Why NBFCs Are Adding Factoring to Their Portfolio

India’s MSMEs are the backbone of the economy, contributing significantly to employment and GDP. Yet, one persistent challenge continues to limit their growth—cash flow gaps caused by d...

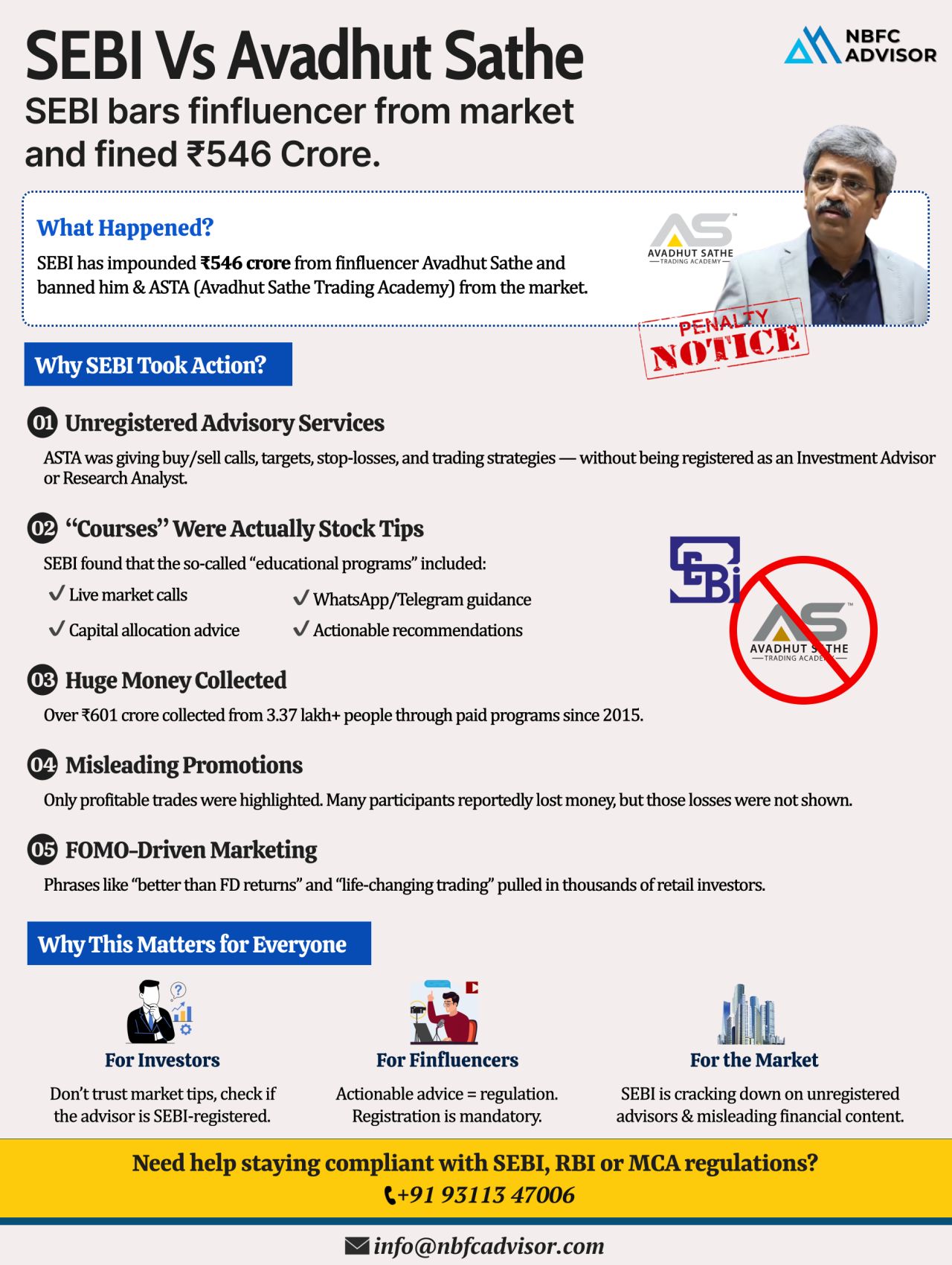

SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut S...

