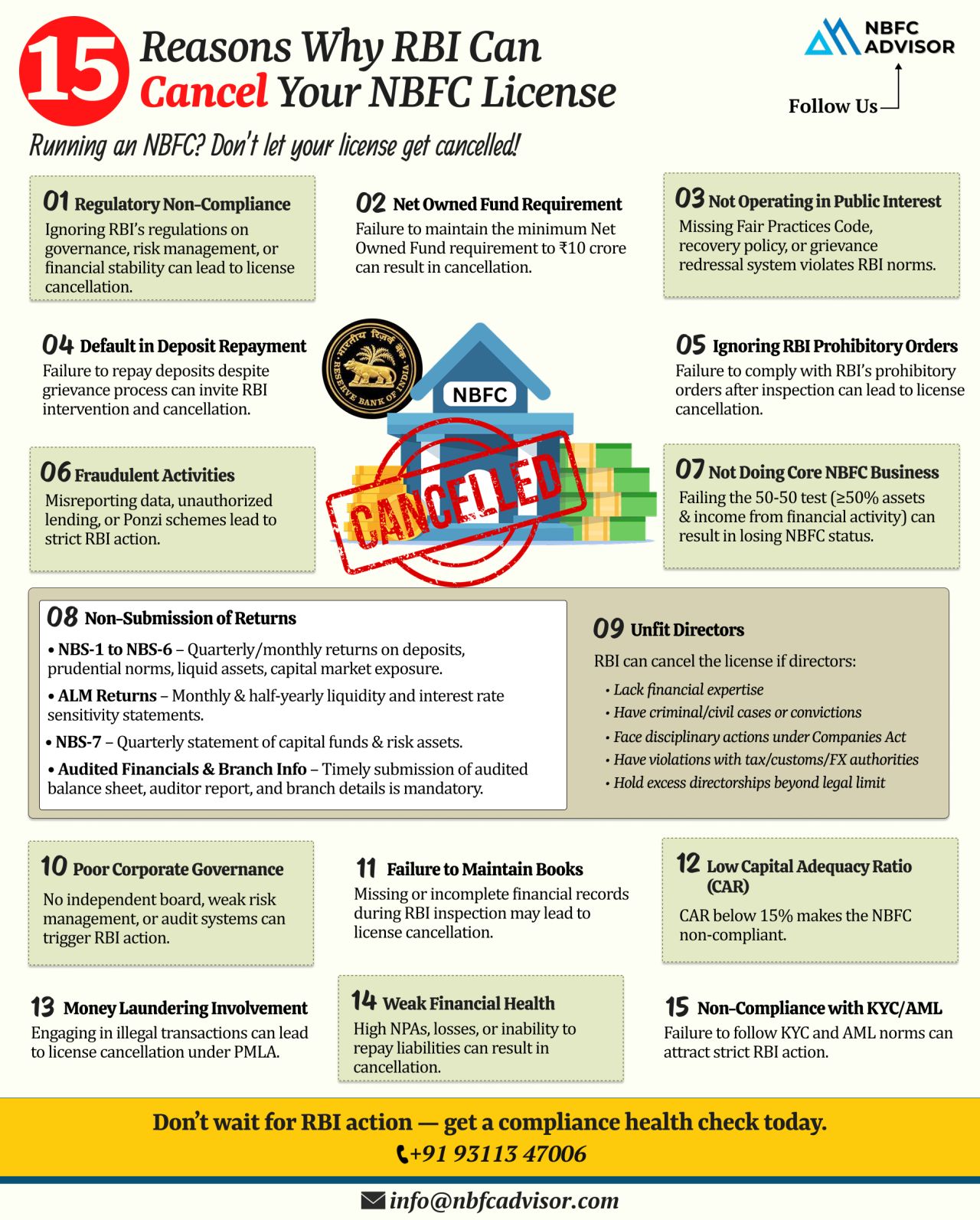

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

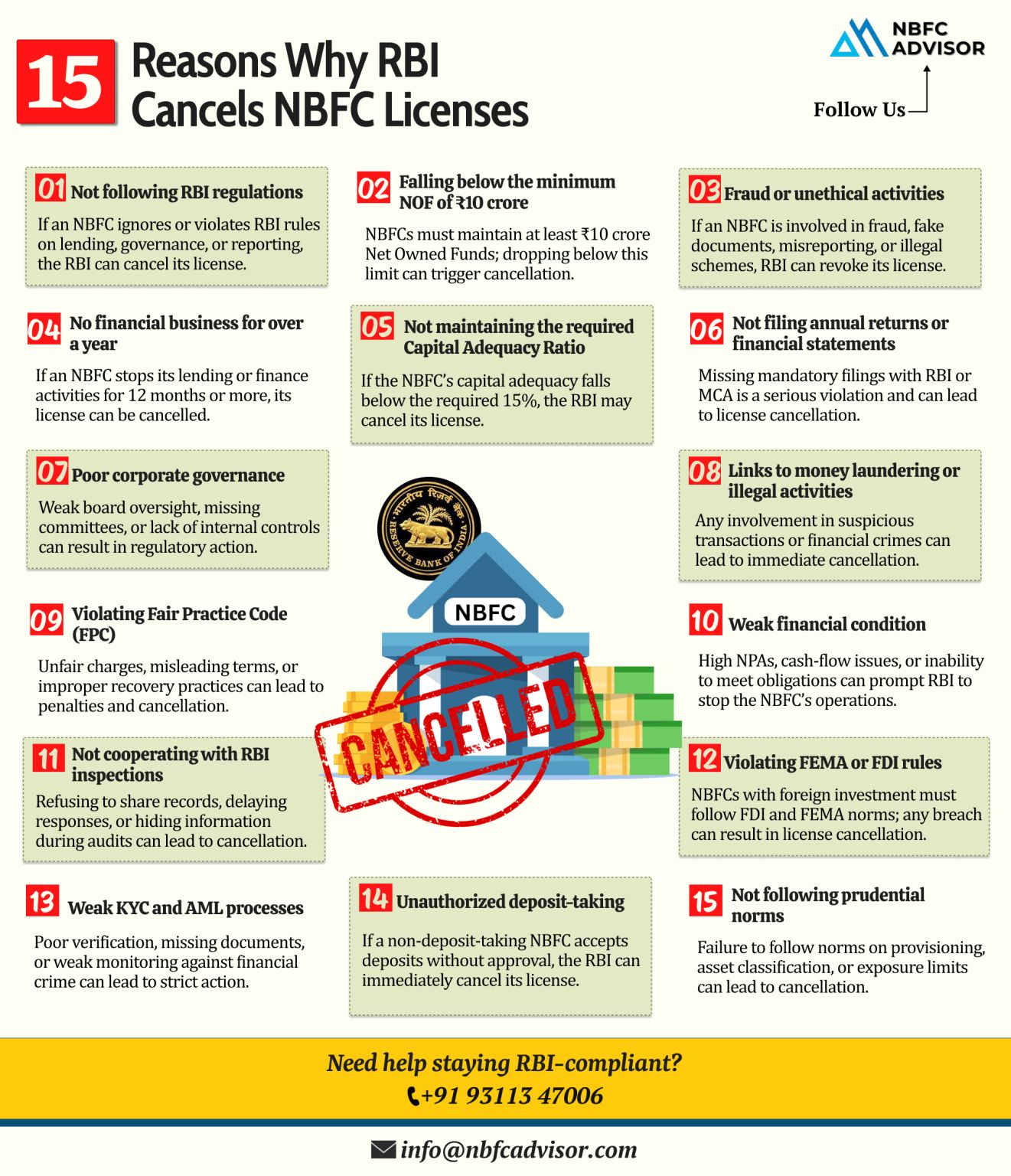

15 Red Flags That Can Shut Down Your NBFC

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Surprisingly, most cancellations are not due to fraud, but rather due to missed compliance, ...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

