Why Do Many NBFCs Fail to Scale? The Real Issue Is Financial Clarity

When NBFCs struggle to scale, the first assumption is often lack of funds.

But in reality, capital is only part of the story.

The real bottleneck is financial clarity.

Wit...

Why NBFCs Are Adding Factoring to Their Portfolio

India’s MSMEs are the backbone of the economy, contributing significantly to employment and GDP. Yet, one persistent challenge continues to limit their growth—cash flow gaps caused by d...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

Reserve Bank of India (RBI) just slapped HDFC Bankwith a Rs 91 lakh penalty (order dated Nov 18, 2025) for outsourcing KYC compliance to third parties—a core function that’s strictly off-limits under RBI’s ironclad guidelines for ba...

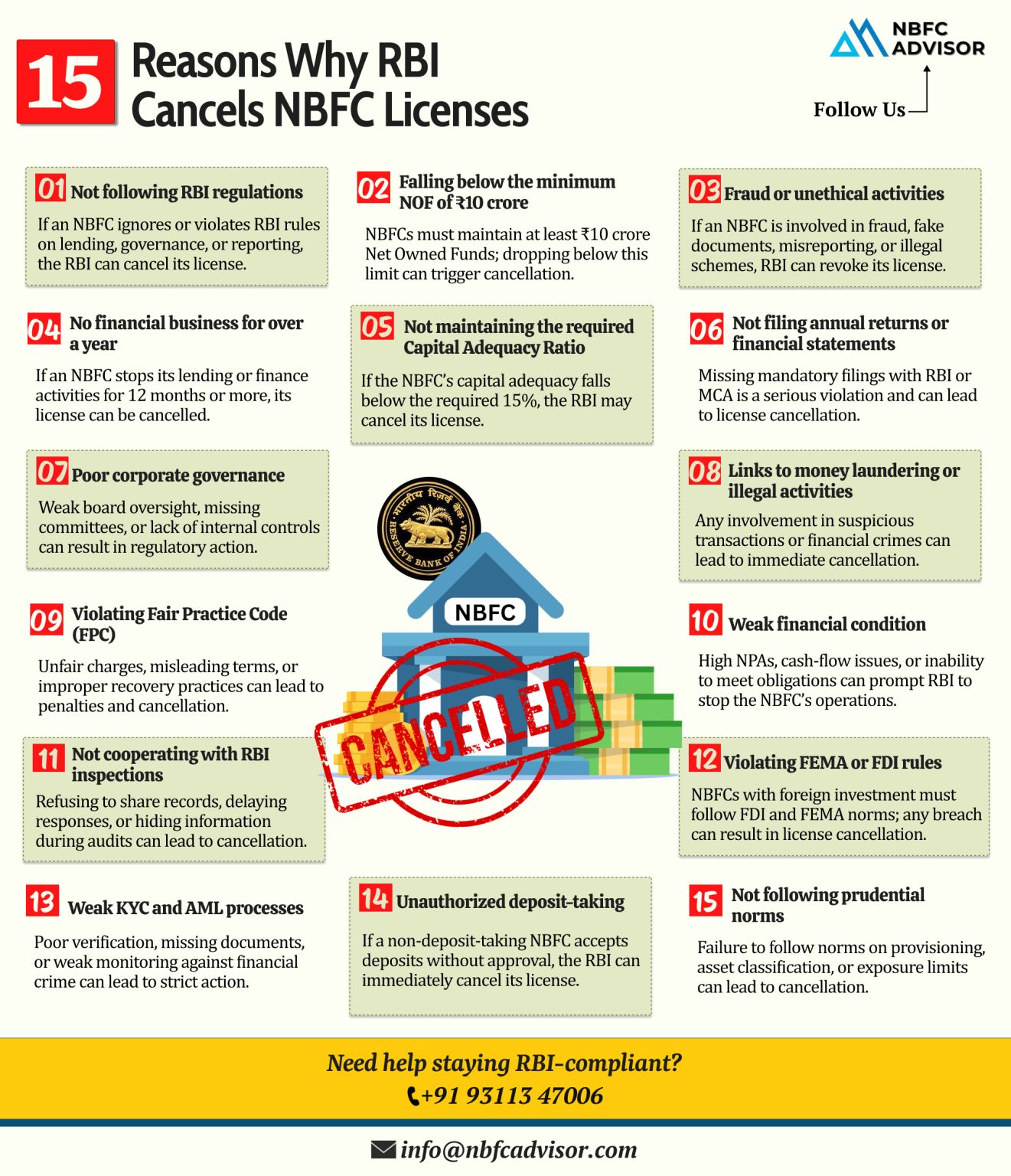

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

Not Sure What License Your Fintech Needs? 🤔

India’s fintech ecosystem — from digital lending apps and payment gateways to neobanks and wealthtech platforms — is expanding faster than ever. But as innovation accelerates, RBI and ...

