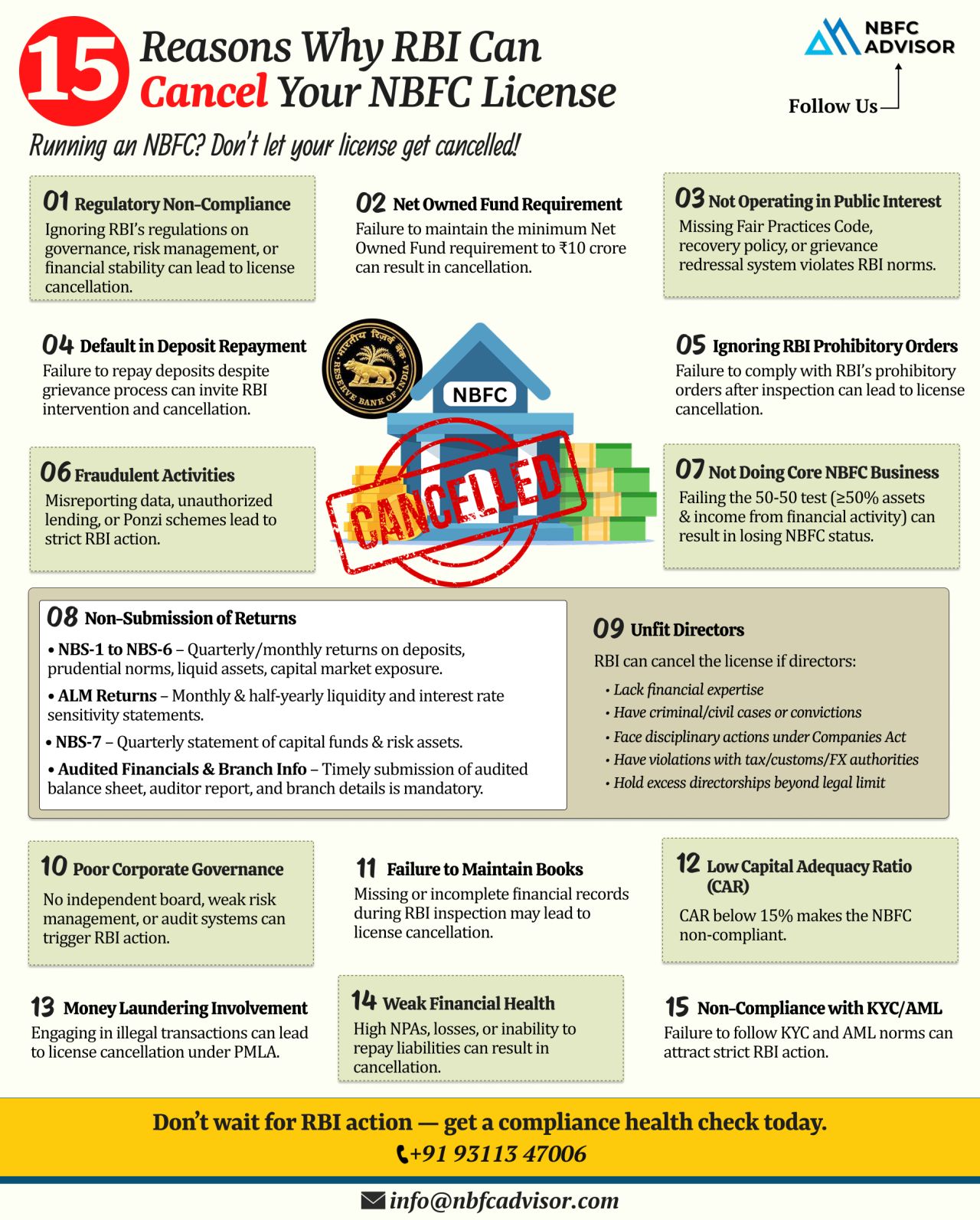

15 Red Flags That Can Shut Down Your NBFC

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Surprisingly, most cancellations are not due to fraud, but rather due to missed compliance, ...