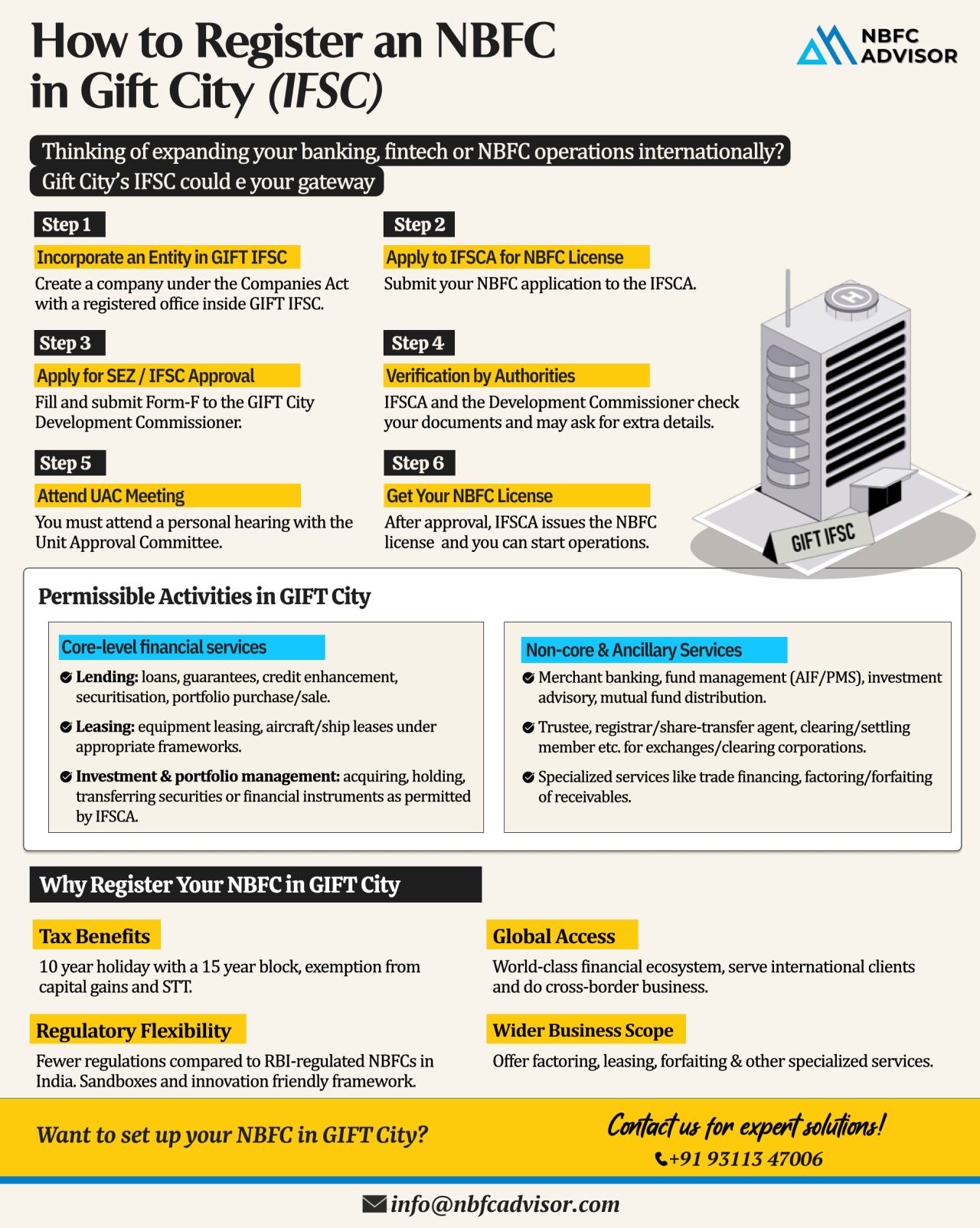

Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (...