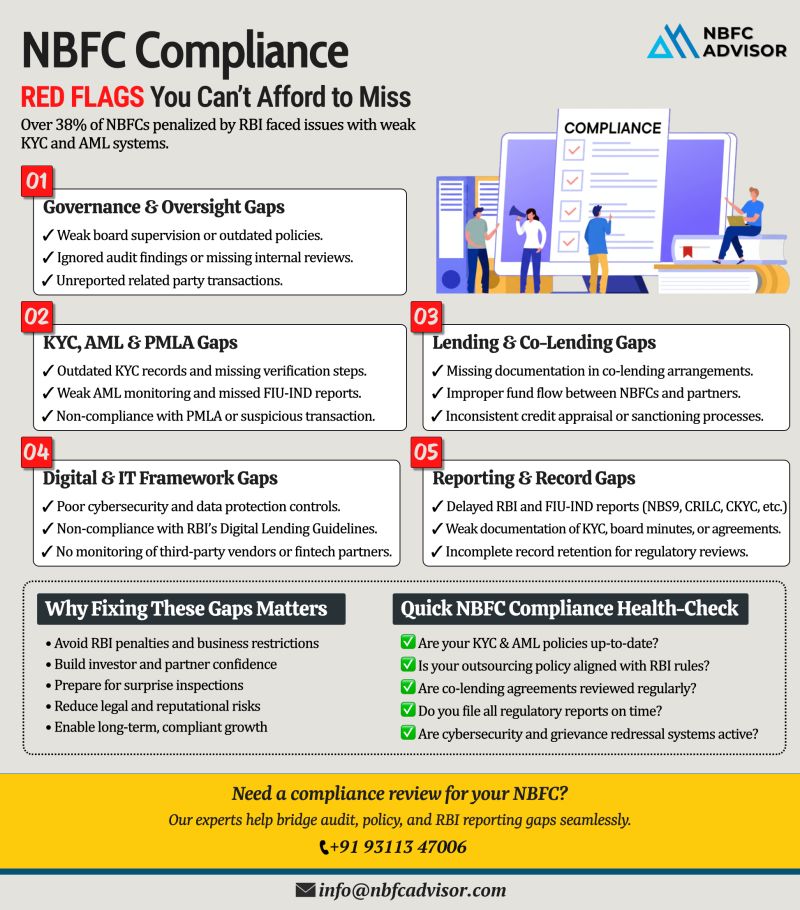

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny!

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several NBFCs — not for fraud or mismanagement — but for missing critical compliance steps.

As...

