SEBI’s New Co-Investment Framework: A Big Boost for India’s Private Capital Market

India’s alternative investment ecosystem just got a major regulatory upgrade.

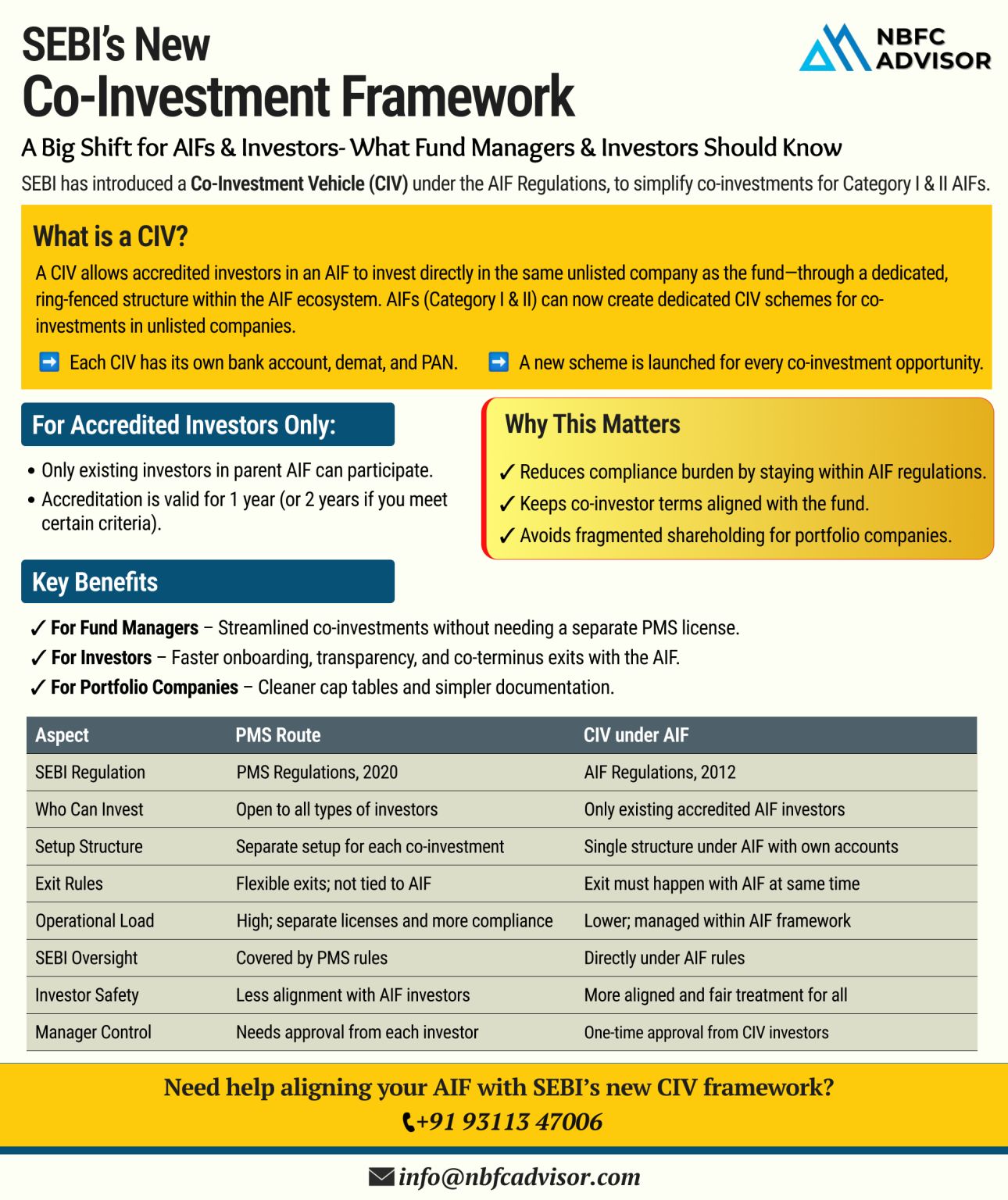

The Securities and Exchange Board of India (SEBI) has introduced a Co-Investment Vehicle (CIV) framework under the AIF (Alternative Investment Funds) Regulations. This new move is designed to make co-investments more structured, transparent, and efficient—especially for Category I and II AIFs.

What Is a CIV?

A Co-Investment Vehicle (CIV) is a dedicated scheme launched within an AIF that allows accredited investors to invest alongside the main fund in the same unlisted company.

This means:

-

No need for a separate PMS license

-

Identical investment terms and exit timeline for the co-investor and the fund

-

Simplified compliance and cleaner cap tables for portfolio companies

Who Benefits and How?

✅ For Fund Managers:

Smooth co-investment execution within the existing AIF structure, reducing regulatory complexity and offering flexibility.

✅ For Investors:

Faster onboarding, increased transparency, and greater legal protection while gaining access to growth-stage investments.

✅ For Portfolio Companies:

Fewer fragmented shareholders and more organized cap tables, improving governance and operational clarity.

Why This Matters

This new framework is a significant step forward in channeling domestic accredited capital into India’s booming private markets. It fosters:

-

Better alignment between fund and co-investors

-

Improved regulatory clarity

-

Increased efficiency for startups and growing businesses

By enabling co-investments under one umbrella, SEBI’s CIV structure will likely attract more participation from HNIs, family offices, and institutional investors—without the friction of fragmented structures or additional licensing.

Is Your AIF Ready for the CIV Era?

If you're managing or investing in AIFs, this is the perfect time to align your strategy with SEBI’s latest framework. Don’t let regulatory complexity slow you down.

📞 Book a free consultation to understand how the CIV model can work for you: +91 93113 47006