Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

Why NBFCs Are Adding Factoring to Their Portfolio

India’s MSMEs are the backbone of the economy, contributing significantly to employment and GDP. Yet, one persistent challenge continues to limit their growth—cash flow gaps caused by d...

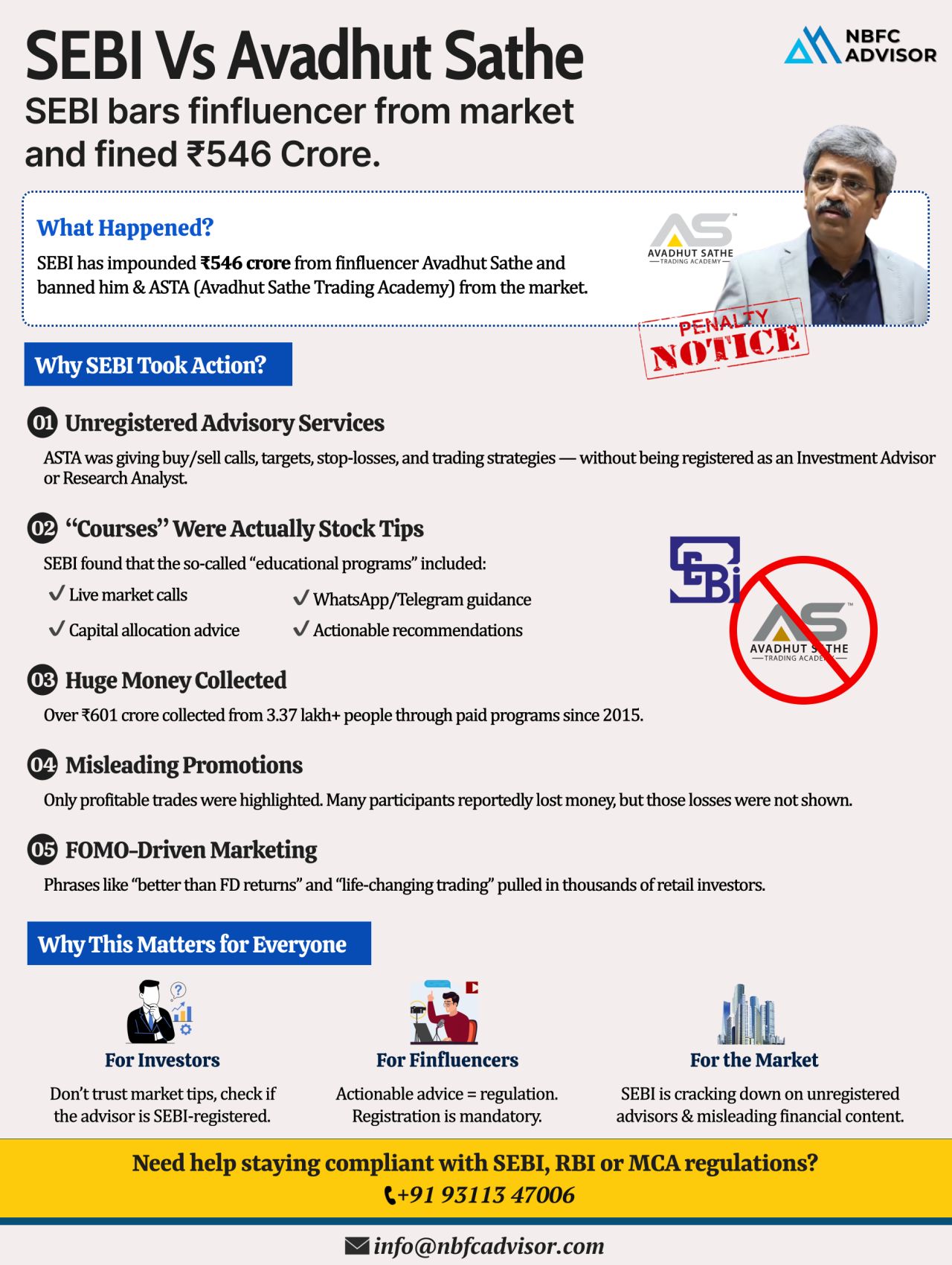

SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut S...

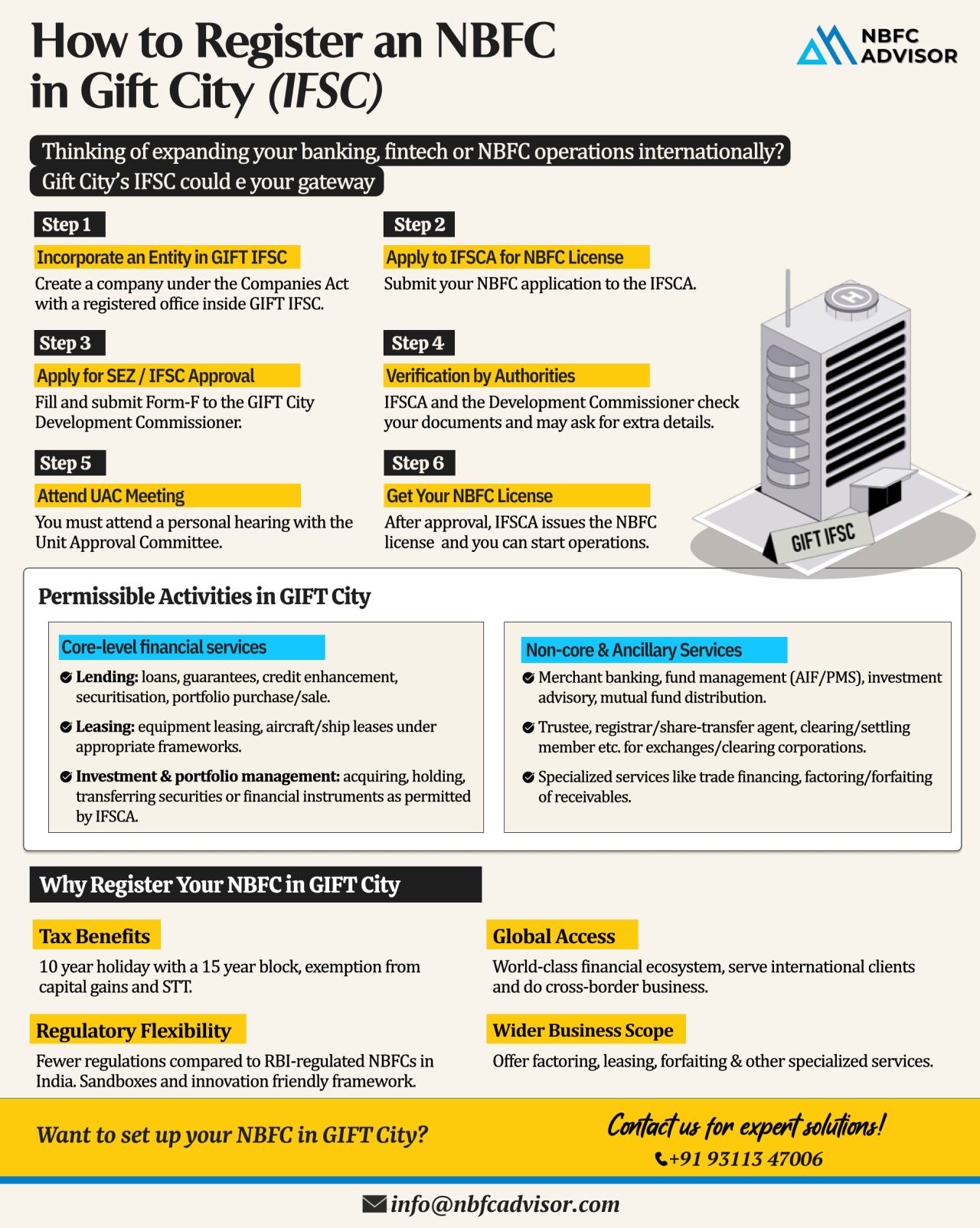

Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (...

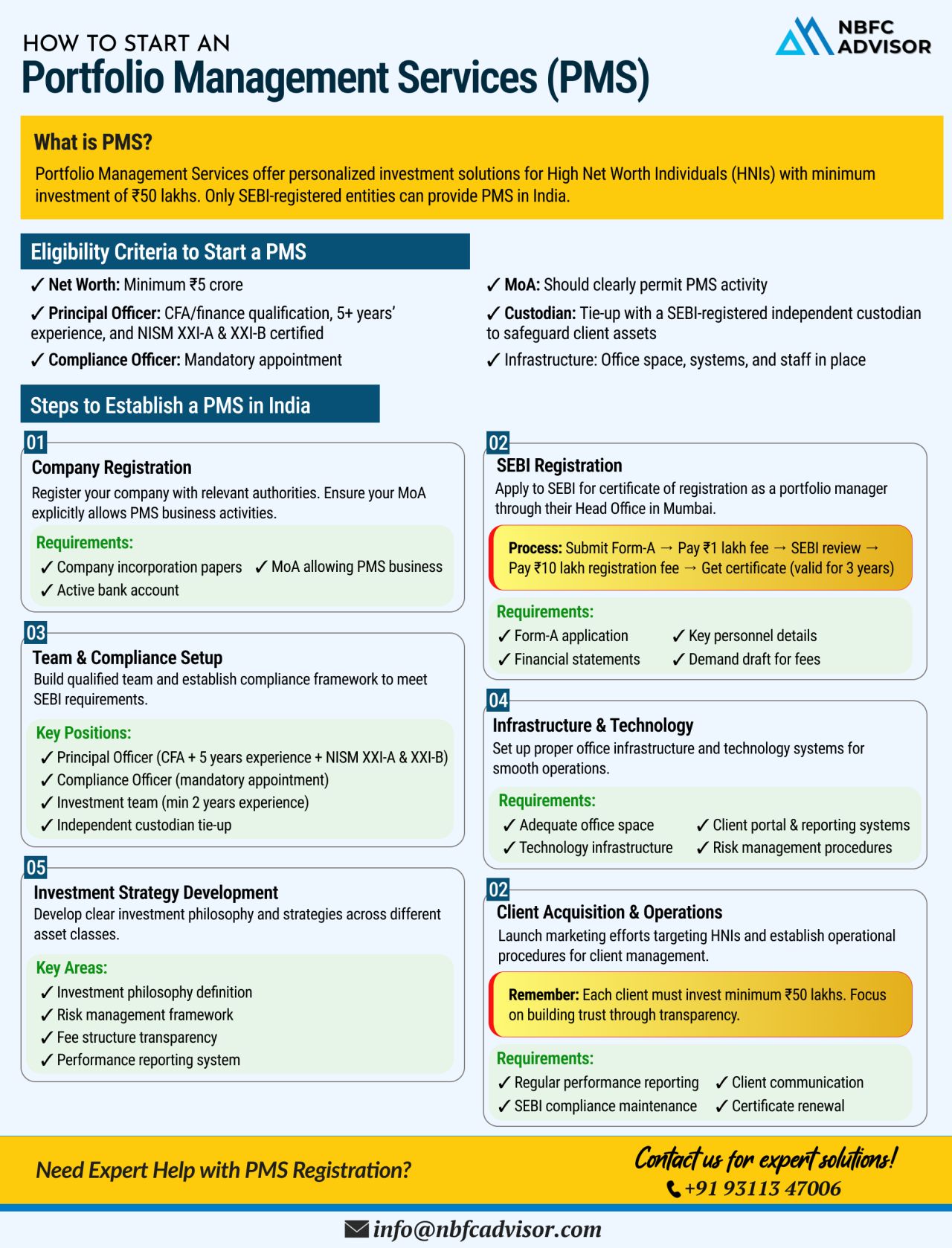

Want to Launch Portfolio Management Service (PMS) with Huge Tax Benefits?

India’s Portfolio Management Services (PMS) industry is witnessing rapid growth, expanding at a 33% CAGR and crossing ₹7 lakh crore in Assets Under Management (AUM). W...

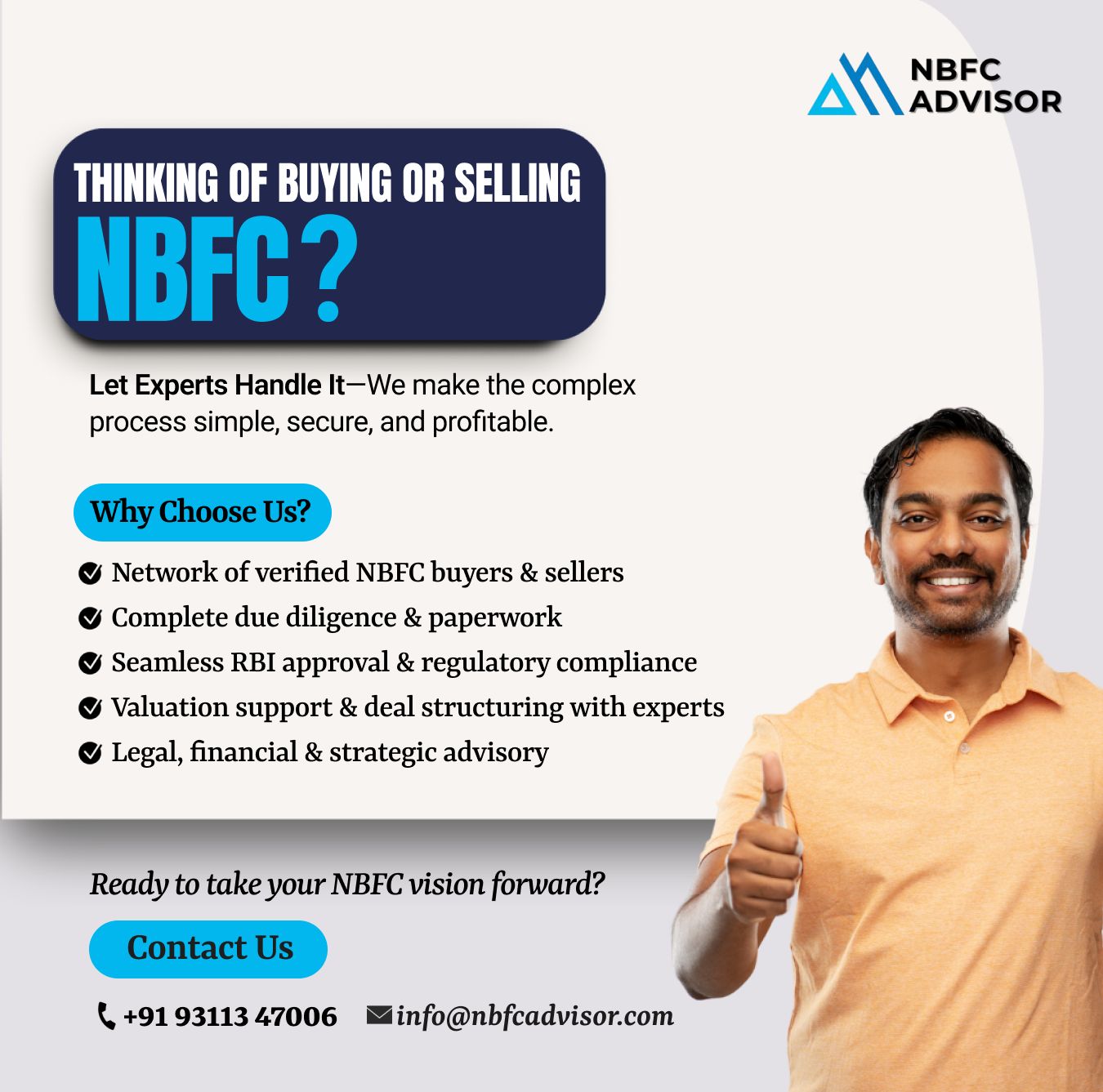

Starting an NBFC vs. Buying One – What’s Smarter?