Rising NPAs Are a Wake-Up Call for NBFCs

India’s NBFC sector is under pressure. The alarming rise in Non-Performing Assets (NPAs) is sending a clear signal—NBFCs need to act now.

From unsecured personal loans to SME and rural lendin...

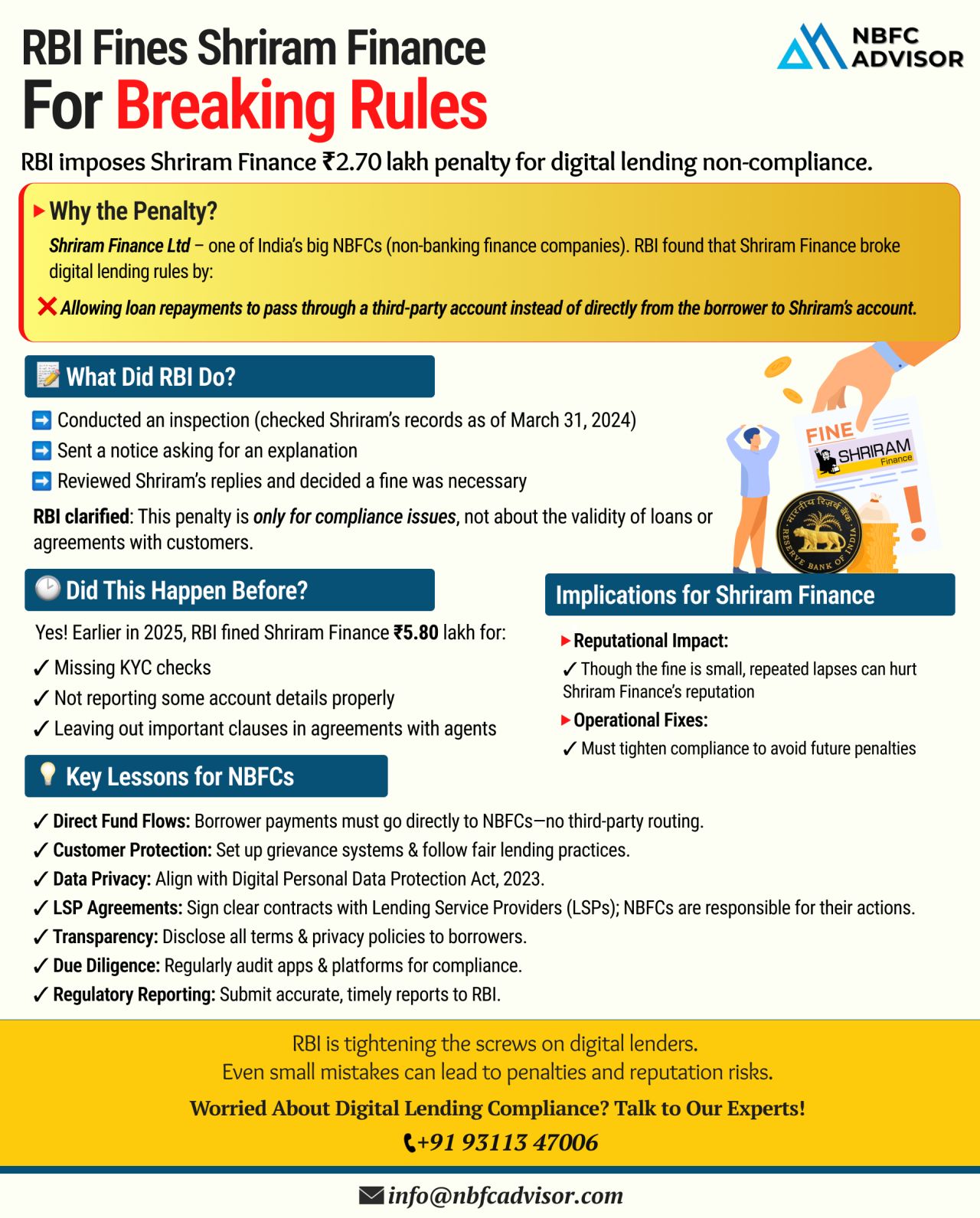

