Why Do Many NBFCs Fail to Scale? The Real Issue Is Financial Clarity

When NBFCs struggle to scale, the first assumption is often lack of funds.

But in reality, capital is only part of the story.

The real bottleneck is financial clarity.

Wit...

Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

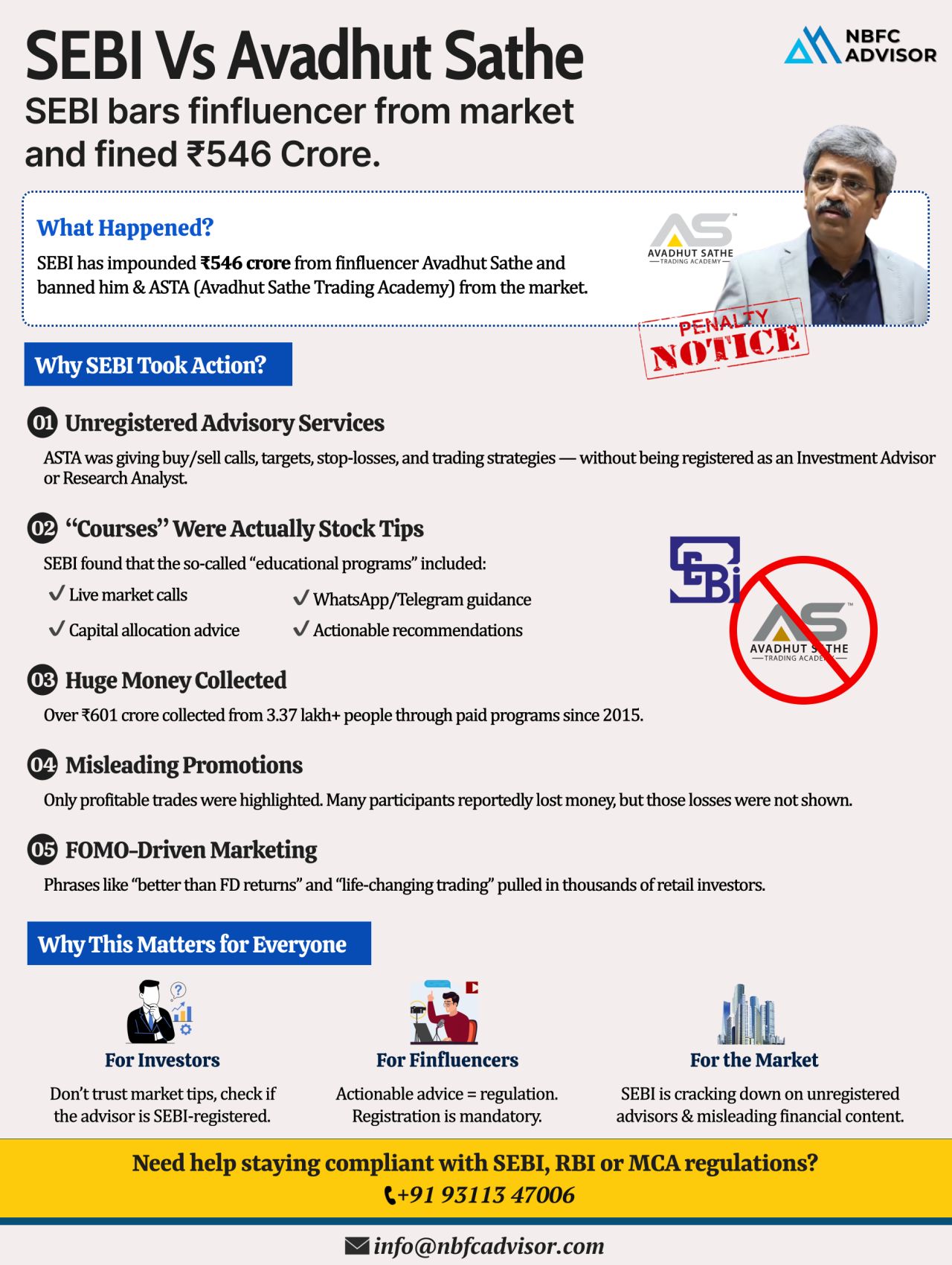

SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut S...

