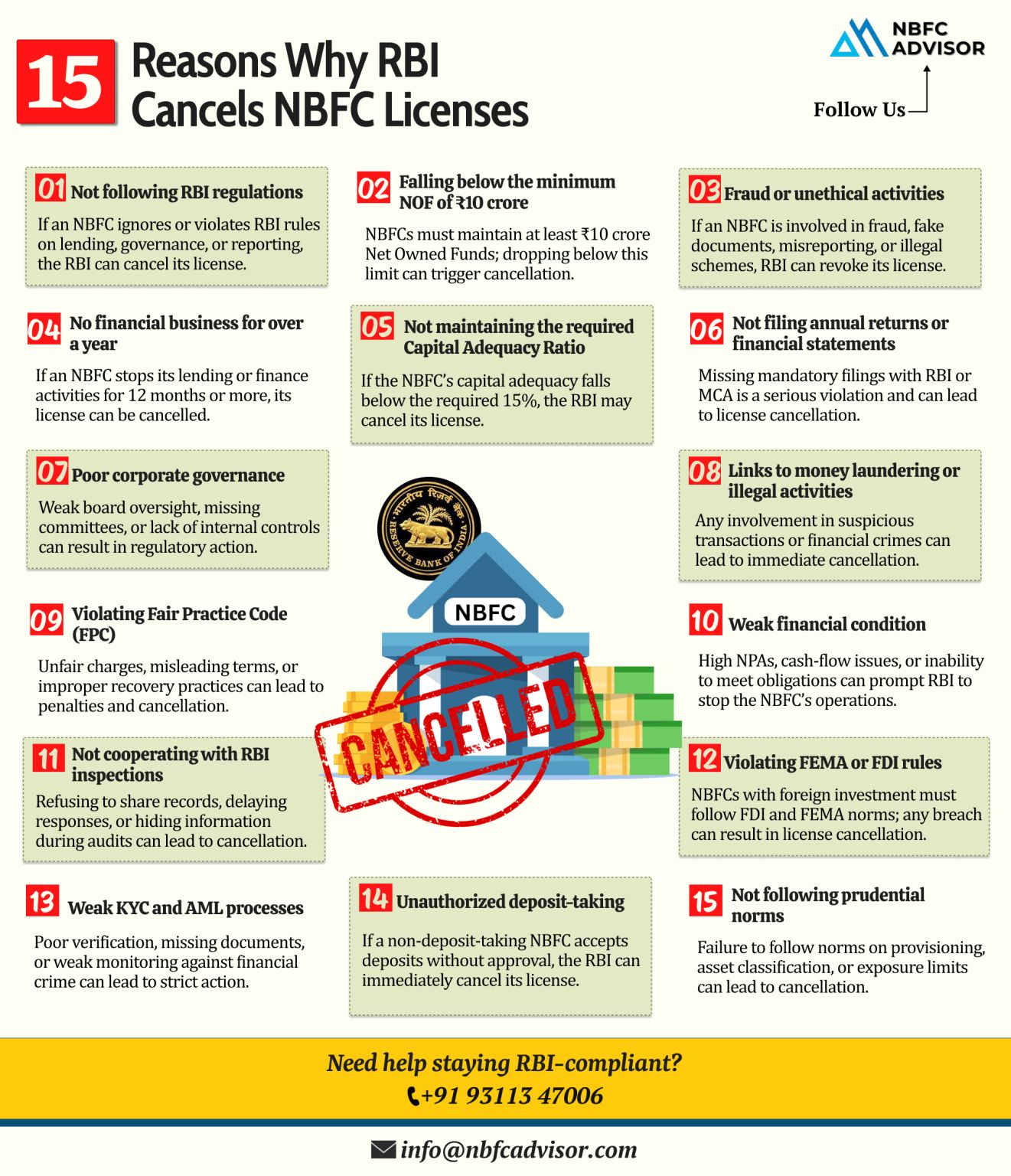

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

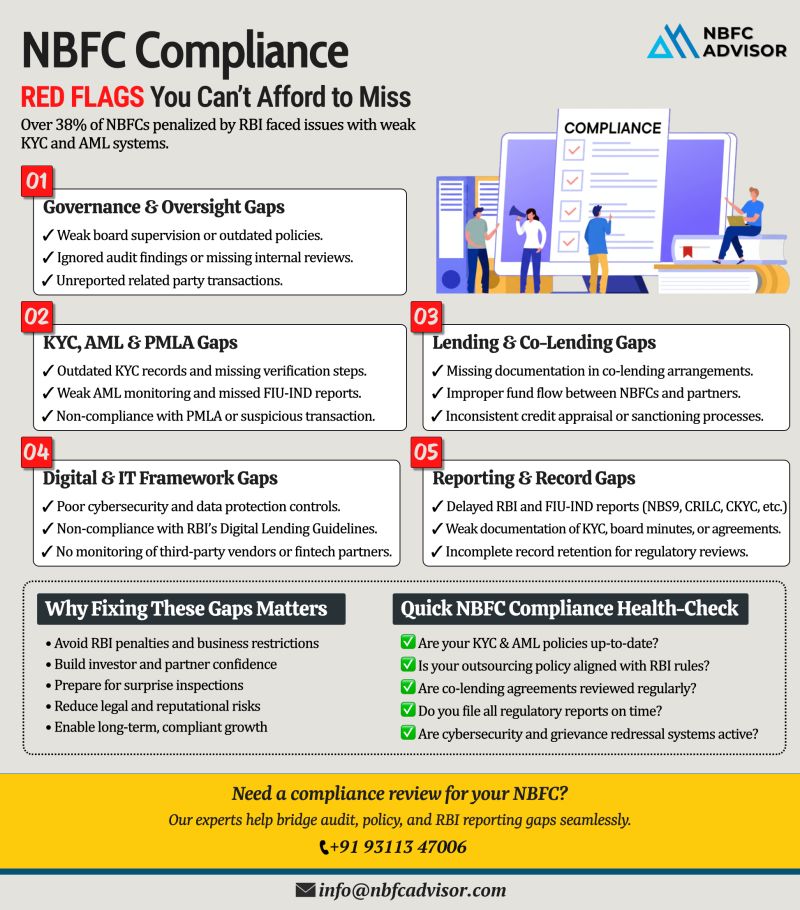

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny!

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several NBFCs — not for fraud or mismanagement — but for missing critical compliance steps.

