India’s Digital Lending Space Is Growing Faster Than Ever — What You Need to Know

India’s digital lending ecosystem is expanding at breakneck speed, transforming how individuals and businesses access credit. Fueled by mobile adop...

NBFC Takeover Procedure in India – Complete Regulatory Guide

A takeover of a Non-Banking Financial Company (NBFC) is a strategic move for investors and businesses seeking a faster entry into the financial services sector. However, due to str...

Why NBFCs Are Adding Factoring to Their Portfolio

India’s MSMEs are the backbone of the economy, contributing significantly to employment and GDP. Yet, one persistent challenge continues to limit their growth—cash flow gaps caused by d...

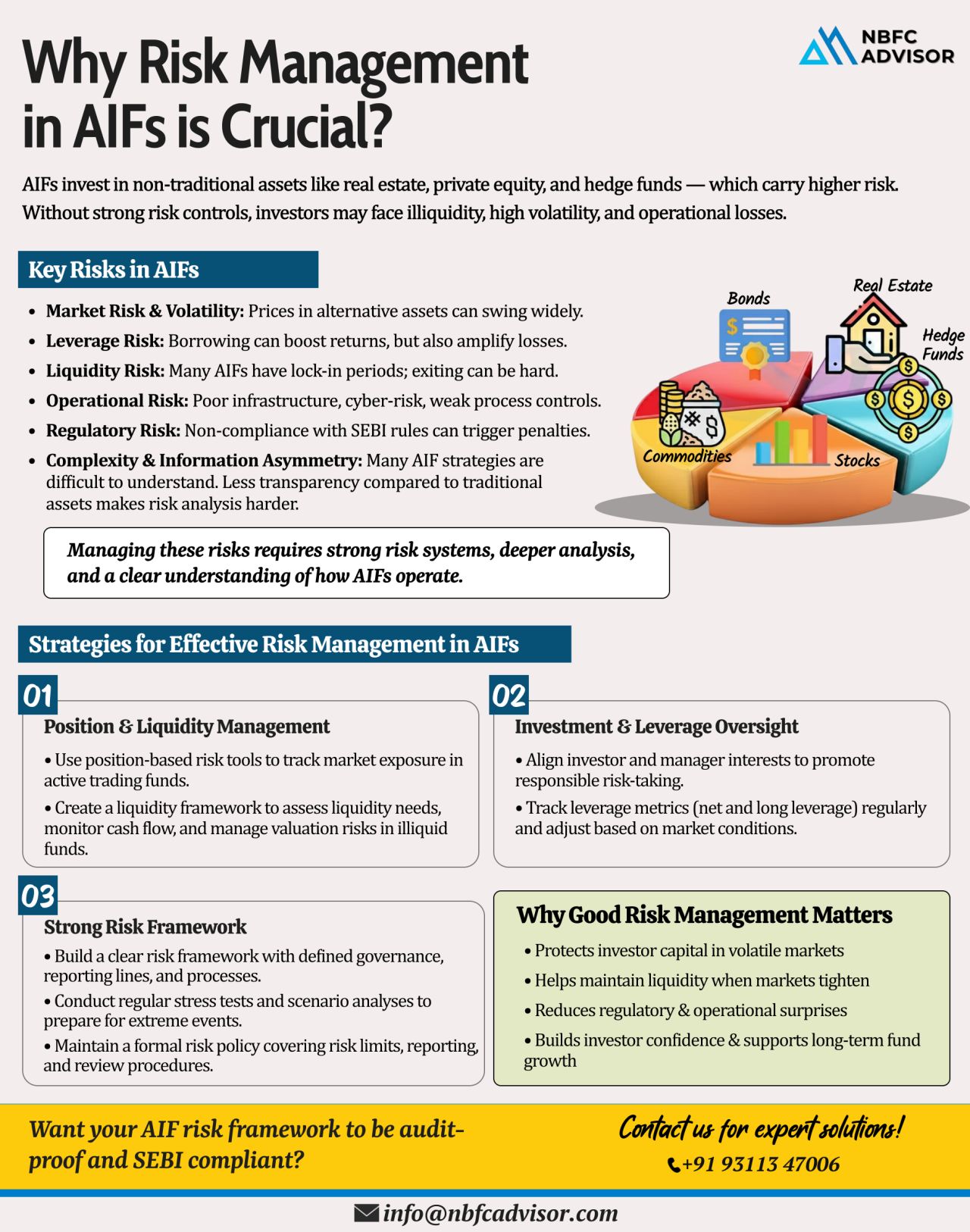

Ignoring Risk in AIFs? Even a Small Market Shift Can Trigger Major Losses

Alternative Investment Funds (AIFs) are growing rapidly in India — from private equity and venture capital to hedge-style Category III funds. But with higher returns c...