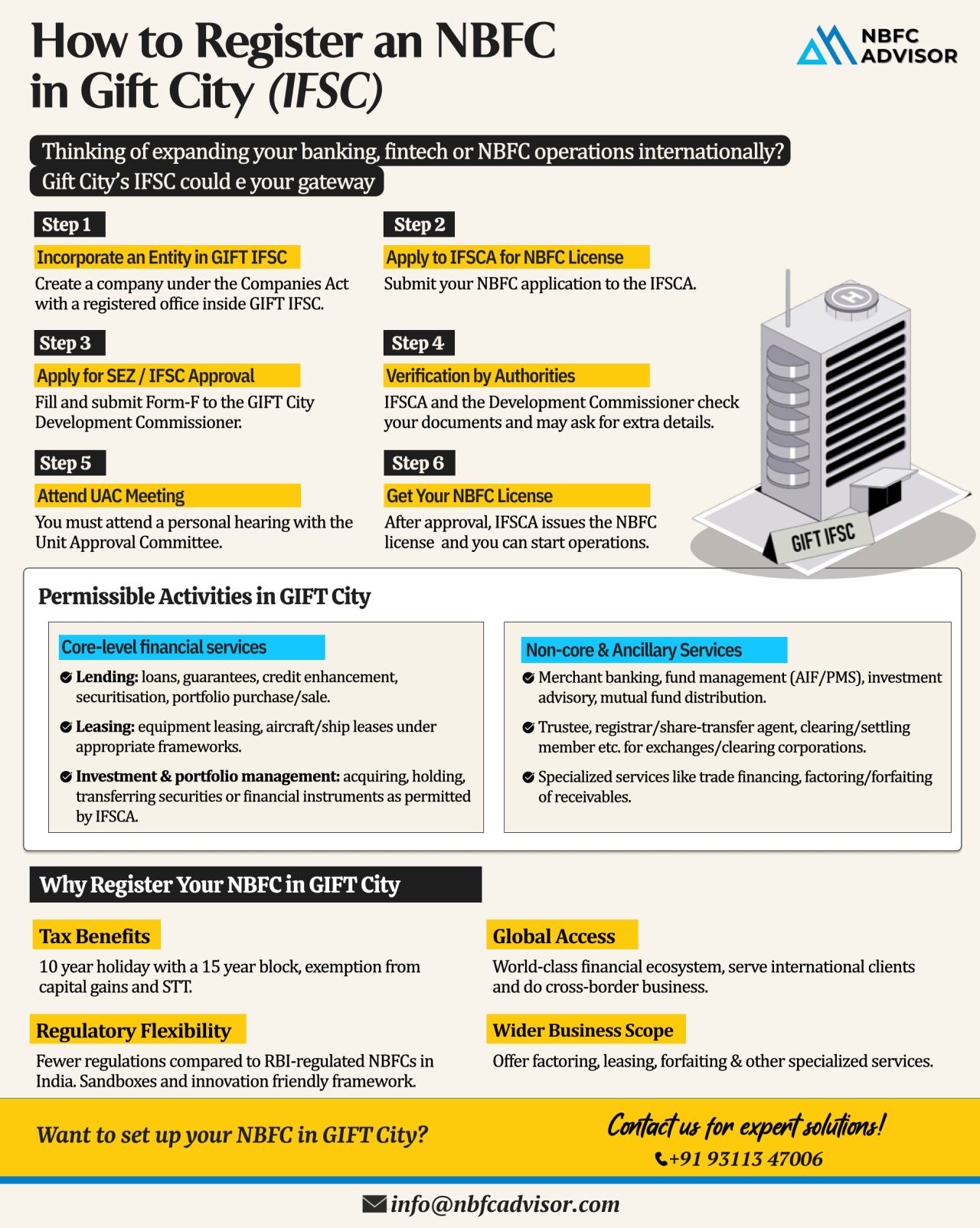

Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (...

