RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in the country.

What many companies don’t realise is that RBI can cancel an NBFC license for several avoidable reasons.

Most cancellations happen not because of fraud — but due to compliance lapses, weak systems, and poor governance.

Once the license is cancelled, the NBFC must stop all financial activities immediately, and reviving or appealing the cancellation becomes extremely challenging.

To stay safe, every NBFC must understand the risks that can attract regulatory action.

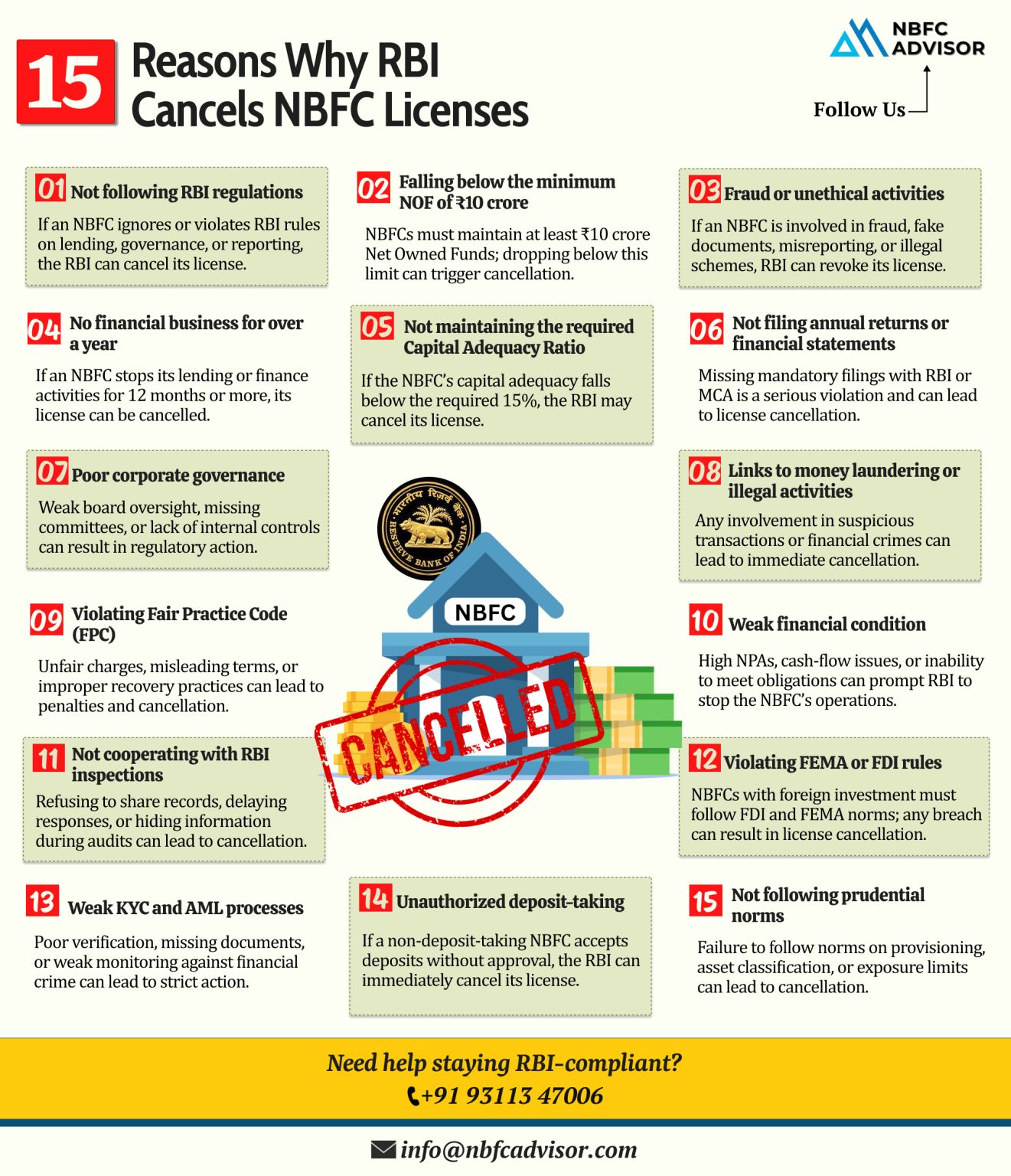

🔍 15 Reasons RBI Can Cancel an NBFC License

Here are the most common — and often preventable — triggers:

1️⃣ Failure to Maintain Minimum Net Owned Funds (NOF)

Falling below the required NOF threshold is one of the biggest reasons for cancellation.

2️⃣ Non-submission of Mandatory Returns

Missing key filings such as NBS1, NBS2, NBS9, and statutory returns signals non-compliance.

3️⃣ Weak KYC & AML Framework

Poor customer verification, missing documents, or weak monitoring systems attract immediate RBI scrutiny.

4️⃣ Poor Corporate Governance

Lack of board oversight, related-party transactions, and mismanagement can lead to regulatory action.

5️⃣ Failure to Commence Business Within a Reasonable Time

Inactive NBFCs or “shell structure” entities risk cancellation.

6️⃣ Not Following Fair Practices Code

Harsh recovery practices, mis-selling, or customer harassment are major violations.

7️⃣ Non-compliant Loan Origination & Collection Processes

Improper documentation, outsourcing risks, and unregulated DSA operations are red flags.

8️⃣ Cybersecurity & IT System Weaknesses

Data breaches, poor IT infrastructure, and weak digital lending systems are serious concerns.

9️⃣ Not Meeting Prudential Norms

Incorrect provisioning, poor asset classification, or incorrect reporting can lead to penalties.

🔟 Engaging in Prohibited Activities

Unapproved business models or activities outside the permitted NBFC category attract action.

1️⃣1️⃣ Failure to Conduct Statutory Audits Properly

Audit qualifications or manipulated statements raise compliance concerns.

1️⃣2️⃣ High Level of NPAs Without Correction Measures

Weak portfolio health signals poor risk management.

1️⃣3️⃣ Misuse of Public Funds or Lack of Transparency

Diversion of funds or undisclosed liabilities is a serious violation.

1️⃣4️⃣ Non-cooperation with RBI Inspections

Avoidance, delay, or incomplete information during inspections is grounds for cancellation.

1️⃣5️⃣ Failure to Protect Customer Interests

Any risk to customers, investors, or depositors can trigger immediate RBI intervention.

🚨 Why You Should Take These Risks Seriously

Once the license is cancelled:

-

Lending operations must stop immediately

-

The NBFC cannot onboard new customers

-

Collections and recovery become complicated

-

Directors may face scrutiny

-

The business may never revive

The only way to stay safe is through robust, continuous compliance.

🔧 Need Help Fixing Your NBFC’s Compliance Gaps?

NBFC Advisor provides comprehensive support for:

-

Compliance audits

-

Regulatory gap assessment

-

Risk mitigation

-

Governance improvements

-

KYC/AML framework strengthening

-

Ongoing RBI reporting support

Our team ensures your NBFC stays compliant, safe, and fully aligned with regulatory expectations.

📩 Want Your NBFC’s Compliance Reviewed?

DM us and get a detailed compliance health check.