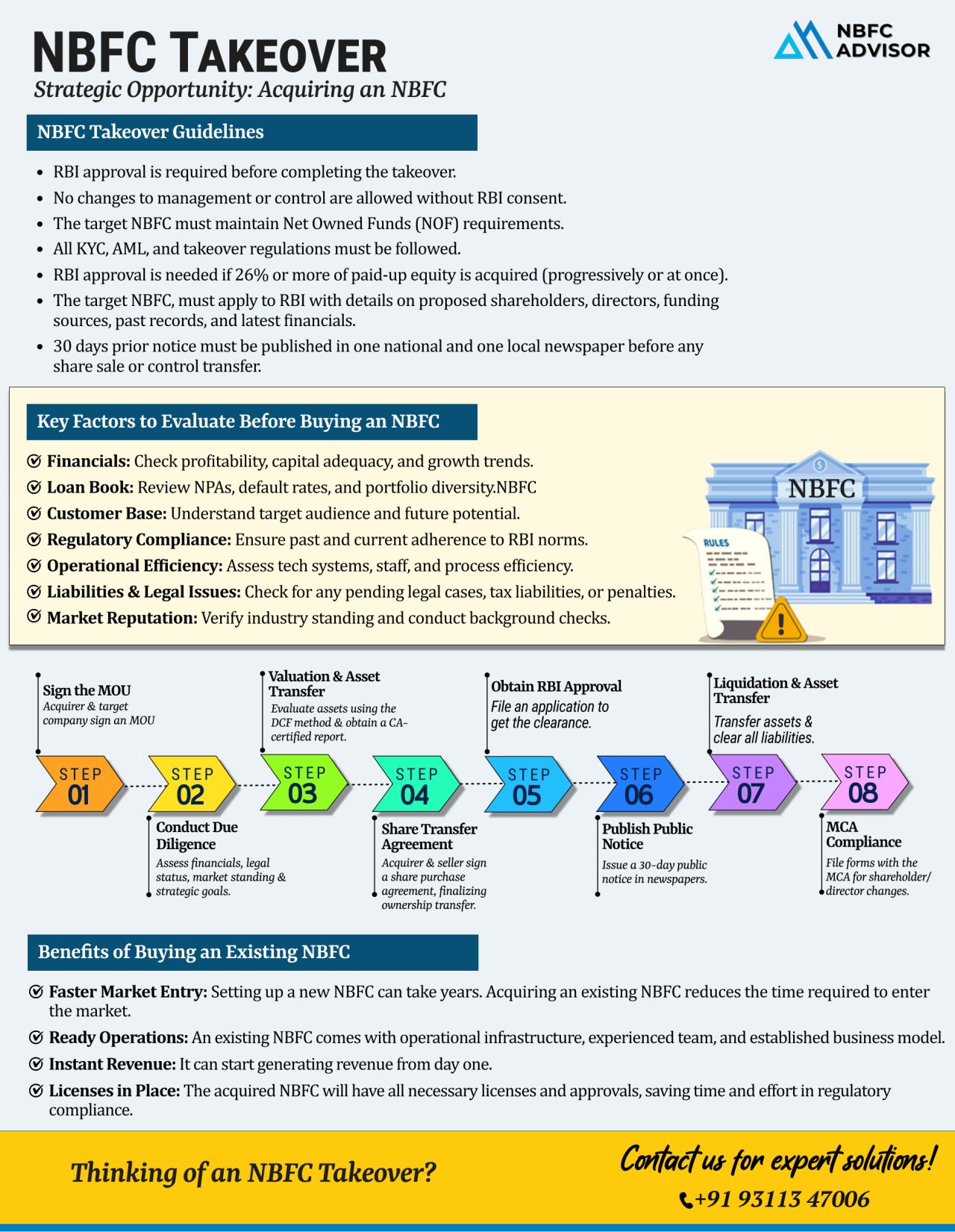

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

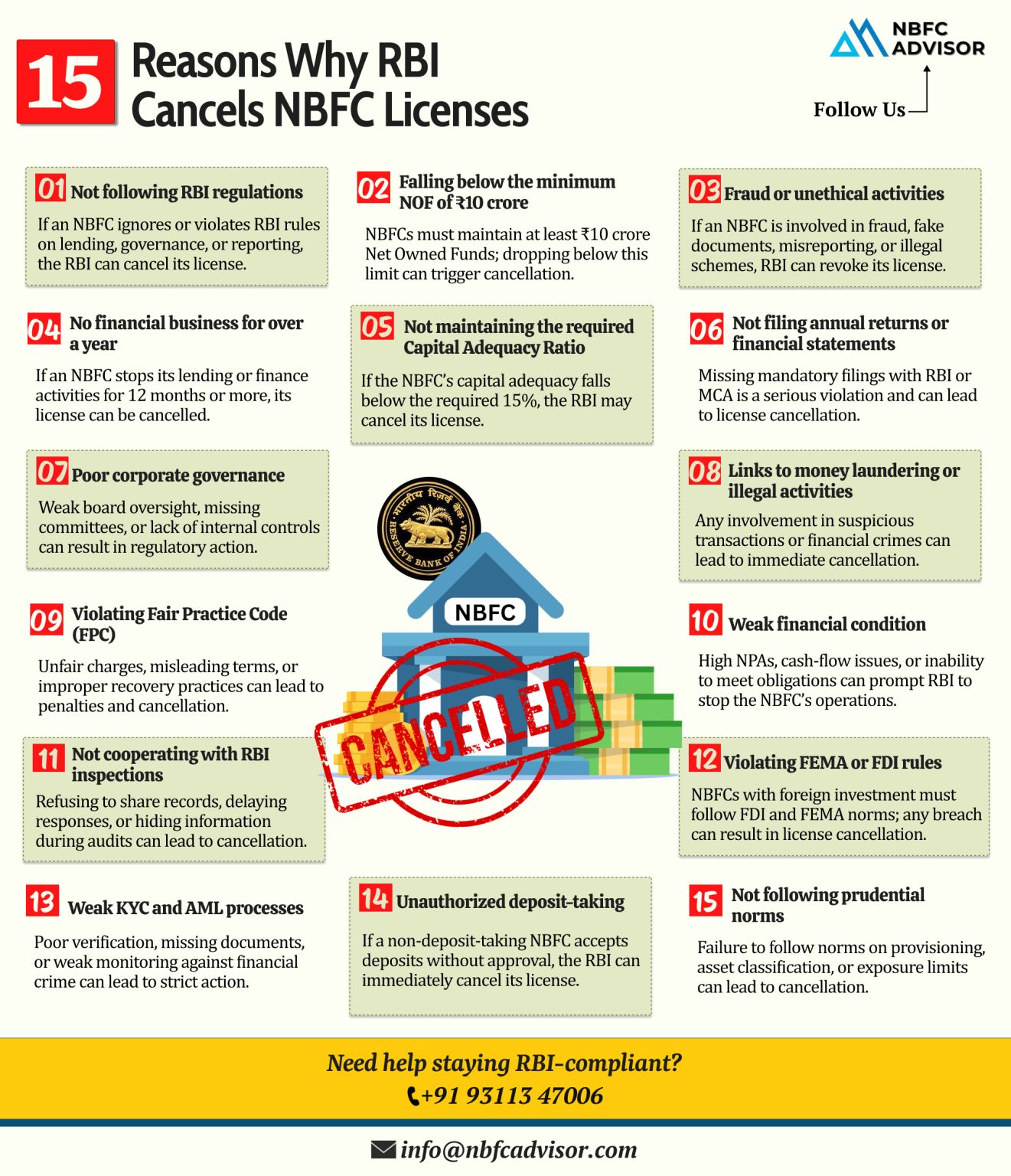

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

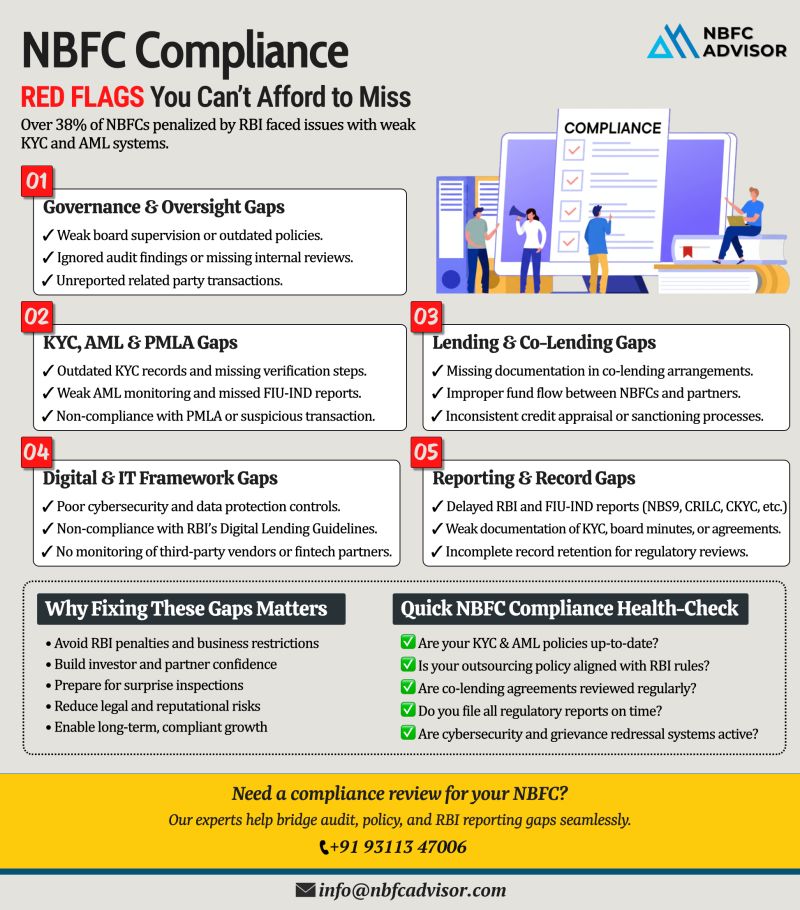

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny!