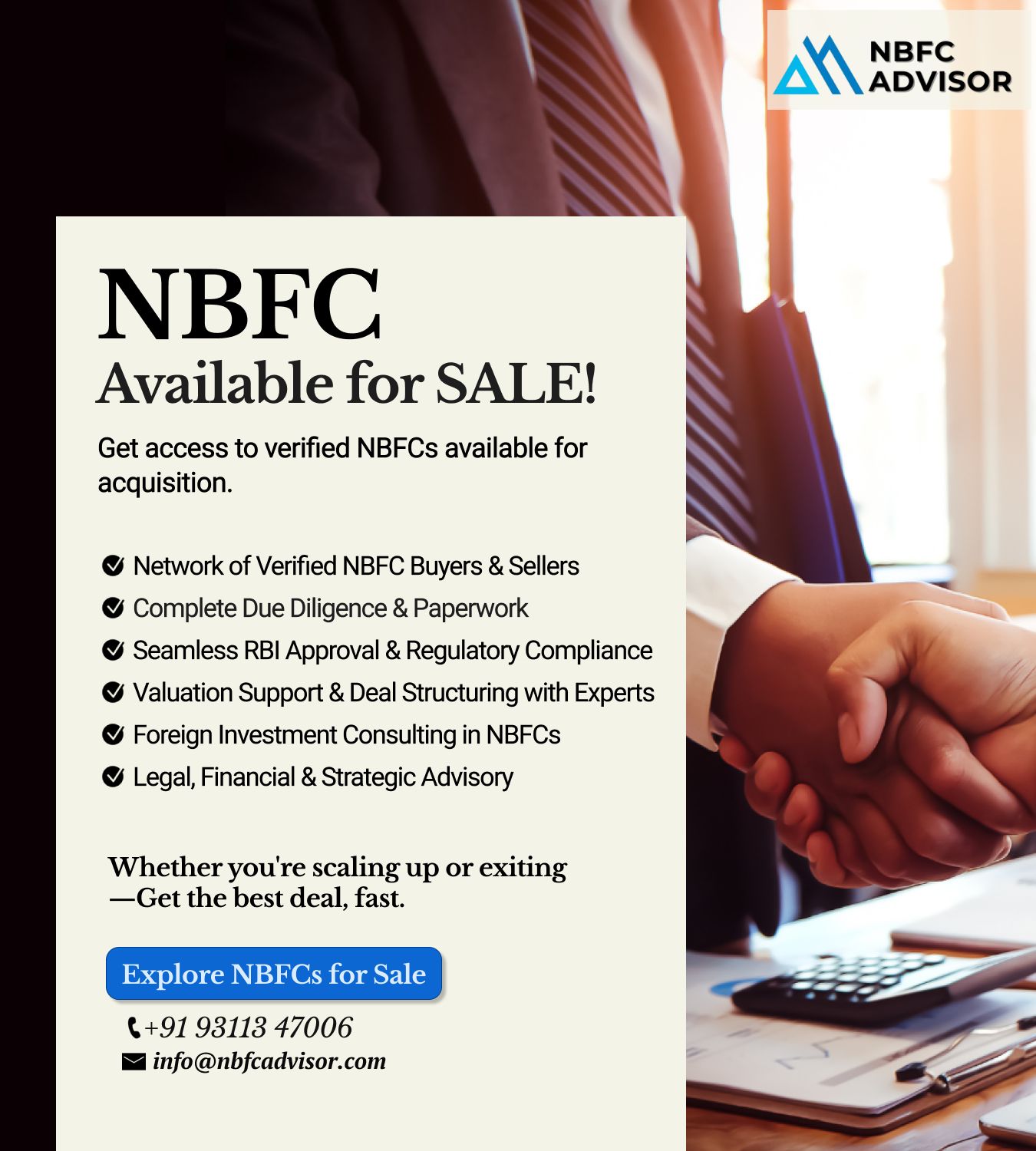

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

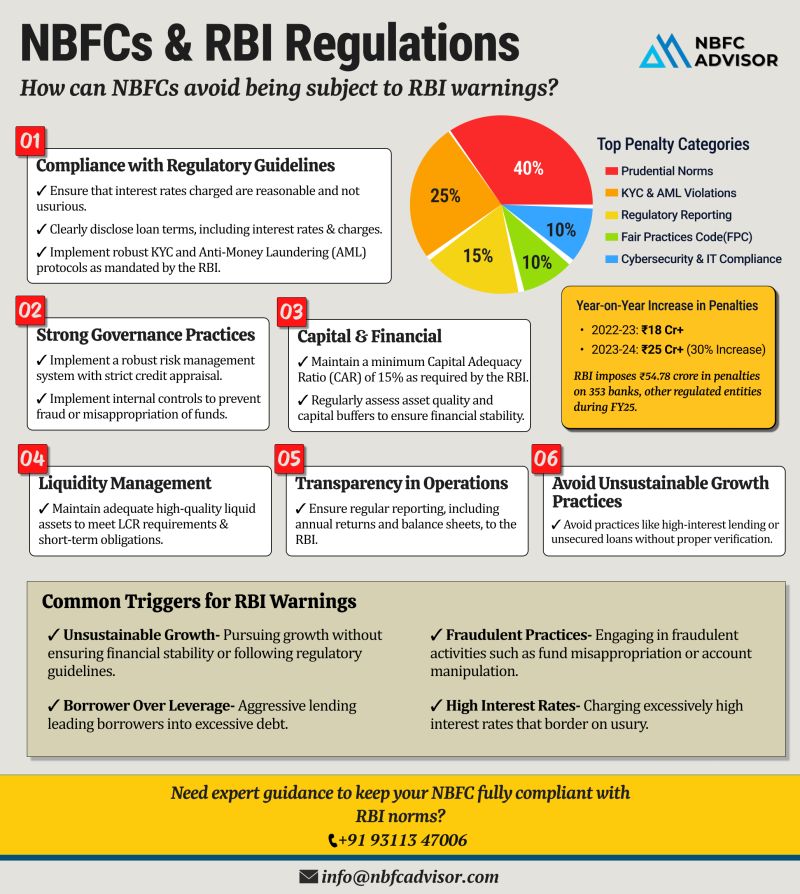

RBI Penalties on NBFCs Jumped 30% in Just One Year — Is Your NBFC at Risk?

The Reserve Bank of India (RBI) has intensified its oversight on financial institutions — and the numbers speak for themselves.

In FY 2022–23, RBI impo...

