Building a Fintech? One Data Leak Can Destroy Everything

In today’s digital-first world, launching a fintech startup is an exciting venture—but one security misstep can bring it all crashing down. Whether you're building a lending app, neobank, or payment platform, data privacy and cybersecurity compliance aren’t optional—they’re essential.

🚨 Why Fintechs Must Take Data Privacy Seriously

1. You Handle Highly Sensitive Information

Fintech companies process and store large volumes of sensitive data—names, contact details, Aadhaar numbers, bank accounts, card details, and transaction histories. If this falls into the wrong hands, it could lead to identity theft, financial loss, and legal action.

2. Regulatory Oversight is Intense

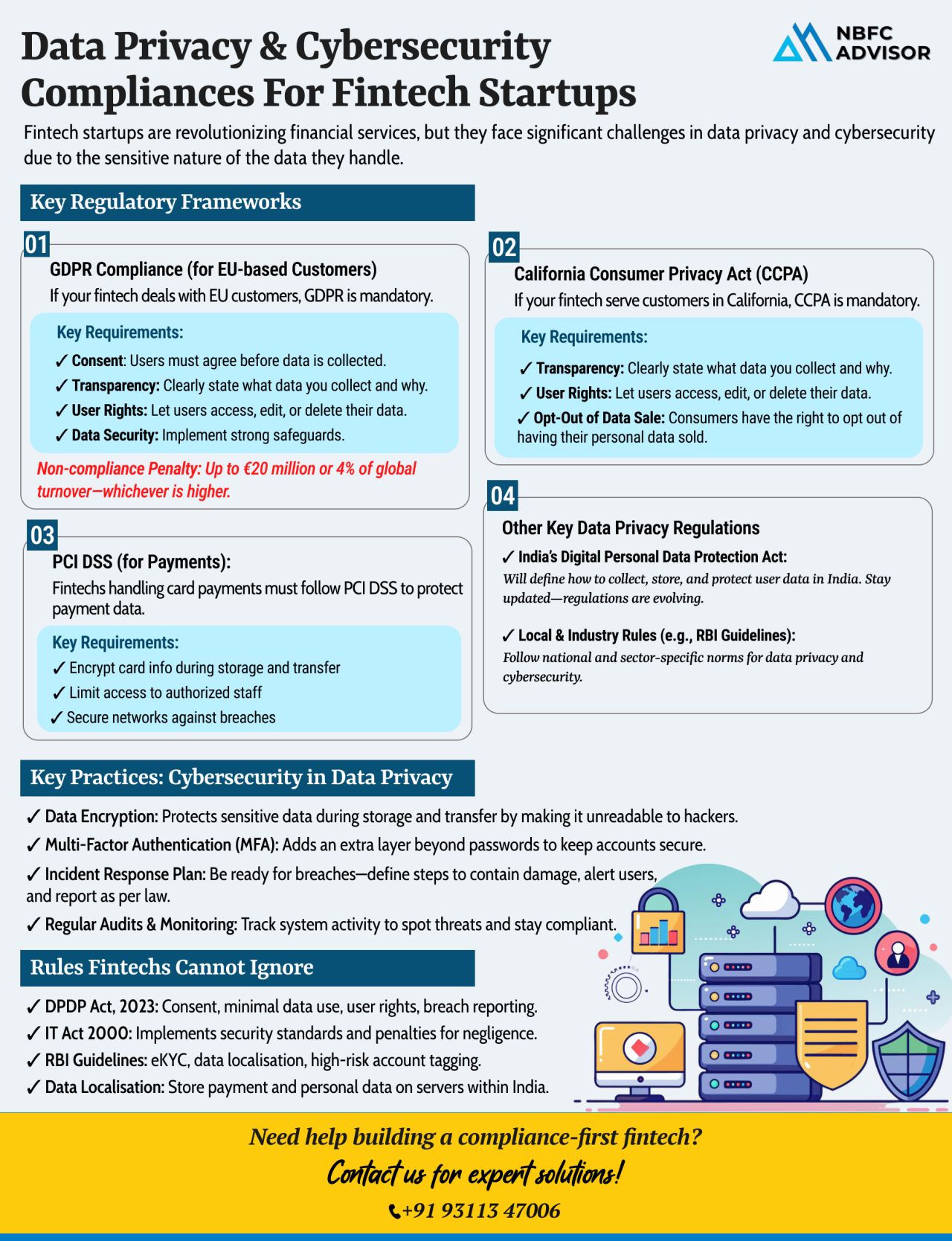

From GDPR (EU) and CCPA (California) to India’s DPDP Act, PCI DSS, and RBI cybersecurity guidelines, regulators are clamping down on how financial data is handled. Non-compliance isn’t just risky—it’s expensive.

3. Customer Trust = Business Survival

Your fintech may offer the best features, but trust is what keeps users coming back. A single data breach can shatter your reputation overnight. In contrast, a secure and transparent platform fosters loyalty and word-of-mouth growth.

4. Cyber Threats Are Evolving Rapidly

Phishing attacks, ransomware, insider threats, and zero-day vulnerabilities are growing more sophisticated. Compliance alone isn’t enough—you need a proactive defense strategy.

✅ Key Strategies for Building a Secure Fintech Platform

🔐 Encrypt Everything – Use strong encryption protocols for data in transit and at rest.

🔐 Enable Multi-Factor Authentication (MFA) – Add layers of protection beyond passwords.

📉 Minimize Data Collection – Collect only what's absolutely necessary.

🔍 Conduct Regular Vulnerability Scans – Identify and fix system loopholes before hackers do.

👨💻 Train Your Team – Ensure everyone—from developers to customer support—understands cybersecurity hygiene.

🚨 Create a Breach Response Plan – Know exactly what to do if things go wrong.

🤝 Work with Compliance Experts – Don’t go it alone. Partner with professionals who understand fintech risk and regulations.

📢 Ready to Build a Compliance-First Fintech?

Whether you're applying for an NBFC license, integrating payment gateways, or designing your app’s data architecture—we can help. Our fintech compliance experts will guide you through data privacy laws, RBI requirements, and security audits.

📞 Contact us today for a free consultation

📱 +91 93113 47006

#NBFCAdvisor #Fintech #DataPrivacy #CyberSecurity #Startup #GDPR #RBICompliance #FintechCompliance #FintechSecurity