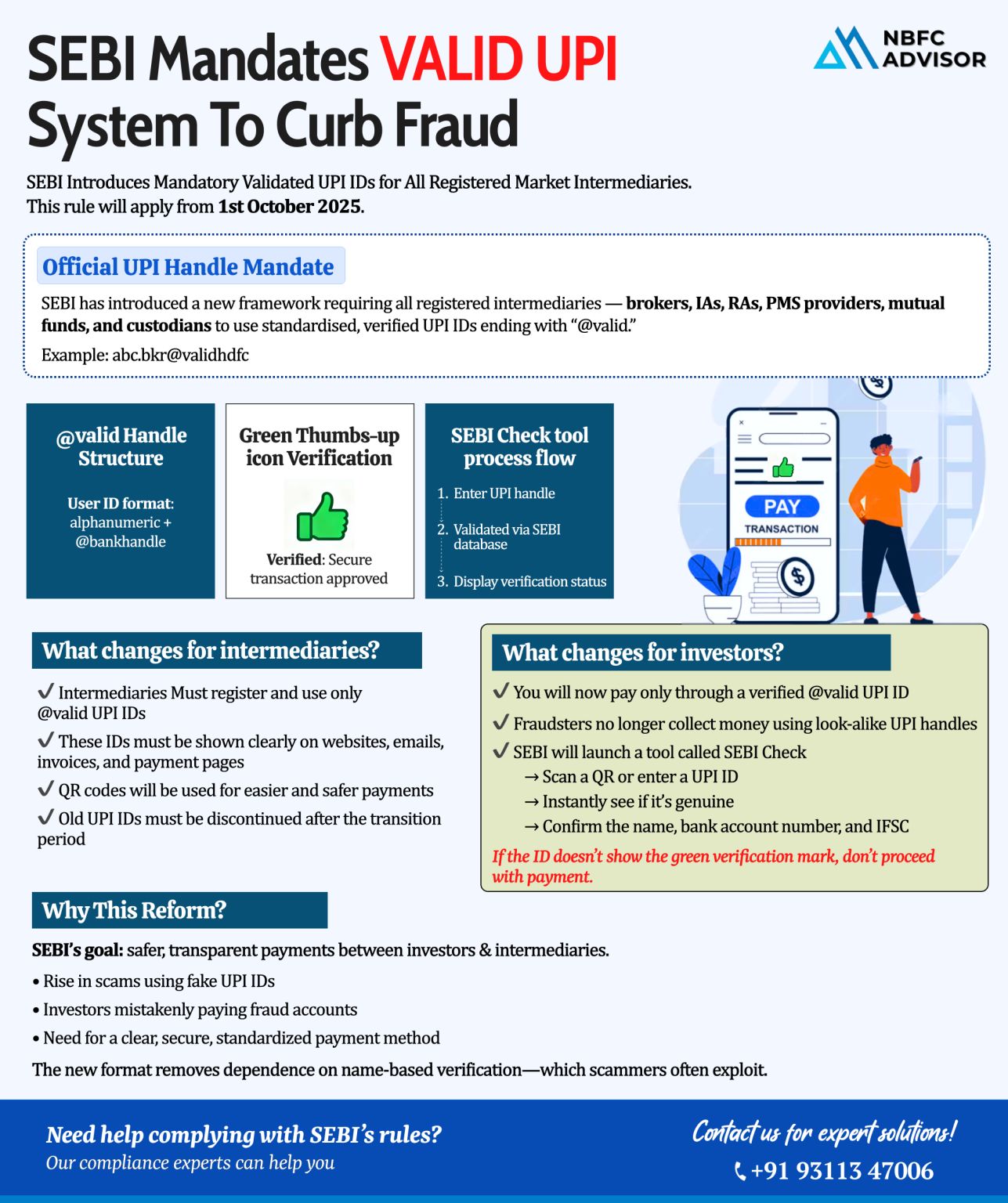

SEBI Introduces VALID UPI System: A Big Move to Protect Investors from Fraud

In a major regulatory development, SEBI has introduced the VALID UPI system, making it mandatory for all registered market intermediaries to use SEBI-verified UPI IDs onl...

