Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

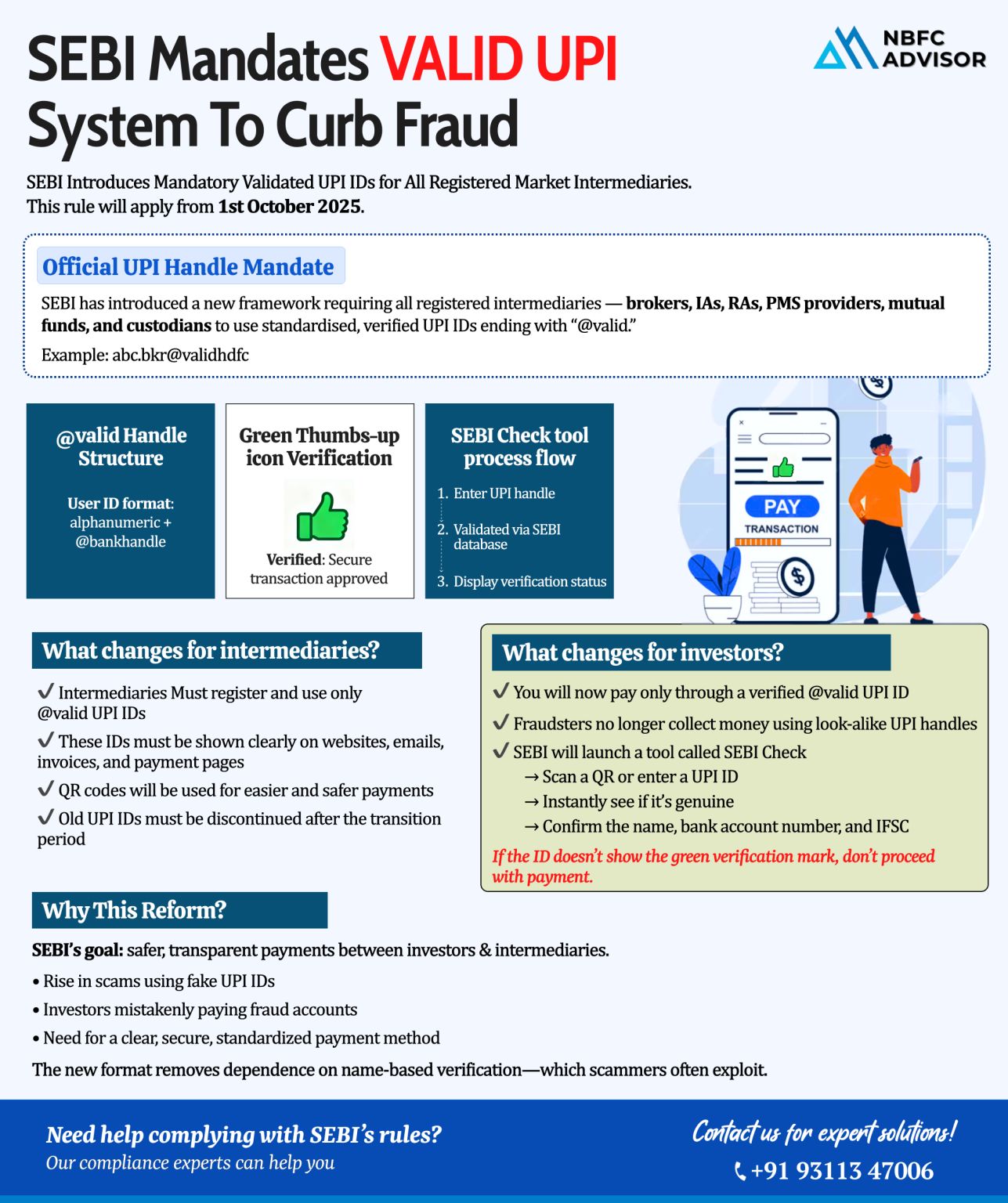

SEBI Introduces VALID UPI System: A Big Move to Protect Investors from Fraud

In a major regulatory development, SEBI has introduced the VALID UPI system, making it mandatory for all registered market intermediaries to use SEBI-verified UPI IDs onl...