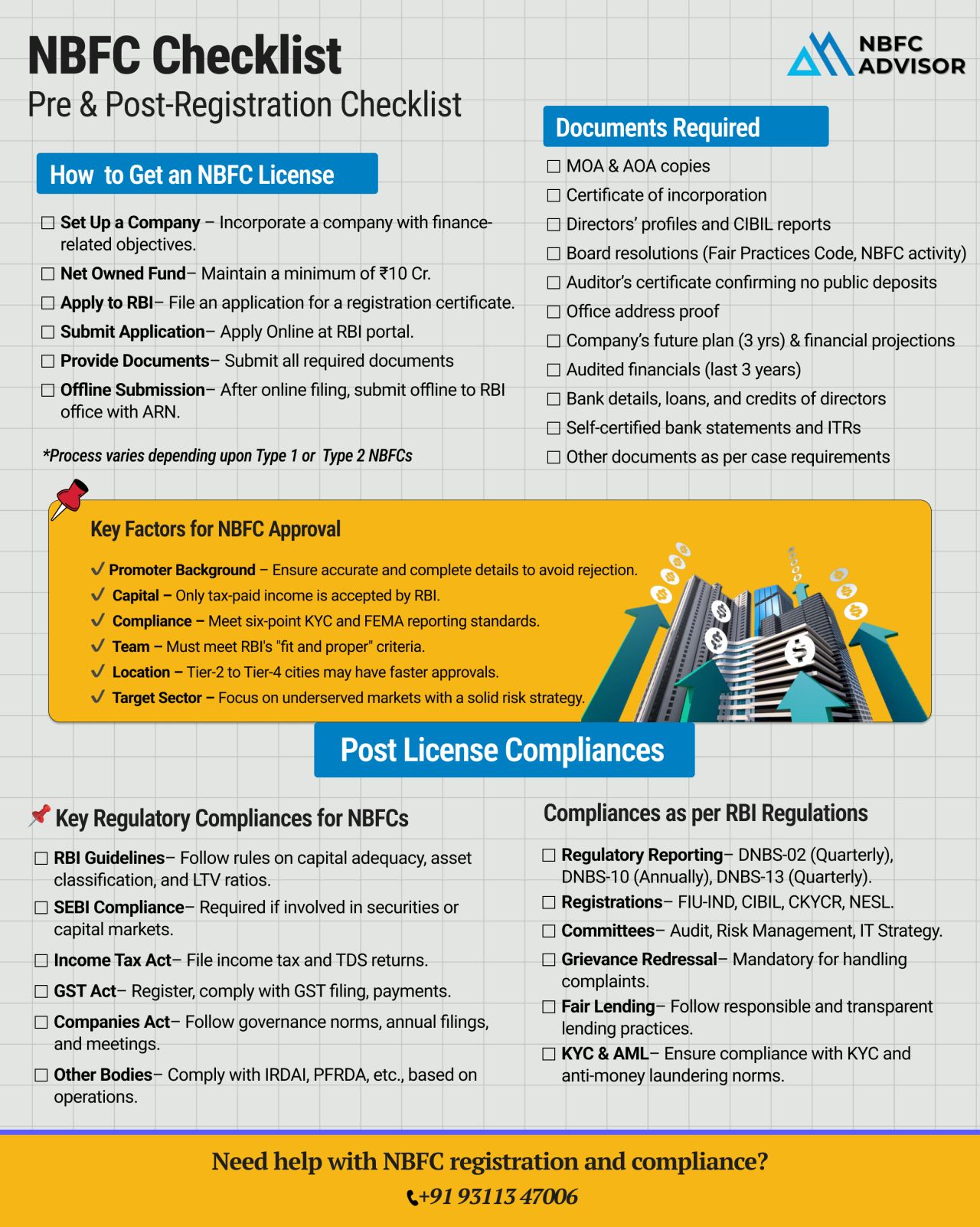

𝐏𝐥𝐚𝐧𝐧𝐢𝐧𝐠 𝐭𝐨 𝐬𝐭𝐚𝐫𝐭 𝐚𝐧 𝐍𝐁𝐅𝐂?