As...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

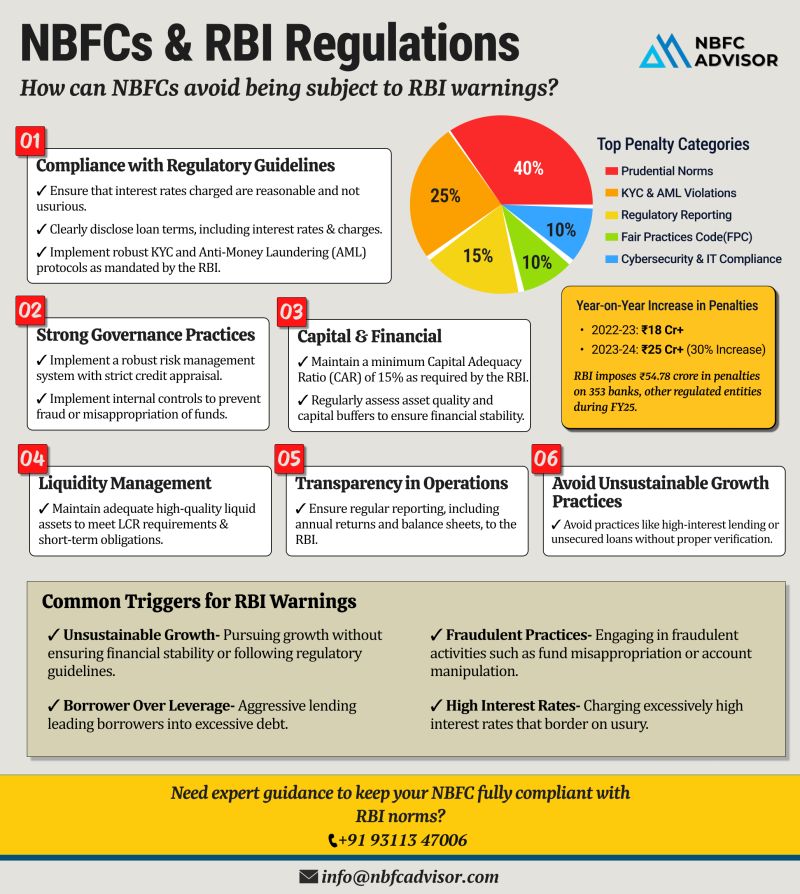

RBI Penalties on NBFCs Jumped 30% in Just One Year — Is Your NBFC at Risk?

The Reserve Bank of India (RBI) has intensified its oversight on financial institutions — and the numbers speak for themselves.

In FY 2022–23, RBI impo...

