Starting an NBFC vs. Buying One – What’s Smarter?

Entering India’s Non-Banking Financial Company (NBFC) sector is an attractive opportunity for investors, fintech founders, and financial institutions. The big question most invest...

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

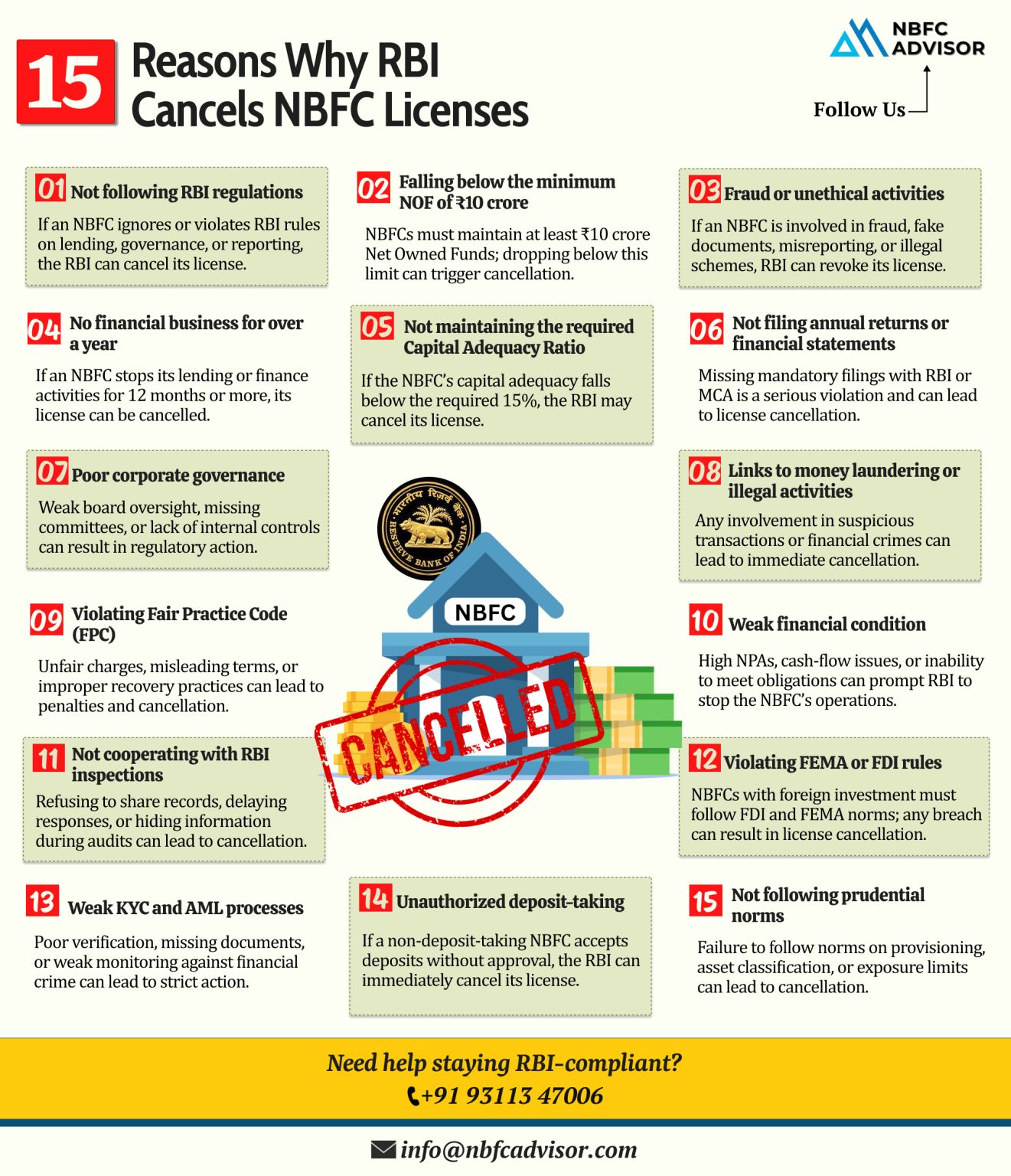

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

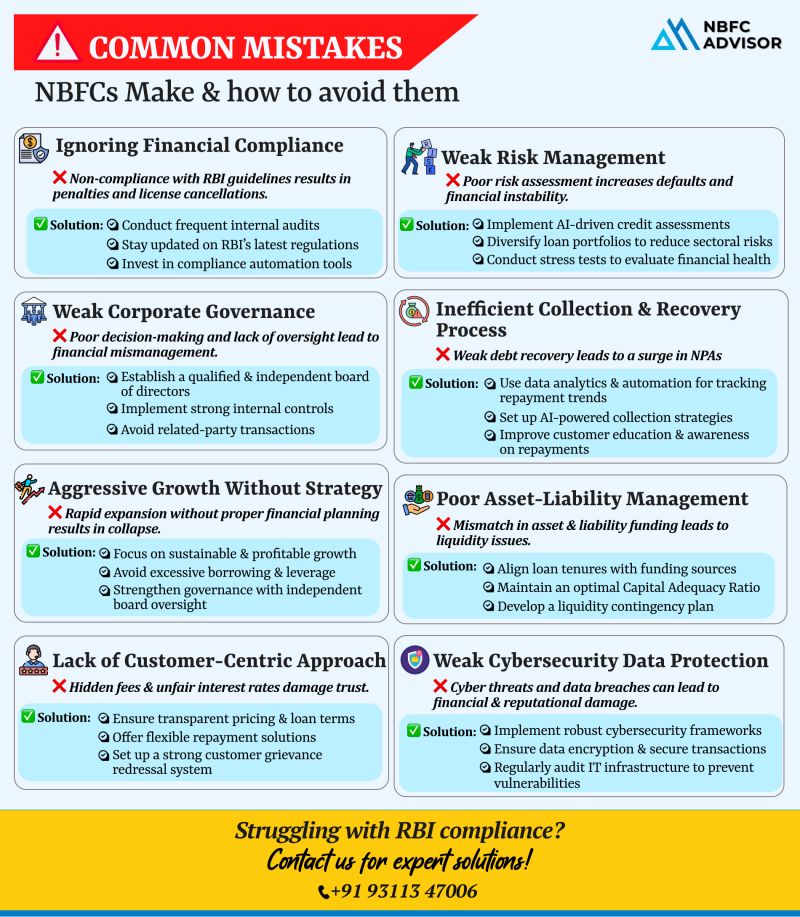

Is Your NBFC Making These Costly Mistakes?

In recent years, the Non-Banking Financial Company (NBFC) sector in India has witnessed rapid growth—but also increased regulatory scrutiny. From RBI license cancellations to skyrocketing NPAs, many...

Avoid These 10 Common Mistakes When Registering an AIF

Registering an Alternative Investment Fund (AIF) with SEBI is a crucial step for fund managers and institutions looking to enter India’s alternative investment space. However, the regist...

