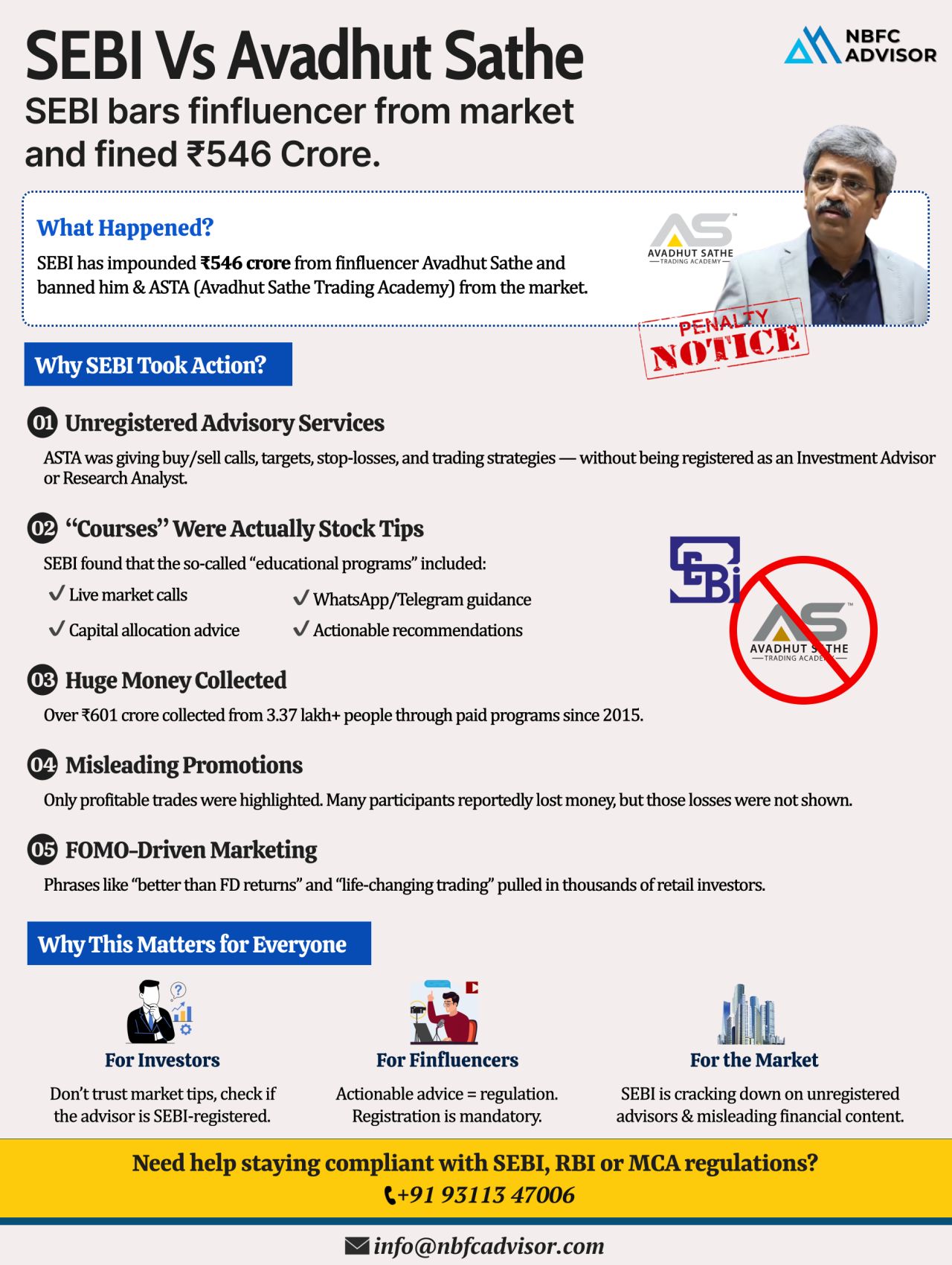

SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut S...

