Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Most defaults don’t happen overnight. They start with weak credit checks, incomplete borrower analysis, or poor post-loan monitoring. The good news? You can minimize them by building a reliable credit appraisal process that ensures every loan decision is data-driven, compliant, and risk-optimized.

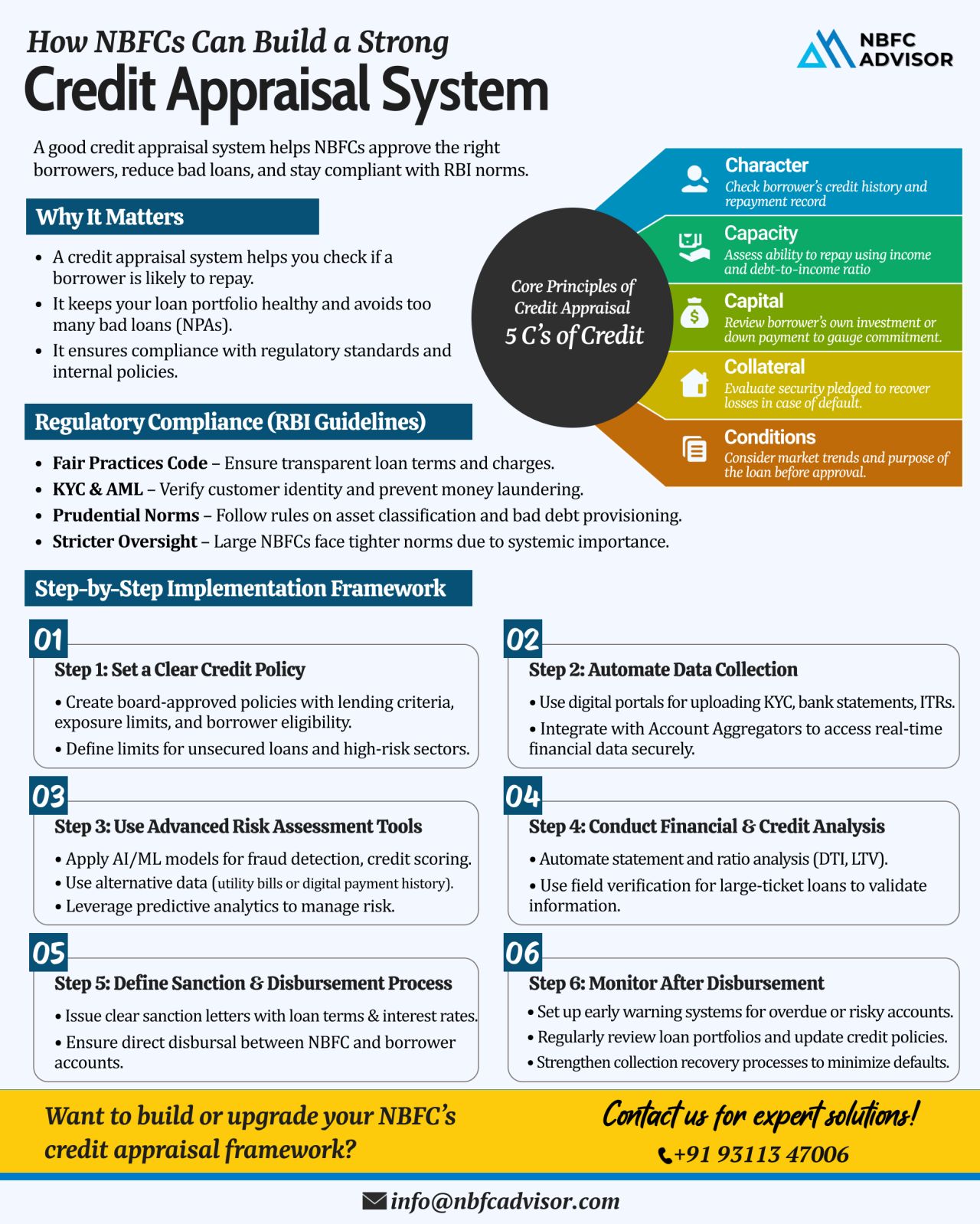

✅ Why Credit Appraisal Matters for NBFCs

A structured credit appraisal system is the backbone of safe lending. It helps you:

-

Identify high-risk borrowers early

-

Ensure documentation and verification accuracy

-

Maintain compliance with RBI lending norms

-

Strengthen your portfolio quality and investor confidence

Without a solid appraisal framework, even the most promising NBFCs can face rising NPAs and regulatory challenges.

📋 Quick Checklist for NBFCs to Strengthen Credit Appraisal

Here’s what every NBFC should review in its credit process:

→ Are borrower documents complete, verified, and authentic?

→ Is there a clear risk-scoring model for loan approvals?

→ Are your decision rules defined and regularly updated?

→ Do you use technology and automation to reduce human error?

→ Is there ongoing post-disbursement monitoring to detect early warning signs?

→ Are your credit policies aligned with RBI’s latest guidelines?

Implementing this checklist not only improves your lending decisions but also ensures long-term stability and compliance.

💼 How NBFC Advisor Can Help

At NBFC Advisor, we help NBFCs and fintech lenders design and implement robust credit appraisal systems tailored to their business model.

Our team assists with:

→ Developing risk assessment frameworks

→ Automating credit workflows using technology

→ Aligning policies with RBI compliance standards

→ Training teams for better credit decision-making

📞 Let’s Build a Safer Lending System

If you want to reduce loan defaults and strengthen your lending operations, it starts with improving your credit appraisal process.

👉 Contact us for a free consultation

📞 +91-93113-47006

#NBFCAdvisor #NBFC #CreditAppraisal #RBICompliance #DigitalLending #RiskManagement #Finance #NBFCSolutions #NBFCCompliance #LendingTechnology