Entering India’s Non-Banking Financial Company (NBFC) sector is an attractive opportunity for investors, fintech founders, and financial institutions. The big question most invest...

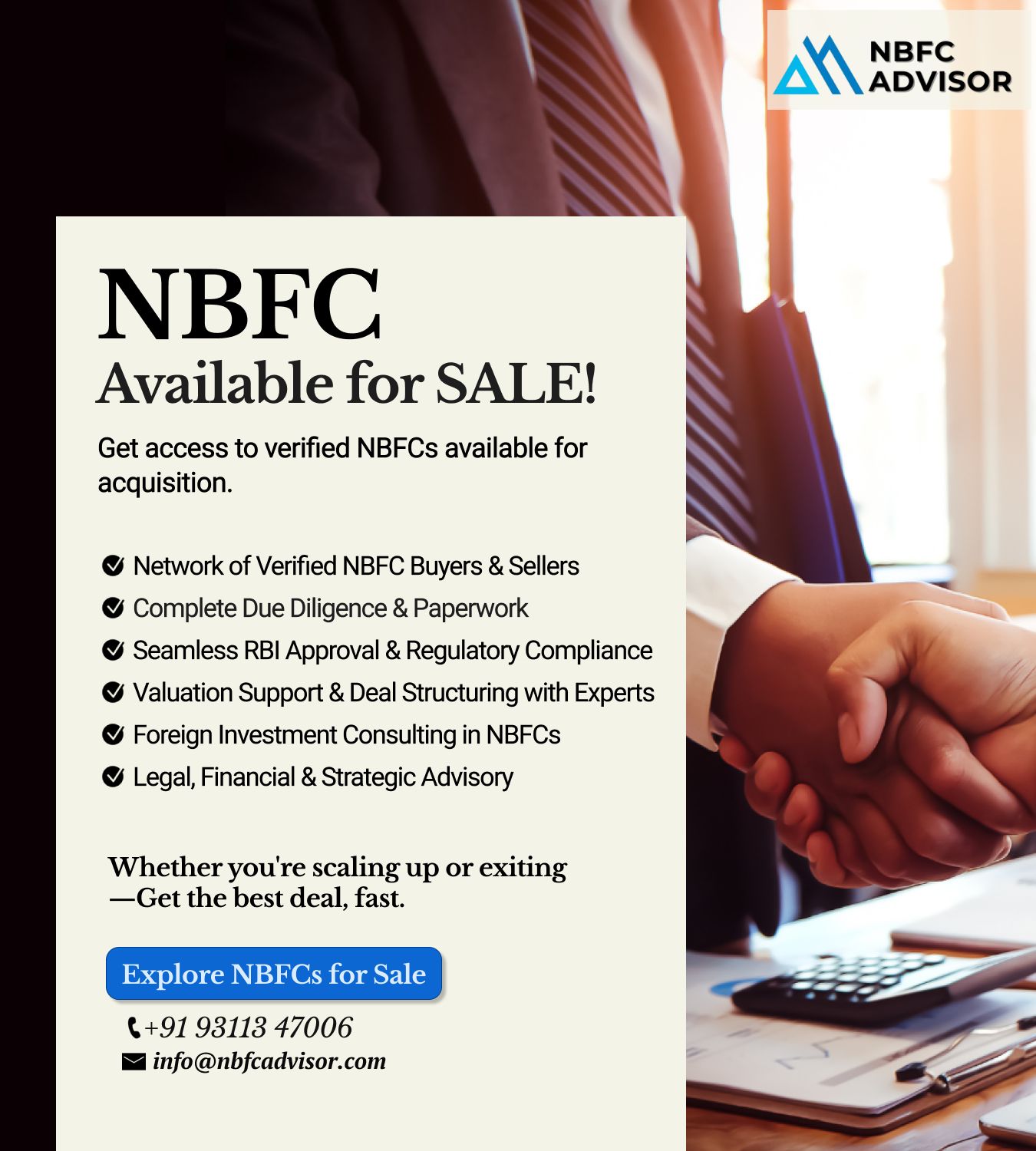

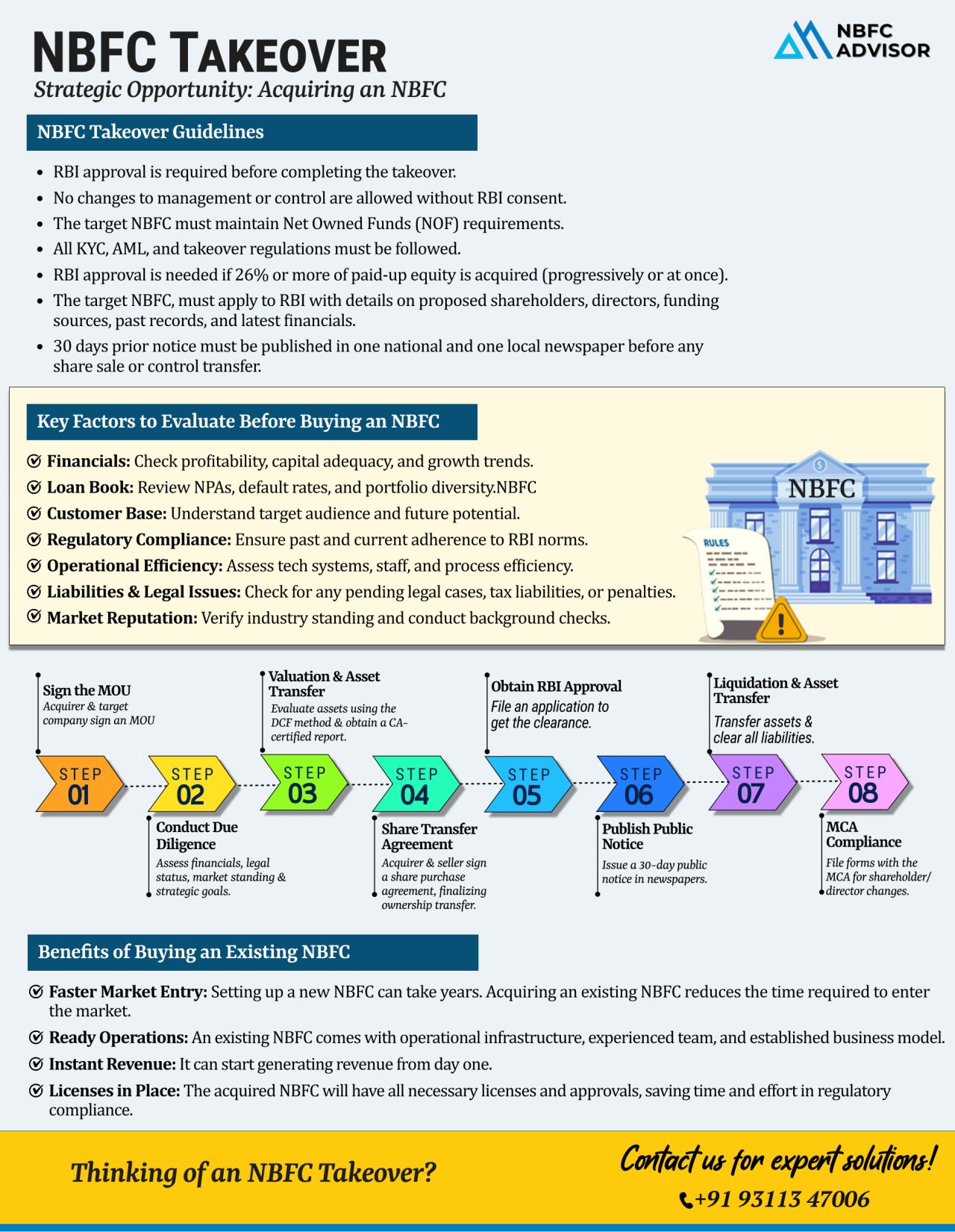

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

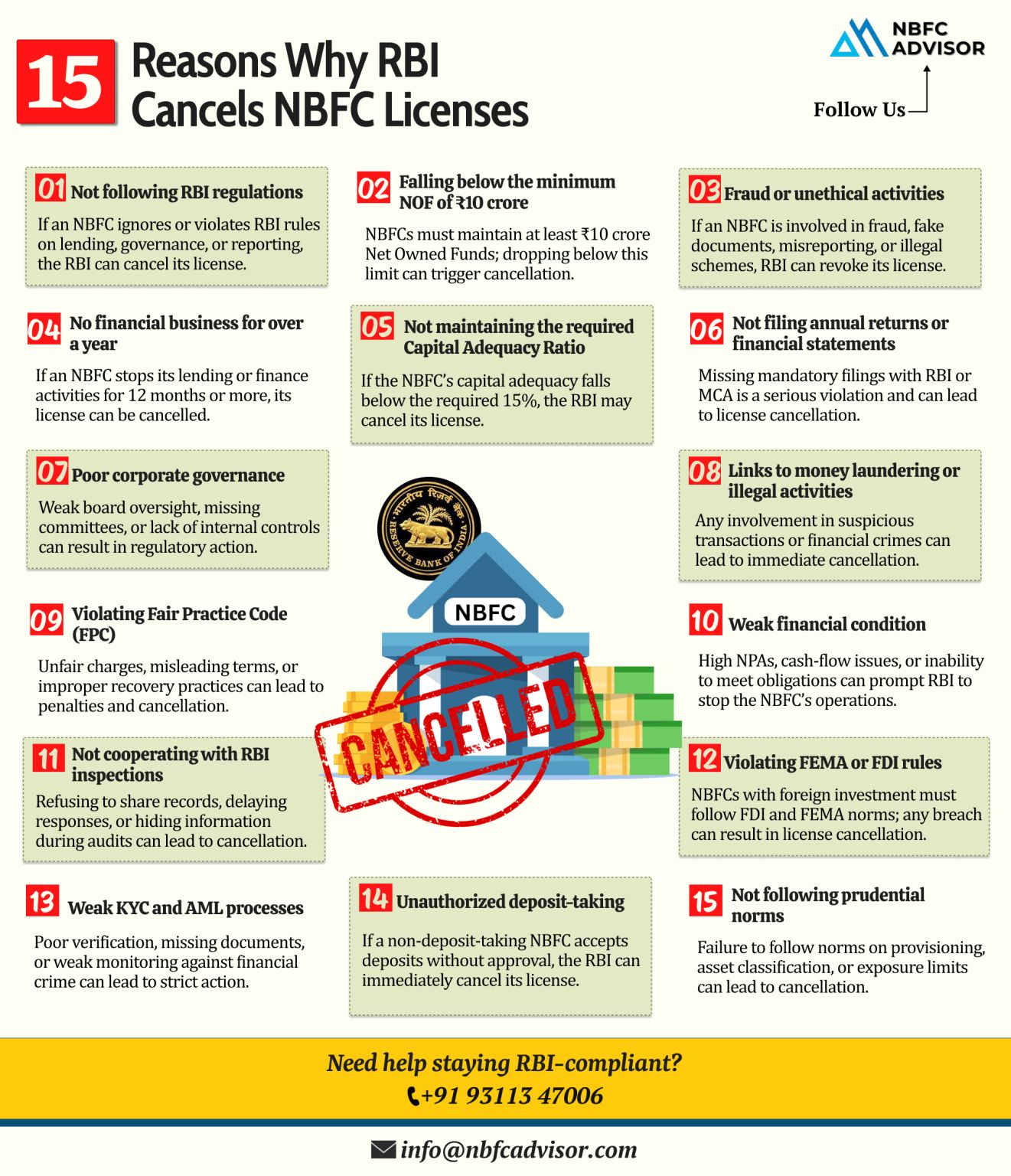

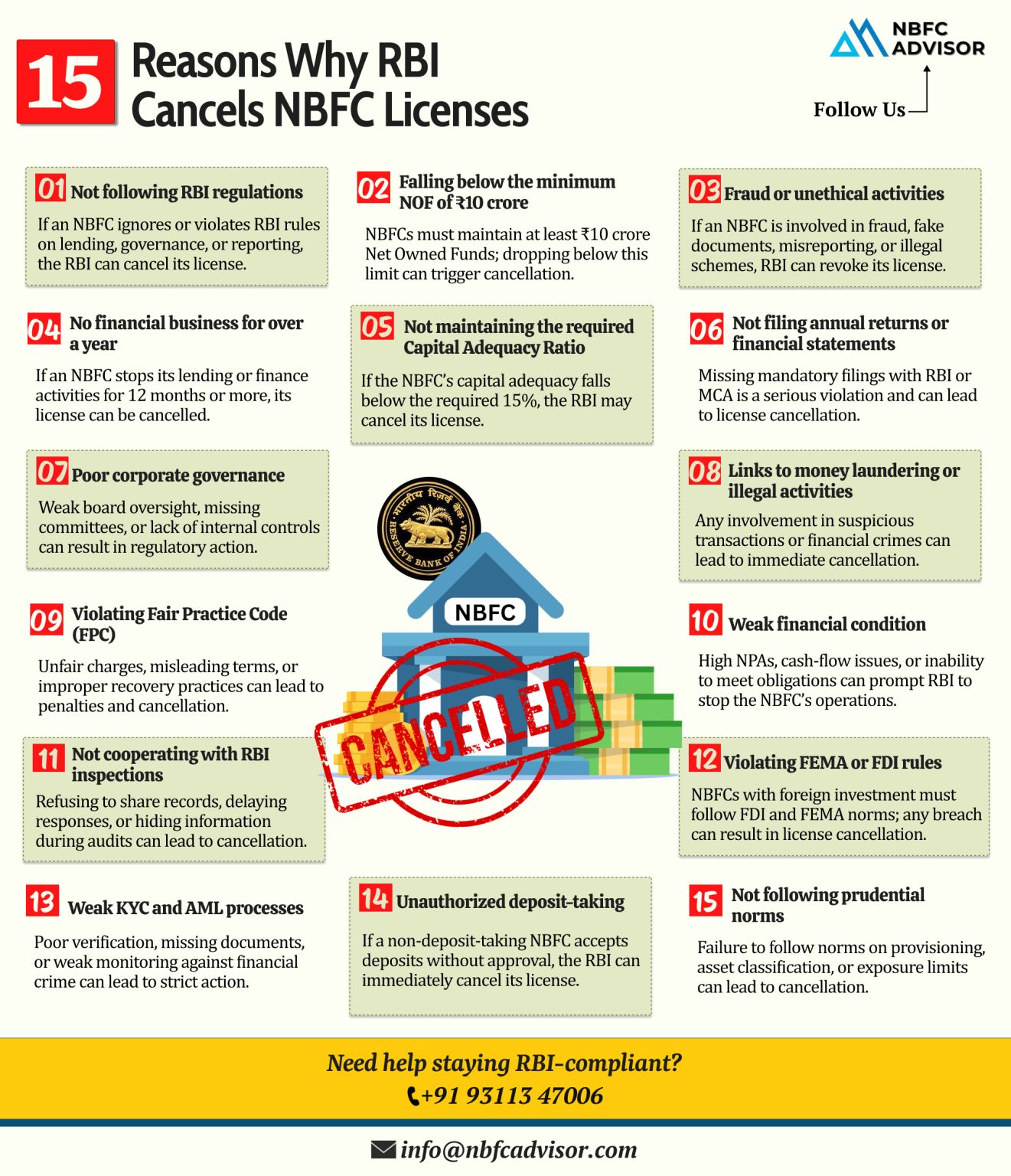

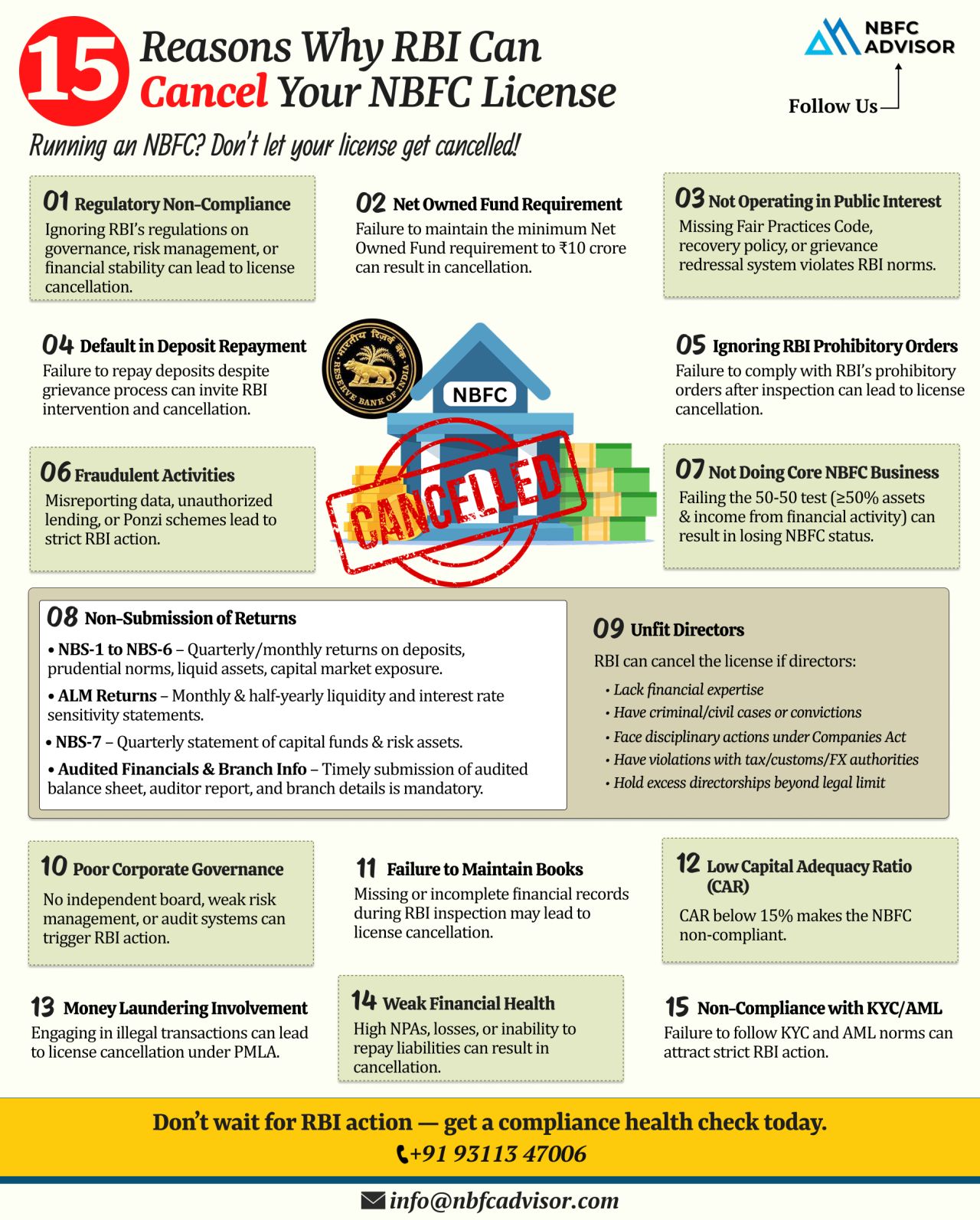

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