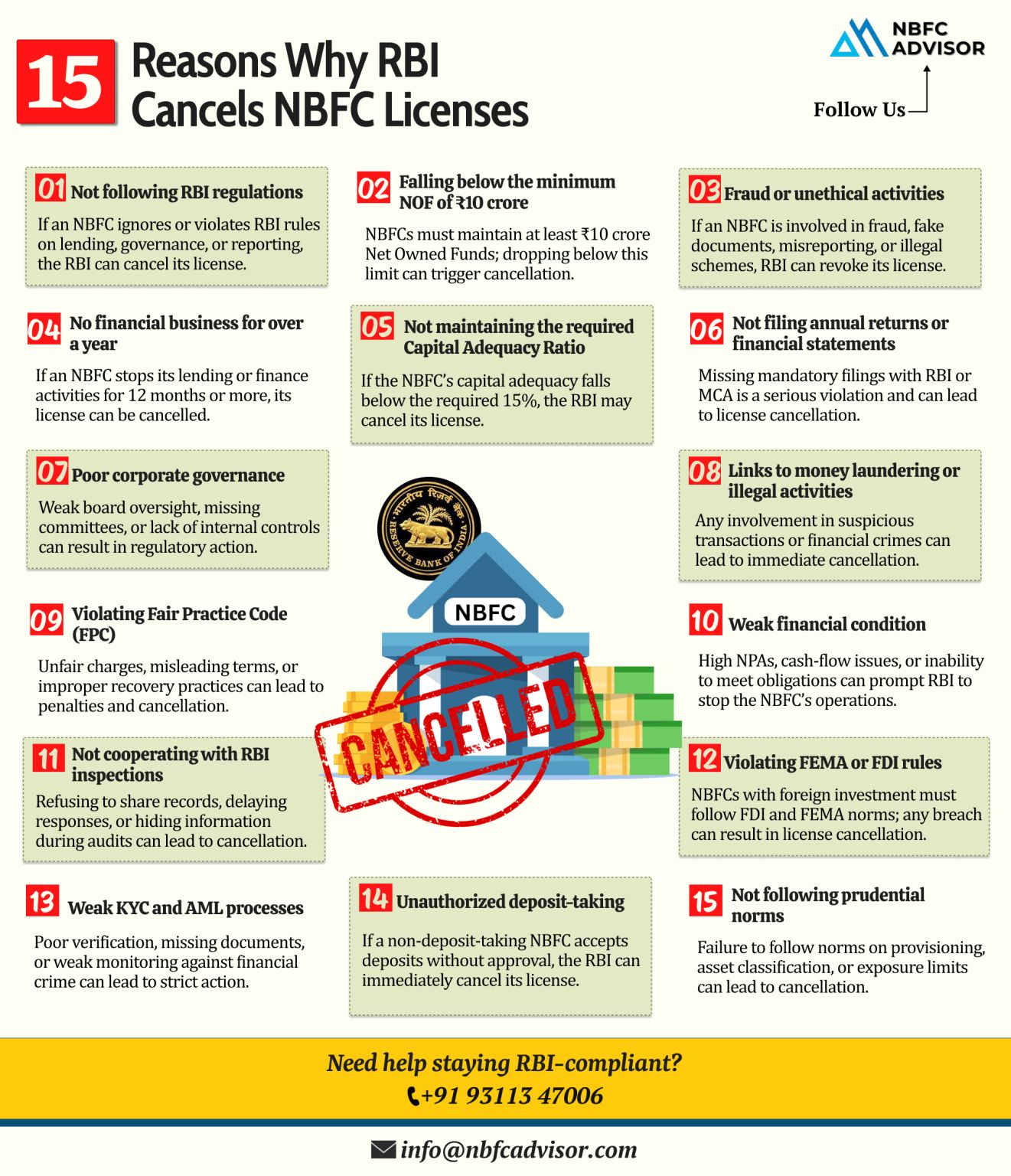

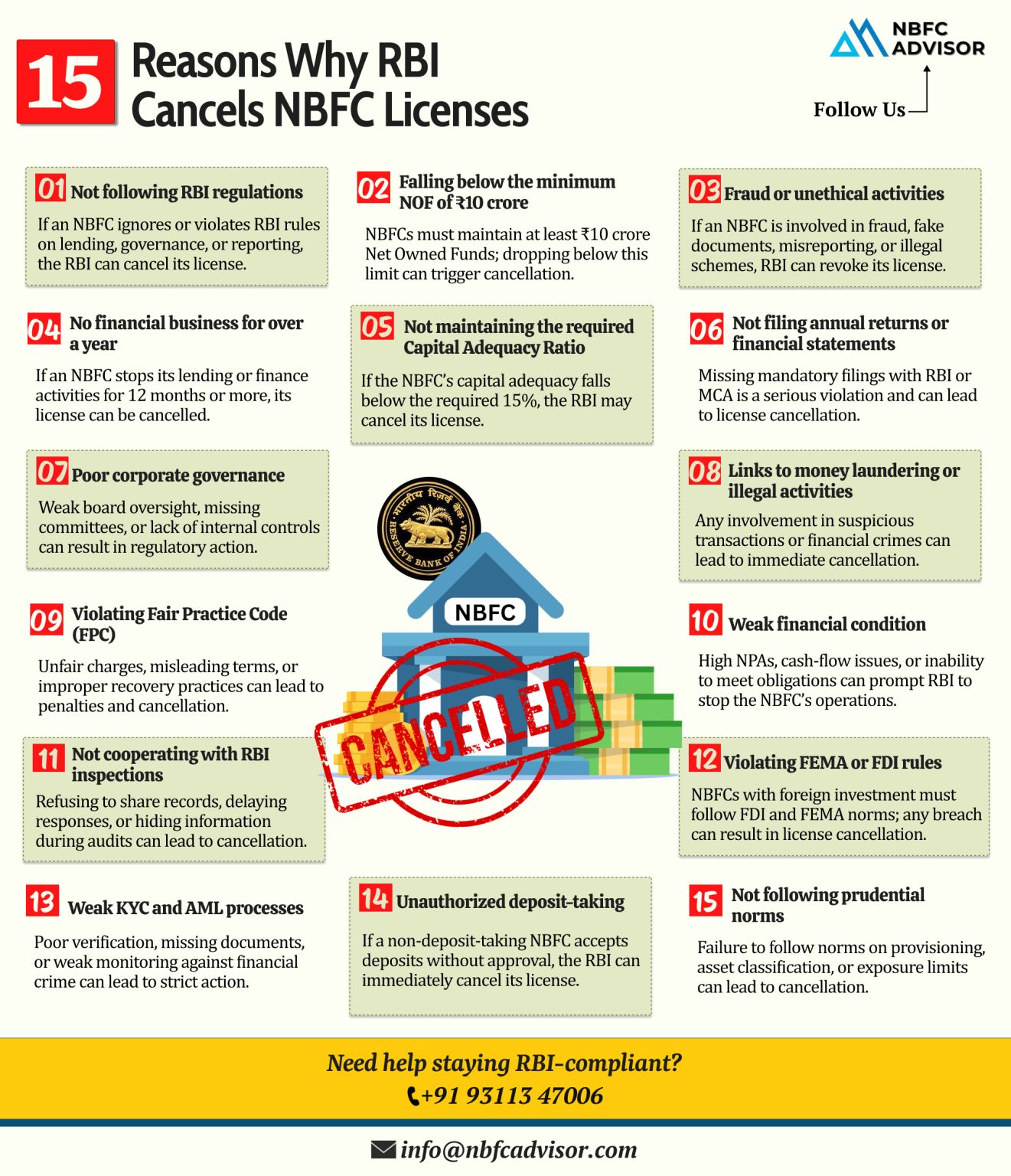

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

Not Sure What License Your Fintech Needs? 🤔

India’s fintech ecosystem — from digital lending apps and payment gateways to neobanks and wealthtech platforms — is expanding faster than ever. But as innovation accelerates, RBI and ...

Non-Banking Financial Companies (NBFCs) are essential players in India's financial ecosystem. They provide crucial financial services such as loans, credit facilities, asset financing and investment services, often reaching segments of the popula...

Non-Banking Financial Companies (NBFCs) have carved a niche for themselves in the Indian financial ecosystem, offering a wide range of services that cater to individuals, businesses and the economy as a whole. While their name might suggest a resembl...