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several NBFCs — not for fraud or mismanagement — but for missing critical compliance steps.

As...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

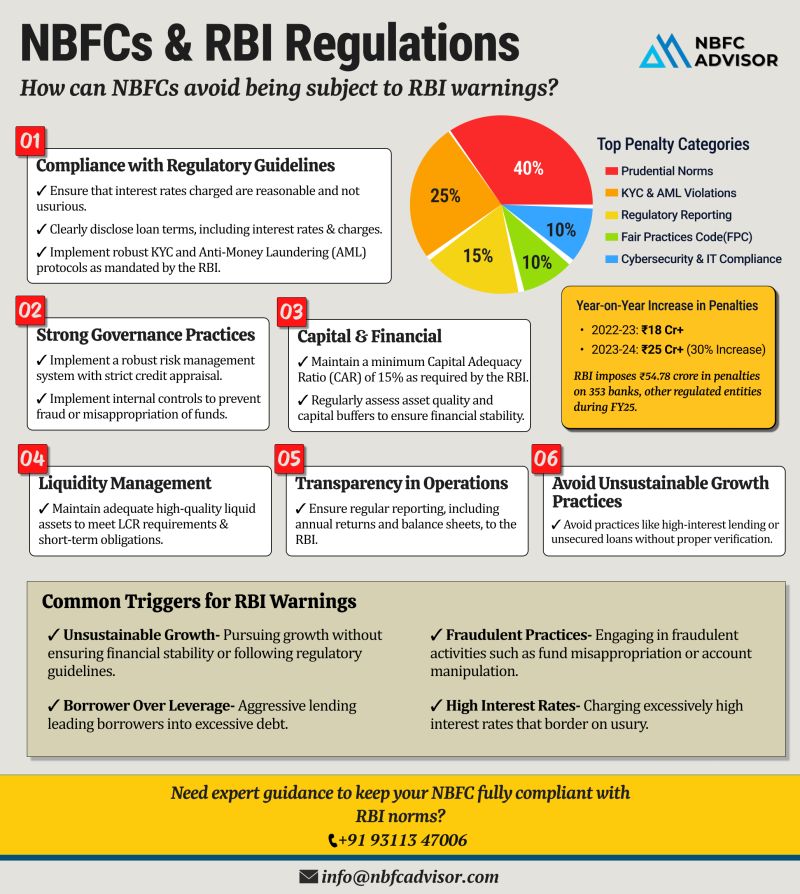

RBI Penalties on NBFCs Jumped 30% in Just One Year — Is Your NBFC at Risk?

The Reserve Bank of India (RBI) has intensified its oversight on financial institutions — and the numbers speak for themselves.

In FY 2022–23, RBI impo...

Want to Enter India’s Booming Lending Sector—Without Waiting Years?

India’s lending market is expanding at an unprecedented pace—driven by fintech innovation, rising credit demand, and digital-first borrowers. But setting u...