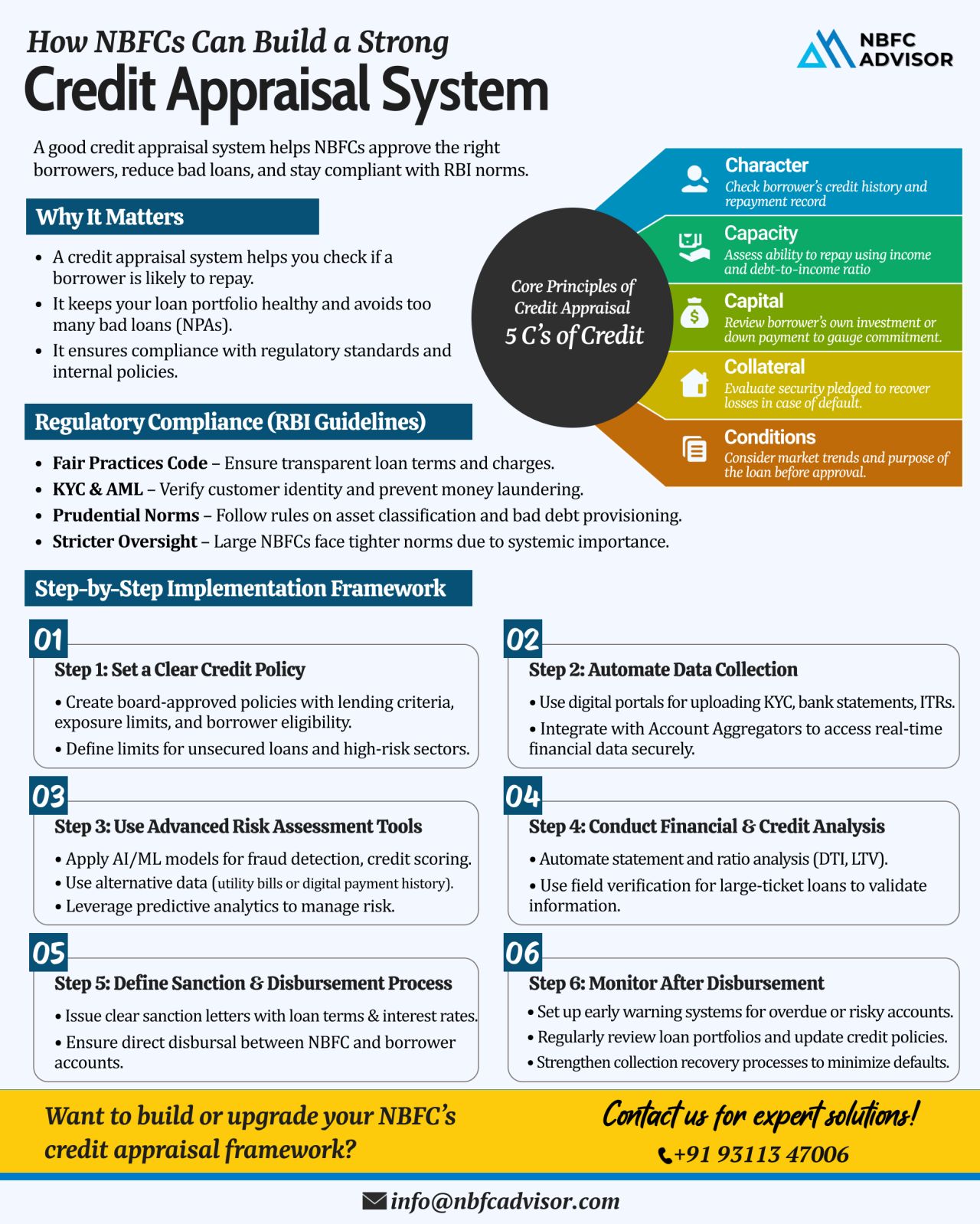

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

Many NBFC Applications Get Rejected by the RBI — Here’s Why! ⚠️

Avoid Costly Mistakes Before You Apply

Every year, the Reserve Bank of India (RBI) receives hundreds of applications for NBFC (Non-Banking Financial Company) registrati...