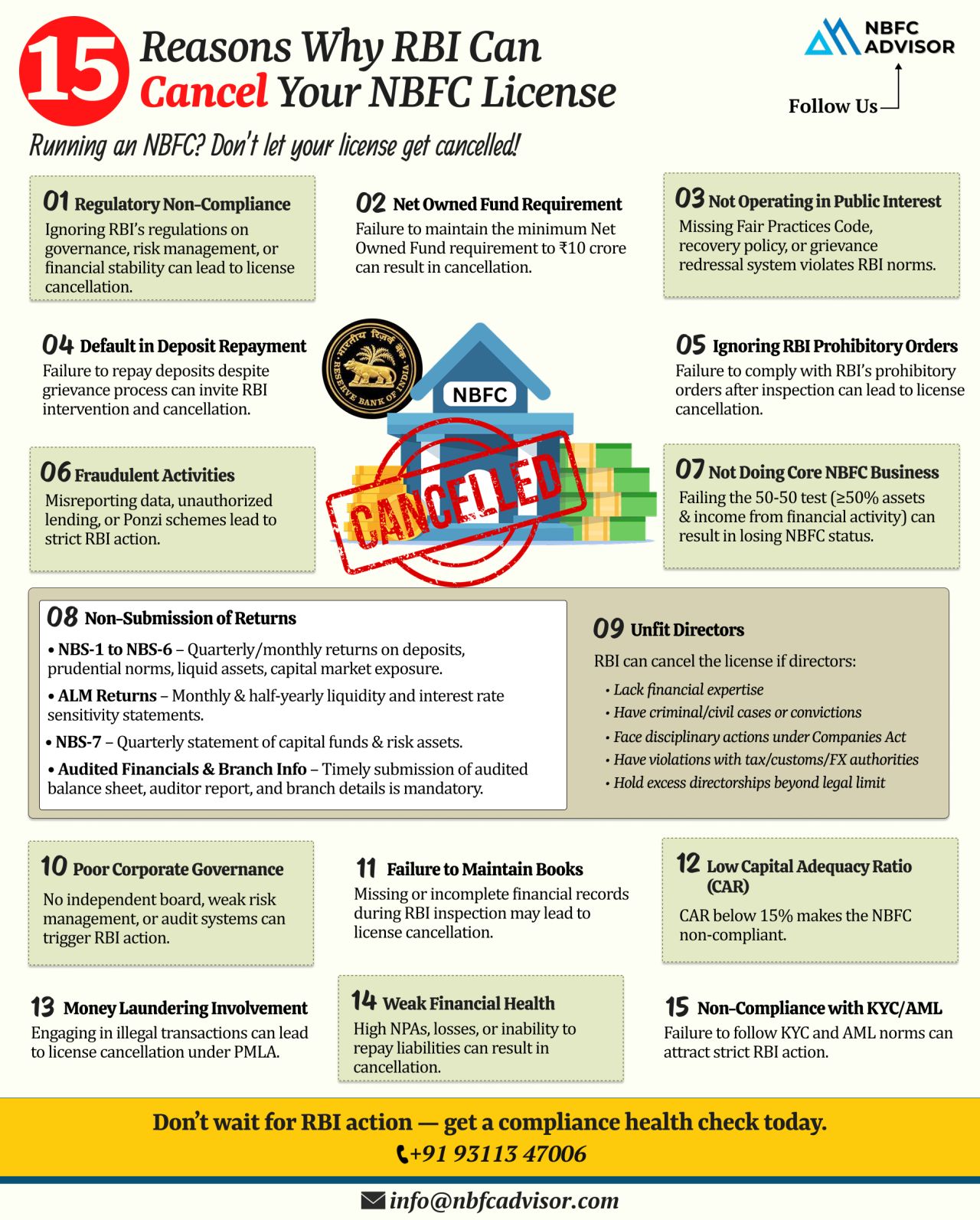

15 Red Flags That Can Shut Down Your NBFC

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Surprisingly, most cancellations are not due to fraud, but rather due to missed compliance, ...