Many founders begin the process without knowing exactly which documents, approvals, and compliance steps are required.

But RBI approval depends on clear paperwork, promoter background, capital pro...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

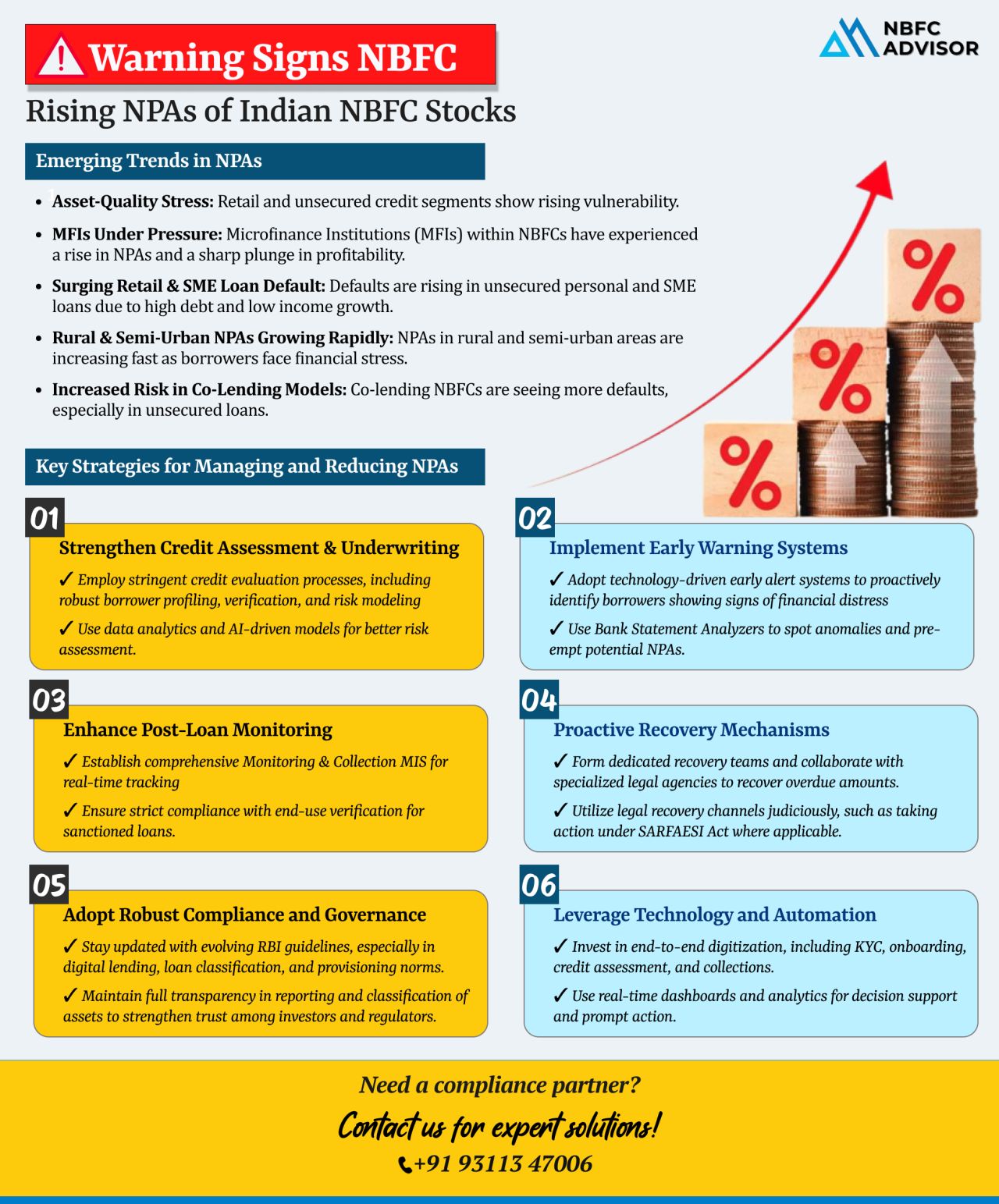

Rising NPAs Are a Wake-Up Call for NBFCs

India’s NBFC sector is under pressure. The alarming rise in Non-Performing Assets (NPAs) is sending a clear signal—NBFCs need to act now.

From unsecured personal loans to SME and rural lendin...

