Starting an NBFC vs. Buying One – What’s Smarter?

Entering India’s Non-Banking Financial Company (NBFC) sector is an attractive opportunity for investors, fintech founders, and financial institutions. The big question most invest...

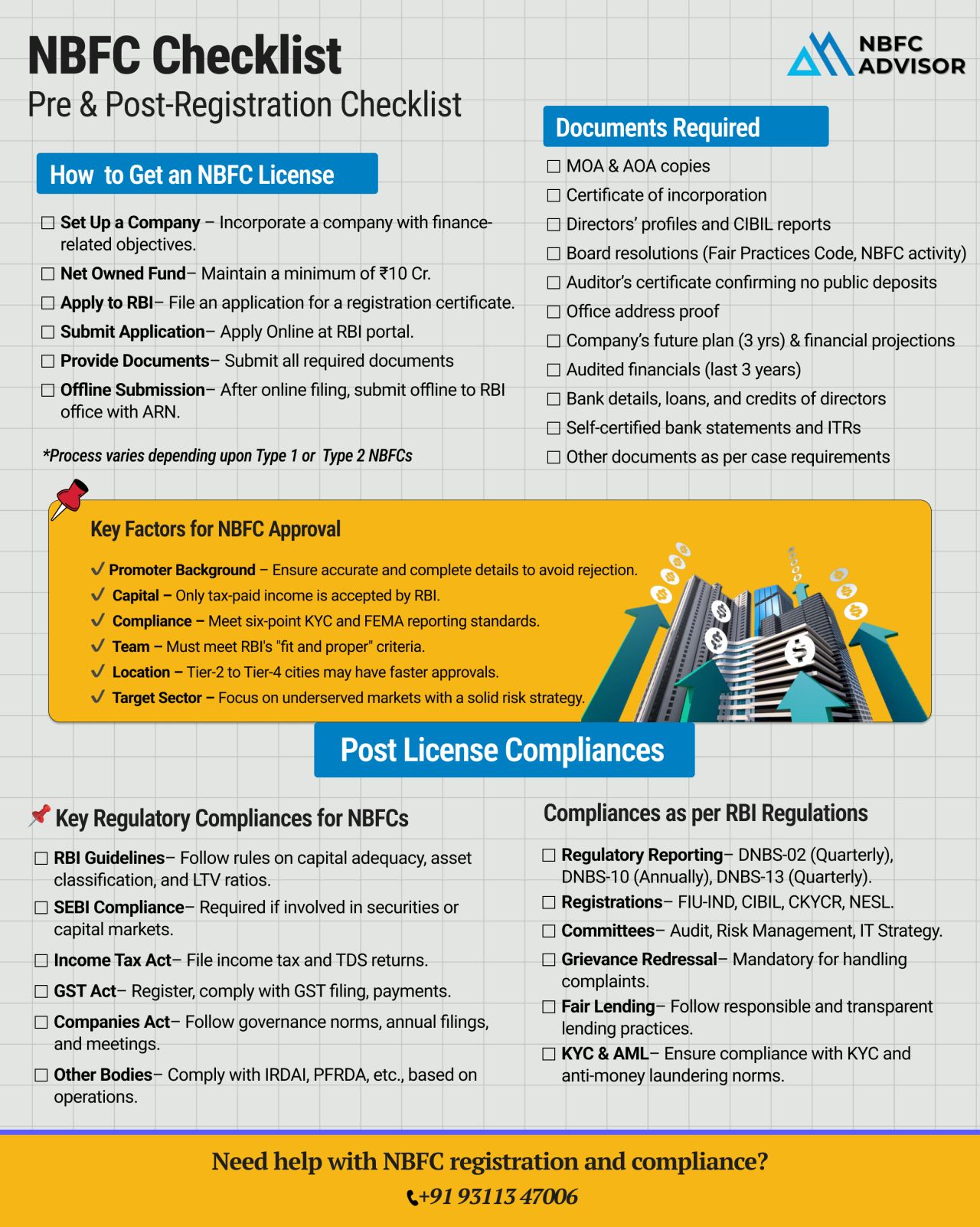

𝐏𝐥𝐚𝐧𝐧𝐢𝐧𝐠 𝐭𝐨 𝐬𝐭𝐚𝐫𝐭 𝐚𝐧 𝐍𝐁𝐅𝐂?

