Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

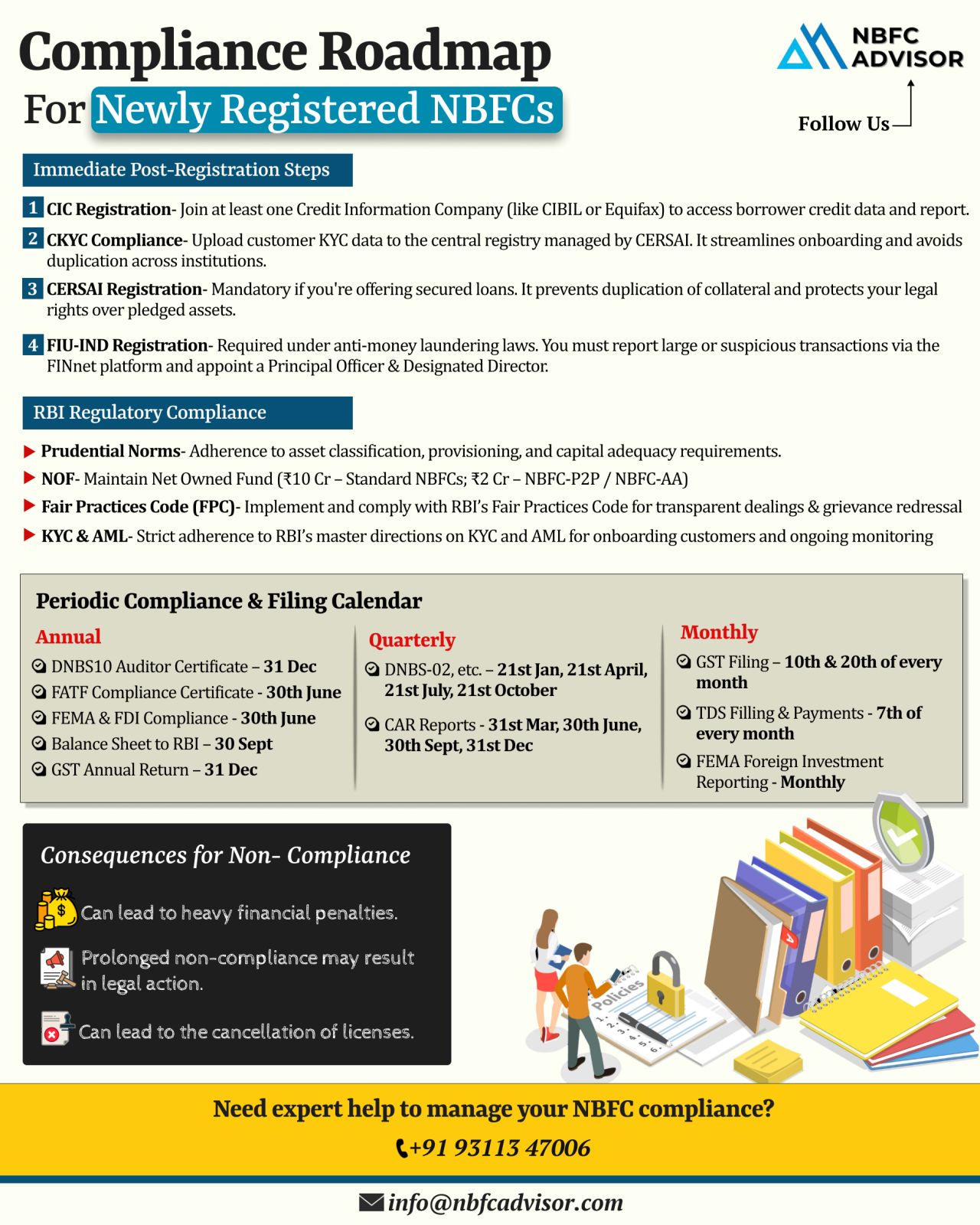

Newly Registered as an NBFC? Here’s What You Need to Know About Compliance

Getting your RBI license is a milestone worth celebrating—but it’s only the beginning of your NBFC journey. The real challenge starts with regulatory comp...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

RBI Set to Tighten Supervisory Norms for NBFCs in FY26: A Shift Toward Stricter Oversight

The Reserve Bank of India (RBI) is poised to implement tighter supervisory norms for Non-Banking Financial Companies (NBFCs) in FY26, with a particular focus...

𝘎𝘰𝘵 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊 𝘓𝘪𝘤𝘦𝘯𝘴𝘦? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Receiving your NBFC license is an exciting milestone — but it’s far from the finish line. In fact, it’s just the start of your complia...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

🚀 The NBFC Sector in India is Experiencing Unmatched Growth! 🚀

Are You Ready to Seize the Opportunity?

India’s Non-Banking Financial Company (NBFC) sector is growing at an extraordinary pace, driven by rising demand for digital lending,...

Non-Banking Financial Companies (NBFCs) have carved a niche for themselves in the Indian financial ecosystem, offering a wide range of services that cater to individuals, businesses and the economy as a whole. While their name might suggest a resembl...