Avoid These 10 Common Mistakes When Registering an AIF

Registering an Alternative Investment Fund (AIF) with SEBI is a crucial step for fund managers and institutions looking to enter India’s alternative investment space. However, the regist...

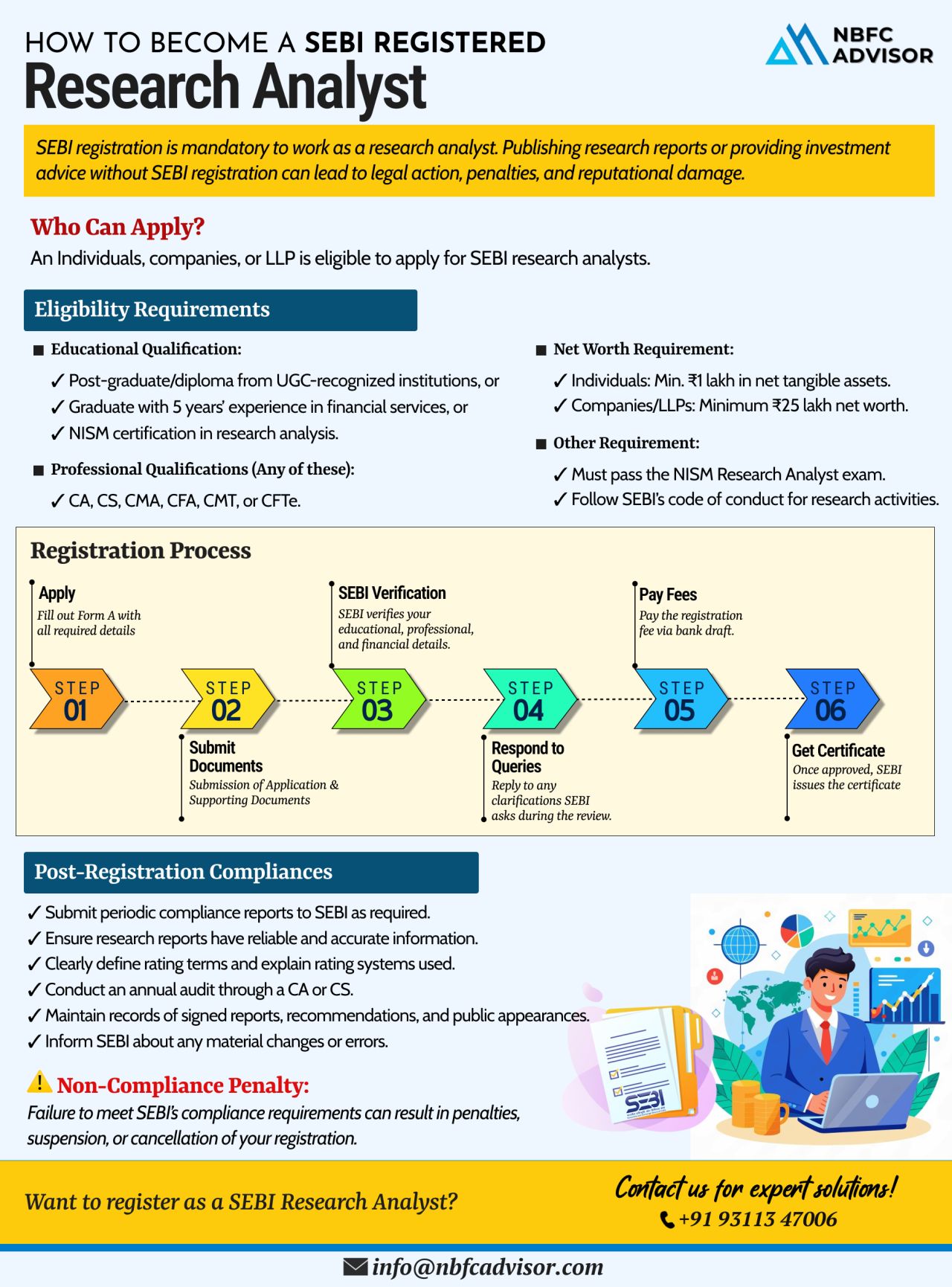

Thinking of publishing financial research reports without SEBI registration?

That shortcut can lead to serious consequences—including penalties, suspension, and long-term reputational harm.

Under SEBI regulations, registration is compulsory...