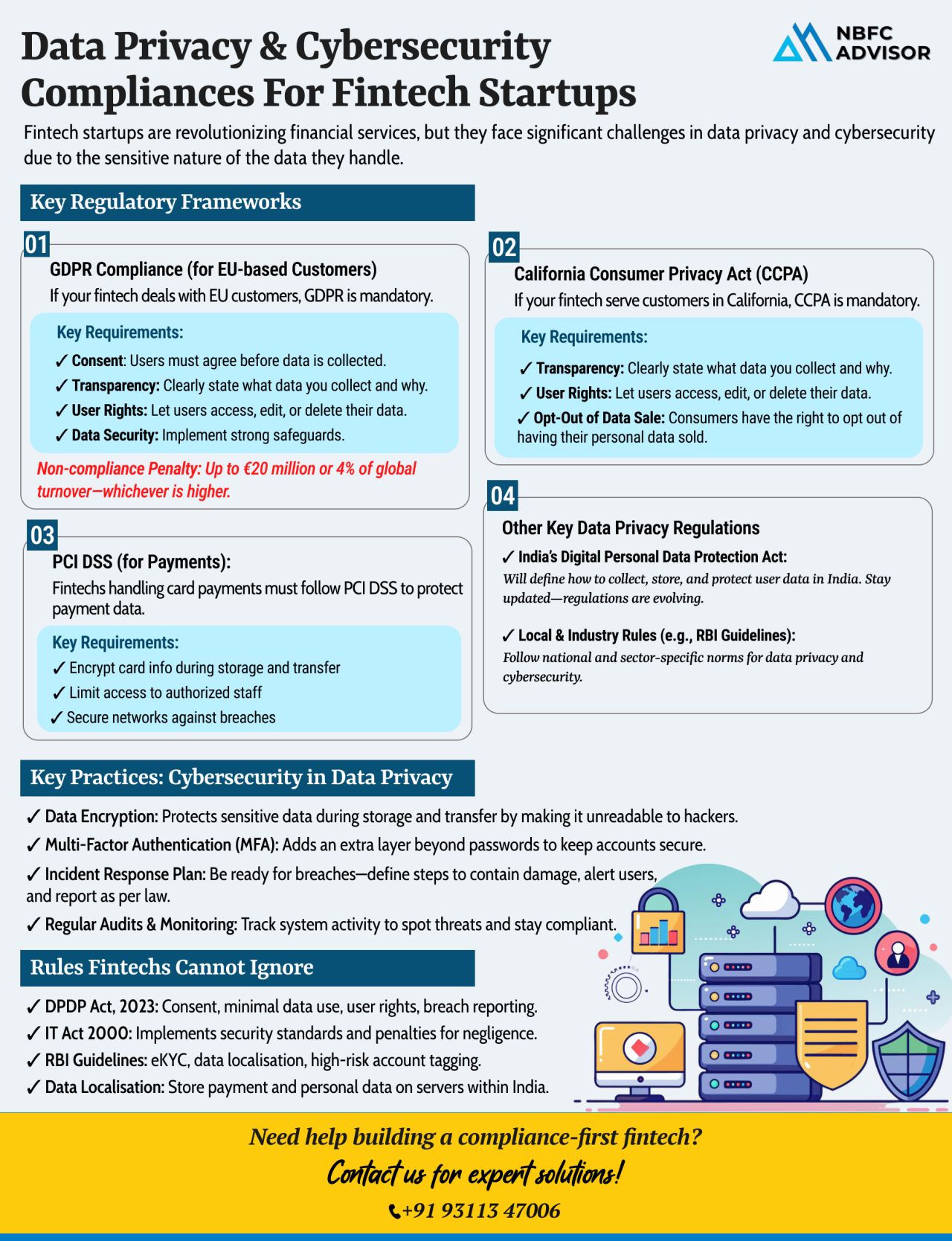

Building a Fintech? One Data Leak Can Destroy Everything

In today’s digital-first world, launching a fintech startup is an exciting venture—but one security misstep can bring it all crashing down. Whether you're building a lending ...

𝘎𝘰𝘵 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊 𝘓𝘪𝘤𝘦𝘯𝘴𝘦? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Receiving your NBFC license is an exciting milestone — but it’s far from the finish line. In fact, it’s just the start of your complia...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

The financial services sector in India is vast and multifaceted, with Non-Banking Financial Companies (NBFCs) playing a crucial role in providing credit and investment solutions. With their increasing presence and significance in the economy, NBFC ta...