Thinking of Buying an NBFC? Here’s How to Do It Right

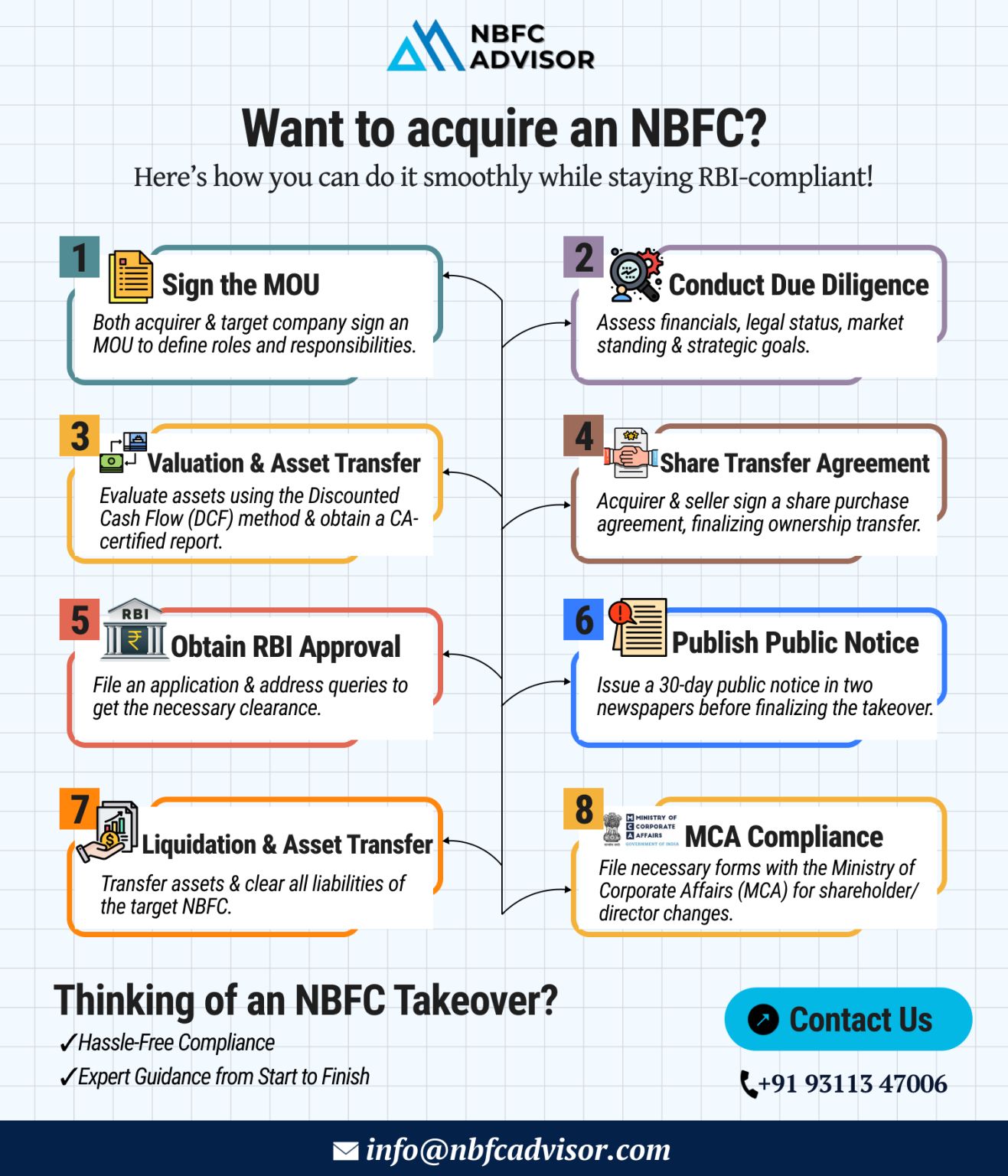

Acquiring a Non-Banking Financial Company (NBFC) can be a strategic move that opens doors to new business opportunities, especially in lending, fintech, and microfinance sectors. But here...

The financial services sector in India is vast and multifaceted, with Non-Banking Financial Companies (NBFCs) playing a crucial role in providing credit and investment solutions. With their increasing presence and significance in the economy, NBFC ta...

In recent years, the Non-Banking Financial Companies (NBFC) sector in India has experienced considerable growth, playing a critical role in providing financial services such as loans, credit and investment. As a result, NBFC takeovers have become inc...