Reserve Bank of India (RBI) just slapped HDFC Bankwith a Rs 91 lakh penalty (order dated Nov 18, 2025) for outsourcing KYC compliance to third parties—a core function that’s strictly off-limits under RBI’s ironclad guidelines for ba...

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

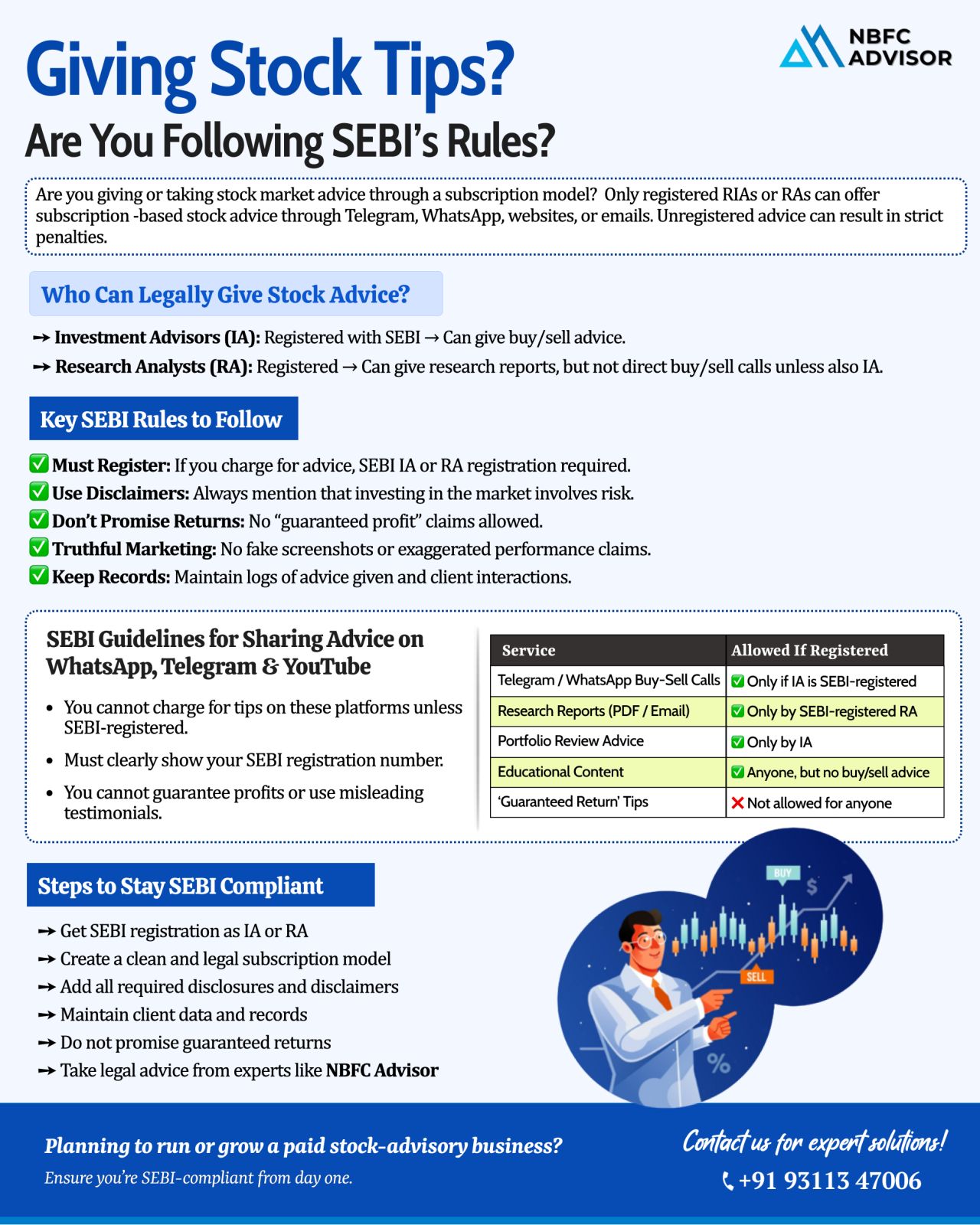

Selling Stock Tips on Telegram, WhatsApp, or Instagram? Read This Before You Start.

Social media is full of stock tips, buy/sell calls, and paid subscription groups. But many people don’t realise that SEBI has strict rules for anyone offerin...

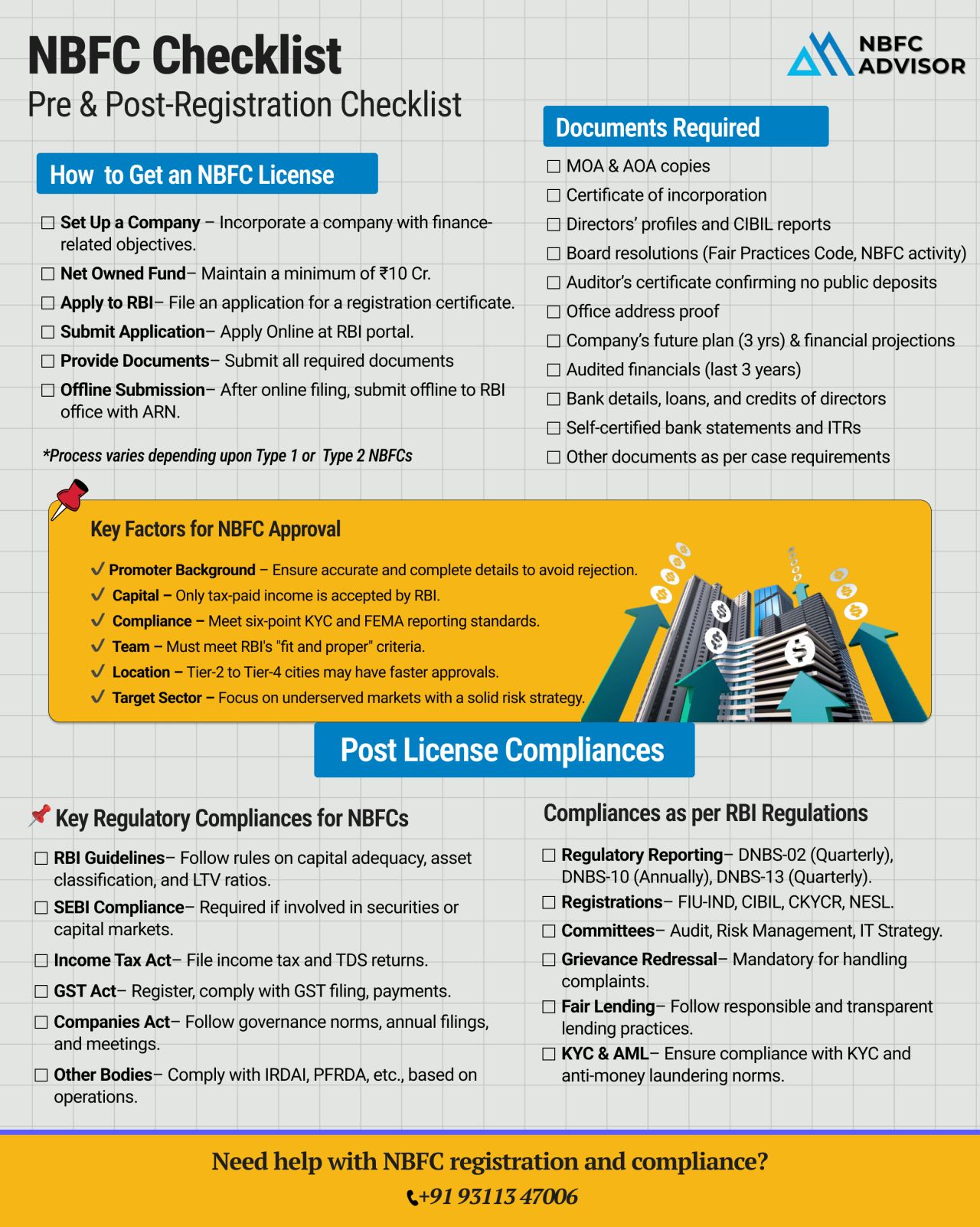

𝐏𝐥𝐚𝐧𝐧𝐢𝐧𝐠 𝐭𝐨 𝐬𝐭𝐚𝐫𝐭 𝐚𝐧 𝐍𝐁𝐅𝐂?