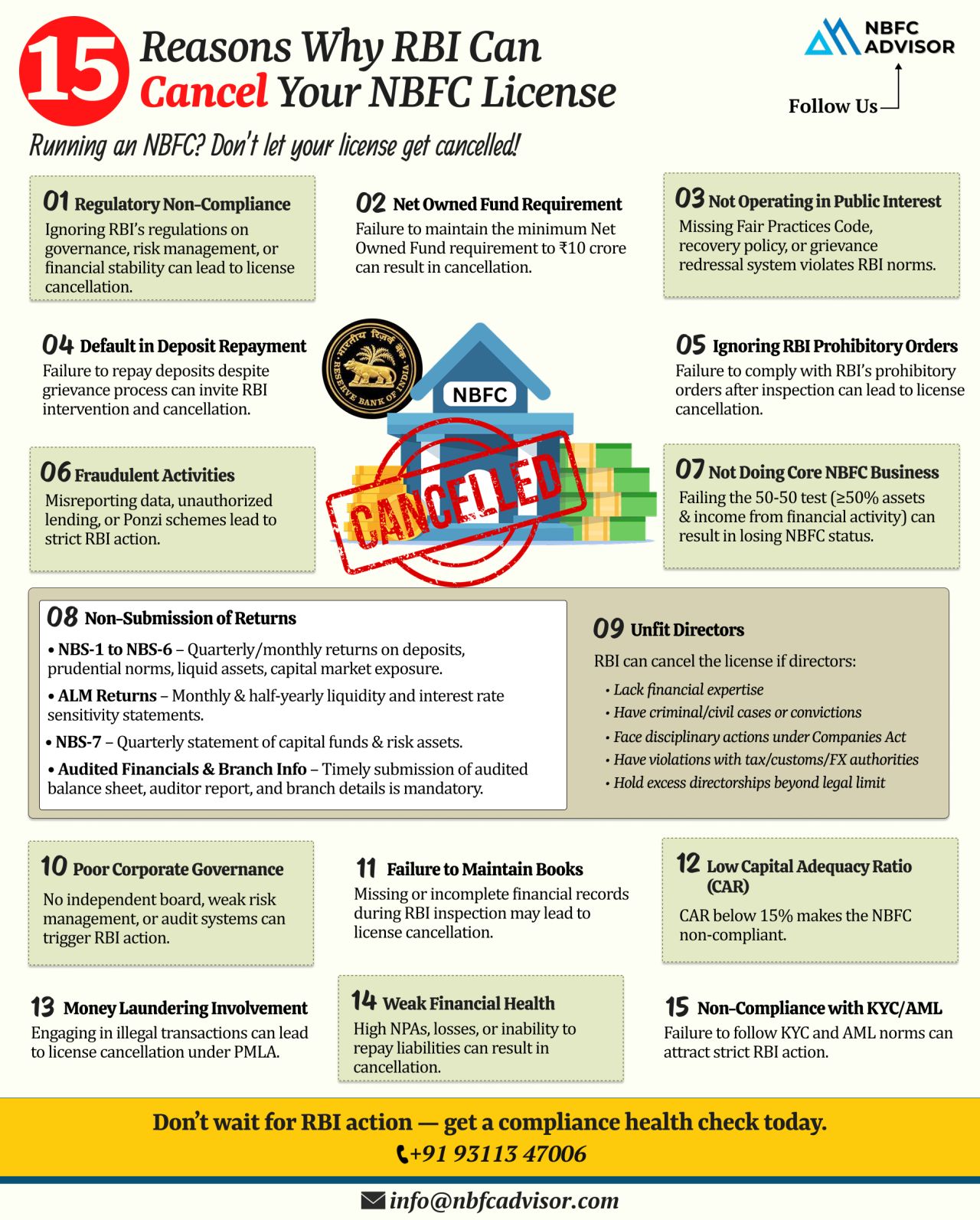

15 Red Flags That Can Shut Down Your NBFC

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Surprisingly, most cancellations are not due to fraud, but rather due to missed compliance, ...

Is Your NBFC Aligned with the Latest RBI Updates?

The Reserve Bank of India (RBI) is taking decisive steps to tighten the compliance framework for Non-Banking Financial Companies (NBFCs), ensuring transparency, customer protection, and responsible...