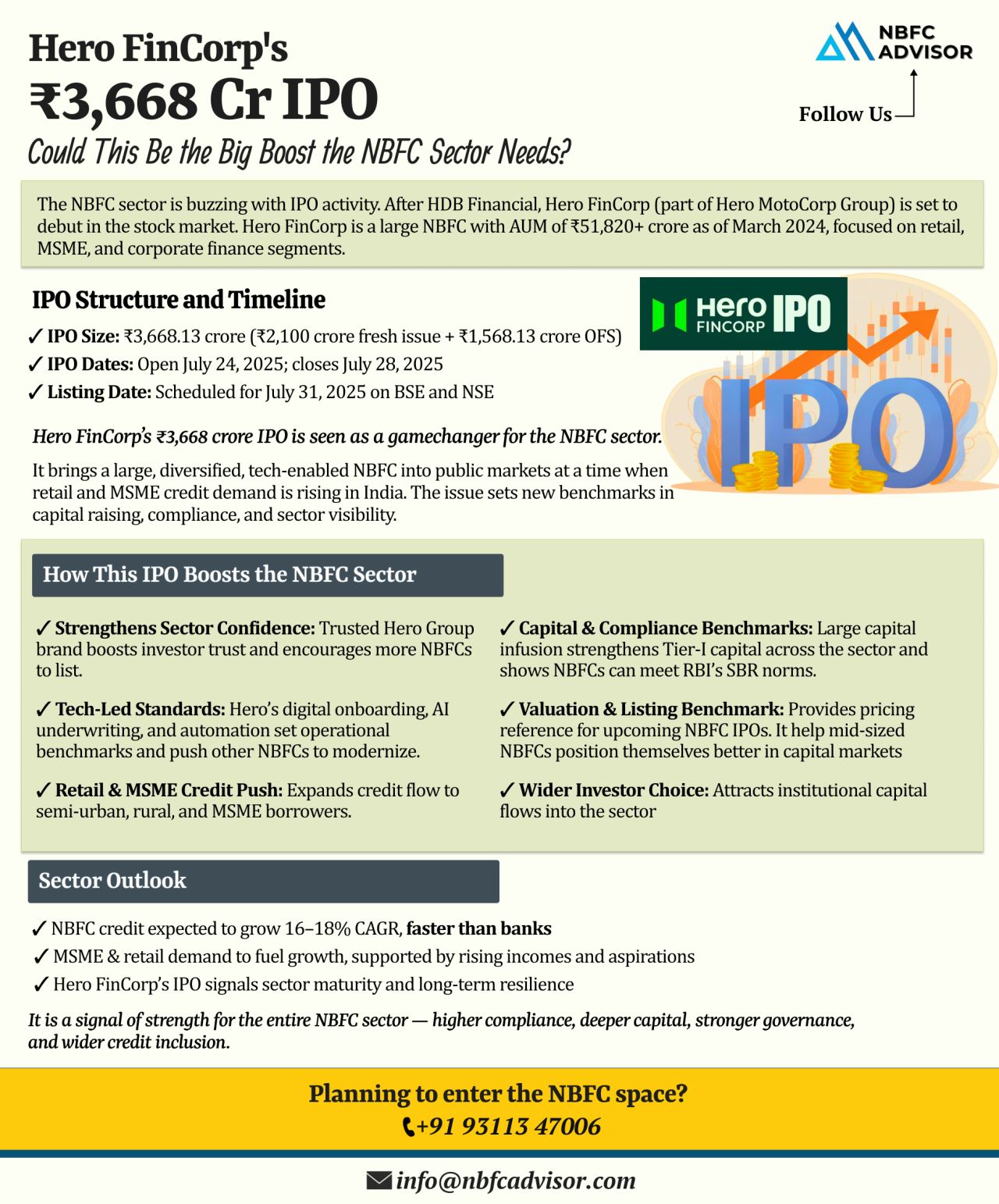

Hero FinCorp’s ₹3,668 Cr IPO: What It Means for NBFCs

The Indian NBFC sector is witnessing a wave of IPOs, signaling strong growth and investor confidence. After HDB Financial Services, Hero FinCorp is now preparing to debut on the stock mar...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

NBFC Takeovers: A Fast Track to Enter India’s Booming Digital Lending Market

India’s digital lending industry is witnessing an unprecedented surge, with projections suggesting it will touch $515 billion by 2030. From P2P lending platfo...