Many founders begin the process without knowing exactly which documents, approvals, and compliance steps are required.

But RBI approval depends on clear paperwork, promoter background, capital pro...

Not Sure What License Your Fintech Needs? 🤔

India’s fintech ecosystem — from digital lending apps and payment gateways to neobanks and wealthtech platforms — is expanding faster than ever. But as innovation accelerates, RBI and ...

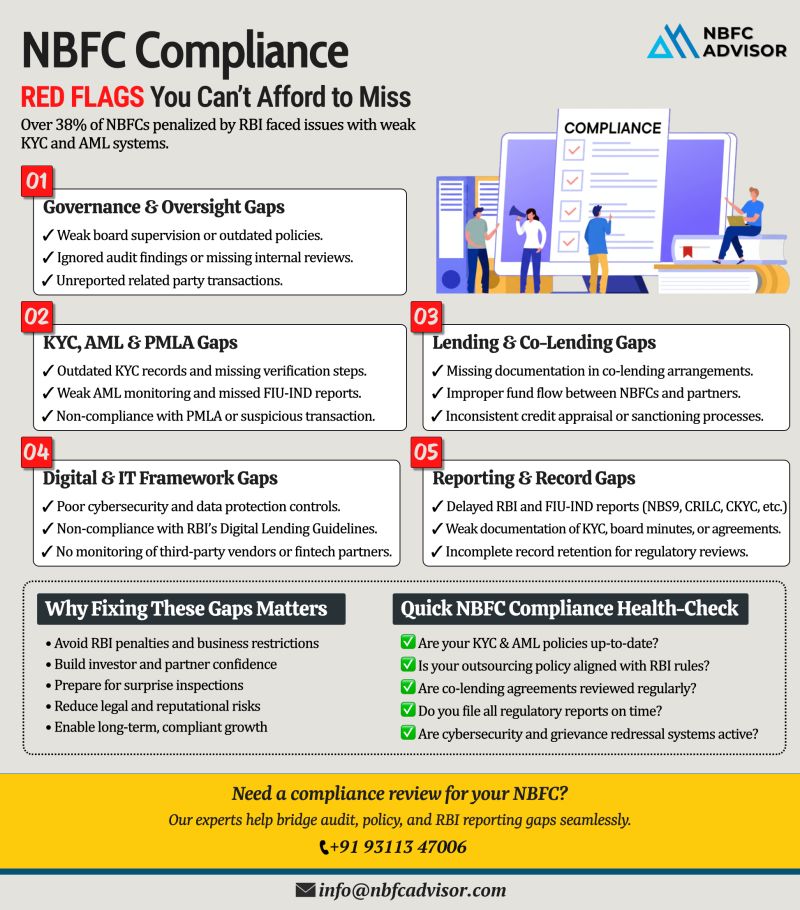

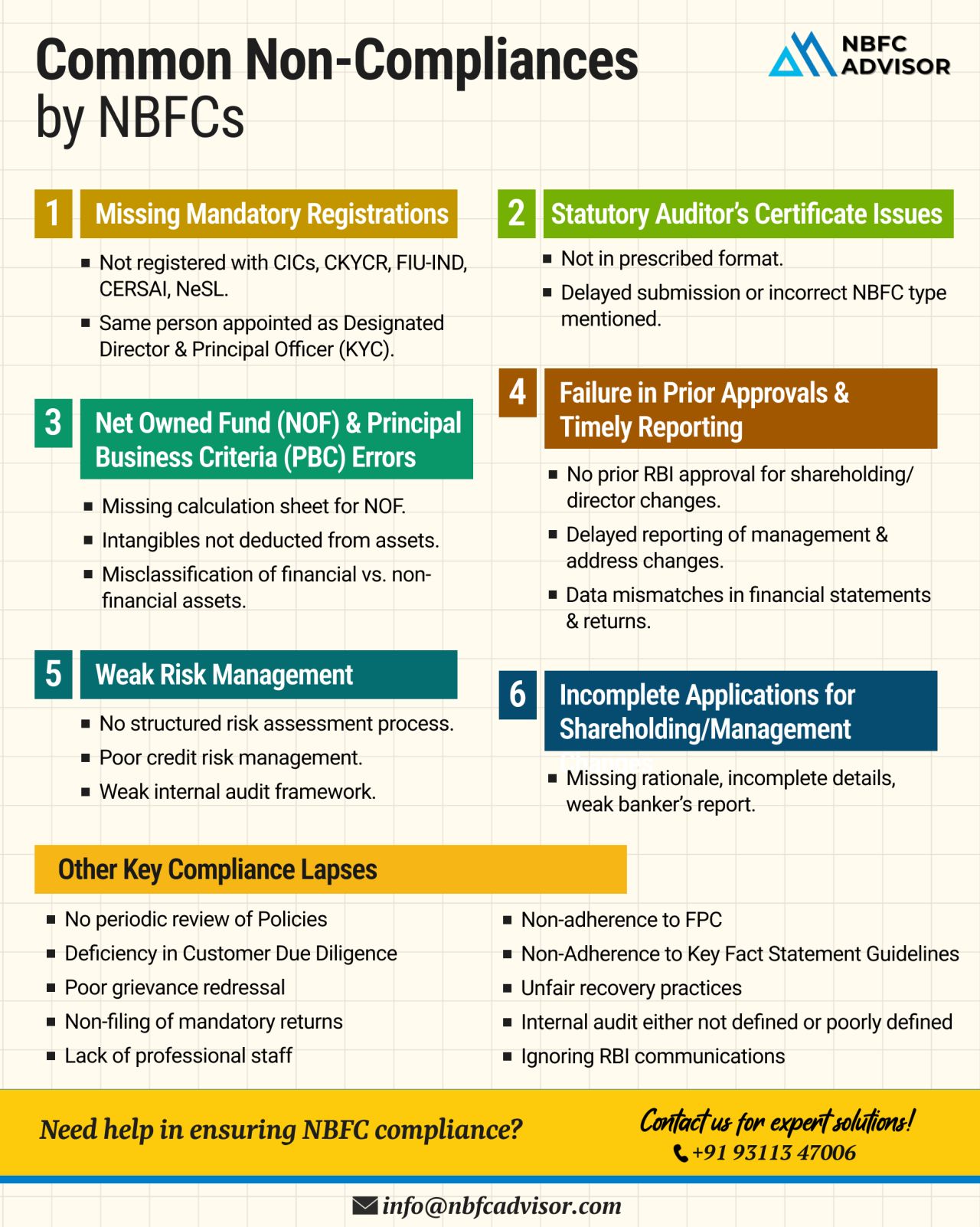

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny!

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several NBFCs — not for fraud or mismanagement — but for missing critical compliance steps.

As...

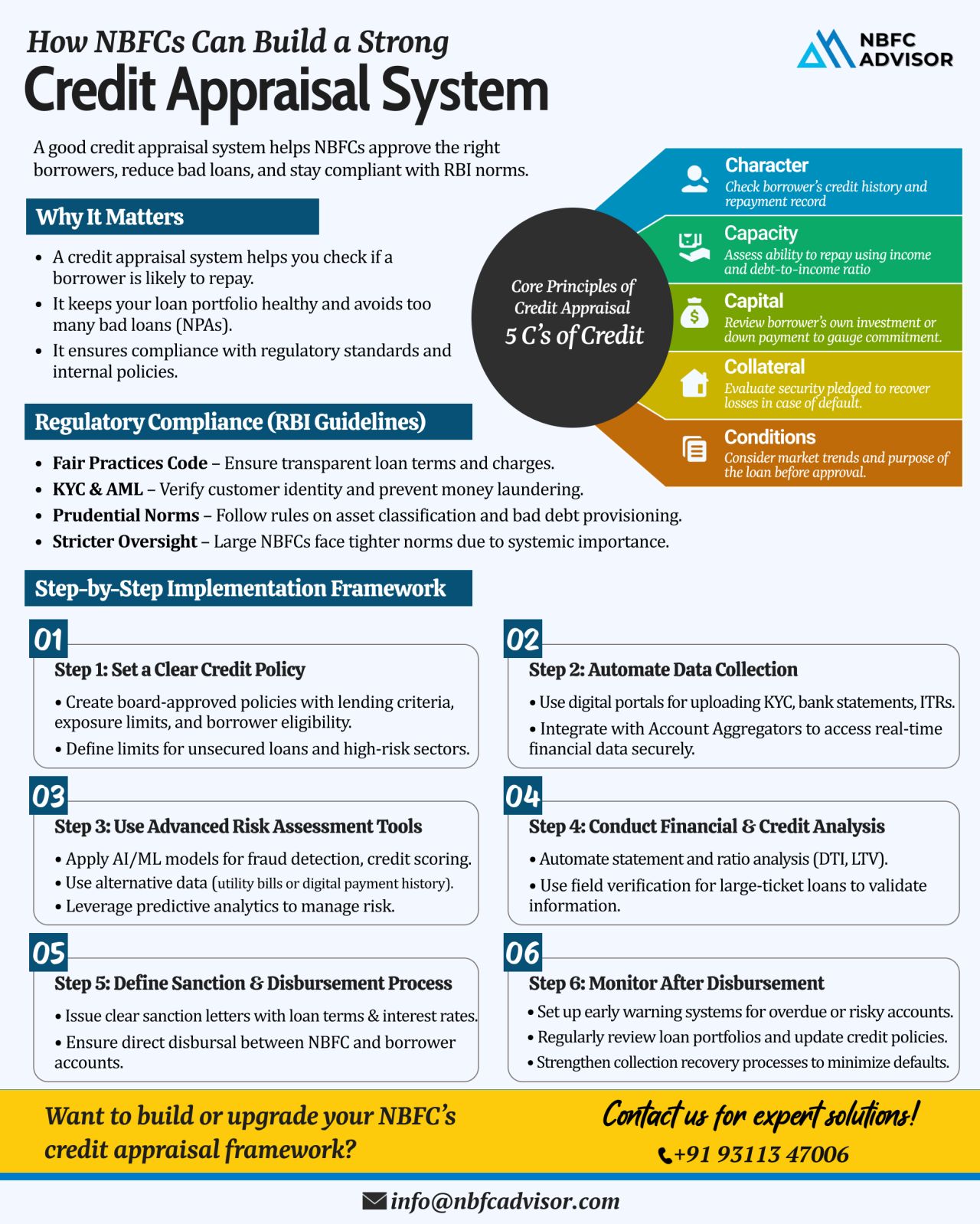

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

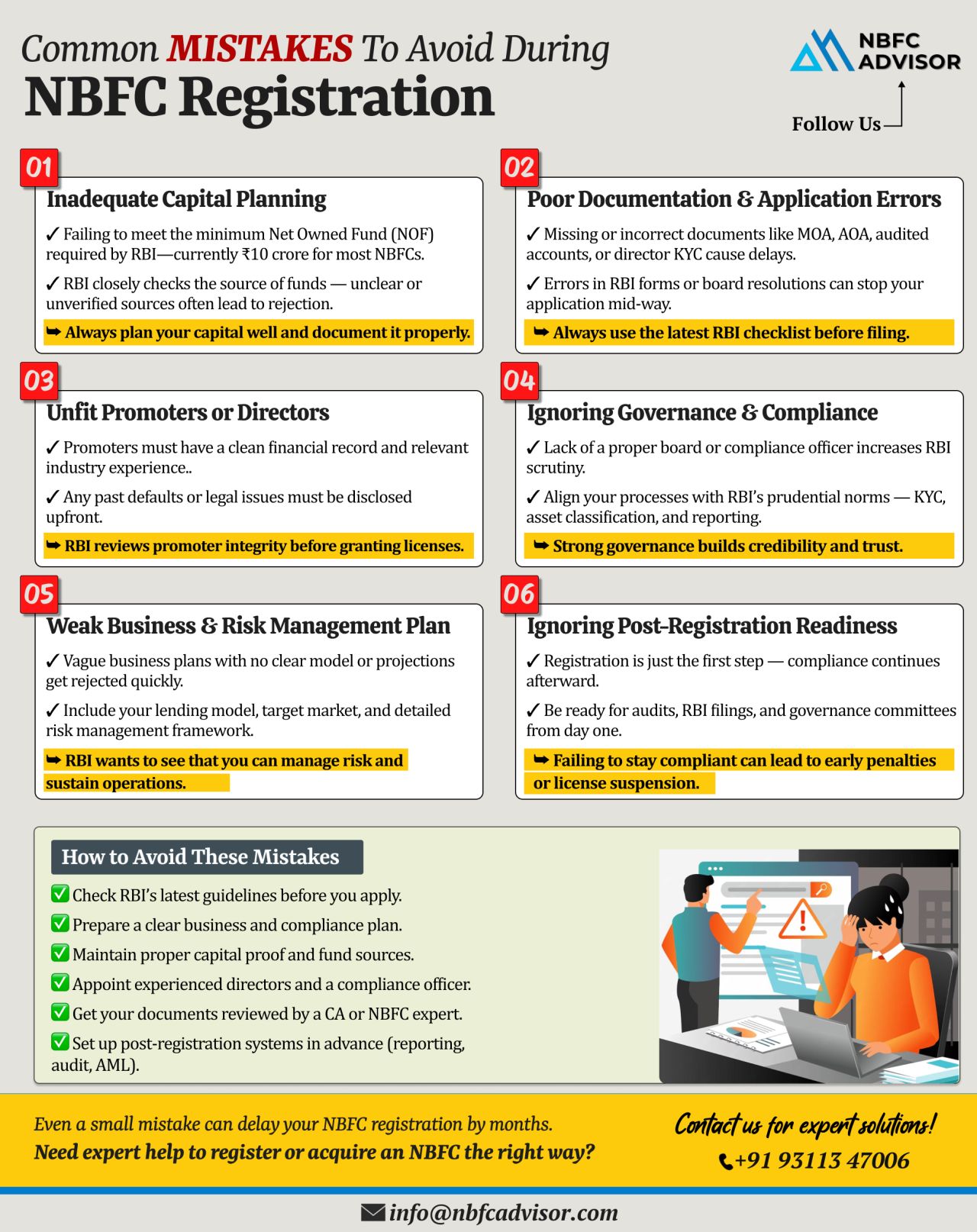

Many NBFC Applications Get Rejected by the RBI — Here’s Why! ⚠️

Avoid Costly Mistakes Before You Apply

Every year, the Reserve Bank of India (RBI) receives hundreds of applications for NBFC (Non-Banking Financial Company) registrati...