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

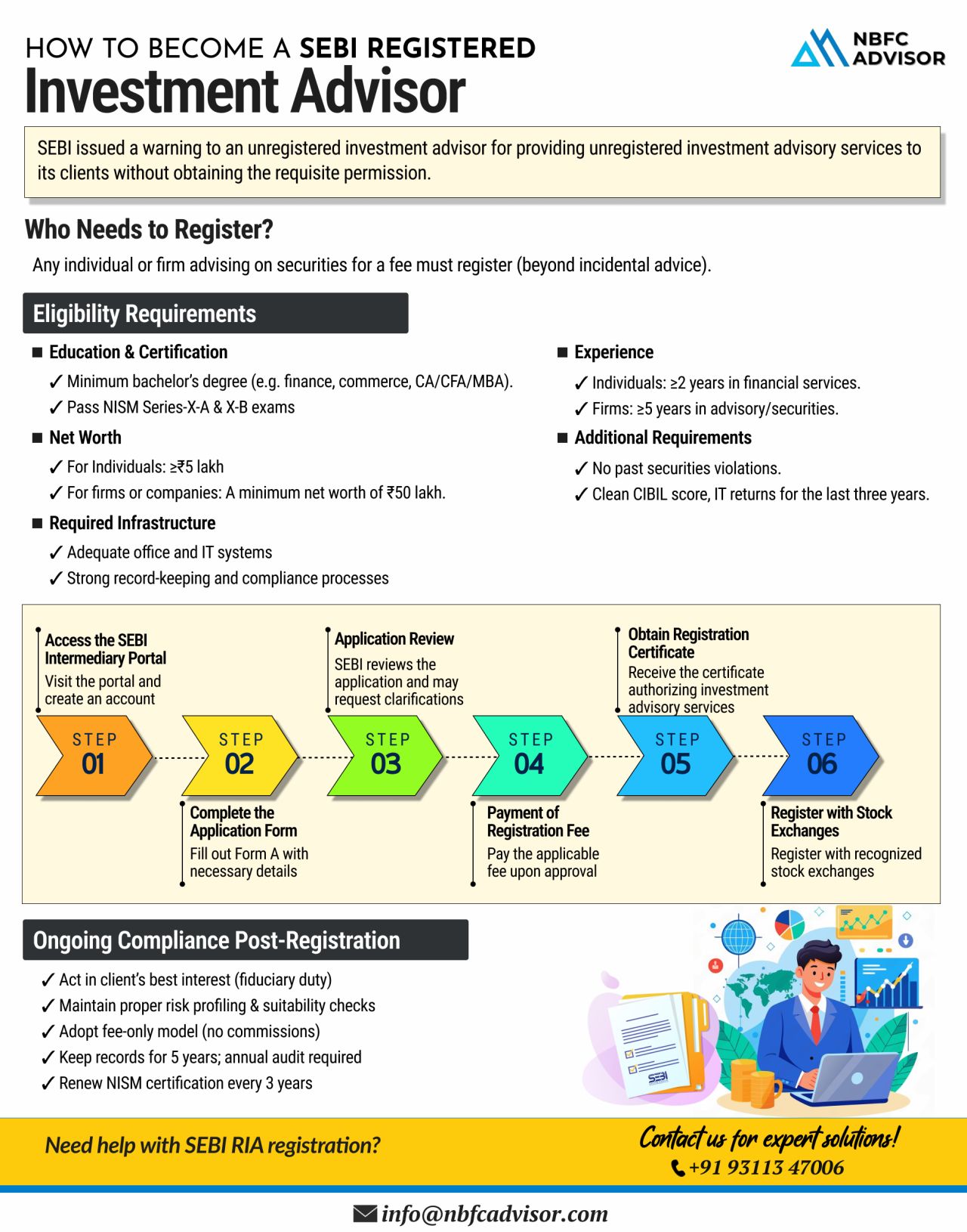

⚠️ SEBI Cracks Down on Unregistered Investment Advisors — Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strict warning to individuals and firms offering investment advice without proper registrati...