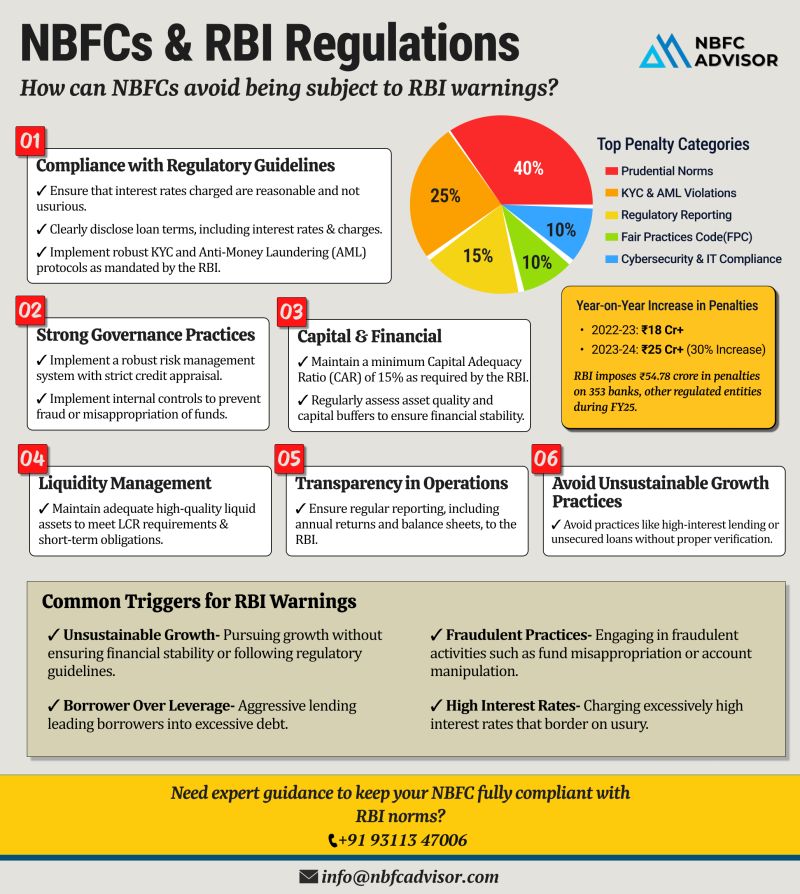

RBI Penalties on NBFCs Jumped 30% in Just One Year — Is Your NBFC at Risk?

The Reserve Bank of India (RBI) has intensified its oversight on financial institutions — and the numbers speak for themselves.

In FY 2022–23, RBI impo...