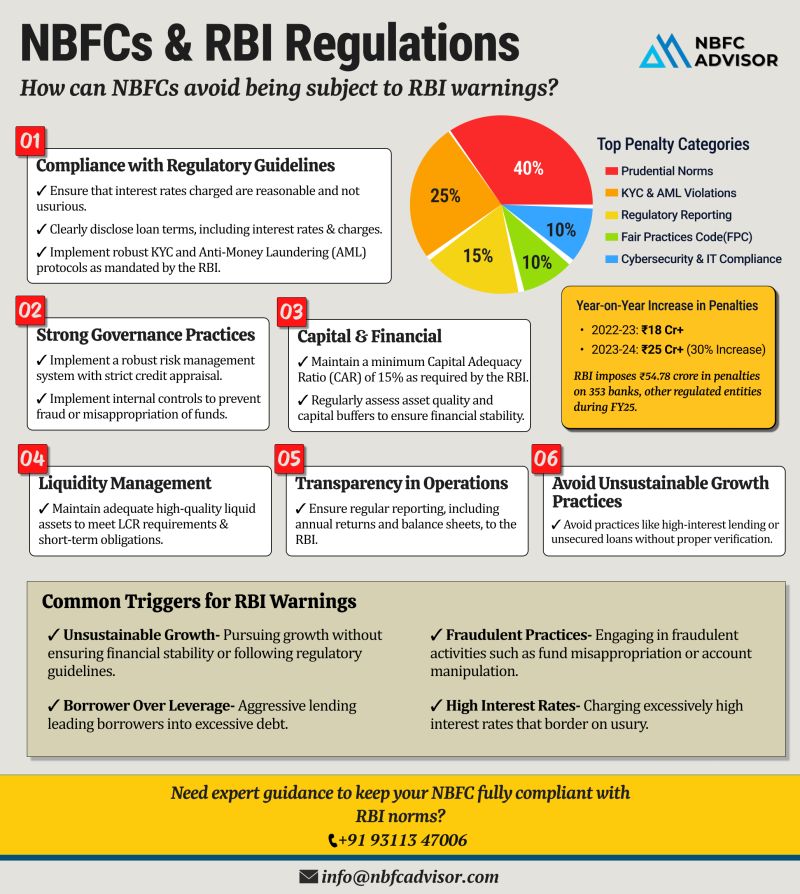

RBI Penalties on NBFCs Jumped 30% in Just One Year — Is Your NBFC at Risk?

The Reserve Bank of India (RBI) has intensified its oversight on financial institutions — and the numbers speak for themselves.

In FY 2022–23, RBI impo...

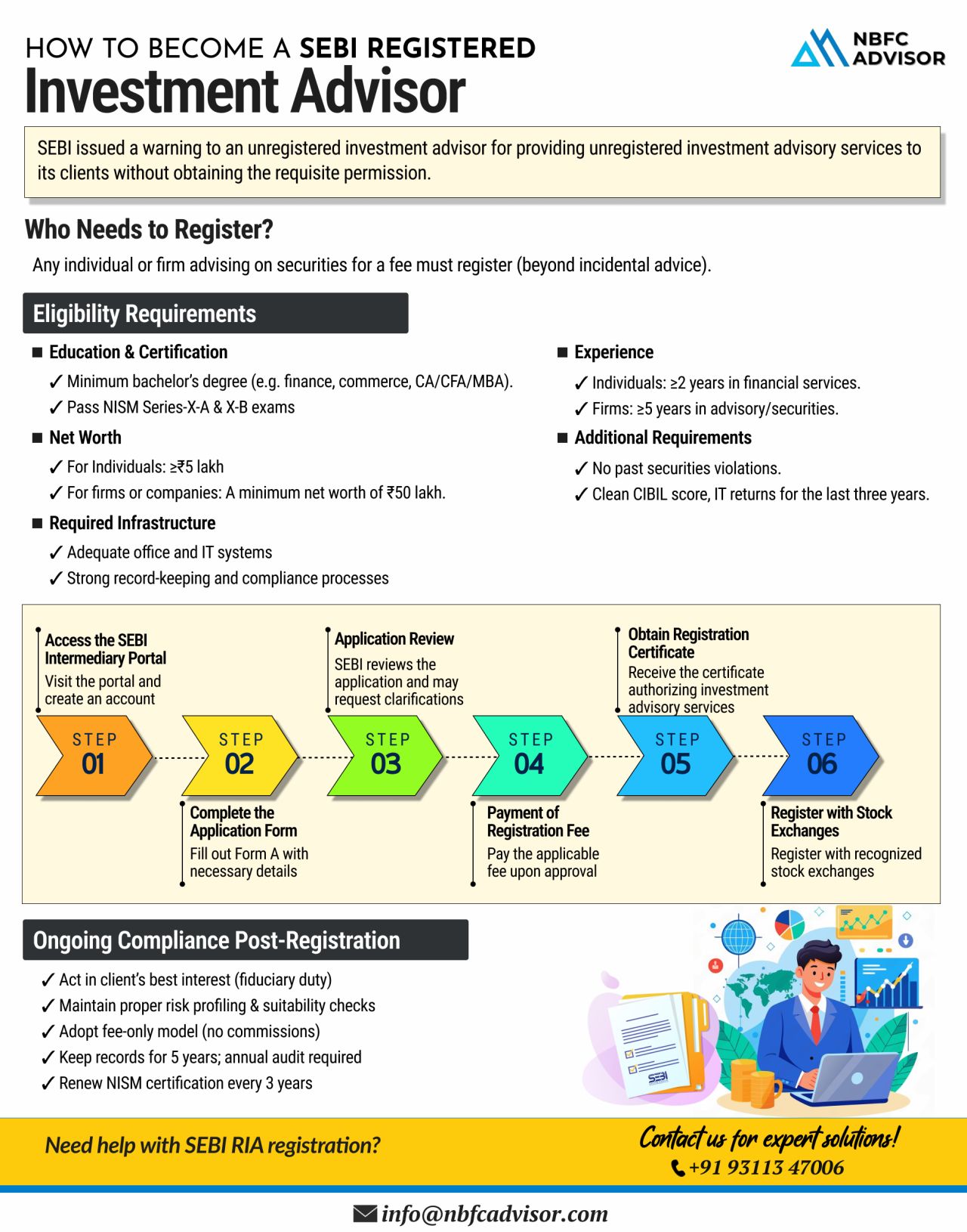

SEBI Tightens Rules for Finance Creators and Startups in the Investment Space

Are you a finance creator or a startup working in the investment space?

Then it’s time to pay close attention — because SEBI is cracking down on unregistere...

15 Red Flags That Can Shut Down Your NBFC

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Surprisingly, most cancellations are not due to fraud, but rather due to missed compliance, ...

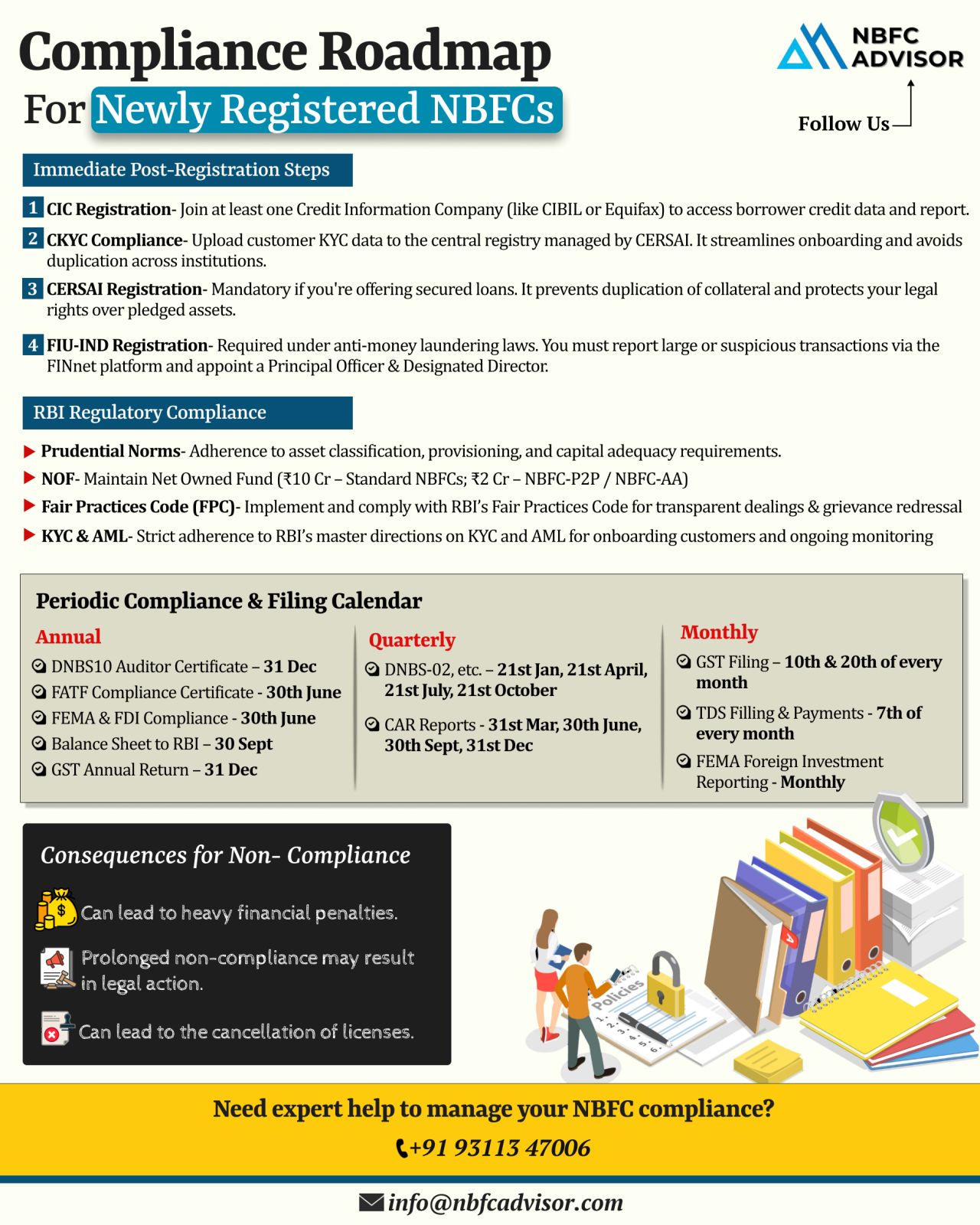

Newly Registered as an NBFC? Here’s What You Need to Know About Compliance

Getting your RBI license is a milestone worth celebrating—but it’s only the beginning of your NBFC journey. The real challenge starts with regulatory comp...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

