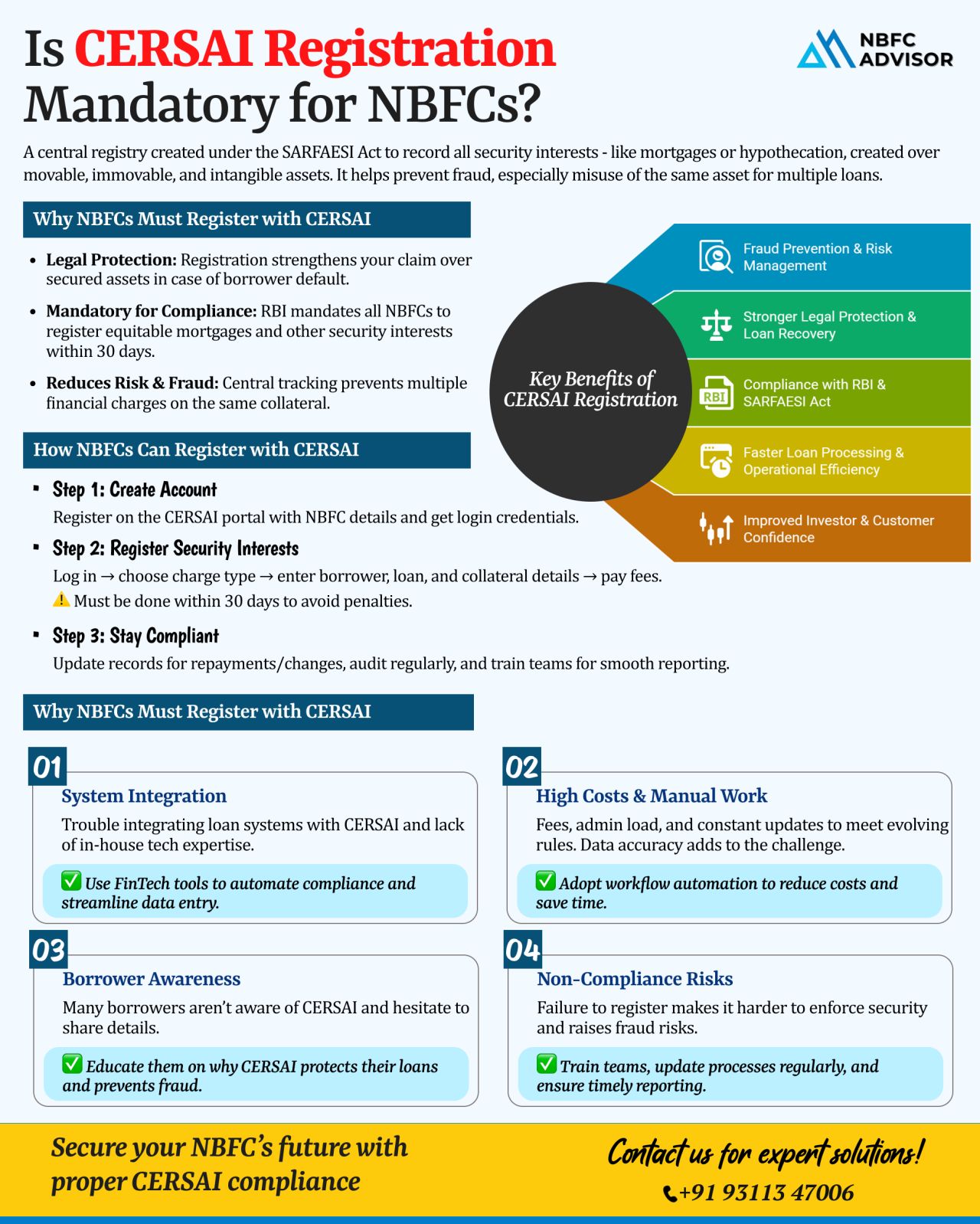

Is CERSAI Registration Mandatory for NBFCs?

One of the most common mistakes many NBFCs make is overlooking CERSAI registration. While compliance with RBI guidelines and customer onboarding processes get due attention, CERSAI often slips under the ...

Cheques Clear Within Hours – Starting October 2025!