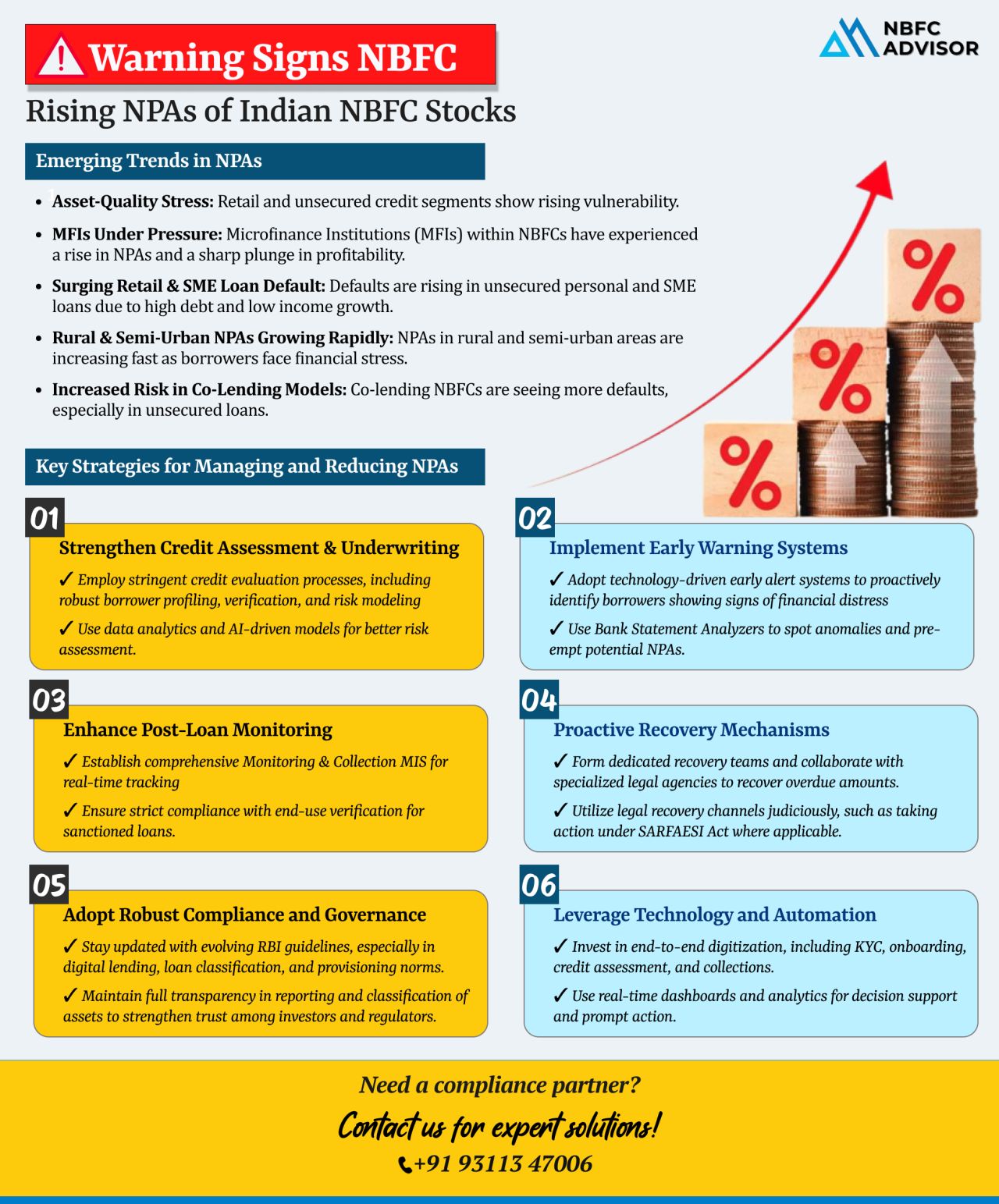

Rising NPAs Are a Wake-Up Call for NBFCs

India’s NBFC sector is under pressure. The alarming rise in Non-Performing Assets (NPAs) is sending a clear signal—NBFCs need to act now.

From unsecured personal loans to SME and rural lendin...