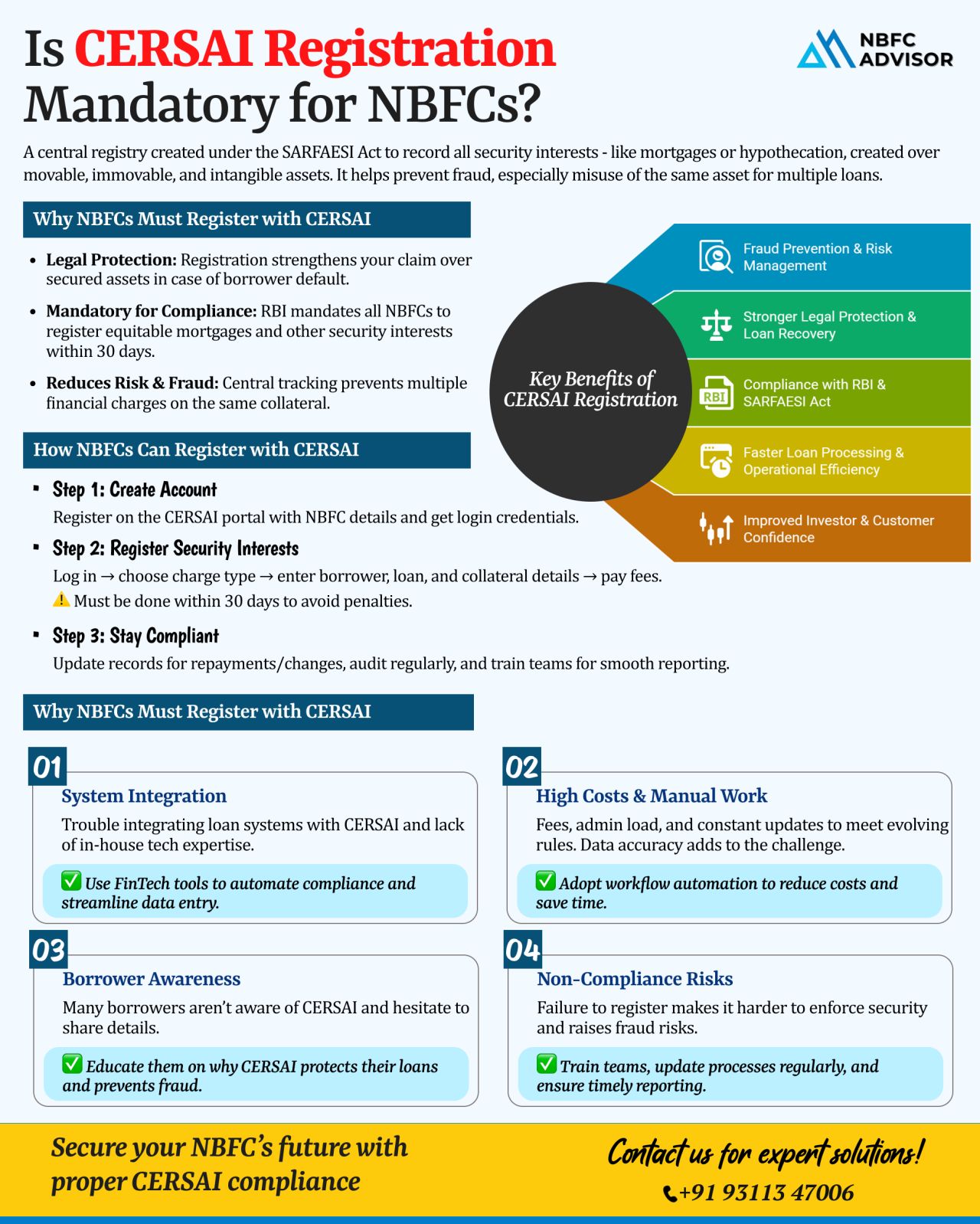

Is CERSAI Registration Mandatory for NBFCs?

One of the most common mistakes many NBFCs make is overlooking CERSAI registration. While compliance with RBI guidelines and customer onboarding processes get due attention, CERSAI often slips under the ...

NBFC Takeovers: A Fast Track to Enter India’s Booming Digital Lending Market

India’s digital lending industry is witnessing an unprecedented surge, with projections suggesting it will touch $515 billion by 2030. From P2P lending platfo...

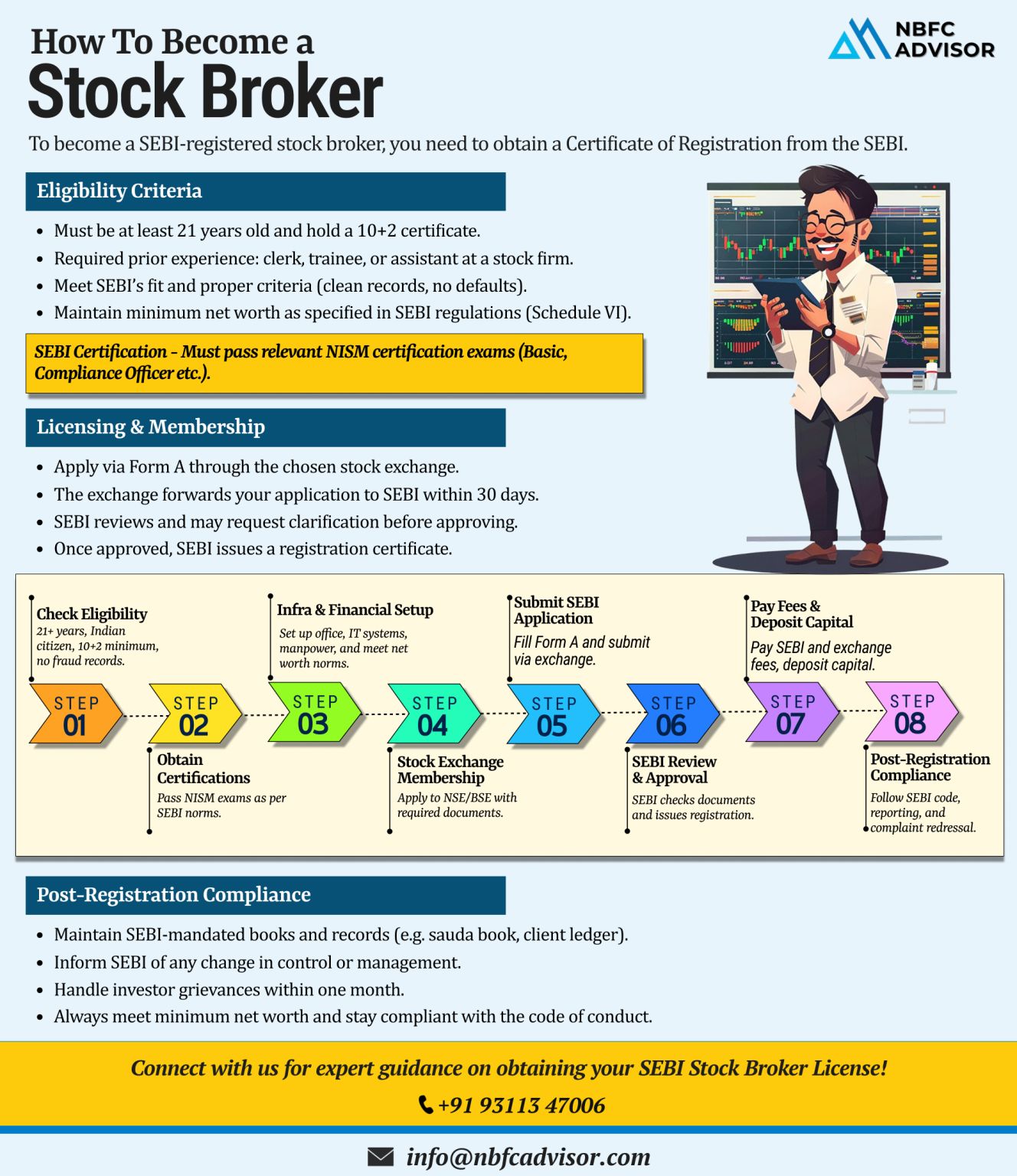

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI-registered stock broker license opens the door to operating legally in India’s capital markets. Whether you plan to trade in equities, derivatives, or other securities, you must mee...

Is Your NBFC Aligned with the Latest RBI Updates?

The Reserve Bank of India (RBI) is taking decisive steps to tighten the compliance framework for Non-Banking Financial Companies (NBFCs), ensuring transparency, customer protection, and responsible...

Want to Enter India’s Booming Lending Sector—Without Waiting Years?

India’s lending market is expanding at an unprecedented pace—driven by fintech innovation, rising credit demand, and digital-first borrowers. But setting u...

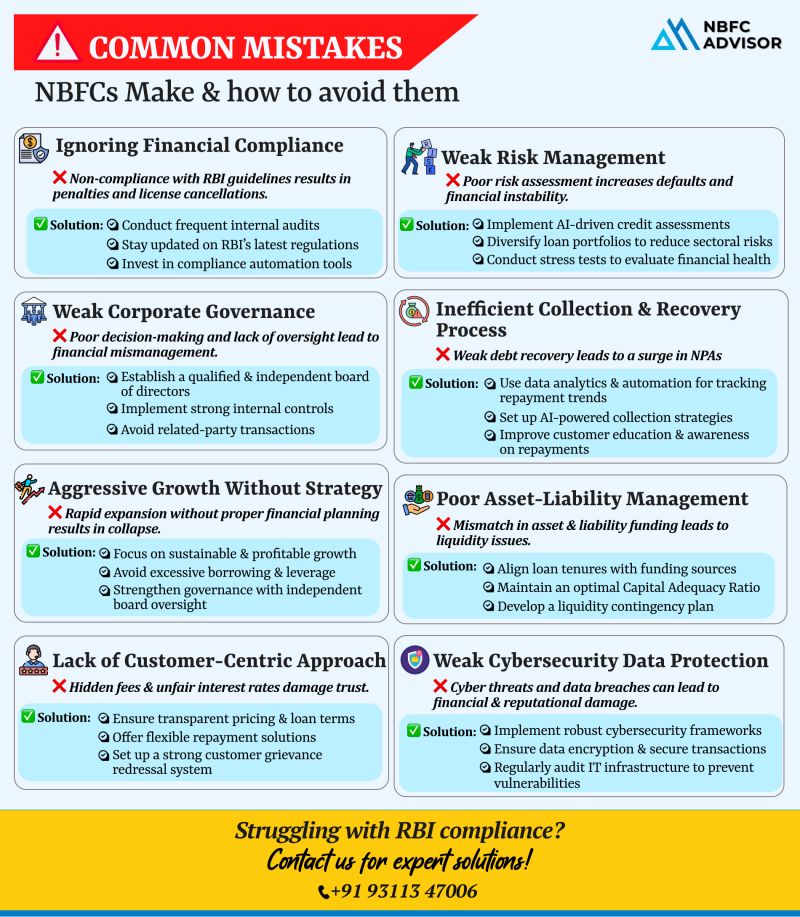

Is Your NBFC Making These Costly Mistakes?

In recent years, the Non-Banking Financial Company (NBFC) sector in India has witnessed rapid growth—but also increased regulatory scrutiny. From RBI license cancellations to skyrocketing NPAs, many...

Avoid These 10 Common Mistakes When Registering an AIF

Registering an Alternative Investment Fund (AIF) with SEBI is a crucial step for fund managers and institutions looking to enter India’s alternative investment space. However, the regist...

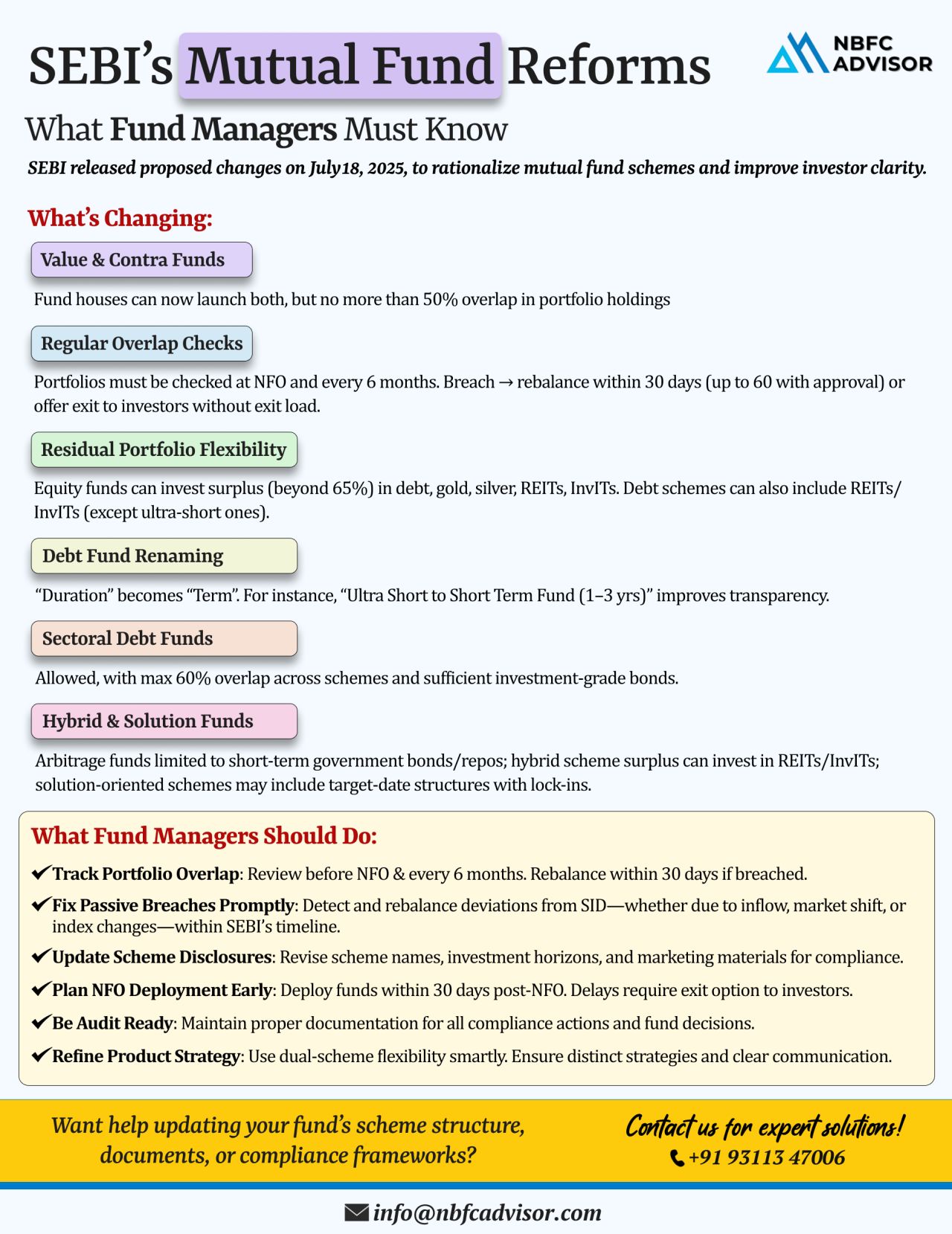

🧭 Enhancing Clarity, Transparency & Flexibility: SEBI’s New Era of Mutual Fund Reforms

In a move to simplify mutual fund structures and protect investor interests, the Securities and Exchange Board of India (SEBI) has proposed a set of ...