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

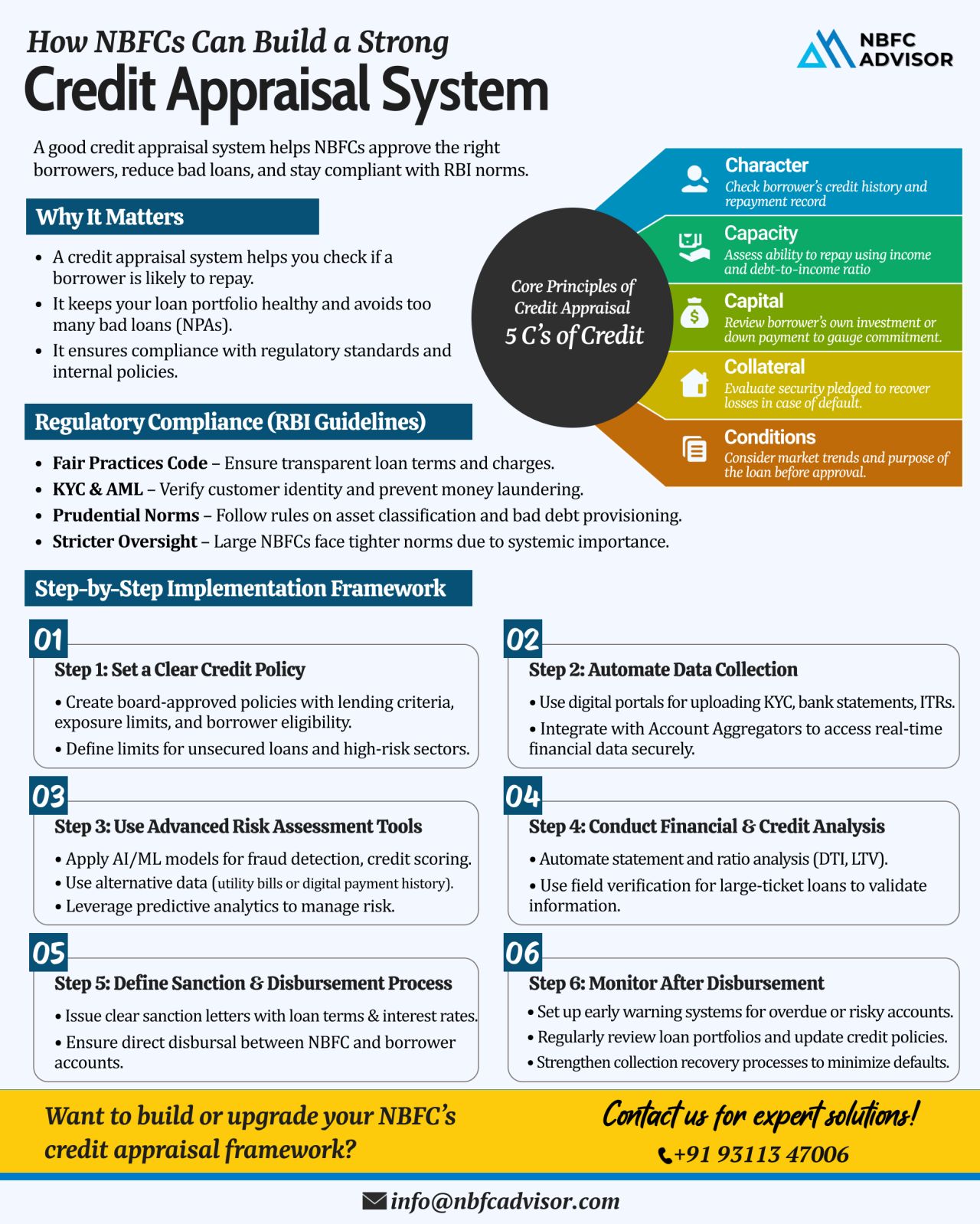

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

SEBI Tightens Rules for Finance Creators and Startups in the Investment Space

Are you a finance creator or a startup working in the investment space?

Then it’s time to pay close attention — because SEBI is cracking down on unregistere...

🚀 The NBFC Sector in India is Experiencing Unmatched Growth! 🚀

Are You Ready to Seize the Opportunity?

India’s Non-Banking Financial Company (NBFC) sector is growing at an extraordinary pace, driven by rising demand for digital lending,...