The Growth of AIFs: How India’s Startup Boom Is Creating New Opportunities

India’s startup ecosystem is witnessing an unprecedented surge.

With 1.59 lakh+ startups and over 110 unicorns, India has emerged as the third-largest startup ...

Why Do Many NBFCs Fail to Scale? The Real Issue Is Financial Clarity

When NBFCs struggle to scale, the first assumption is often lack of funds.

But in reality, capital is only part of the story.

The real bottleneck is financial clarity.

Wit...

Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

Why NBFCs Are Adding Factoring to Their Portfolio

India’s MSMEs are the backbone of the economy, contributing significantly to employment and GDP. Yet, one persistent challenge continues to limit their growth—cash flow gaps caused by d...

Want to Launch Portfolio Management Service (PMS) with Huge Tax Benefits?

India’s Portfolio Management Services (PMS) industry is witnessing rapid growth, expanding at a 33% CAGR and crossing ₹7 lakh crore in Assets Under Management (AUM). W...

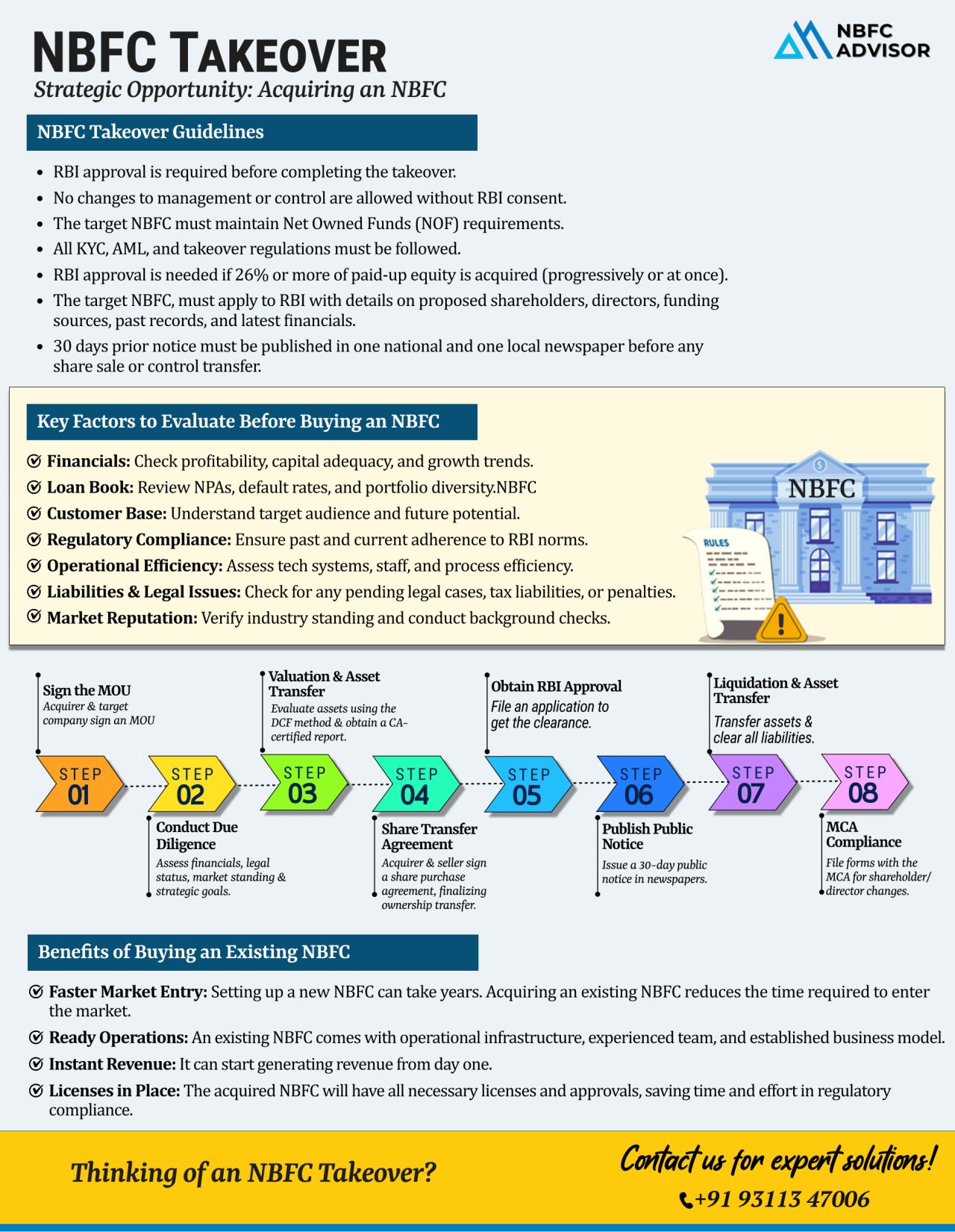

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

Hero FinCorp’s ₹3,668 Cr IPO: What It Means for NBFCs

The Indian NBFC sector is witnessing a wave of IPOs, signaling strong growth and investor confidence. After HDB Financial Services, Hero FinCorp is now preparing to debut on the stock mar...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

Cheques Clear Within Hours – Starting October 2025!