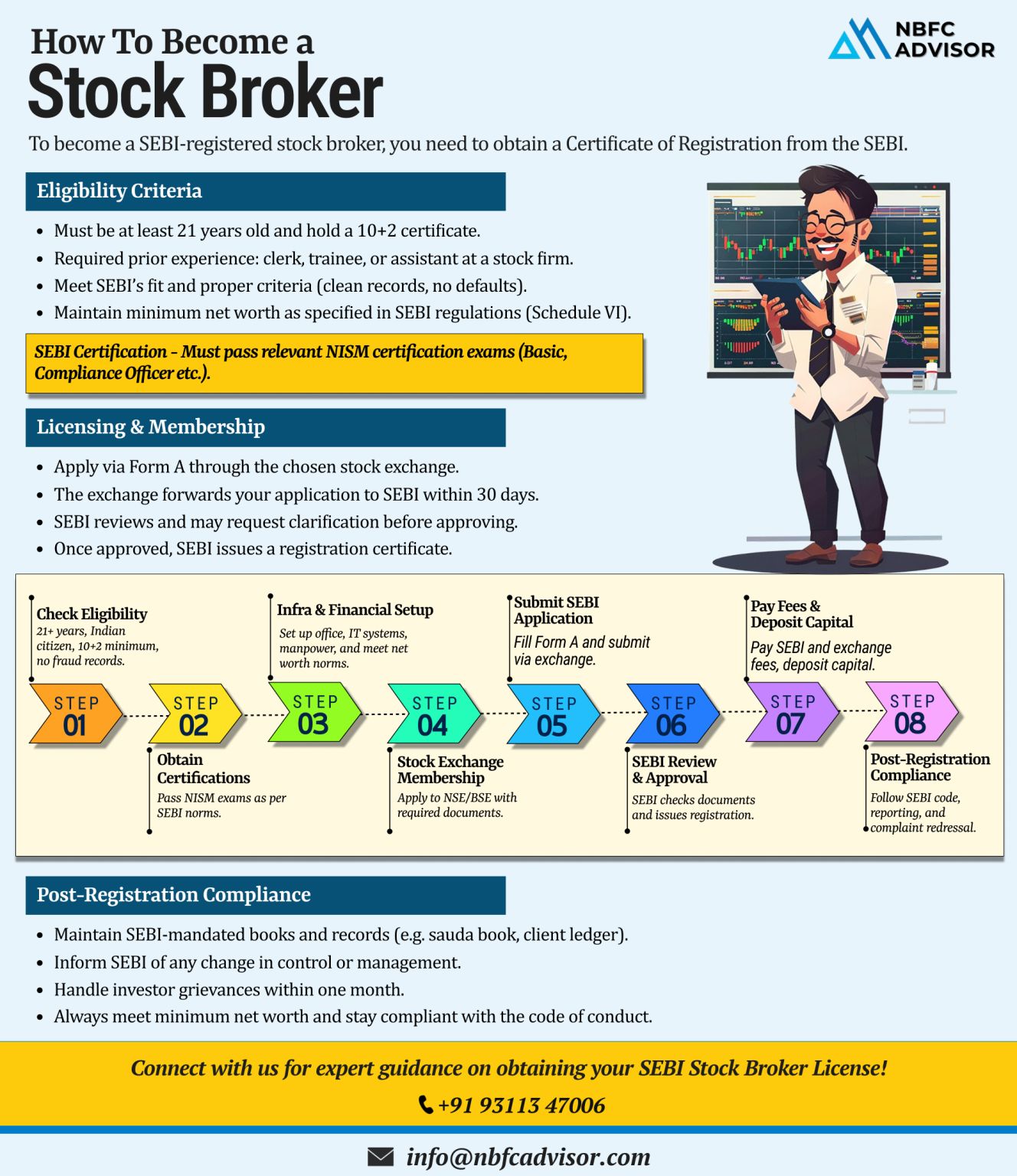

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI-registered stock broker license opens the door to operating legally in India’s capital markets. Whether you plan to trade in equities, derivatives, or other securities, you must mee...