Many founders begin the process without knowing exactly which documents, approvals, and compliance steps are required.

But RBI approval depends on clear paperwork, promoter background, capital pro...

Cheques Clear Within Hours – Starting October 2025!

Big news is on the horizon for India’s banking ecosystem! The Reserve Bank of India (RBI) is set to transform the way cheques are cleared, reducing the waiting time from days to just ...

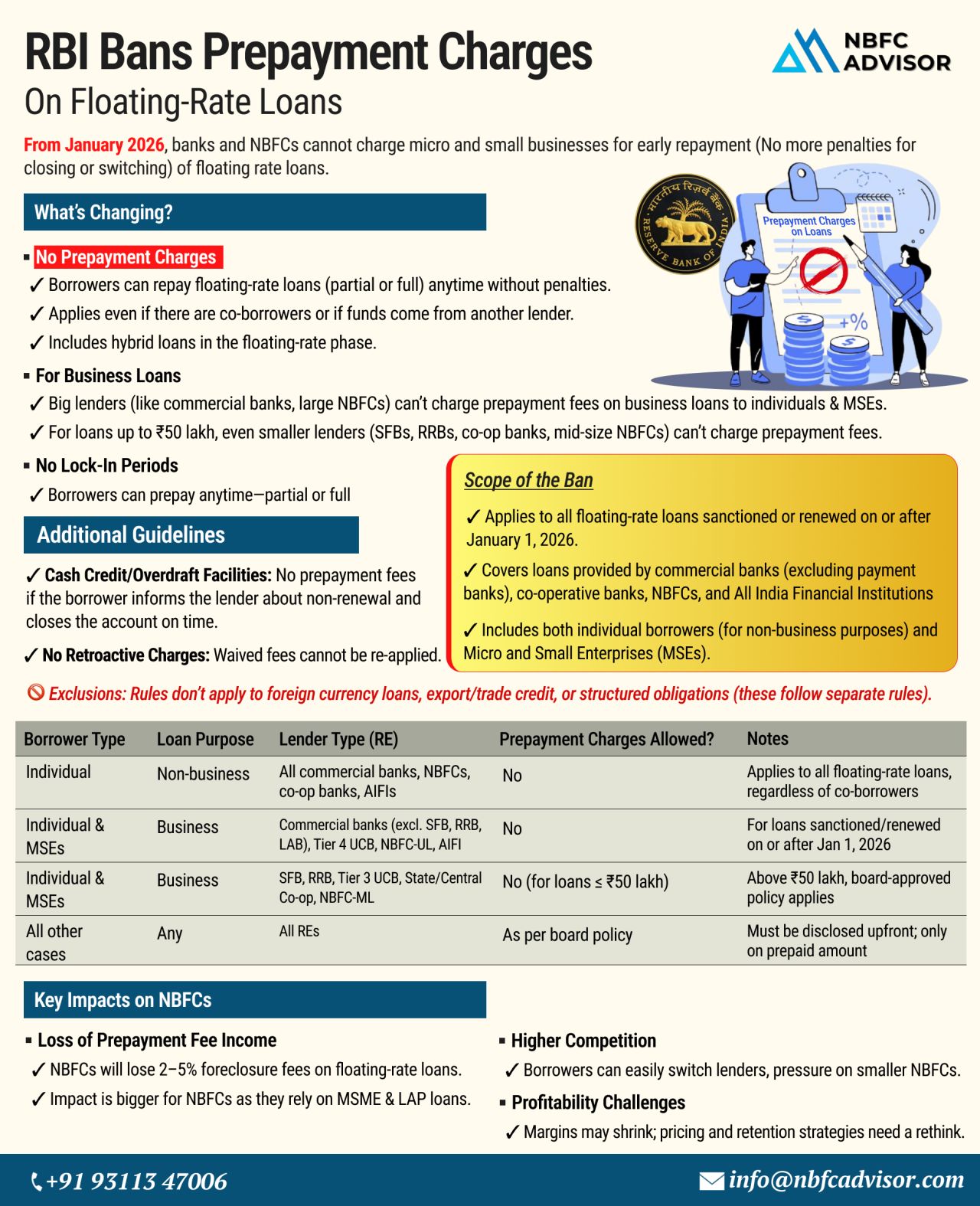

RBI Bans Prepayment Charges on Floating-Rate Loans

What It Means for NBFCs Starting January 2026

The Reserve Bank of India (RBI) has rolled out a major regulatory change aimed at giving borrowers more freedom. From January 1, 2026, no prepaymen...