Big news is on the horizon for India’s banking ecosystem! The Reserve Bank of India (RBI) is set to transform the way cheques are cleared, reducing the waiting time from days to just ...

Rising NPAs Are a Wake-Up Call for NBFCs

India’s NBFC sector is under pressure. The alarming rise in Non-Performing Assets (NPAs) is sending a clear signal—NBFCs need to act now.

From unsecured personal loans to SME and rural lendin...

RBI Tightens the Reins on NBFCs — Is Your Company Ready for Compliance Scrutiny?

India’s financial watchdog, the Reserve Bank of India (RBI), is stepping up its enforcement measures against Non-Banking Financial Companies (NBFCs). Rece...

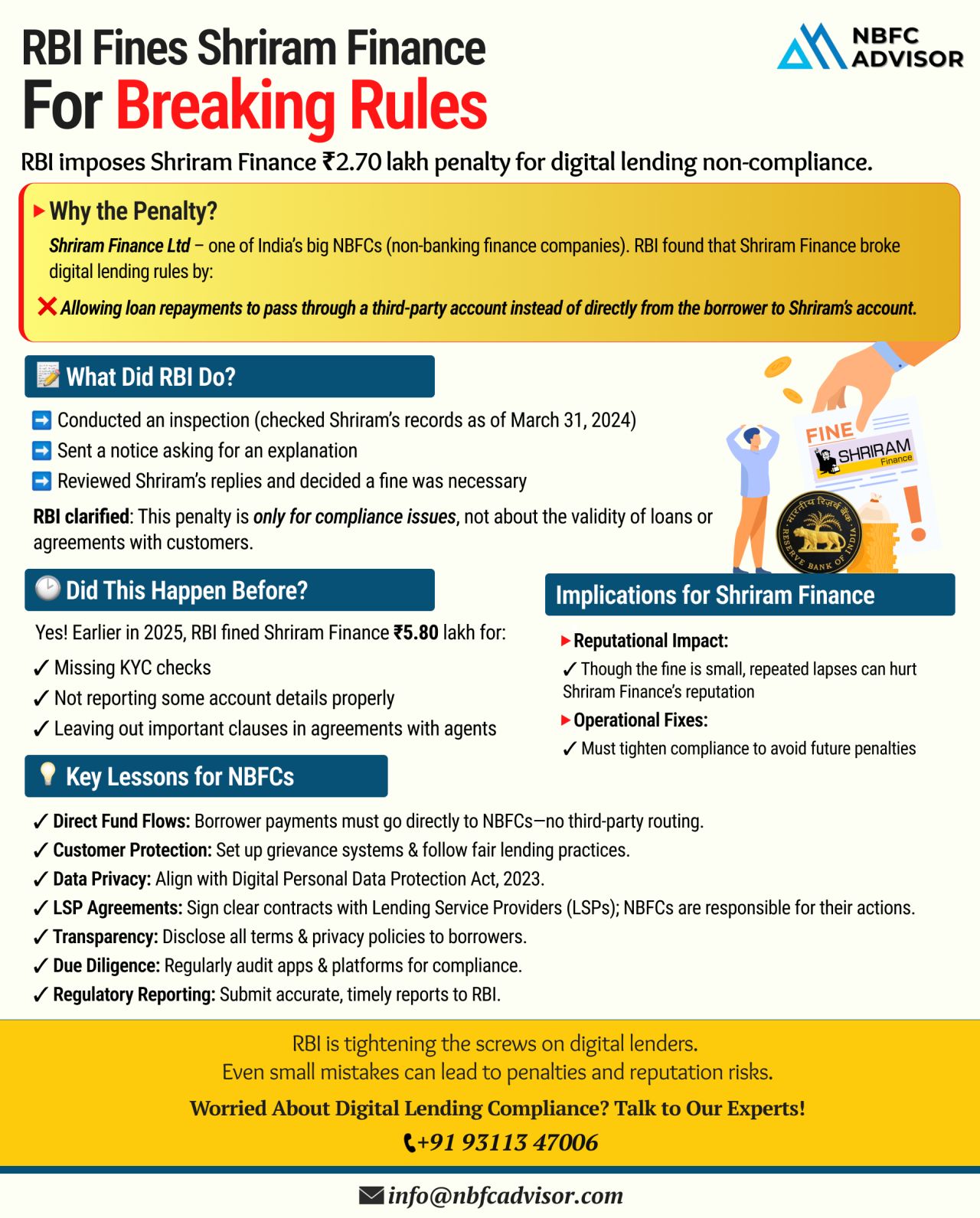

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

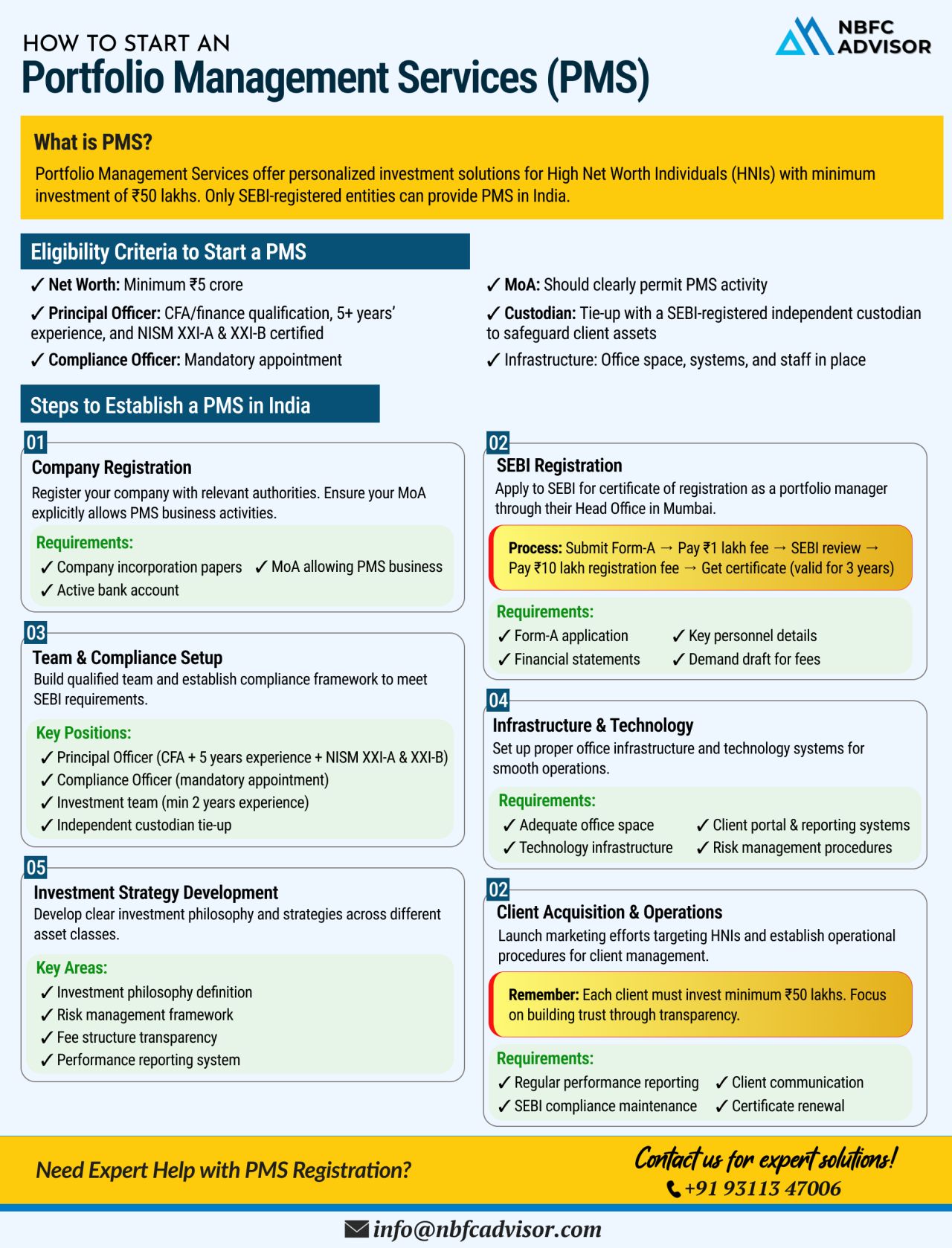

🚀 India’s PMS Industry Is Accelerating – Here's What You Need to Know

India’s Portfolio Management Services (PMS) sector is witnessing phenomenal growth, with assets under management (AUM) now exceeding ₹7.08 lakh crore. Thi...

