Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

Starting an NBFC vs. Buying One – What’s Smarter?

Entering India’s Non-Banking Financial Company (NBFC) sector is an attractive opportunity for investors, fintech founders, and financial institutions. The big question most invest...

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

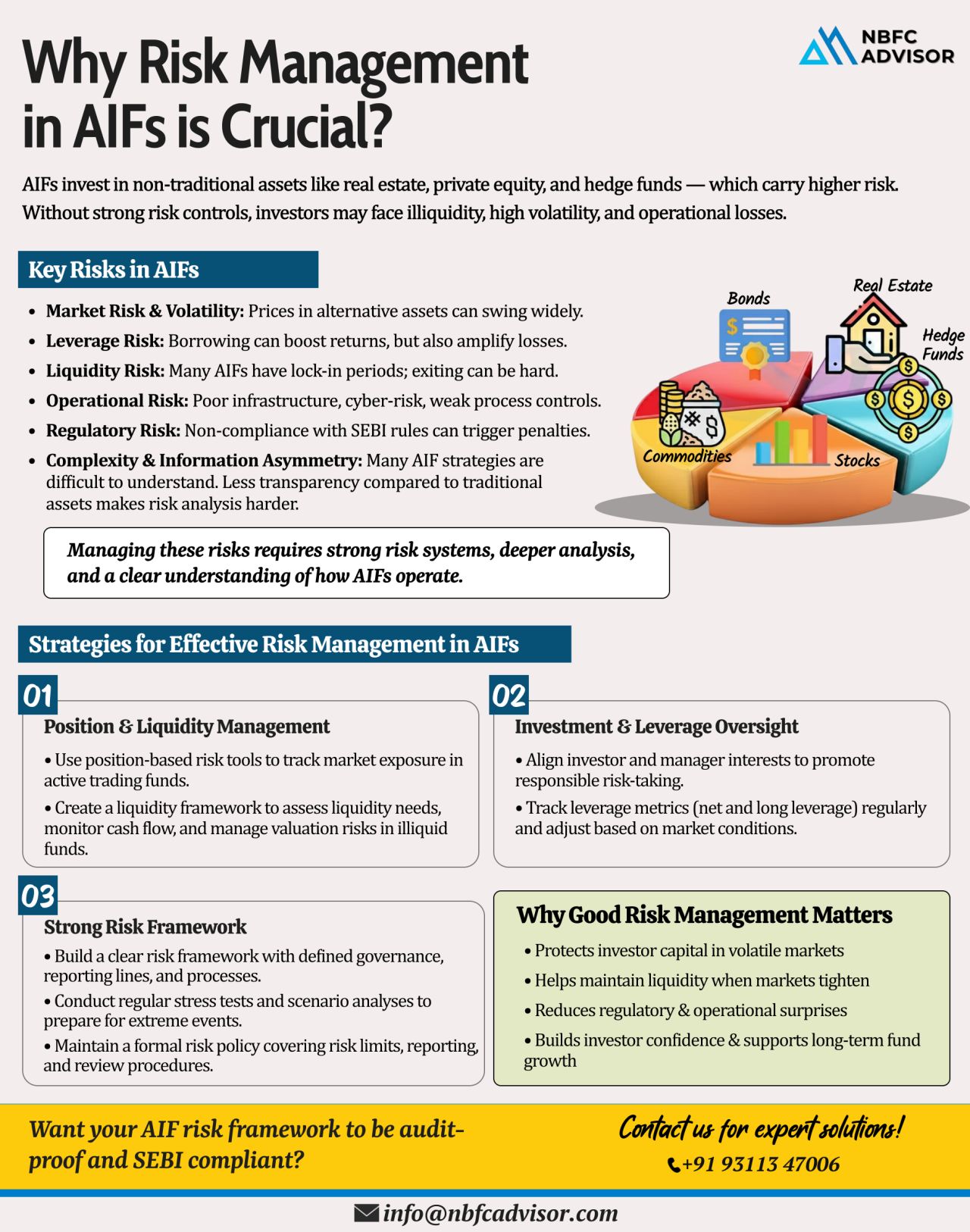

Ignoring Risk in AIFs? Even a Small Market Shift Can Trigger Major Losses

Alternative Investment Funds (AIFs) are growing rapidly in India — from private equity and venture capital to hedge-style Category III funds. But with higher returns c...