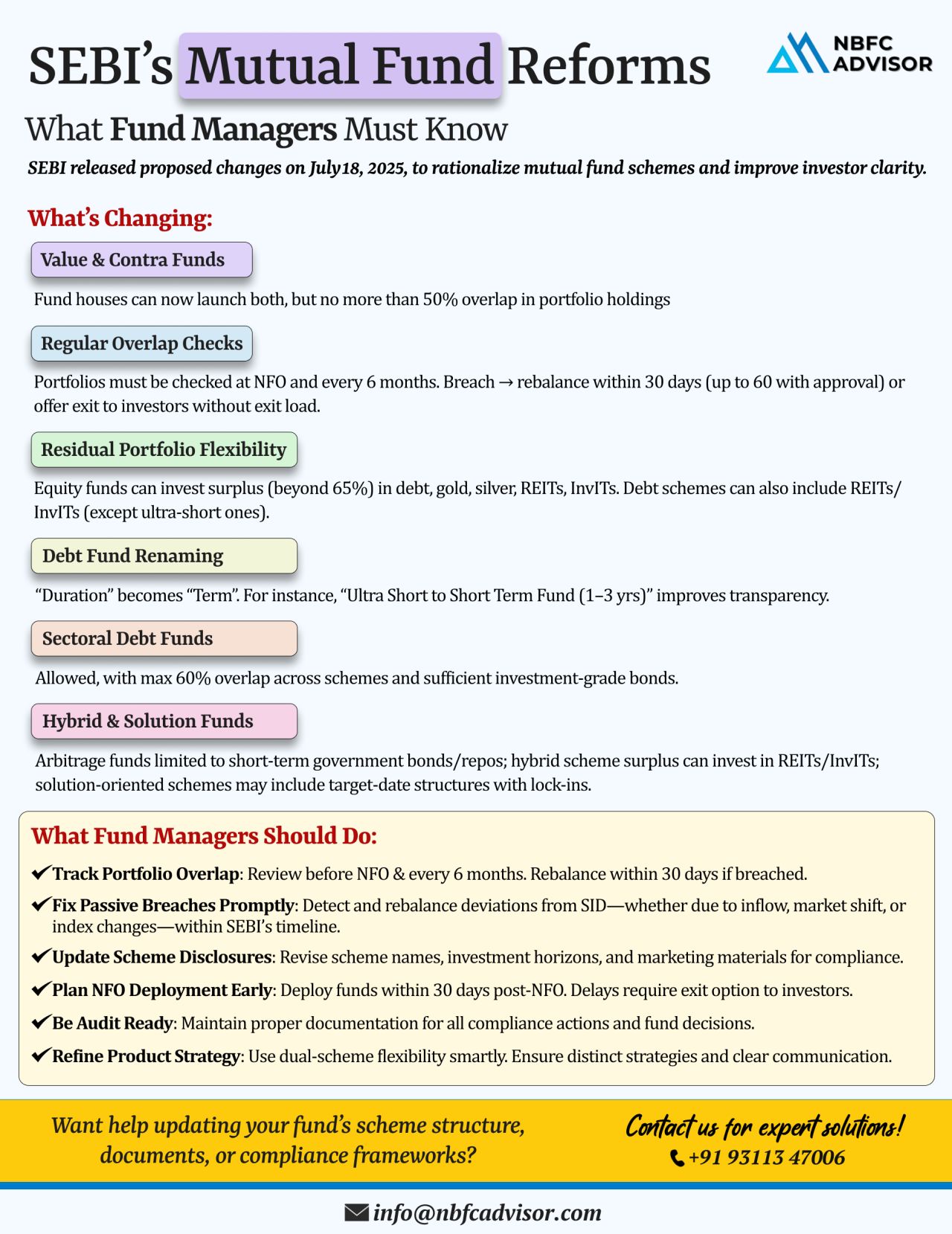

📰 SEBI’s New Mutual Fund Reforms: What Investors & Fund Managers Need to Know

The Securities and Exchange Board of India (SEBI) has proposed sweeping changes to the mutual fund framework to enhance transparency, reduce overlap, and ensu...

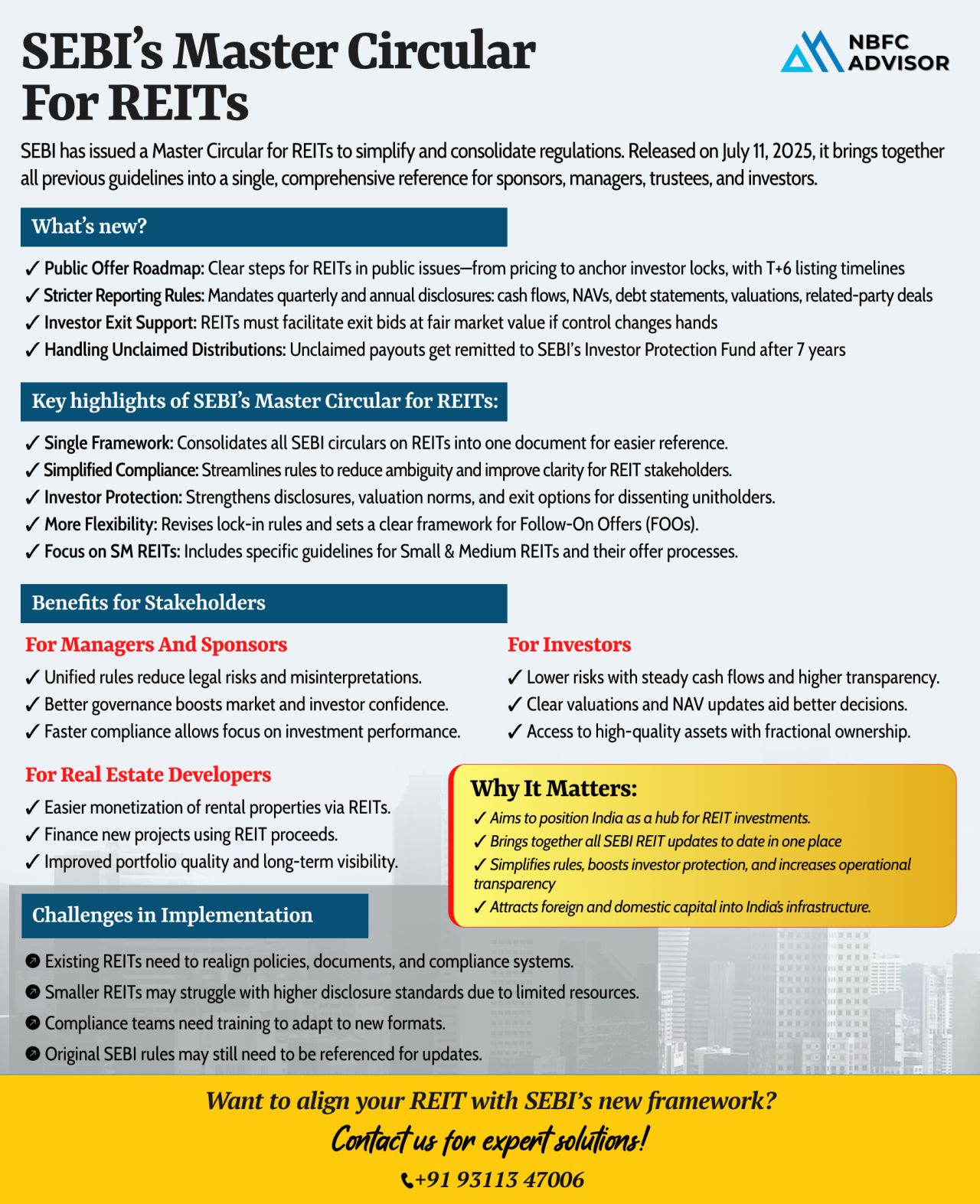

SEBI’s Master Circular for REITs: Transparency, Simplicity & Growth in One Framework

The Securities and Exchange Board of India (SEBI) has taken a bold step to reshape the future of Real Estate Investment Trusts (REITs) in India. With it...

