Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (IFSC), GIFT City is rapidly becoming the preferred destination for NBFCs, banks, fintech companies, and global financial institutions looking to scale cross-border operations efficiently.

Why Are NBFCs and Financial Institutions Moving to GIFT City?

The biggest reason is regulatory and operational flexibility compared to the domestic financial system. Institutions operating from GIFT City enjoy a business-friendly ecosystem that aligns with global financial hubs.

Key Advantages of GIFT City:

-

Lower compliance burden with simplified regulatory frameworks

-

10-year tax holiday along with significant tax exemptions on income and transactions

-

Single-window regulation under the International Financial Services Centres Authority (IFSCA)

-

Freedom to operate in foreign currencies such as USD, EUR, and GBP

-

Seamless cross-border lending, borrowing, and investment opportunities

-

Lower operating costs compared to global hubs like Singapore or Dubai

-

World-class infrastructure combined with access to a strong financial and tech talent pool

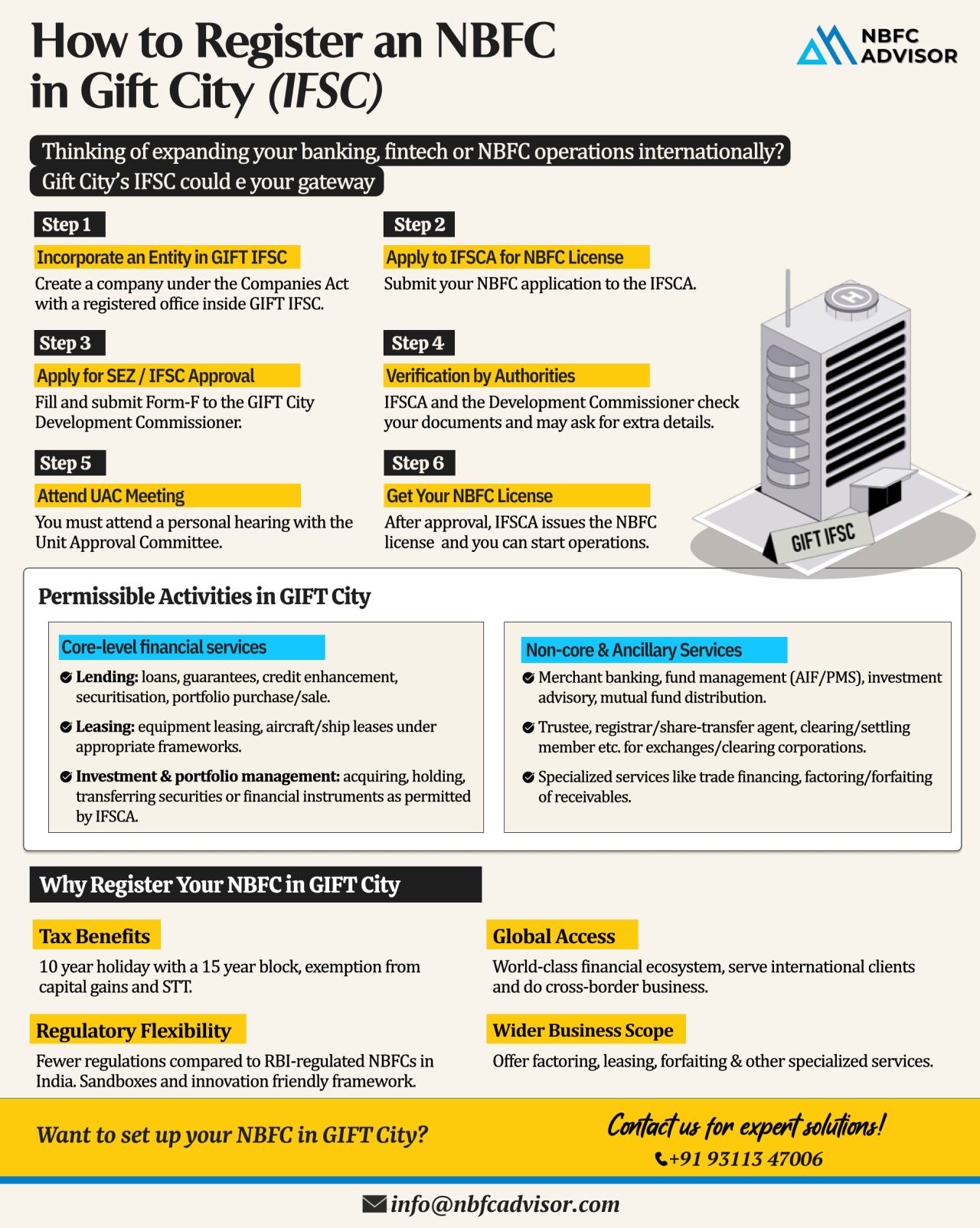

Simple and Streamlined Registration Process

Setting up in GIFT City is far more structured and transparent than many global jurisdictions. The process typically includes:

-

Setting up the entity in GIFT City (IFSC unit)

-

Application to IFSCA with business plan and compliance details

-

Unit Approval Committee (UAC) review and approval

-

Grant of license to commence financial operations

With the right guidance, the process is efficient and time-bound.

Strong Institutional Confidence

GIFT City’s credibility is reinforced by early movers and global participation:

-

Power Finance Corporation (PFC) became the first government NBFC to establish operations in GIFT City

-

Global banks like HSBC and MUFG are significantly expanding their lending and financial services through the IFSC

This momentum signals strong confidence in GIFT City as a long-term global financial hub.

GIFT City: India’s Global Financial Gateway

GIFT City is no longer just a vision—it is rapidly evolving into India’s gateway to global finance. NBFCs and financial institutions that establish their presence early stand to gain a first-mover advantage, access international capital, and operate in a globally competitive regulatory environment.

Planning to Set Up an NBFC in GIFT City?

Early entry can unlock long-term strategic benefits. Professional support ensures faster approvals, regulatory clarity, and smooth operational setup.

Need help with NBFC registration or setting up operations in GIFT City?

📩 DM us to get started.

#NBFCAdvisor #NBFC #GIFTCity #IFSCA #Fintech #Banking #Compliance #SEZ #FinancialServices