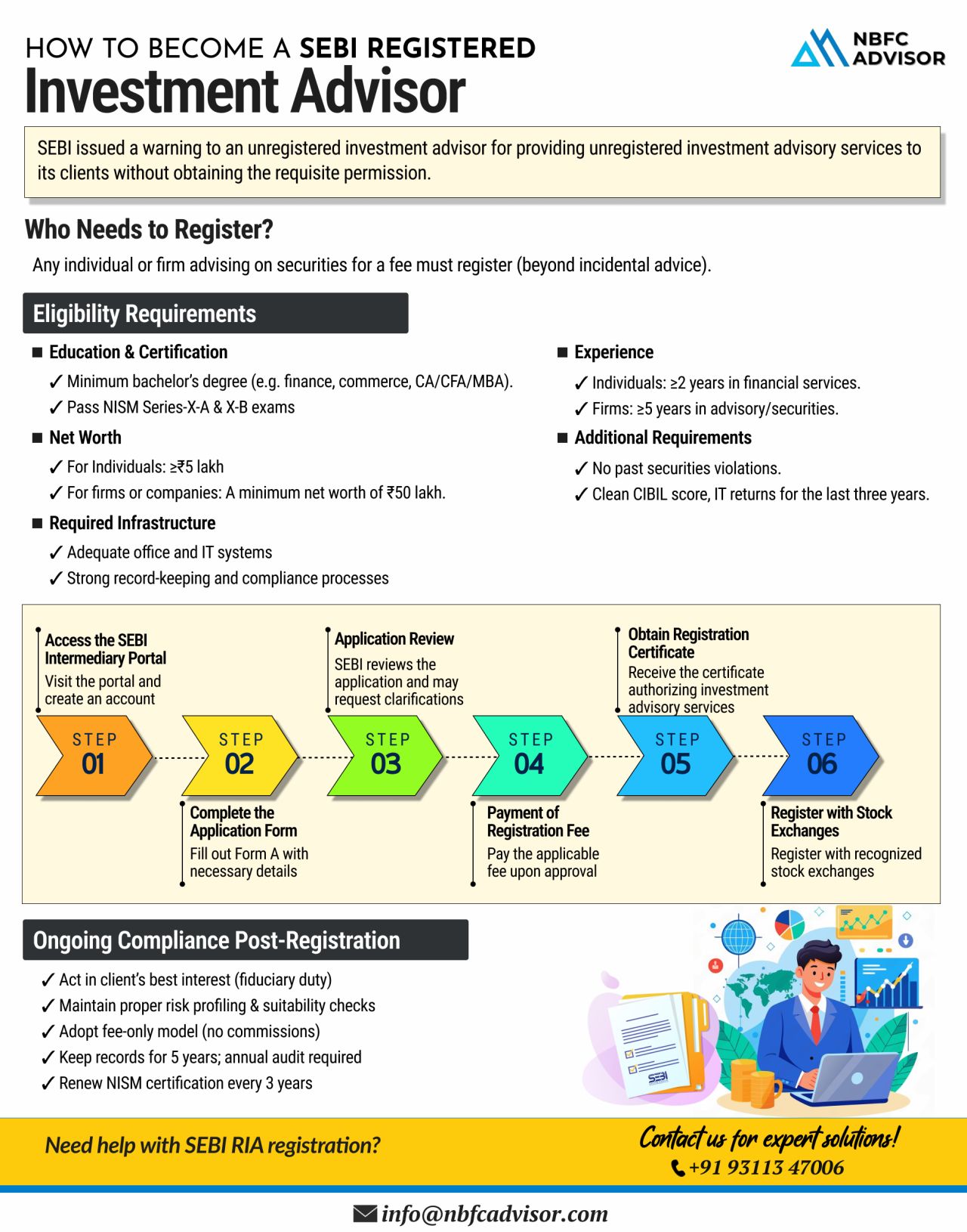

⚠️ SEBI Cracks Down on Unregistered Investment Advisors — Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strict warning to individuals and firms offering investment advice without proper registrati...