SEBI Introduces VALID UPI System: A Big Move to Protect Investors from Fraud

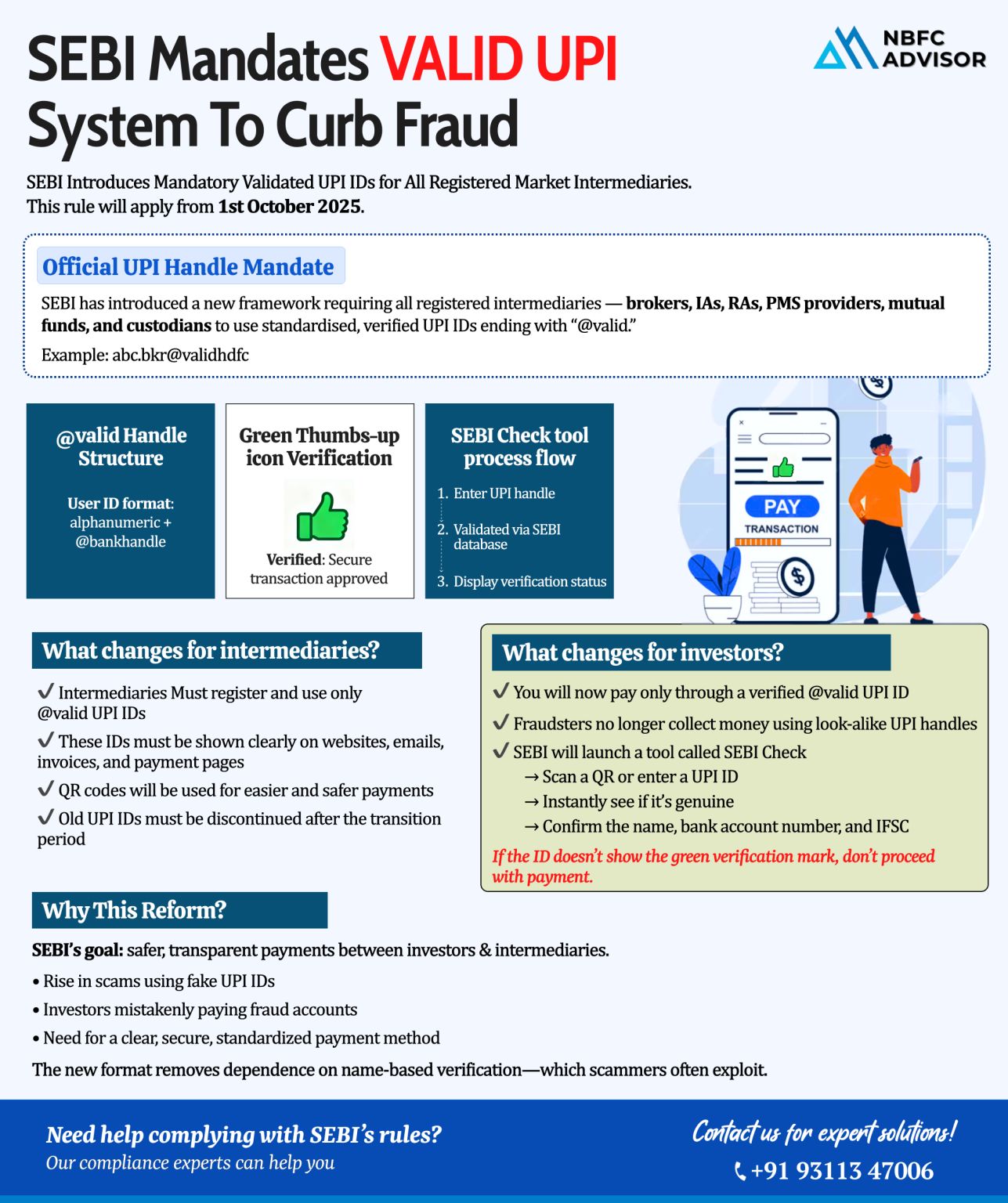

In a major regulatory development, SEBI has introduced the VALID UPI system, making it mandatory for all registered market intermediaries to use SEBI-verified UPI IDs only for collecting payments from investors.

This step is aimed squarely at eliminating fake UPI scams, improving transparency, and strengthening trust in India’s digital investment ecosystem.

What Is the SEBI VALID UPI System?

The VALID UPI system ensures that payments made by investors go only to SEBI-verified bank accounts of registered intermediaries.

Under this framework, UPI IDs will clearly reflect:

- The intermediary’s registered name

- SEBI-recognised identification

- Verification through approved banking channels

This makes it much harder for fraudsters to impersonate brokers or advisors.

Who Must Comply with VALID UPI Guidelines?

SEBI has made VALID UPI mandatory for:

- Stock Brokers

- Investment Advisers (IAs)

- Research Analysts (RAs)

- Portfolio Management Service (PMS) Providers

- Mutual Funds

- Custodians

Non-compliance can invite regulatory action and penalties.

Key SEBI Requirements Under VALID UPI

All regulated entities must now:

✔ Use only SEBI-verified @VALID UPI handles

✔ Clearly display the verified UPI ID on websites, invoices, apps, and payment pages

✔ Replace old or unverified UPI IDs after the prescribed transition period

✔ Use SEBI-verified QR codes for secure and traceable payments

These measures significantly reduce the risk of investors sending money to fake or misleading UPI IDs.

Why This Move Is a Game-Changer

UPI-based frauds targeting investors have increased rapidly. SEBI’s VALID UPI framework:

- Enhances payment transparency

- Prevents impersonation and fake payment links

- Protects investor funds

- Strengthens trust in digital financial services

It’s a strong signal that compliance and investor safety are top regulatory priorities.

What Intermediaries Should Do Now

If you are a SEBI-registered entity, you should immediately:

- Audit all existing UPI IDs and QR codes

- Apply for SEBI-verified VALID UPI handles

- Update payment details across all digital and physical platforms

- Ensure internal compliance and staff awareness

Delays or oversight can lead to regulatory scrutiny.

Need Help with SEBI VALID UPI Compliance?

Navigating new SEBI regulations can be complex—but you don’t have to do it alone.

We assist regulated entities with end-to-end compliance, from verification to implementation.

📞 Contact us for a free consultation: +91 93113 47006

Let’s make your payment systems secure, compliant, and investor-ready.

Hashtags

#NBFCAdvisor #SEBI #UPI #DigitalPayments #Fintech

#RegulatoryUpdate #ComplianceExperts #InvestmentAdvisors