📰 SEBI’s New Mutual Fund Reforms: What Investors & Fund Managers Need to Know

The Securities and Exchange Board of India (SEBI) has proposed sweeping changes to the mutual fund framework to enhance transparency, reduce overlap, and ensu...

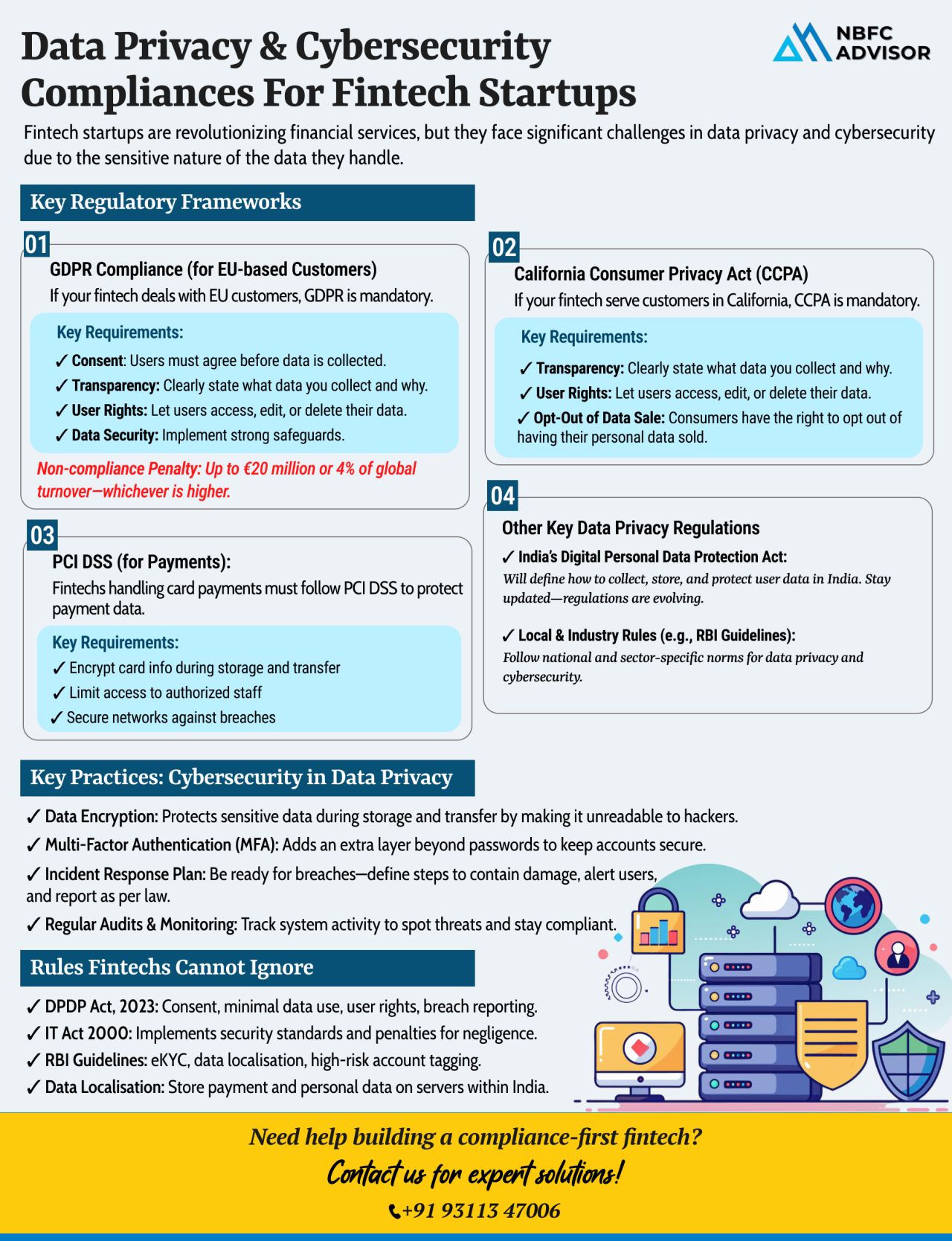

Building a Fintech? One Data Leak Can Destroy Everything

In today’s digital-first world, launching a fintech startup is an exciting venture—but one security misstep can bring it all crashing down. Whether you're building a lending ...

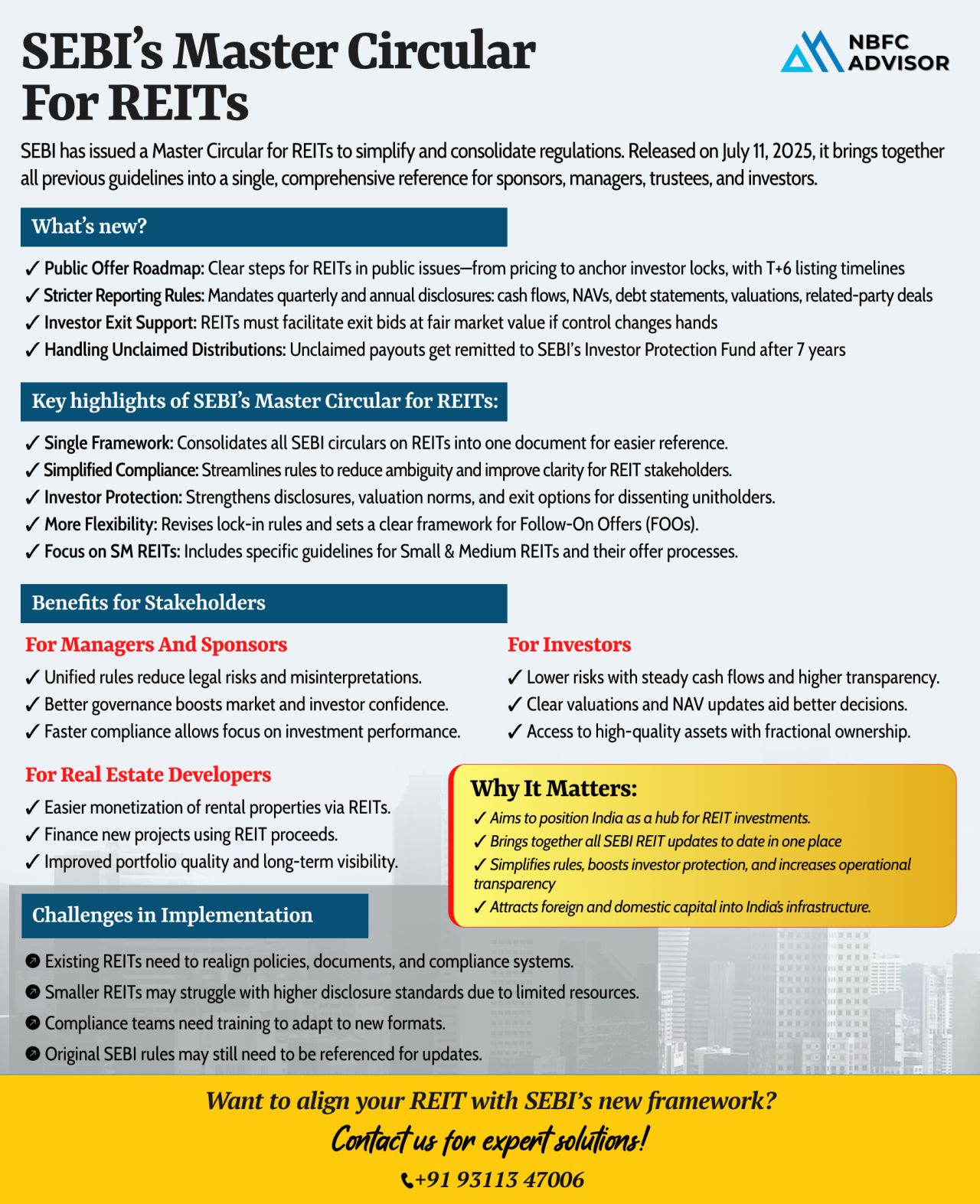

SEBI’s Master Circular for REITs: Transparency, Simplicity & Growth in One Framework

The Securities and Exchange Board of India (SEBI) has taken a bold step to reshape the future of Real Estate Investment Trusts (REITs) in India. With it...

The Reserve Bank of India (RBI) is actively preparing for the future of finance with a strategic officer training program at its Hyderabad campus. This initiative is laser-focused on emerging areas such as:

✅ Digital Banking

✅ Fintec...

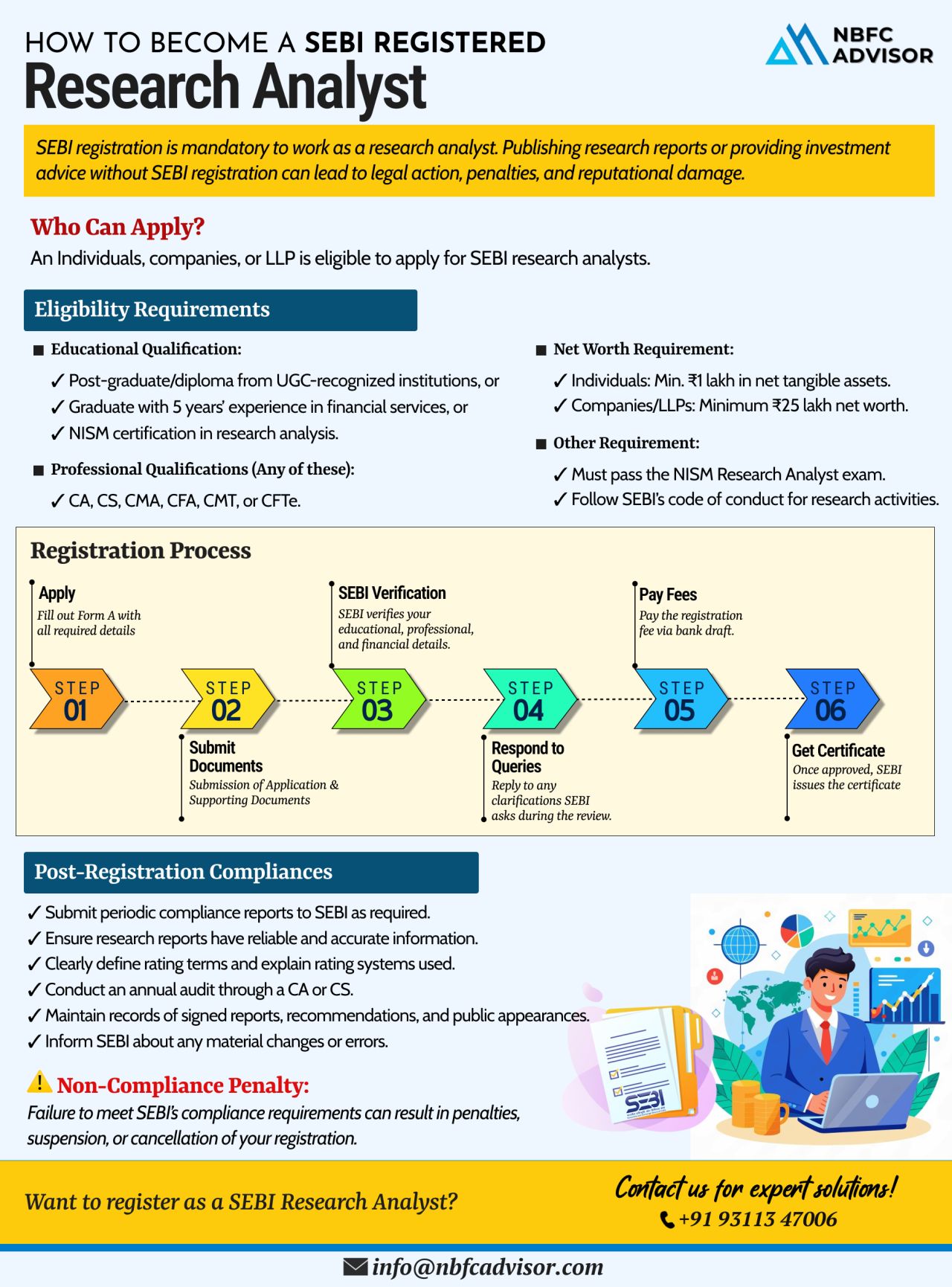

Thinking of publishing financial research reports without SEBI registration?

That shortcut can lead to serious consequences—including penalties, suspension, and long-term reputational harm.

Under SEBI regulations, registration is compulsory...

⚠️ Is Your NBFC Prepared for RBI Scrutiny?

The Reserve Bank of India (RBI) has intensified its oversight of Non-Banking Financial Companies (NBFCs), and non-compliance—whether intentional or not—can lead to serious repercussions.

Fr...

RBI Tightens the Reins on NBFCs — Is Your Company Ready for Compliance Scrutiny?

India’s financial watchdog, the Reserve Bank of India (RBI), is stepping up its enforcement measures against Non-Banking Financial Companies (NBFCs). Rece...