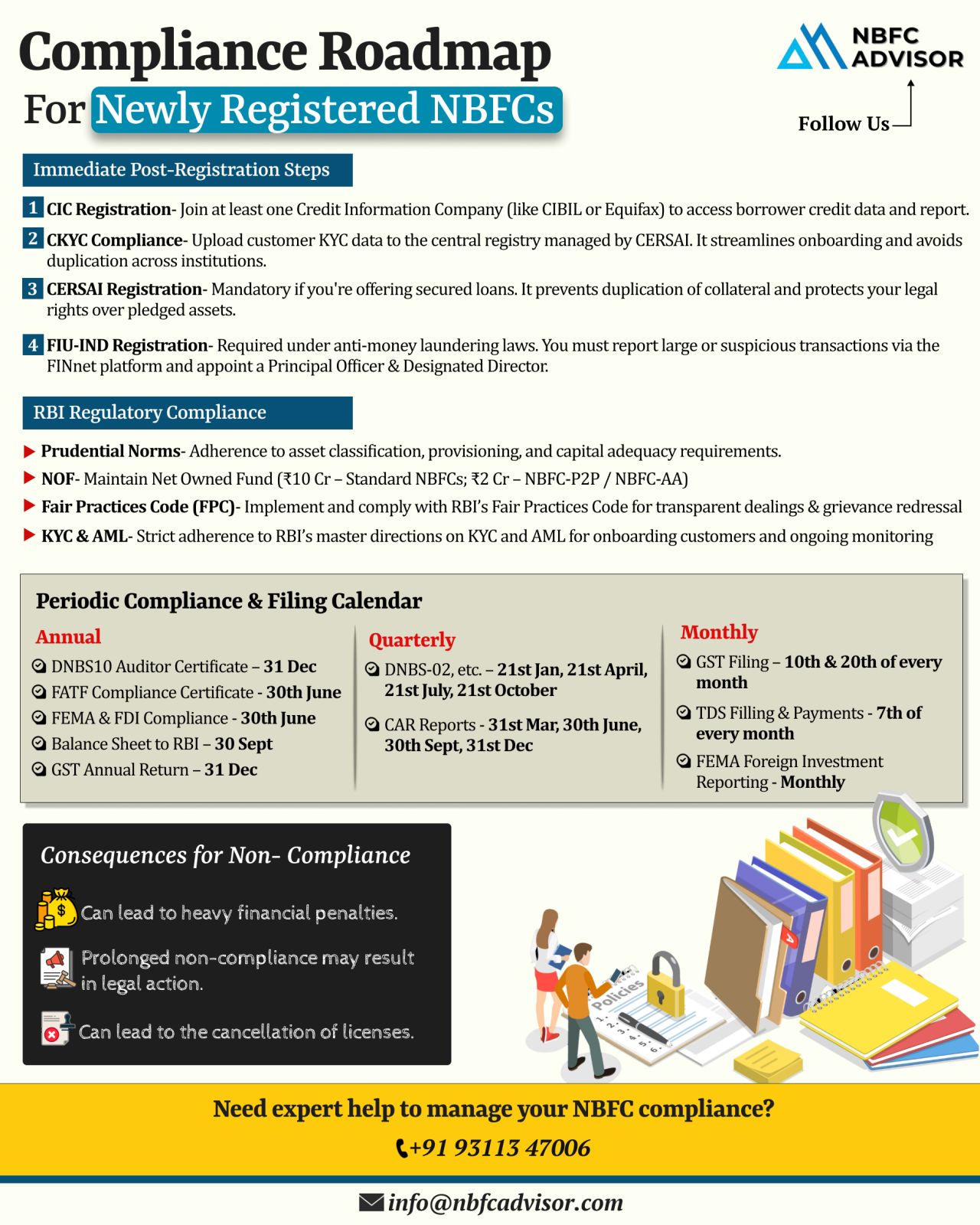

Newly Registered as an NBFC? Here’s What You Need to Know About Compliance

Getting your RBI license is a milestone worth celebrating—but it’s only the beginning of your NBFC journey. The real challenge starts with regulatory comp...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

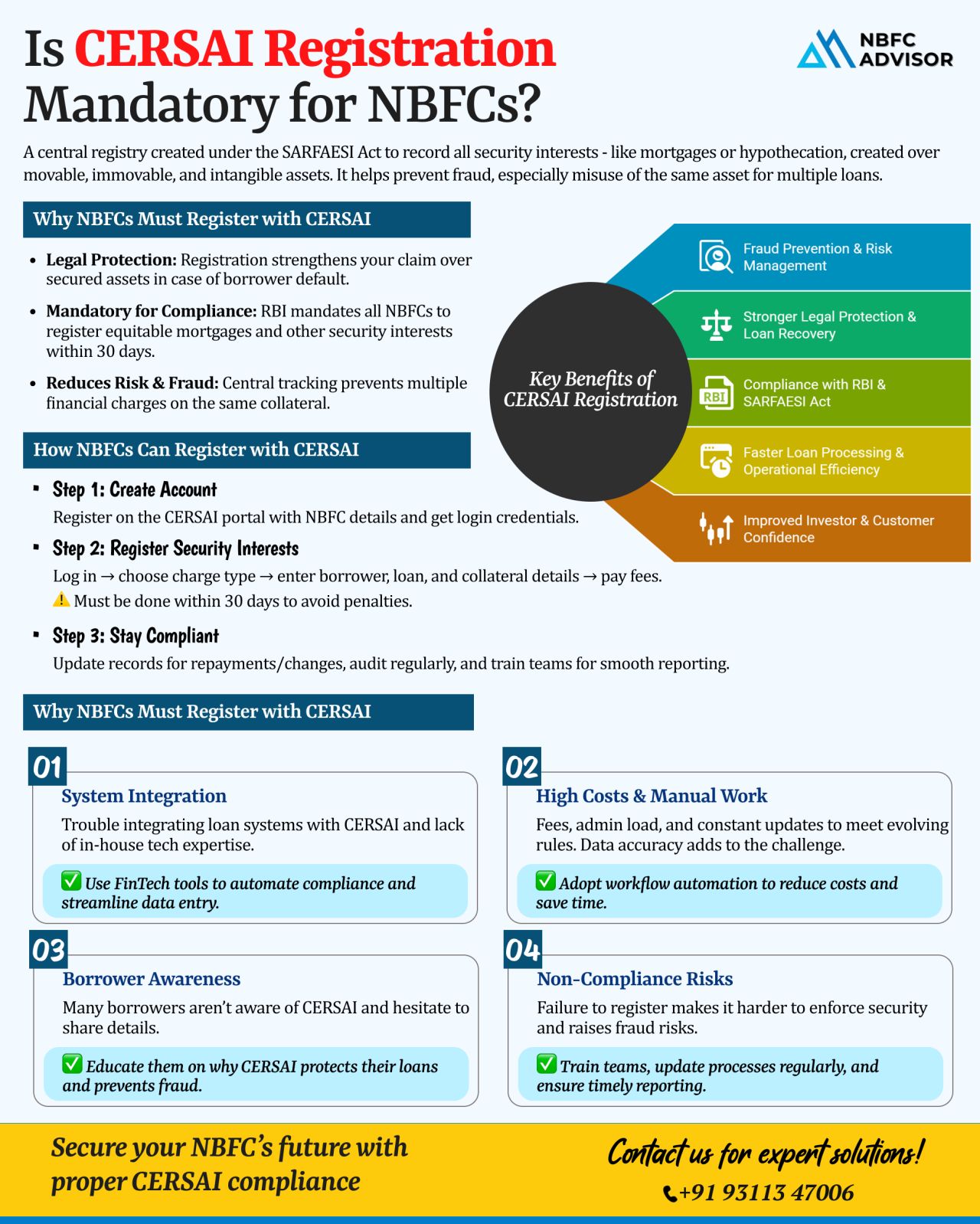

Is CERSAI Registration Mandatory for NBFCs?

