SEBI’s Master Circular for REITs: Transparency, Simplicity & Growth in One Framework

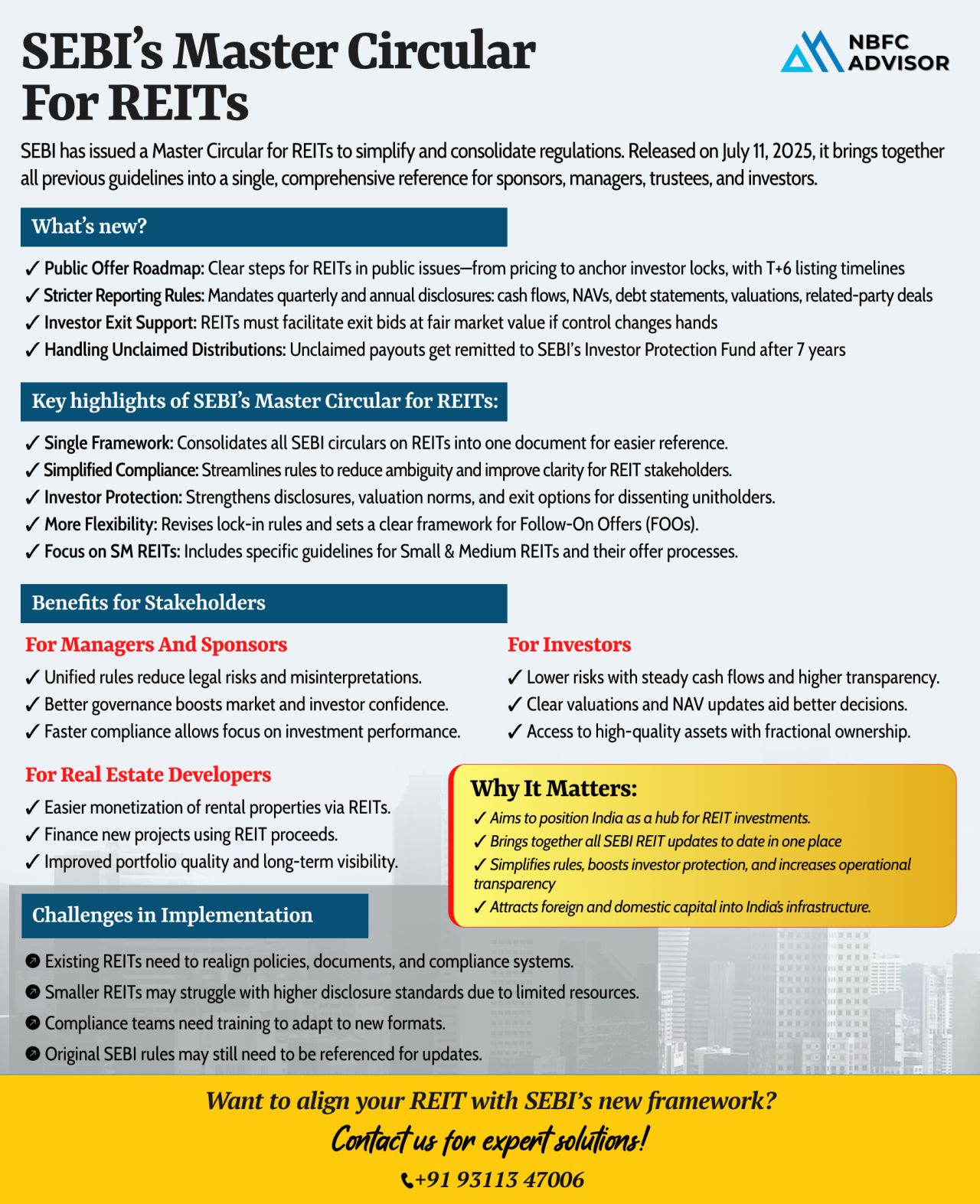

The Securities and Exchange Board of India (SEBI) has taken a bold step to reshape the future of Real Estate Investment Trusts (REITs) in India. With its newly released Master Circular, SEBI has consolidated and streamlined all REIT-related regulations into a single, cohesive framework — a major milestone for India’s real estate and investment sectors.

This move is aimed at reducing regulatory ambiguity, improving transparency, and attracting long-term institutional and global capital into Indian real estate.

🏗️ What’s New in SEBI’s Master Circular for REITs?

The updated framework simplifies and strengthens the REIT ecosystem with the following key enhancements:

✅ Unified Regulatory Framework

A single consolidated circular now governs all REIT-related rules, making it easier for sponsors, investors, and advisors to comply.

✅ Clearer Public Issue Process

The circular outlines structured steps for public issues — including pricing, offer timing, and listing protocols — removing previous grey areas.

✅ Enhanced Disclosure & Reporting

REITs must now follow stricter quarterly and annual reporting norms, ensuring more consistent and transparent information flow for investors.

✅ Improved Exit Mechanisms

Investors are offered better exit options in the event of a change in control, which adds a new layer of investor protection and confidence.

✅ Support for Small & Medium REITs

SEBI has introduced rules for Small and Medium REITs (SM REITs), easing market entry and encouraging wider participation in the real estate investment space.

🌍 Why This Matters for India’s REIT Landscape

The impact of this circular is far-reaching and strategically important:

-

🔐 Reduces Legal Risk

A streamlined framework minimizes the risk of misinterpretation or non-compliance for REIT sponsors and managers. -

📊 Boosts Investor Confidence

Improved disclosures and exit clarity instill greater trust in the REIT structure, making it more appealing to both retail and institutional investors. -

🌐 Attracts Global Capital

With regulatory clarity and investor protection, India becomes a more competitive destination for foreign capital in real estate.

📈 The Road Ahead for REIT Stakeholders

For REIT sponsors, developers, fund managers, and investors, this is a pivotal moment. The new framework encourages all stakeholders to reassess their operational and compliance strategies and embrace the evolving regulatory environment.

Whether you're looking to launch a REIT, invest in one, or simply stay compliant, aligning with SEBI’s updated framework is no longer optional — it’s essential.

🤝 Need Expert Guidance?

Navigating regulatory changes can be complex — but you don’t have to do it alone.

📞 Contact us today for a FREE consultation on how SEBI’s new REIT Master Circular impacts your business strategy.

+91 93113 47006

Let’s ensure you stay compliant, competitive, and capital-ready.

#NBFCAdvisor #REIT #SEBI #RealEstateInvesting #Compliance #IndiaREIT #Investments #Governance