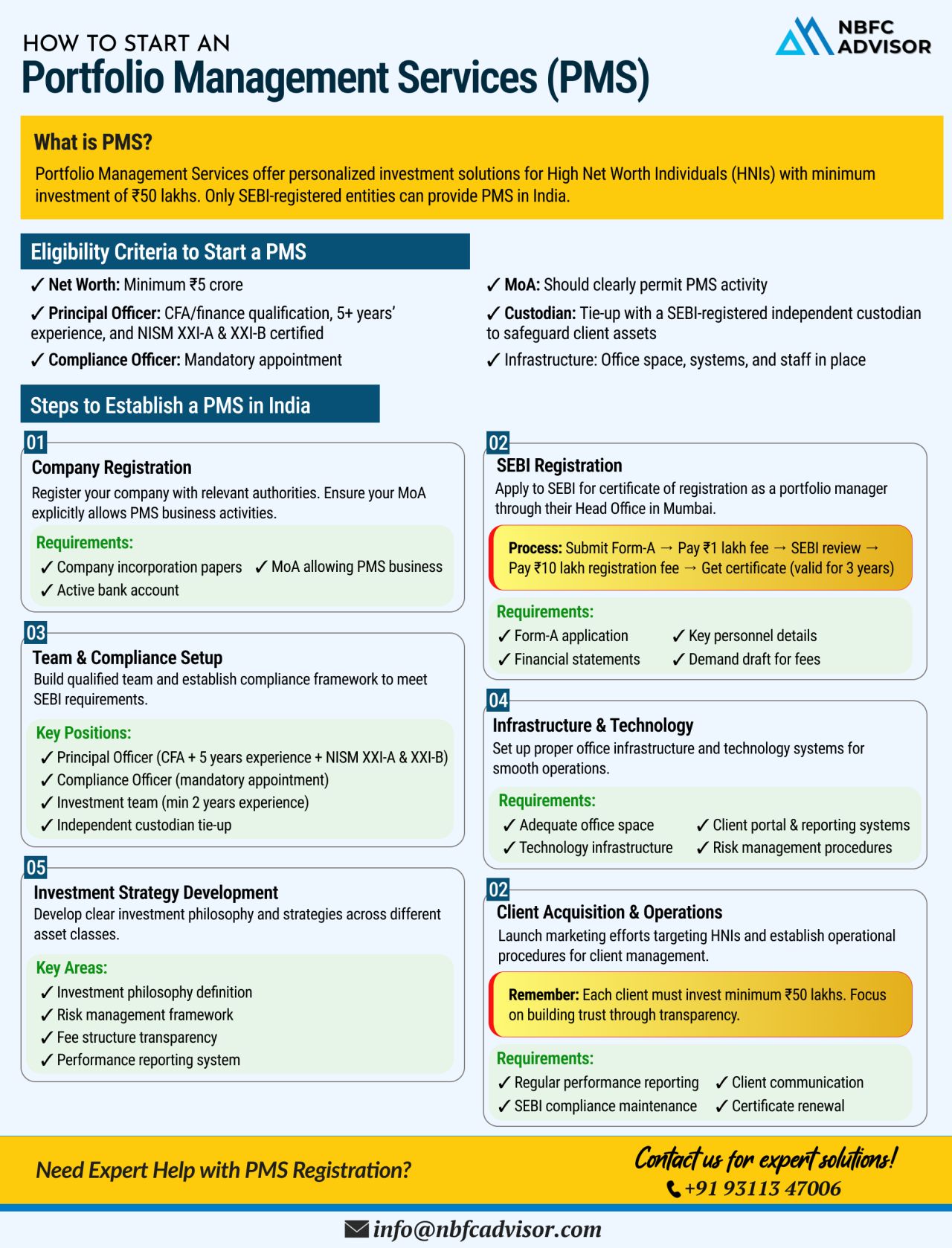

🚀 India’s PMS Industry Is Accelerating – Here's What You Need to Know

India’s Portfolio Management Services (PMS) sector is witnessing phenomenal growth, with assets under management (AUM) now exceeding ₹7.08 lakh crore. Thi...