Want to Enter India’s Booming Lending Sector—Without Waiting Years?

India’s lending market is expanding at an unprecedented pace—driven by fintech innovation, rising credit demand, and digital-first borrowers. But setting up a new NBFC (Non-Banking Financial Company) from scratch can take years, with no guarantee of RBI approval.

The smarter move? Acquire an existing NBFC.

✅ Why Buying an NBFC is a Strategic Shortcut

Acquiring a pre-existing NBFC gives you an instant entry into the financial services landscape—fully RBI-approved and operational from Day One.

Here’s what makes this route so attractive:

-

Pre-Approved by RBI – Save time on fresh licensing.

-

Ready-to-Run Operations – Access to a functioning team, systems, and processes.

-

Existing Loan Book – Immediate revenue from active lending operations.

But make no mistake—NBFC takeovers aren’t plug-and-play. RBI regulations are strict, and every step requires careful due diligence and legal precision.

⚠️ What Every NBFC Buyer Must Assess

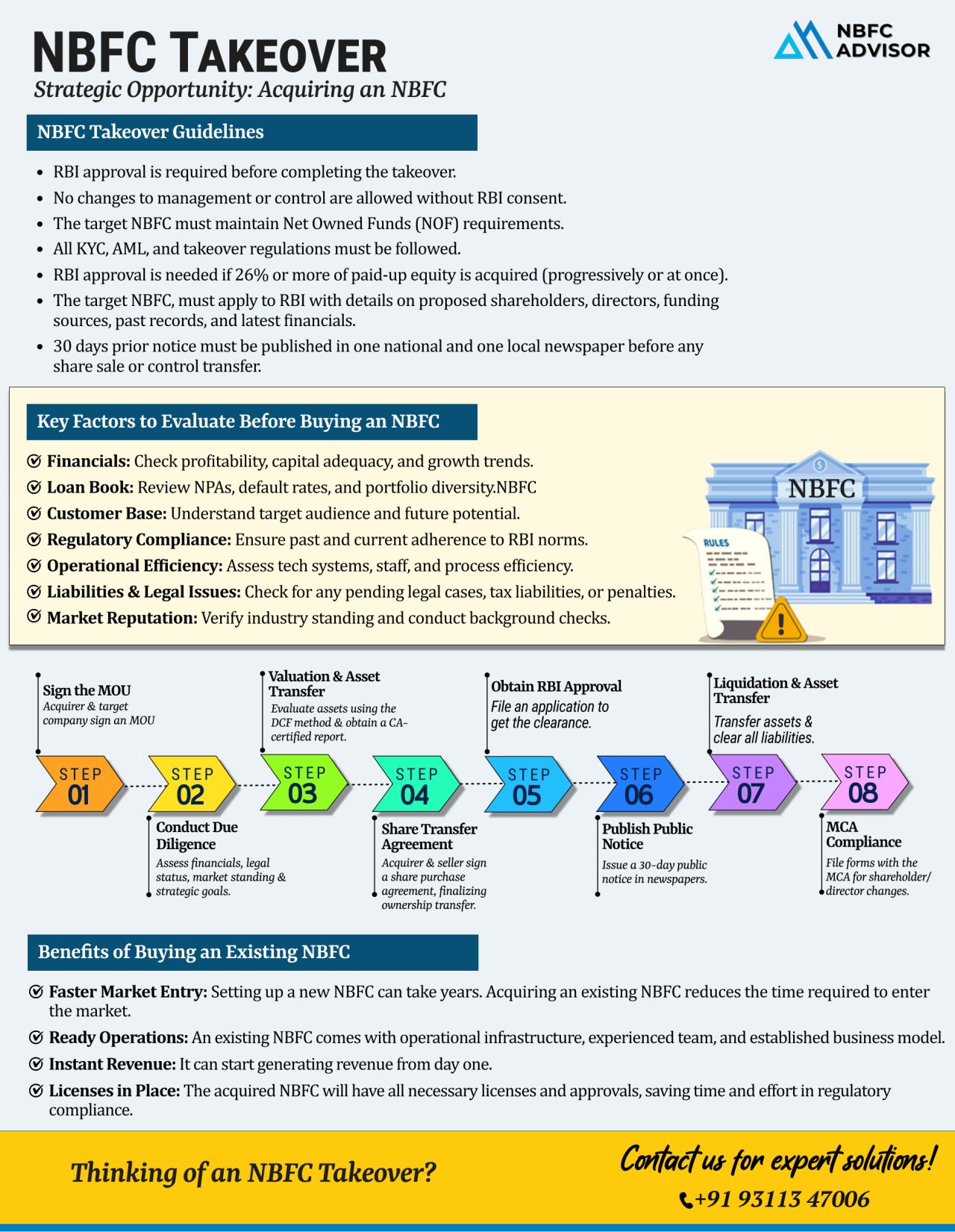

Before you make an offer, it’s crucial to evaluate the target NBFC’s health and compliance status. Key checkpoints include:

-

📊 Financial Strength & Capital Adequacy

Ensure the NBFC meets RBI’s net owned fund (NOF) and liquidity requirements. -

📉 Loan Book Quality

Analyze current NPAs, collection efficiency, and default risk. -

🏢 Operational Infrastructure

Review technology, manpower, credit processes, and internal controls. -

⚖️ Legal & Regulatory Standing

Check for past penalties, compliance gaps, and any ongoing litigations. -

🌐 Market Reputation

Understand the NBFC’s brand equity and borrower trust.

🛑 Don’t Ignore the RBI Mandates

NBFC takeovers must be approved by the Reserve Bank of India (RBI) before any transfer of control. Here’s what’s involved:

-

Filing for prior approval under RBI’s Master Direction for NBFCs

-

Drafting a proper MOU and Share Purchase Agreement (SPA)

-

Issuing public notices in newspapers

-

Updating the Ministry of Corporate Affairs (MCA) and ROC records

-

Demonstrating “fit and proper” status of new directors/shareholders

Missing a single step can lead to regulatory rejection or penalties.

🧭 Want a Smooth, Legally Compliant NBFC Acquisition?

Navigating the NBFC takeover process is complex—but it doesn’t have to be overwhelming. Our expert team guides you through every phase of the transaction, including:

-

Comprehensive Due Diligence

-

Legal & Financial Vetting

-

MOU & SPA Structuring

-

RBI Filing & Approval

-

Post-Takeover Compliance Updates

-

MCA & Public Notice Filing

📞 Ready to explore NBFC acquisition? Let’s make it seamless.

Contact us today for a free consultation.

+91 93113 47006

#NBFCAdvisor #NBFCtakeover #RBI #FinancialServices #Fintech #NBFC #Compliance #DueDiligence #DigitalLending #RBIapproval #NBFCsetup