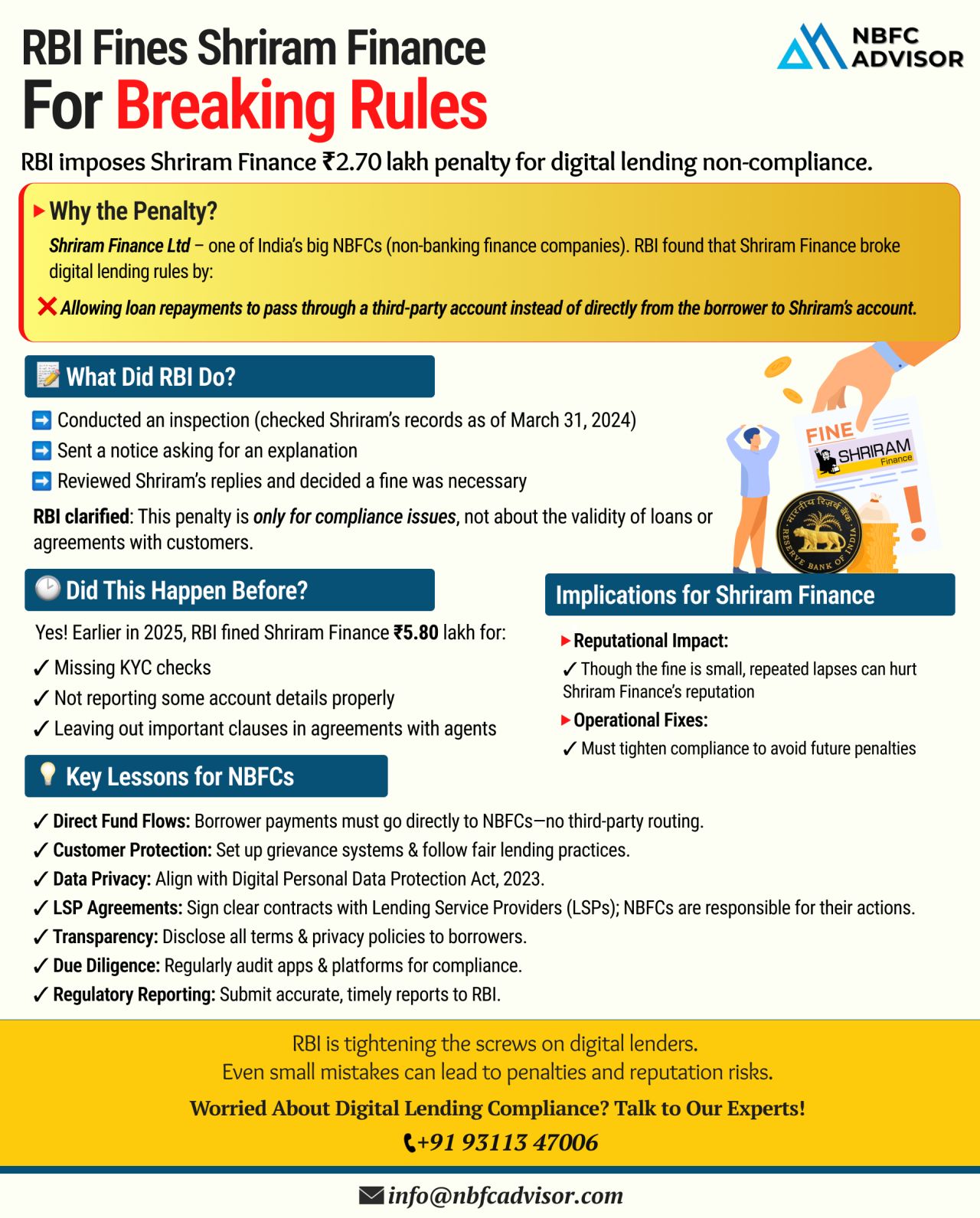

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

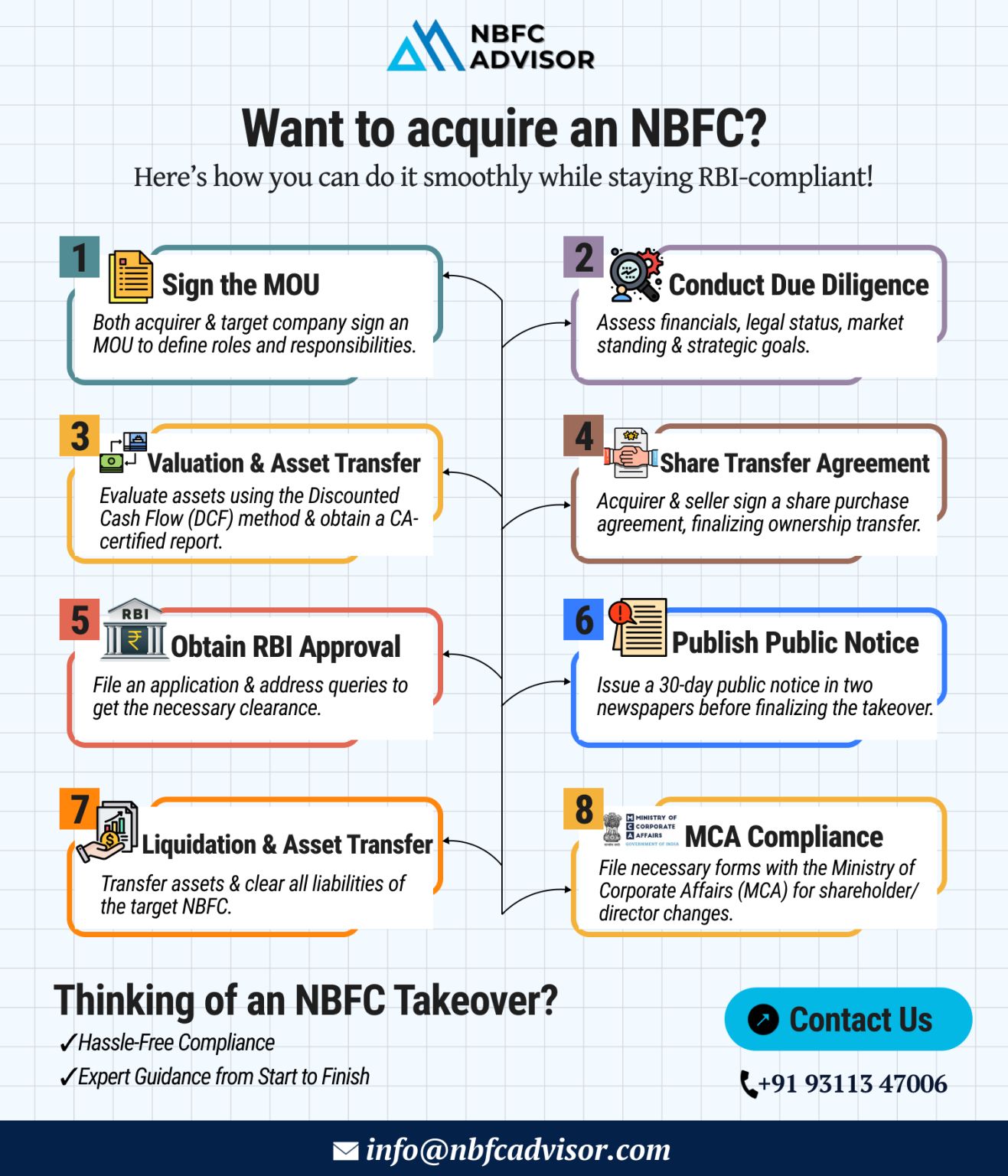

Thinking of Buying an NBFC? Here’s How to Do It Right

Acquiring a Non-Banking Financial Company (NBFC) can be a strategic move that opens doors to new business opportunities, especially in lending, fintech, and microfinance sectors. But here...

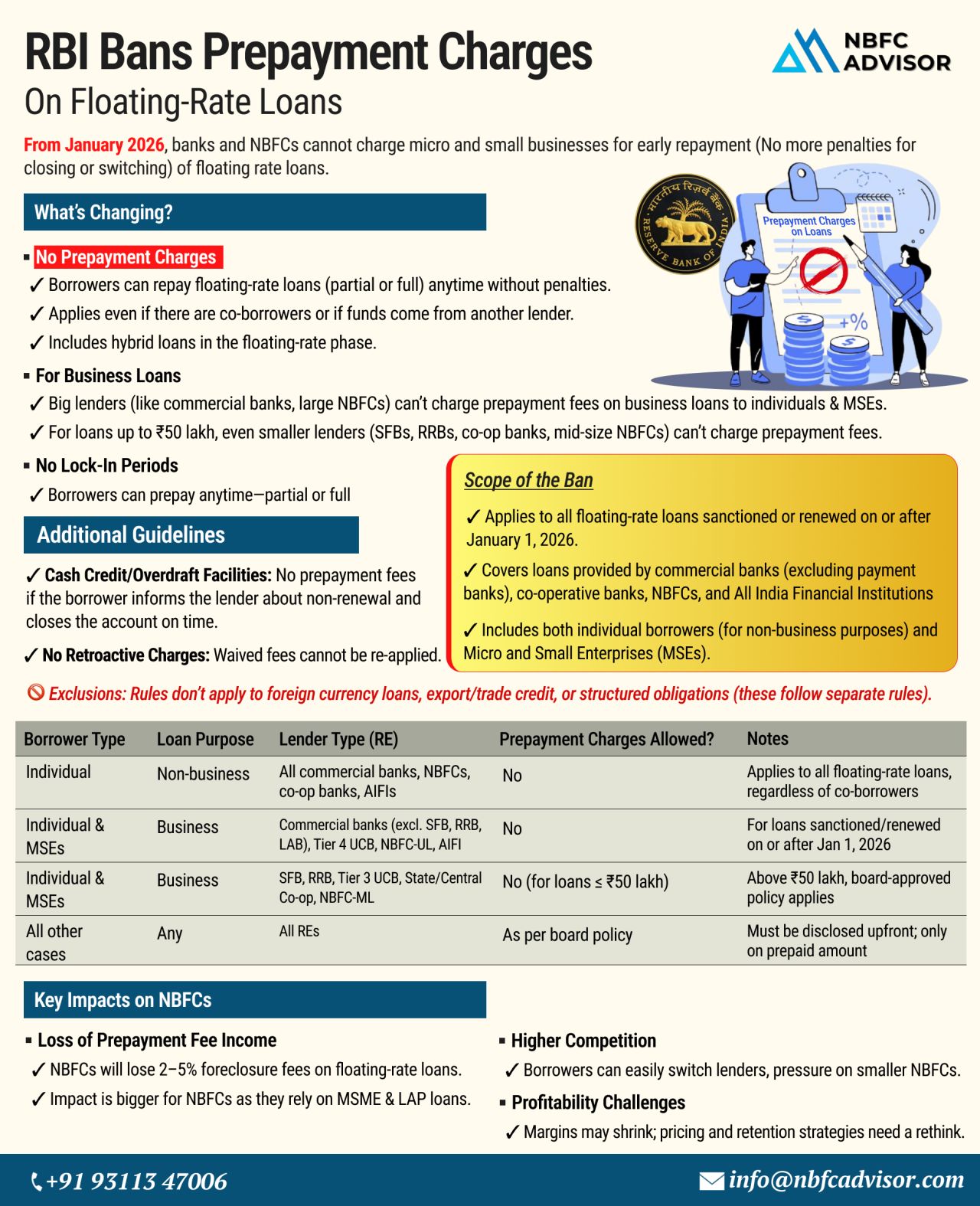

RBI Bans Prepayment Charges on Floating-Rate Loans

What It Means for NBFCs Starting January 2026

The Reserve Bank of India (RBI) has rolled out a major regulatory change aimed at giving borrowers more freedom. From January 1, 2026, no prepaymen...

𝘎𝘰𝘵 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊 𝘓𝘪𝘤𝘦𝘯𝘴𝘦? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Receiving your NBFC license is an exciting milestone — but it’s far from the finish line. In fact, it’s just the start of your complia...

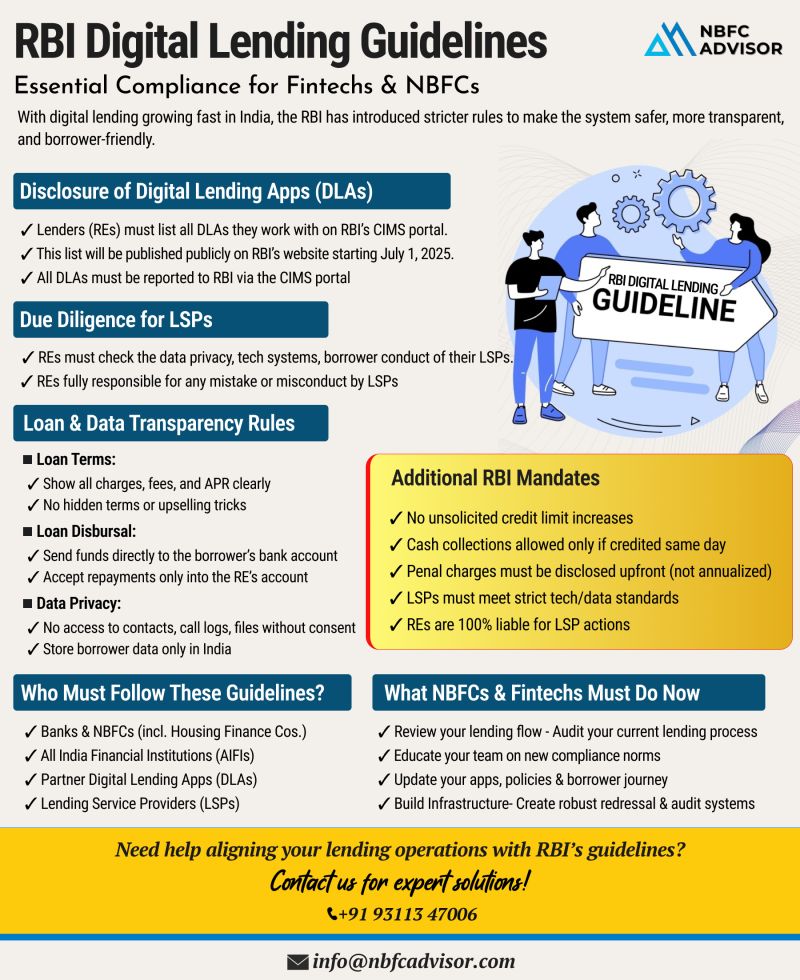

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐆𝐫𝐢𝐩 𝐨𝐧 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐎𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

India's digital lending sector has seen exponential growth—but so have regulatory concerns. In a move ...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

🚀 India’s PMS Industry Is Accelerating – Here's What You Need to Know

India’s Portfolio Management Services (PMS) sector is witnessing phenomenal growth, with assets under management (AUM) now exceeding ₹7.08 lakh crore. Thi...

⚠️ SEBI Cracks Down on Unregistered Investment Advisors — Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strict warning to individuals and firms offering investment advice without proper registrati...

In recent years, the Non-Banking Financial Companies (NBFC) sector in India has experienced considerable growth, playing a critical role in providing financial services such as loans, credit and investment. As a result, NBFC takeovers have become inc...