Big news is on the horizon for India’s banking ecosystem! The Reserve Bank of India (RBI) is set to transform the way cheques are cleared, reducing the waiting time from days to just ...

Want to Enter India’s Booming Lending Sector—Without Waiting Years?

India’s lending market is expanding at an unprecedented pace—driven by fintech innovation, rising credit demand, and digital-first borrowers. But setting u...

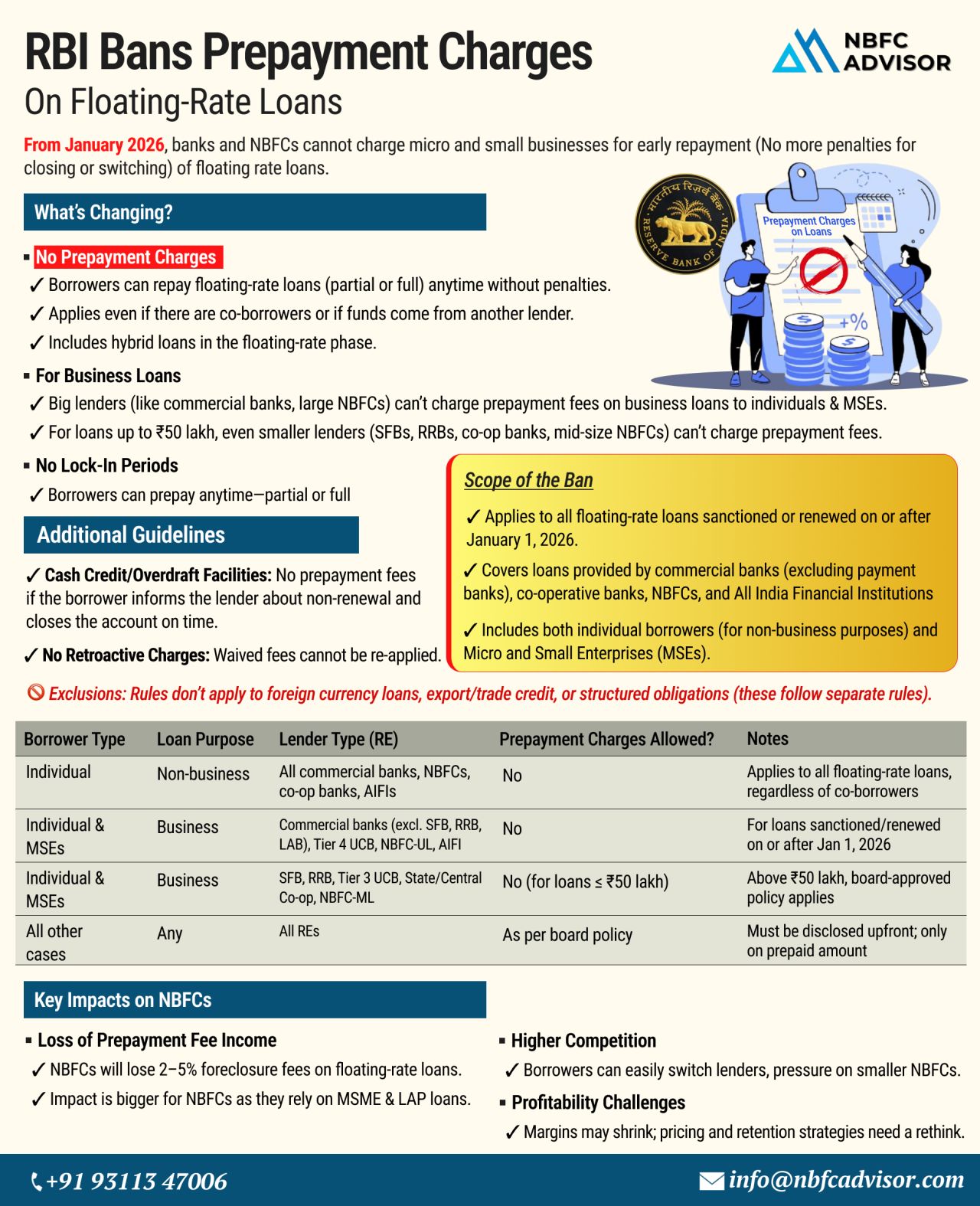

RBI Bans Prepayment Charges on Floating-Rate Loans

What It Means for NBFCs Starting January 2026

The Reserve Bank of India (RBI) has rolled out a major regulatory change aimed at giving borrowers more freedom. From January 1, 2026, no prepaymen...

A Landmark Deal Reshaping India’s NBFC Landscape

In a decisive move that signals the rising consolidation in India’s NBFC sector, UGRO Capital has announced the acquisition of Profectus Capital Pvt. Ltd. for ₹1,400 crore. This strategi...

The financial services sector in India is vast and multifaceted, with Non-Banking Financial Companies (NBFCs) playing a crucial role in providing credit and investment solutions. With their increasing presence and significance in the economy, NBFC ta...

In recent years, the Non-Banking Financial Companies (NBFC) sector in India has experienced considerable growth, playing a critical role in providing financial services such as loans, credit and investment. As a result, NBFC takeovers have become inc...