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

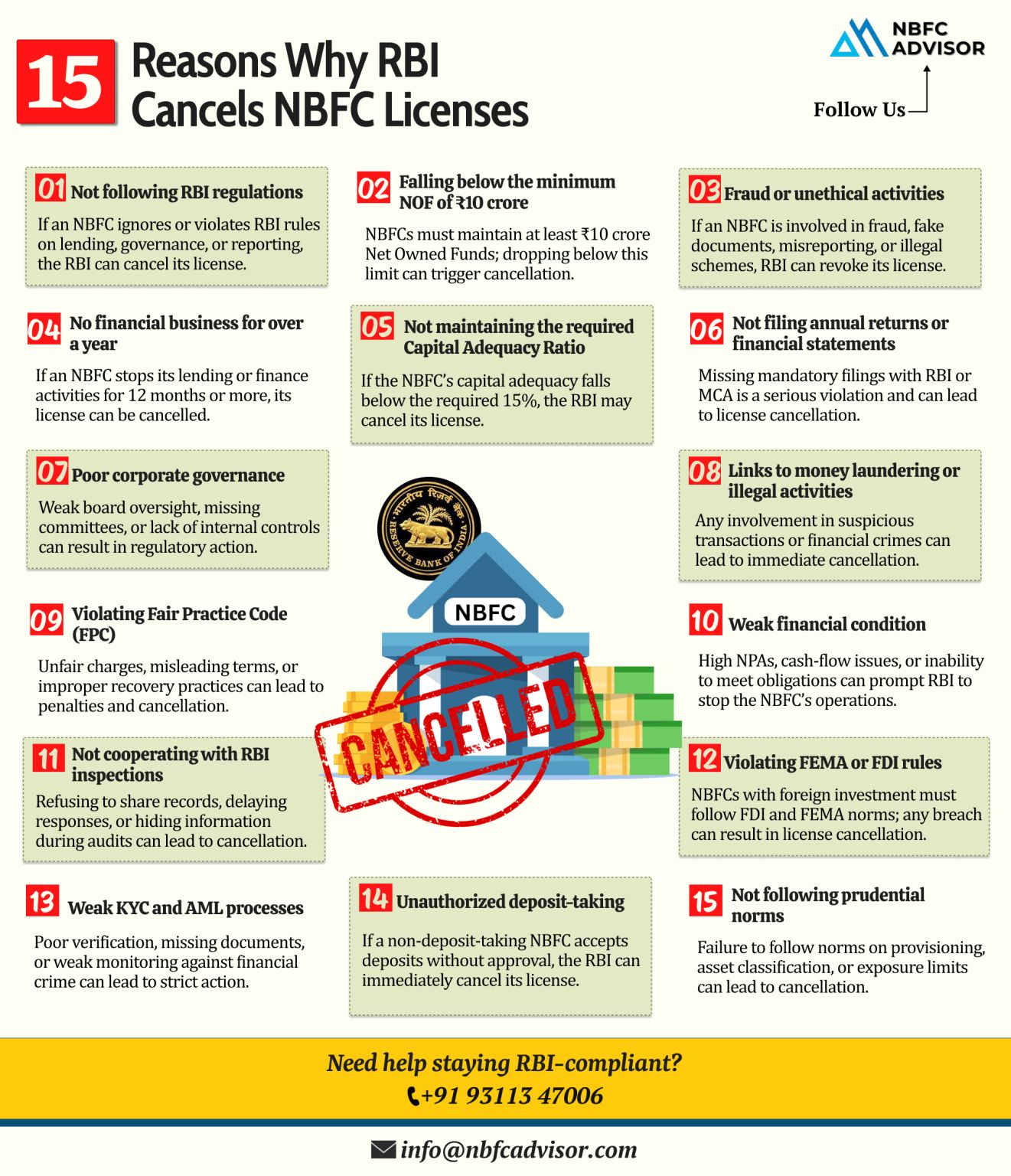

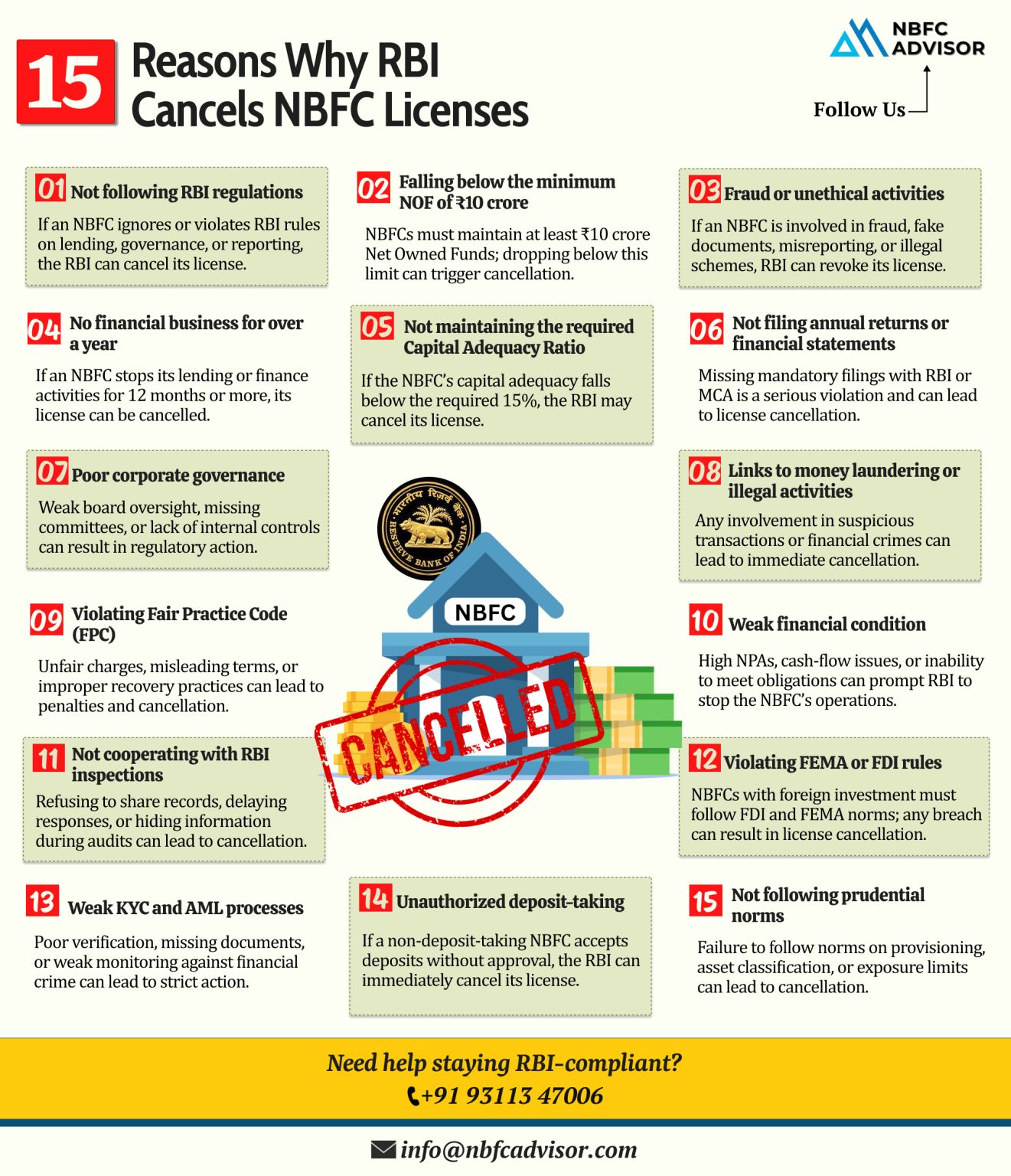

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

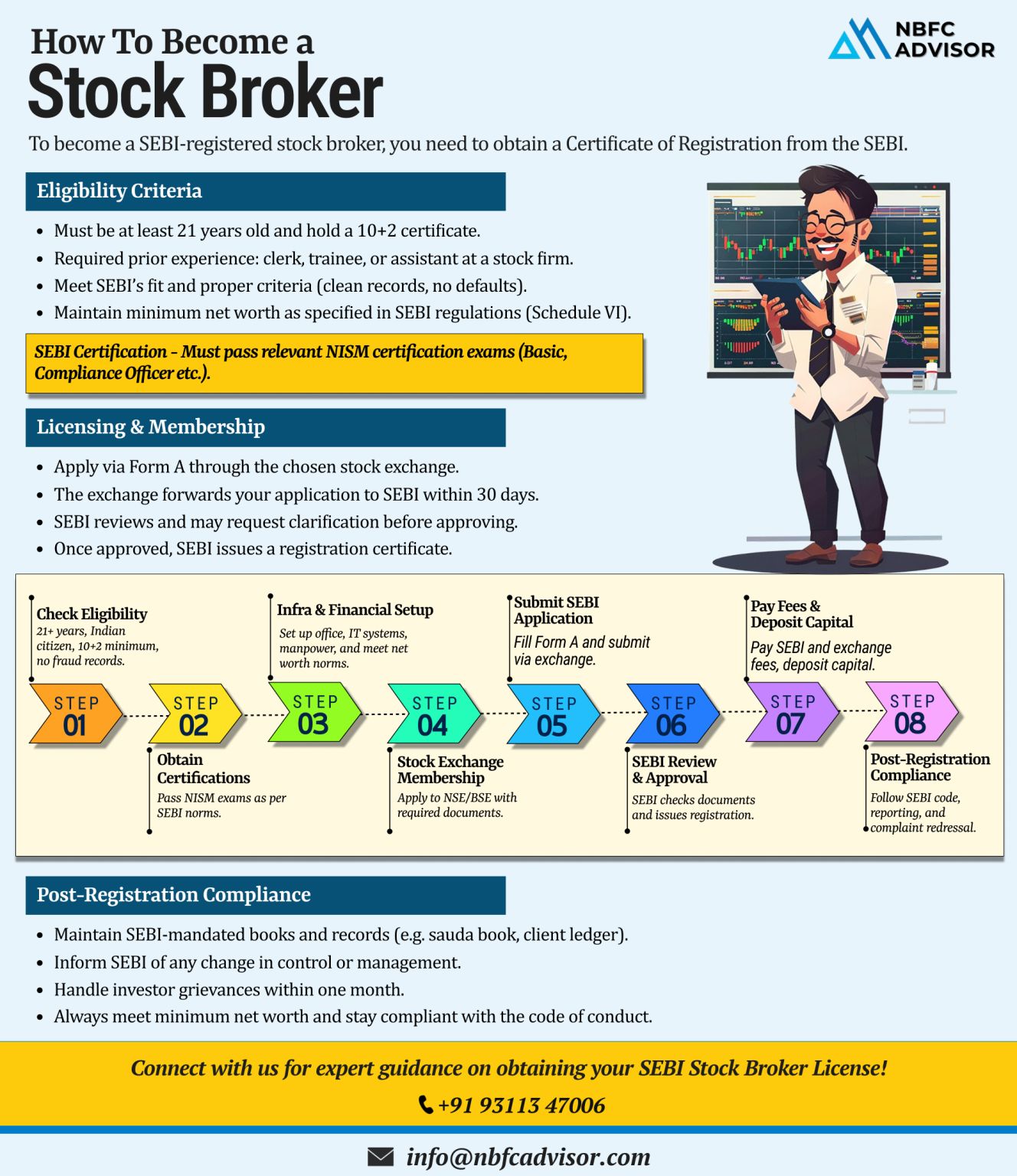

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI-registered stock broker license opens the door to operating legally in India’s capital markets. Whether you plan to trade in equities, derivatives, or other securities, you must mee...

Is Your NBFC Aligned with the Latest RBI Updates?

The Reserve Bank of India (RBI) is taking decisive steps to tighten the compliance framework for Non-Banking Financial Companies (NBFCs), ensuring transparency, customer protection, and responsible...

Avoid These 10 Common Mistakes When Registering an AIF

Registering an Alternative Investment Fund (AIF) with SEBI is a crucial step for fund managers and institutions looking to enter India’s alternative investment space. However, the regist...