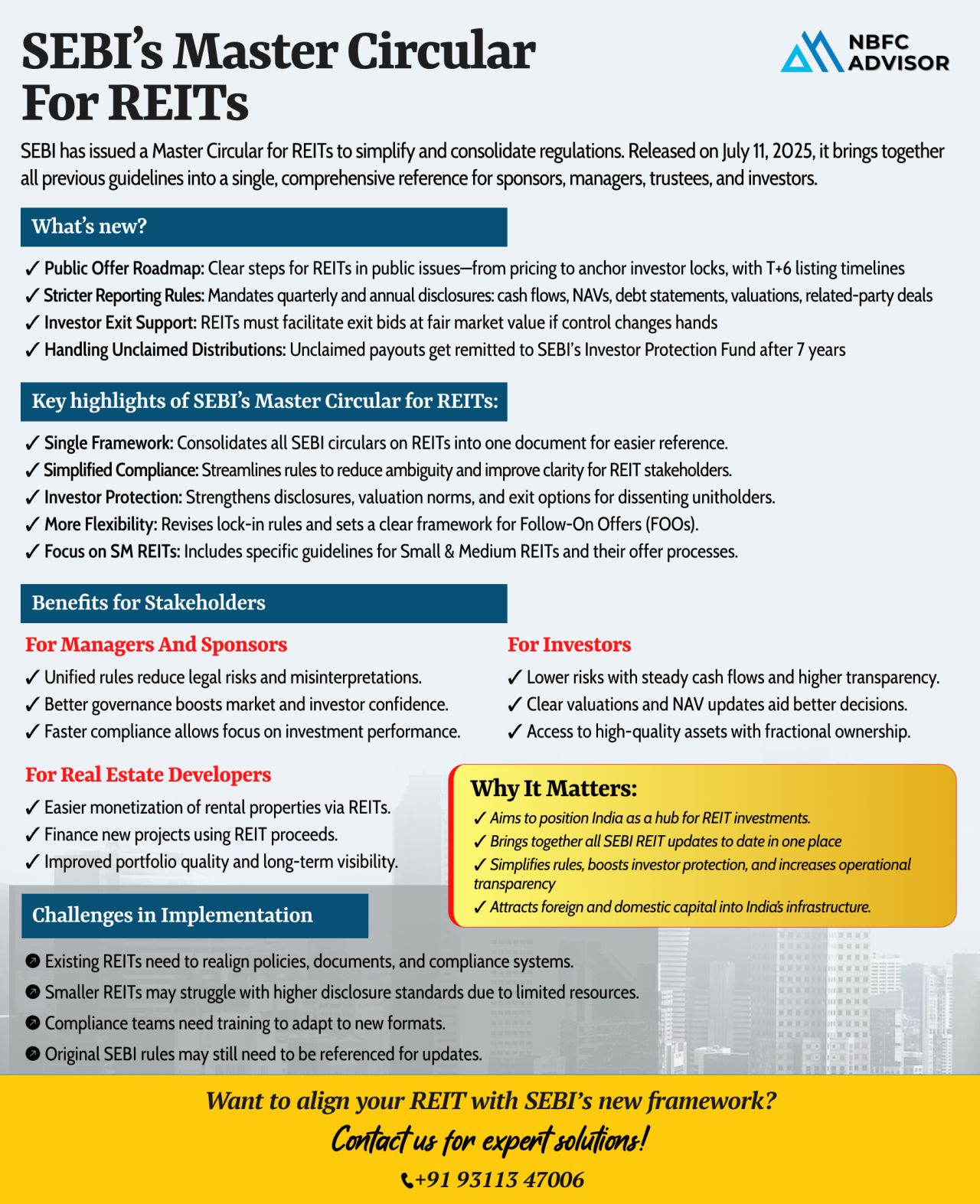

SEBI’s Master Circular for REITs: Transparency, Simplicity & Growth in One Framework

The Securities and Exchange Board of India (SEBI) has taken a bold step to reshape the future of Real Estate Investment Trusts (REITs) in India. With it...

The Reserve Bank of India (RBI) is actively preparing for the future of finance with a strategic officer training program at its Hyderabad campus. This initiative is laser-focused on emerging areas such as:

✅ Digital Banking

✅ Fintec...