Not Sure What License Your Fintech Needs? 🤔

India’s fintech ecosystem — from digital lending apps and payment gateways to neobanks and wealthtech platforms — is expanding faster than ever. But as innovation accelerates, RBI and ...

SEBI Tightens Rules for Finance Creators and Startups in the Investment Space

Are you a finance creator or a startup working in the investment space?

Then it’s time to pay close attention — because SEBI is cracking down on unregistere...

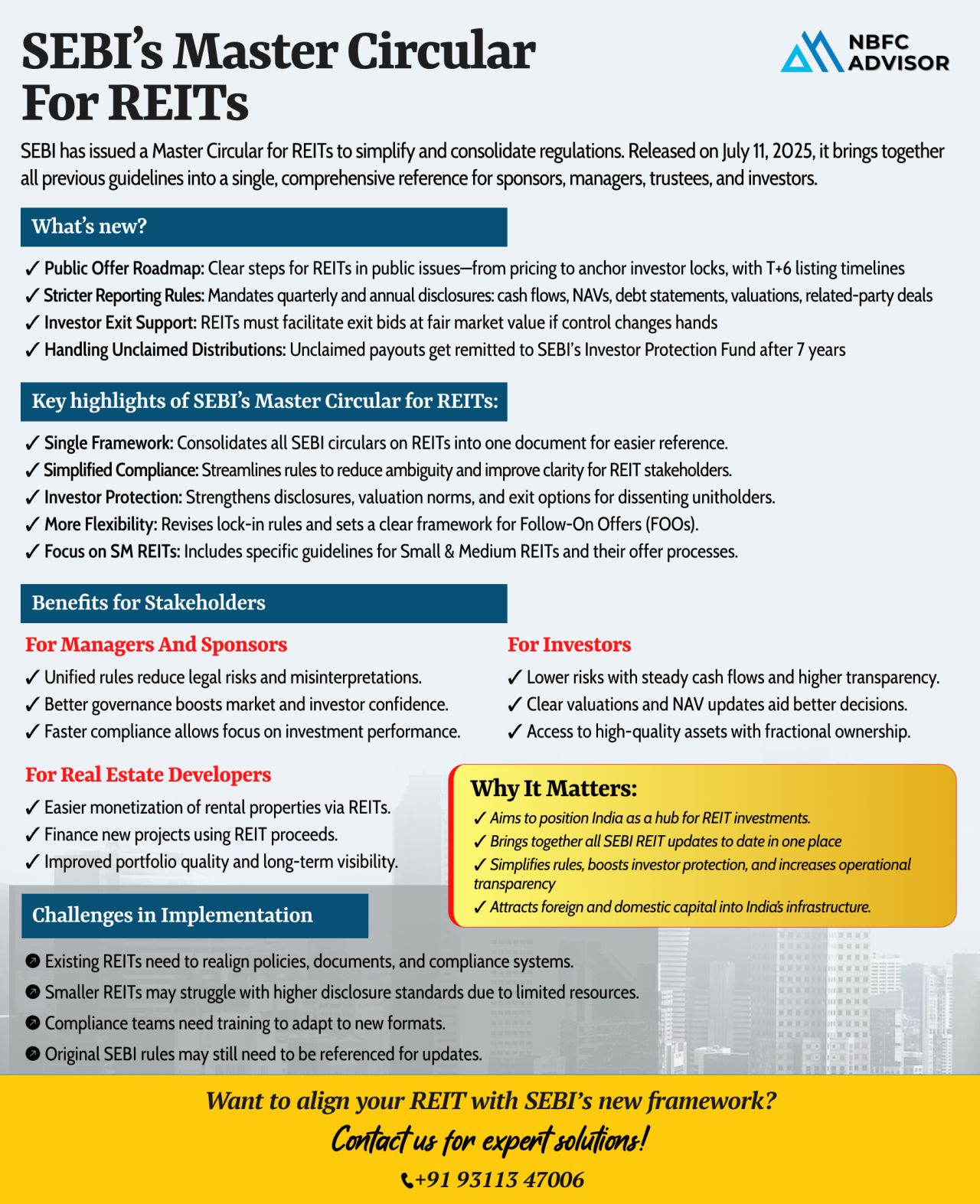

SEBI’s Master Circular for REITs: Transparency, Simplicity & Growth in One Framework

The Securities and Exchange Board of India (SEBI) has taken a bold step to reshape the future of Real Estate Investment Trusts (REITs) in India. With it...