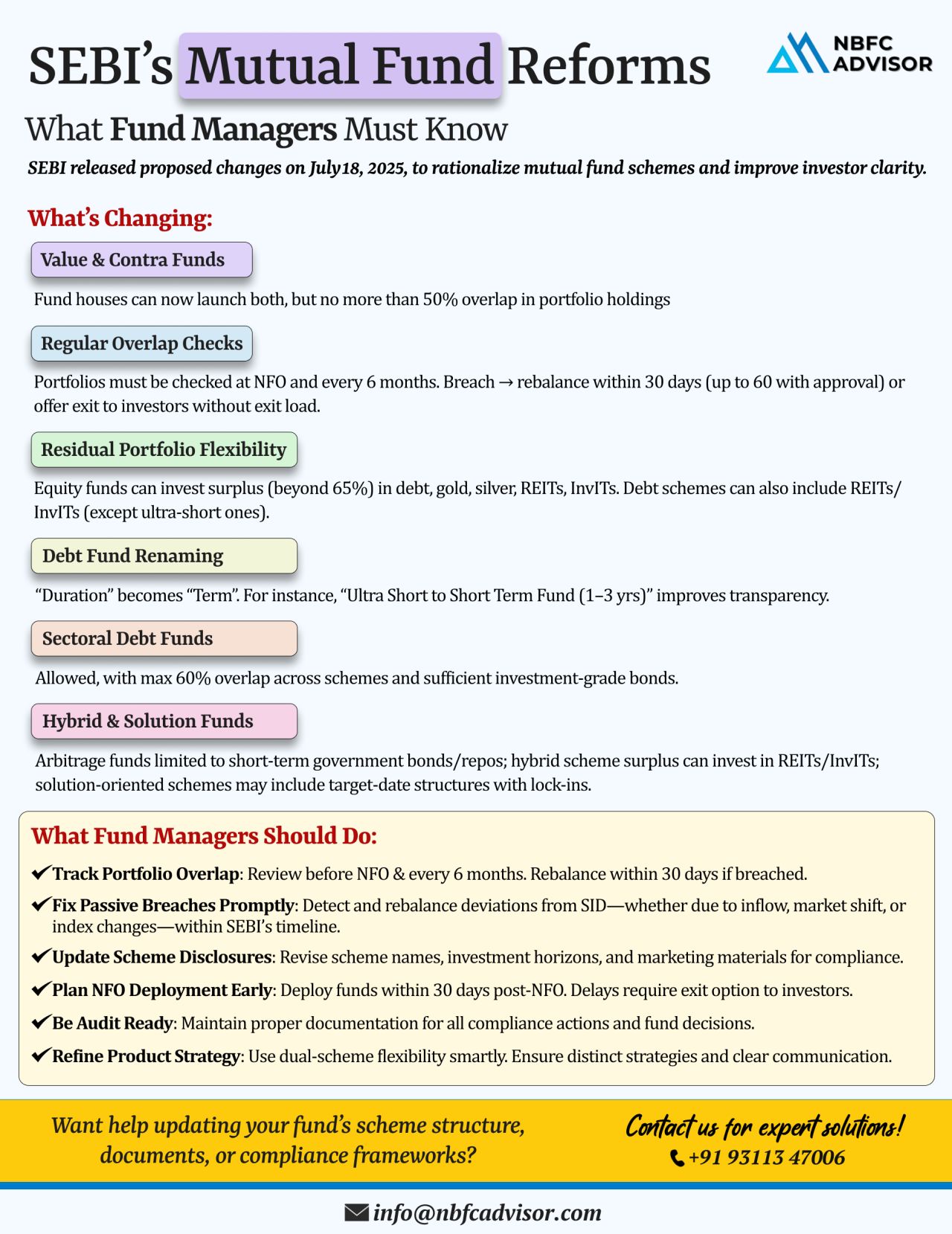

📰 SEBI’s New Mutual Fund Reforms: What Investors & Fund Managers Need to Know

The Securities and Exchange Board of India (SEBI) has proposed sweeping changes to the mutual fund framework to enhance transparency, reduce overlap, and ensu...

RBI Tightens the Reins on NBFCs — Is Your Company Ready for Compliance Scrutiny?

India’s financial watchdog, the Reserve Bank of India (RBI), is stepping up its enforcement measures against Non-Banking Financial Companies (NBFCs). Rece...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

A Landmark Deal Reshaping India’s NBFC Landscape

In a decisive move that signals the rising consolidation in India’s NBFC sector, UGRO Capital has announced the acquisition of Profectus Capital Pvt. Ltd. for ₹1,400 crore. This strategi...