One of the most common mistakes many NBFCs make is overlooking CERSAI registration. While compliance with RBI guidelines and customer onboarding processes get due attention, CERSAI often slips under the ...

Is Your NBFC Aligned with the Latest RBI Updates?

The Reserve Bank of India (RBI) is taking decisive steps to tighten the compliance framework for Non-Banking Financial Companies (NBFCs), ensuring transparency, customer protection, and responsible...

Rising NPAs Are a Wake-Up Call for NBFCs

India’s NBFC sector is under pressure. The alarming rise in Non-Performing Assets (NPAs) is sending a clear signal—NBFCs need to act now.

From unsecured personal loans to SME and rural lendin...

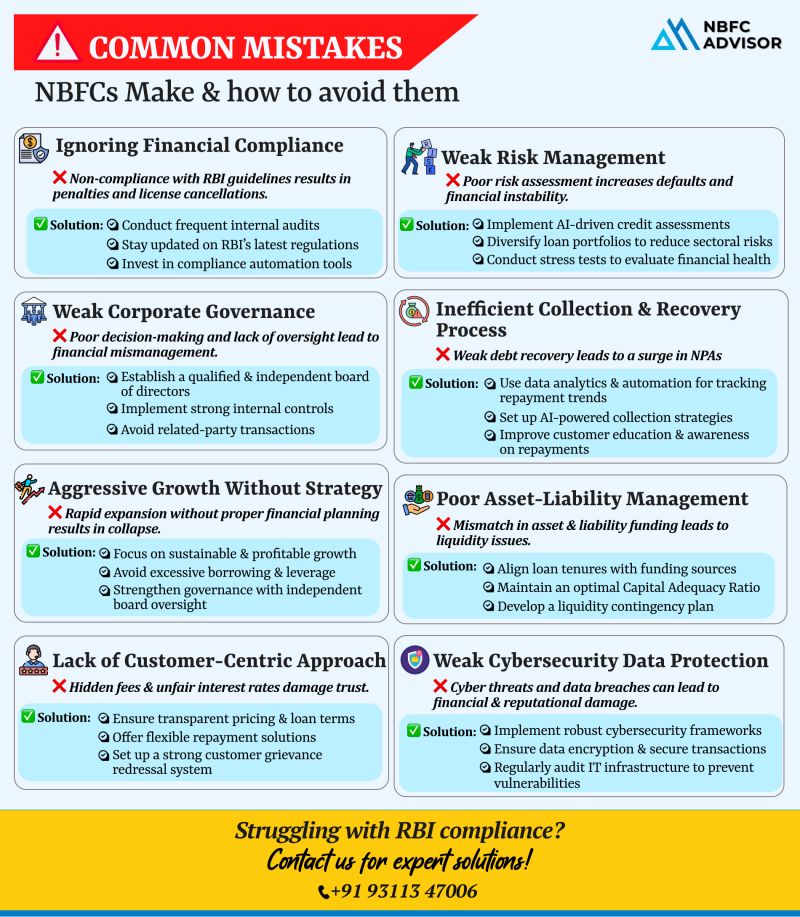

Is Your NBFC Making These Costly Mistakes?

In recent years, the Non-Banking Financial Company (NBFC) sector in India has witnessed rapid growth—but also increased regulatory scrutiny. From RBI license cancellations to skyrocketing NPAs, many...