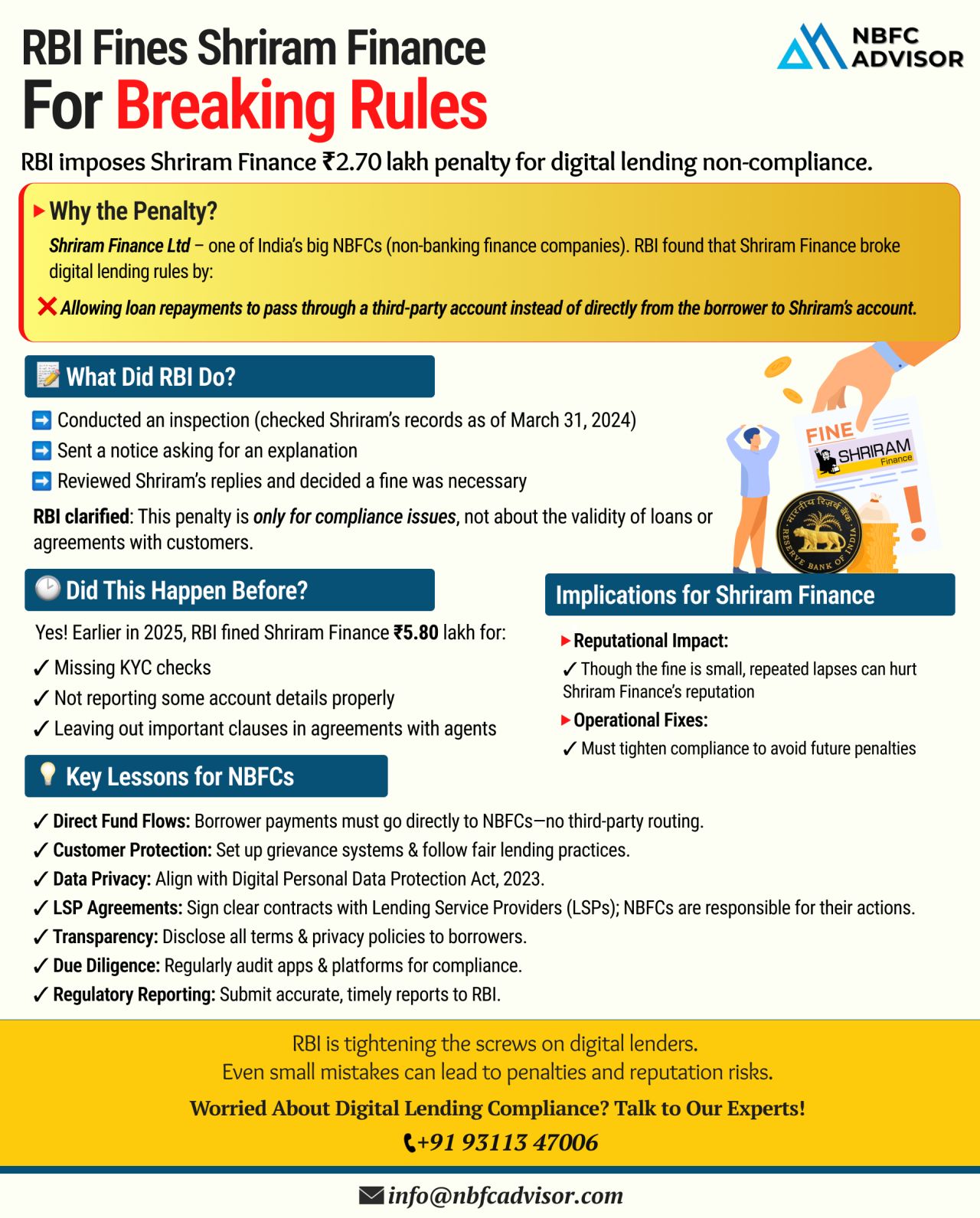

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

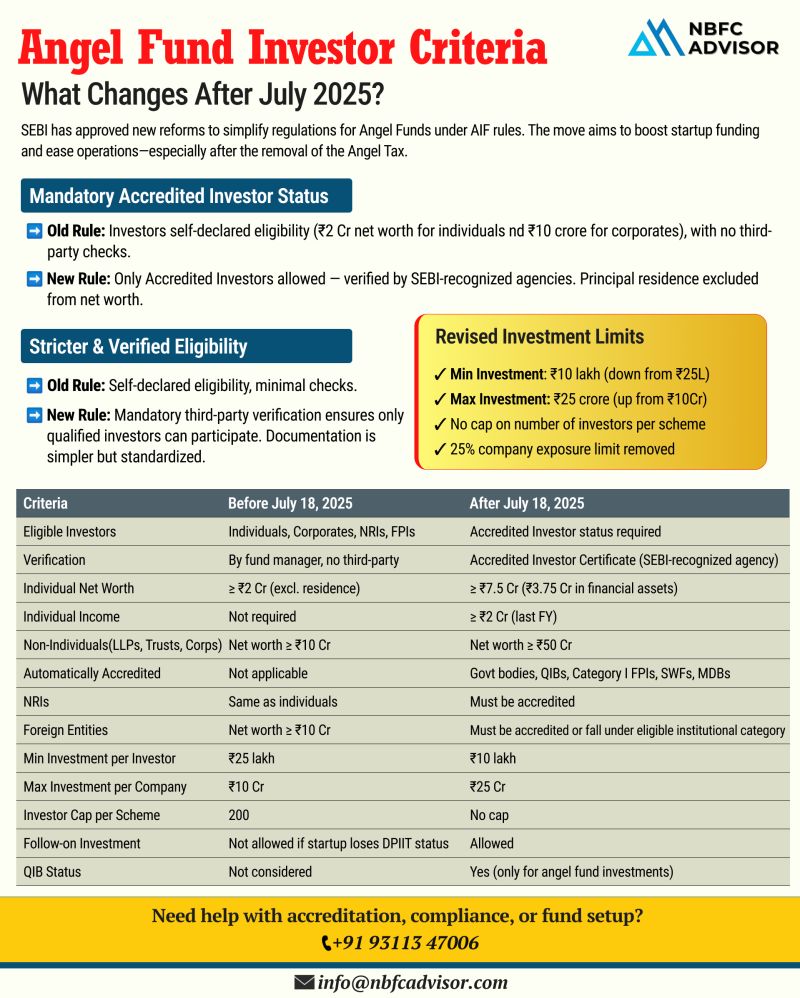

𝘉𝘪𝘨 𝘊𝘩𝘢𝘯𝘨𝘦𝘴 𝘈𝘩𝘦𝘢𝘥 𝘧𝘰𝘳 𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥𝘴 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘙𝘦𝘢𝘥𝘺?

From July 2025, Angel Funds in India will function under a revamped SEBI framework, bringing clarity, credibility, and new opportunities to early-stage...

Non-Banking Financial Companies (NBFCs) are essential players in India's financial ecosystem. They provide crucial financial services such as loans, credit facilities, asset financing and investment services, often reaching segments of the popula...