Not Sure What License Your Fintech Needs? 🤔

India’s fintech ecosystem — from digital lending apps and payment gateways to neobanks and wealthtech platforms — is expanding faster than ever. But as innovation accelerates, RBI and ...

NBFC Takeovers: A Fast Track to Enter India’s Booming Digital Lending Market

India’s digital lending industry is witnessing an unprecedented surge, with projections suggesting it will touch $515 billion by 2030. From P2P lending platfo...

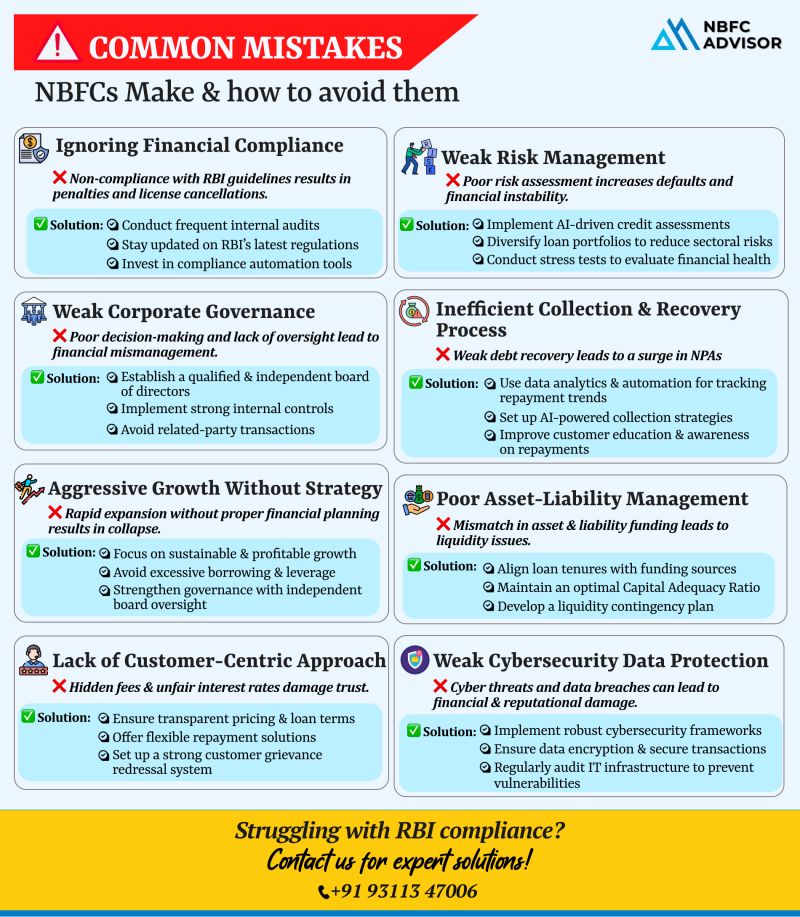

Is Your NBFC Making These Costly Mistakes?

In recent years, the Non-Banking Financial Company (NBFC) sector in India has witnessed rapid growth—but also increased regulatory scrutiny. From RBI license cancellations to skyrocketing NPAs, many...

RBI Set to Tighten Supervisory Norms for NBFCs in FY26: A Shift Toward Stricter Oversight

The Reserve Bank of India (RBI) is poised to implement tighter supervisory norms for Non-Banking Financial Companies (NBFCs) in FY26, with a particular focus...

𝘎𝘰𝘵 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊 𝘓𝘪𝘤𝘦𝘯𝘴𝘦? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Receiving your NBFC license is an exciting milestone — but it’s far from the finish line. In fact, it’s just the start of your complia...