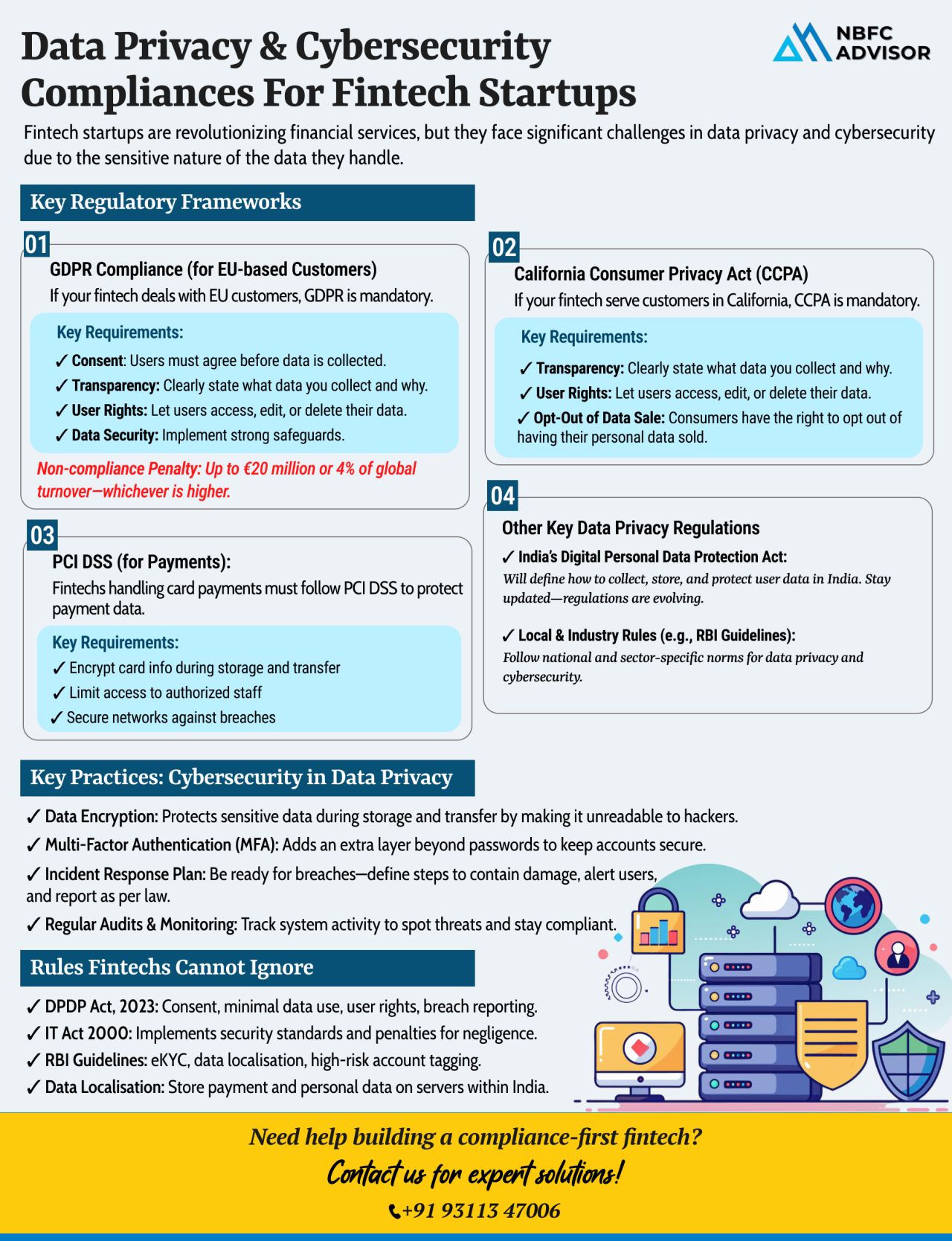

Building a Fintech? One Data Leak Can Destroy Everything

In today’s digital-first world, launching a fintech startup is an exciting venture—but one security misstep can bring it all crashing down. Whether you're building a lending ...

The Reserve Bank of India (RBI) is actively preparing for the future of finance with a strategic officer training program at its Hyderabad campus. This initiative is laser-focused on emerging areas such as:

✅ Digital Banking

✅ Fintec...

𝐑𝐁𝐈 𝐓𝐢𝐠𝐡𝐭𝐞𝐧𝐬 𝐆𝐫𝐢𝐩 𝐨𝐧 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐎𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭?

India's digital lending sector has seen exponential growth—but so have regulatory concerns. In a move ...

❌ Top Reasons Why NBFC License Applications Get Rejected

1. Weak Business Plan and Unrealistic Projections

The RBI expects applicants to submit a well-defined, sector-focused business plan backed by in-depth market research and practical financia...

A Landmark Deal Reshaping India’s NBFC Landscape

In a decisive move that signals the rising consolidation in India’s NBFC sector, UGRO Capital has announced the acquisition of Profectus Capital Pvt. Ltd. for ₹1,400 crore. This strategi...

Non-Banking Financial Companies (NBFCs) are essential players in India's financial ecosystem. They provide crucial financial services such as loans, credit facilities, asset financing and investment services, often reaching segments of the popula...