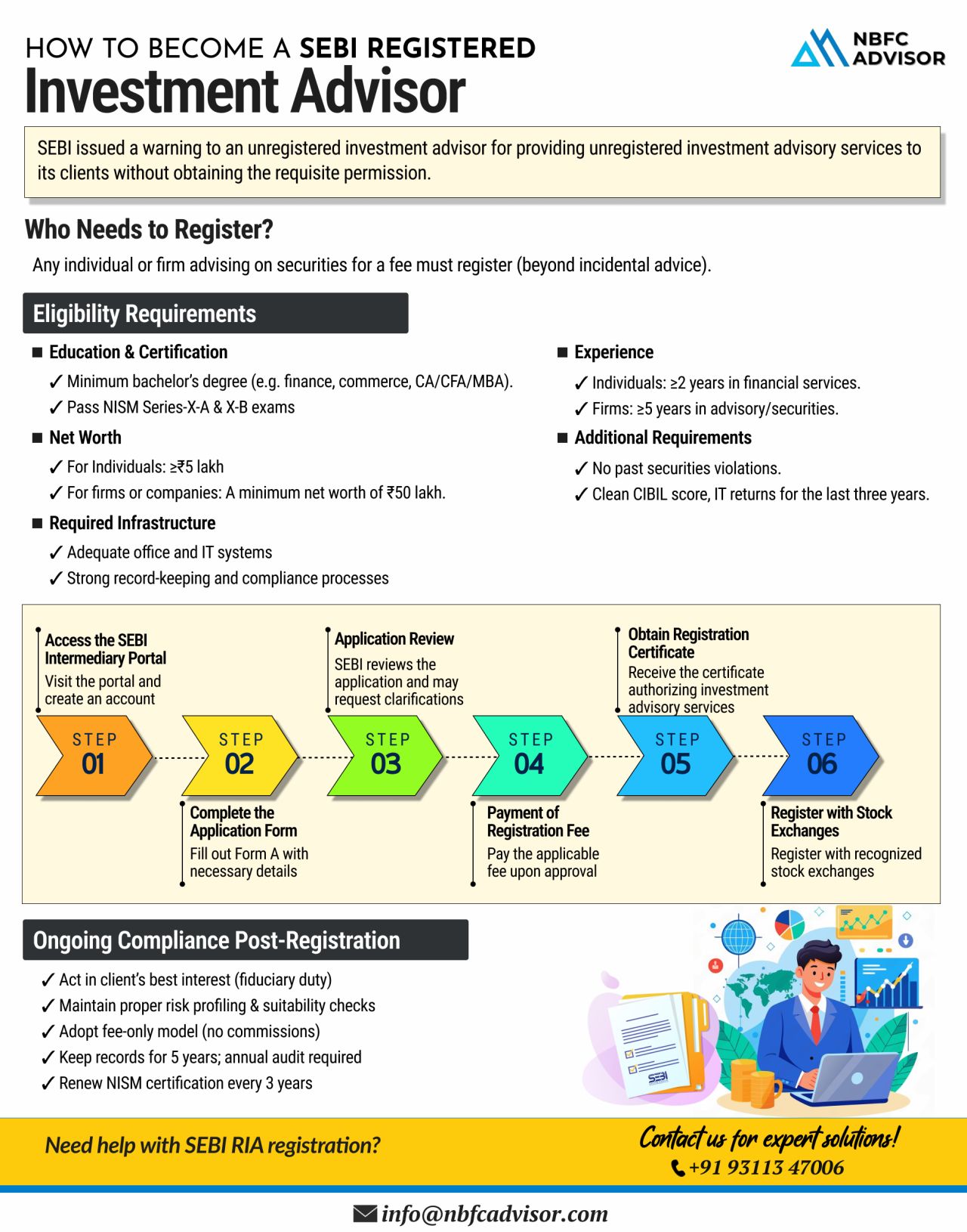

⚠️ SEBI Cracks Down on Unregistered Investment Advisors — Are You Compliant?

The Securities and Exchange Board of India (SEBI) has recently issued a strict warning to individuals and firms offering investment advice without proper registrati...

Non-Banking Financial Companies (NBFCs) have carved a niche for themselves in the Indian financial ecosystem, offering a wide range of services that cater to individuals, businesses and the economy as a whole. While their name might suggest a resembl...