India’s Digital Lending Space Is Growing Faster Than Ever

India’s digital lending sector is on a meteoric rise — and it's showing no signs of slowing down. According to industry projections, the market is set to touch a stagg...

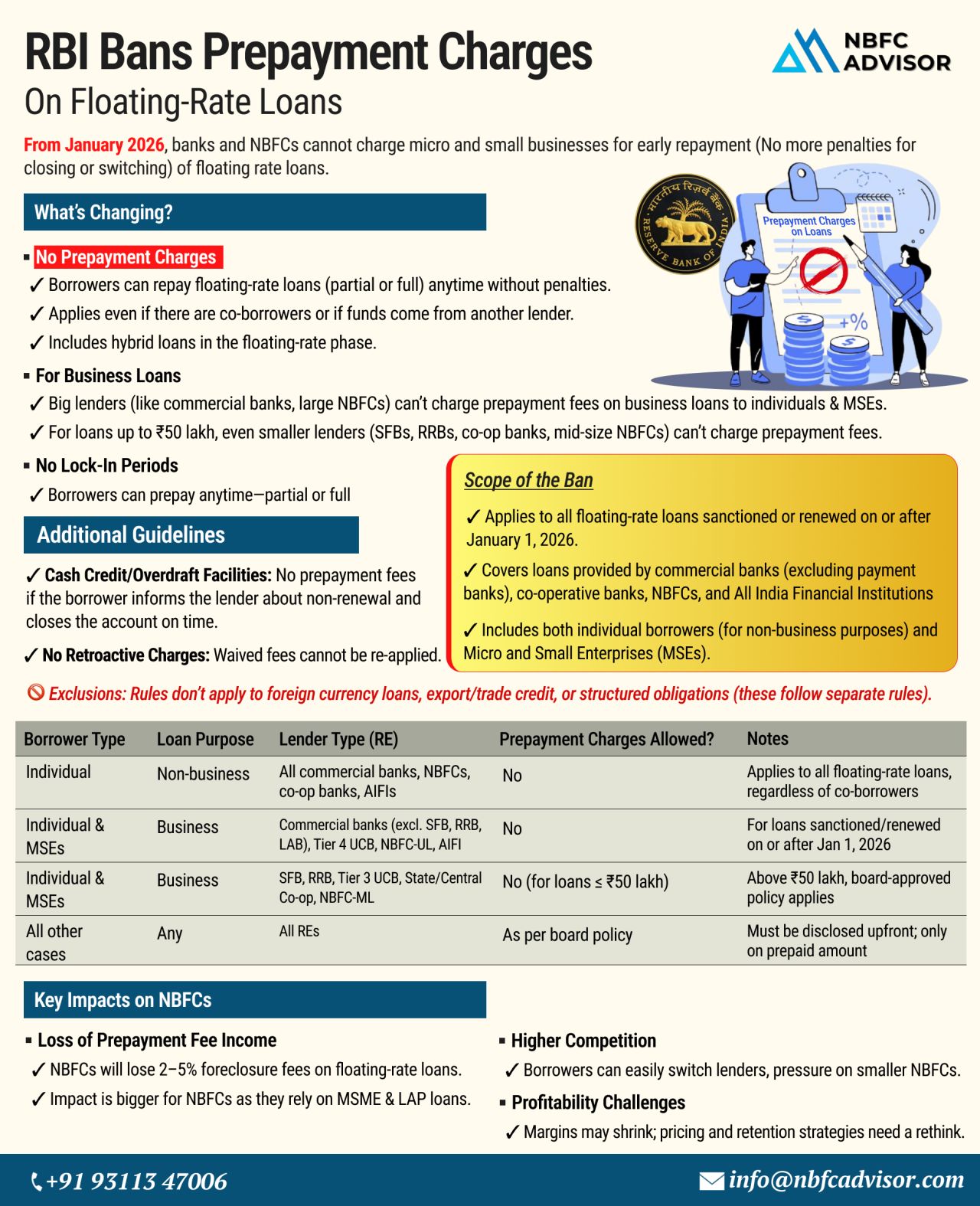

RBI Bans Prepayment Charges on Floating-Rate Loans

What It Means for NBFCs Starting January 2026

The Reserve Bank of India (RBI) has rolled out a major regulatory change aimed at giving borrowers more freedom. From January 1, 2026, no prepaymen...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

Non-Banking Financial Companies (NBFCs) have carved a niche for themselves in the Indian financial ecosystem, offering a wide range of services that cater to individuals, businesses and the economy as a whole. While their name might suggest a resembl...

The financial services sector in India is vast and multifaceted, with Non-Banking Financial Companies (NBFCs) playing a crucial role in providing credit and investment solutions. With their increasing presence and significance in the economy, NBFC ta...