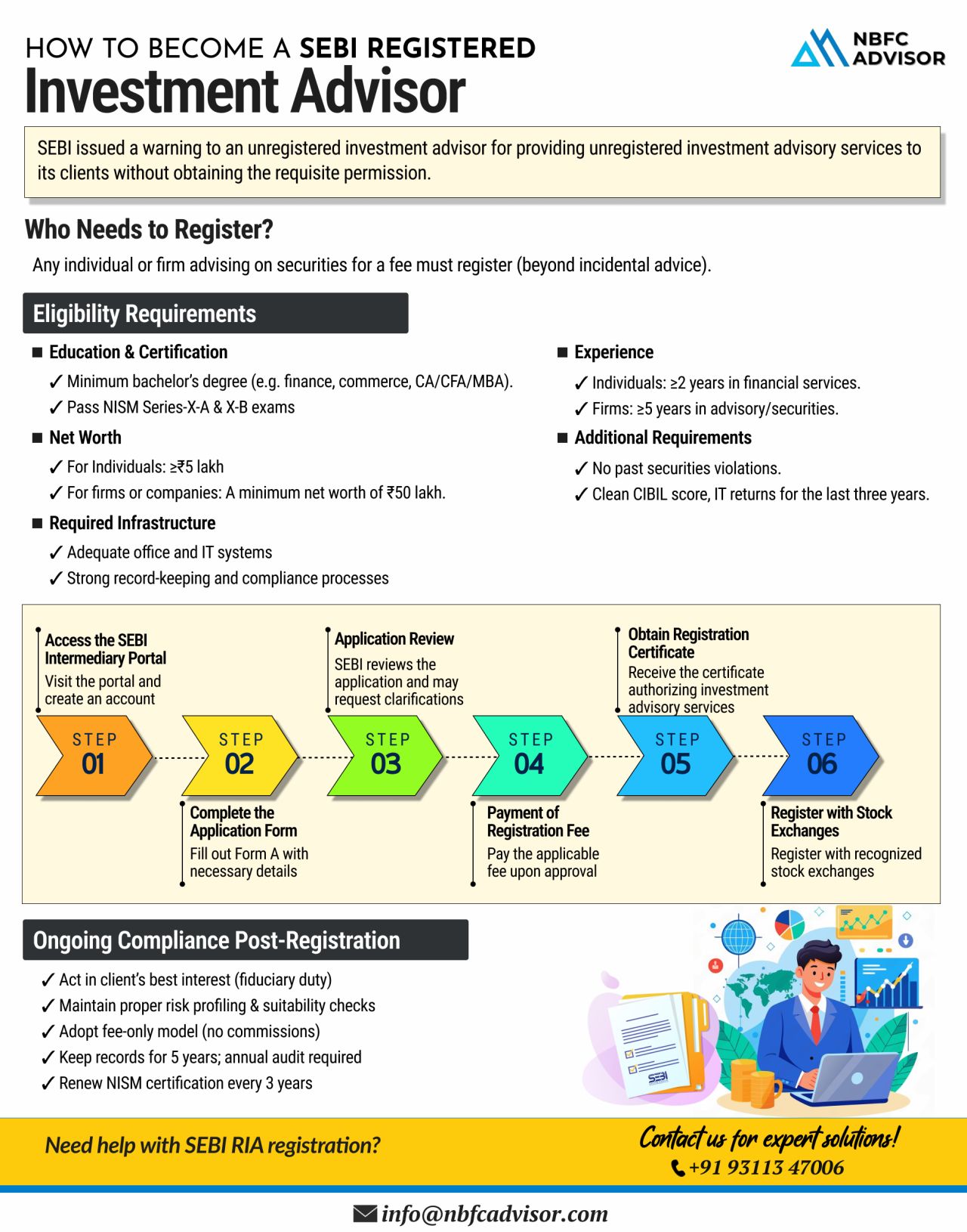

⚠️ SEBI Cracks Down on Unregistered Investment Advisors — Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strict warning to individuals and firms offering investment advice without proper registrati...