15 Red Flags That Can Shut Down Your NBFC

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Surprisingly, most cancellations are not due to fraud, but rather due to missed compliance, weak financial health, or failure to adhere to RBI guidelines.

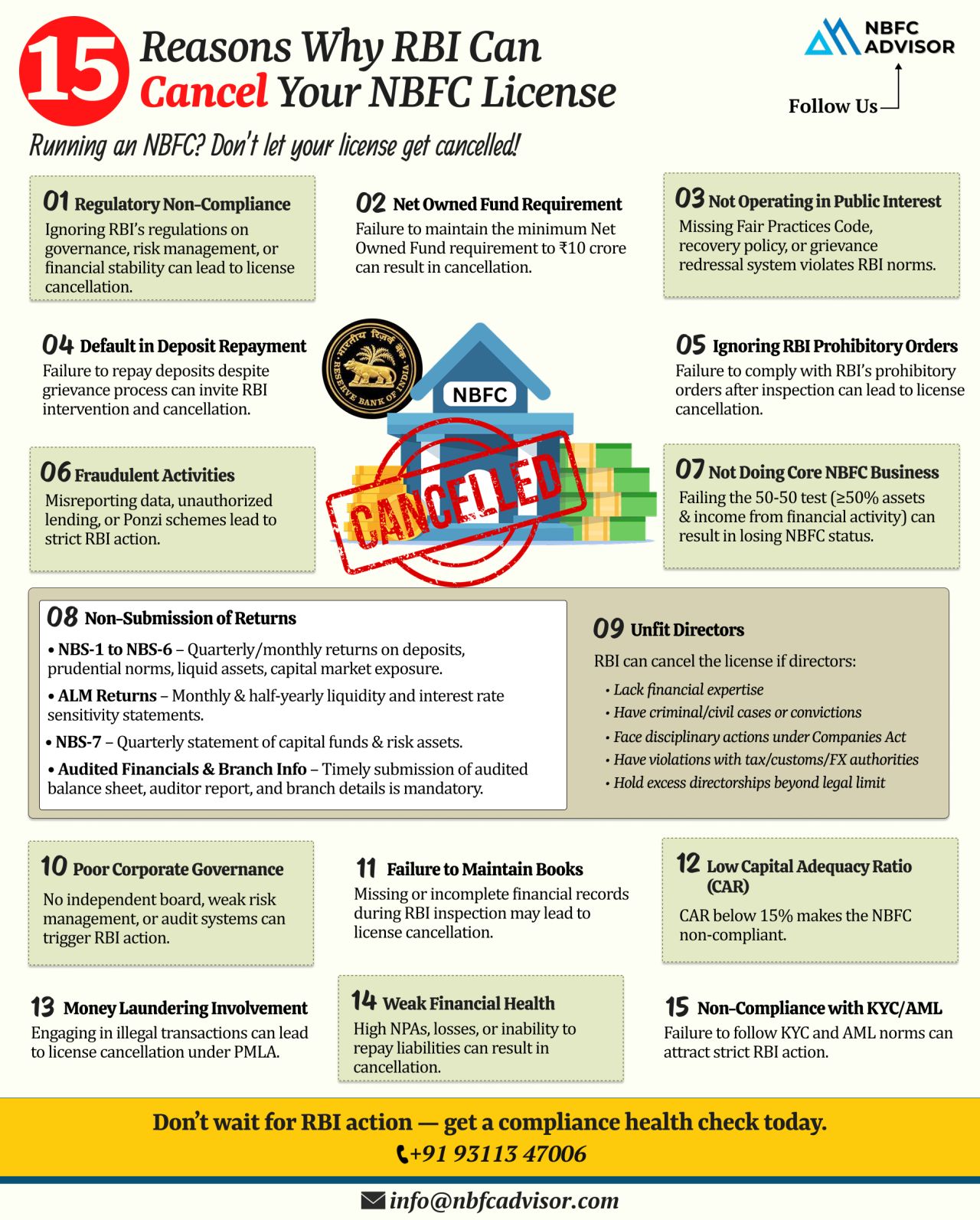

If you are running an NBFC, it is crucial to stay vigilant and ensure that your company meets all regulatory requirements. Here are 15 red flags that can put your NBFC license at risk:

(Note: While we are not listing all 15 here, this serves as a reminder to regularly review your compliance practices.)

Common Reasons NBFCs Lose Their License

-

Non-compliance with RBI Directions: Ignoring circulars, notifications, or instructions issued by the RBI.

-

Weak Financial Health: Poor capitalization, low net owned funds, or unsustainable operations.

-

Inadequate KYC & AML Practices: Failing to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

-

Irregular Reporting: Delayed or inaccurate submission of financial statements and reports to the RBI.

-

High NPAs (Non-Performing Assets): Excessive bad loans without proper provisioning.

-

Poor Corporate Governance: Lack of internal controls, board oversight, or transparency in operations.

-

Operational Risks: Weak risk management processes or technological failures.

-

Fraud or Mismanagement: Even if rare, significant operational frauds can trigger regulatory action.

-

Violation of Lending Norms: Breaching interest rate caps, exposure limits, or loan disbursal guidelines.

-

Unclear Ownership Structure: Lack of clarity about promoters, shareholders, or beneficial ownership.

-

Failure to Maintain Statutory Reserves: Inability to maintain the minimum required reserves or funds.

-

Ignoring RBI Audits or Inspections: Not cooperating during regulatory inspections or audits.

-

Unethical Practices: Misleading investors, clients, or other stakeholders.

-

Non-updated Policies: Not updating internal policies to reflect RBI or industry guidelines.

-

Delayed Remediation of Issues: Ignoring warnings, observations, or directions from RBI.

Stay Compliant, Stay Safe

Running an NBFC comes with responsibilities. Ensuring compliance with RBI regulations not only protects your license but also builds trust with investors, customers, and stakeholders.

If you need guidance on NBFC compliance, KYC, AML, or regulatory reporting, our experts can help. Contact us for a free consultation and safeguard your NBFC today.

📞 +91 93113 47006

Hashtags:

#NBFCAdvisor #RBICompliance #NOF #KYC #AML #NBFC #Fintech