Small NBFCs: The Backbone of India’s Lending Ecosystem—Yet Struggling to Scale

Small NBFCs play a critical role in India’s financial ecosystem. They reach underserved borrowers, support MSMEs, and operate in geographies where tra...

Why NBFCs Are Adding Factoring to Their Portfolio

India’s MSMEs are the backbone of the economy, contributing significantly to employment and GDP. Yet, one persistent challenge continues to limit their growth—cash flow gaps caused by d...

Starting an NBFC vs. Buying One – What’s Smarter?

Entering India’s Non-Banking Financial Company (NBFC) sector is an attractive opportunity for investors, fintech founders, and financial institutions. The big question most invest...

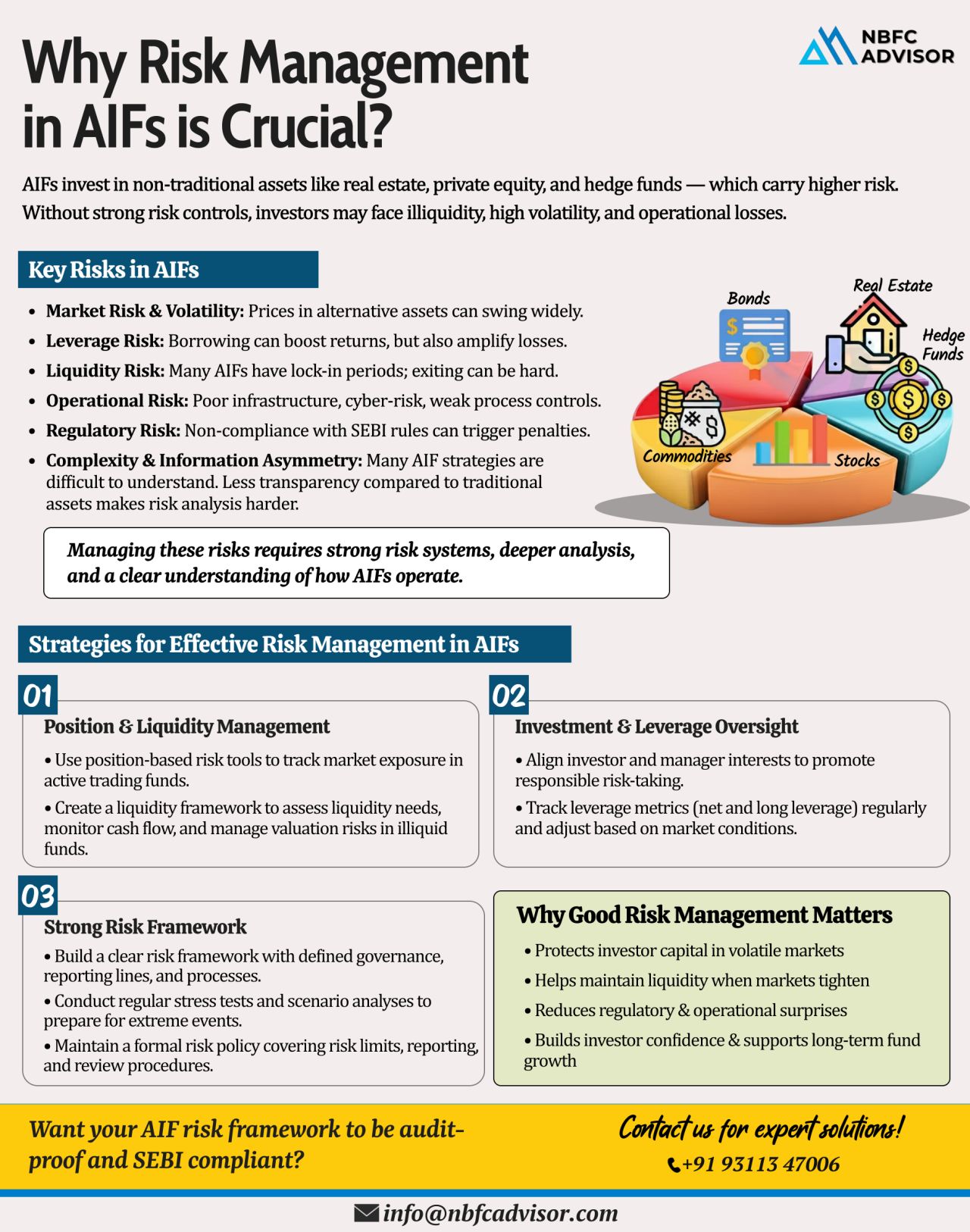

Ignoring Risk in AIFs? Even a Small Market Shift Can Trigger Major Losses

Alternative Investment Funds (AIFs) are growing rapidly in India — from private equity and venture capital to hedge-style Category III funds. But with higher returns c...

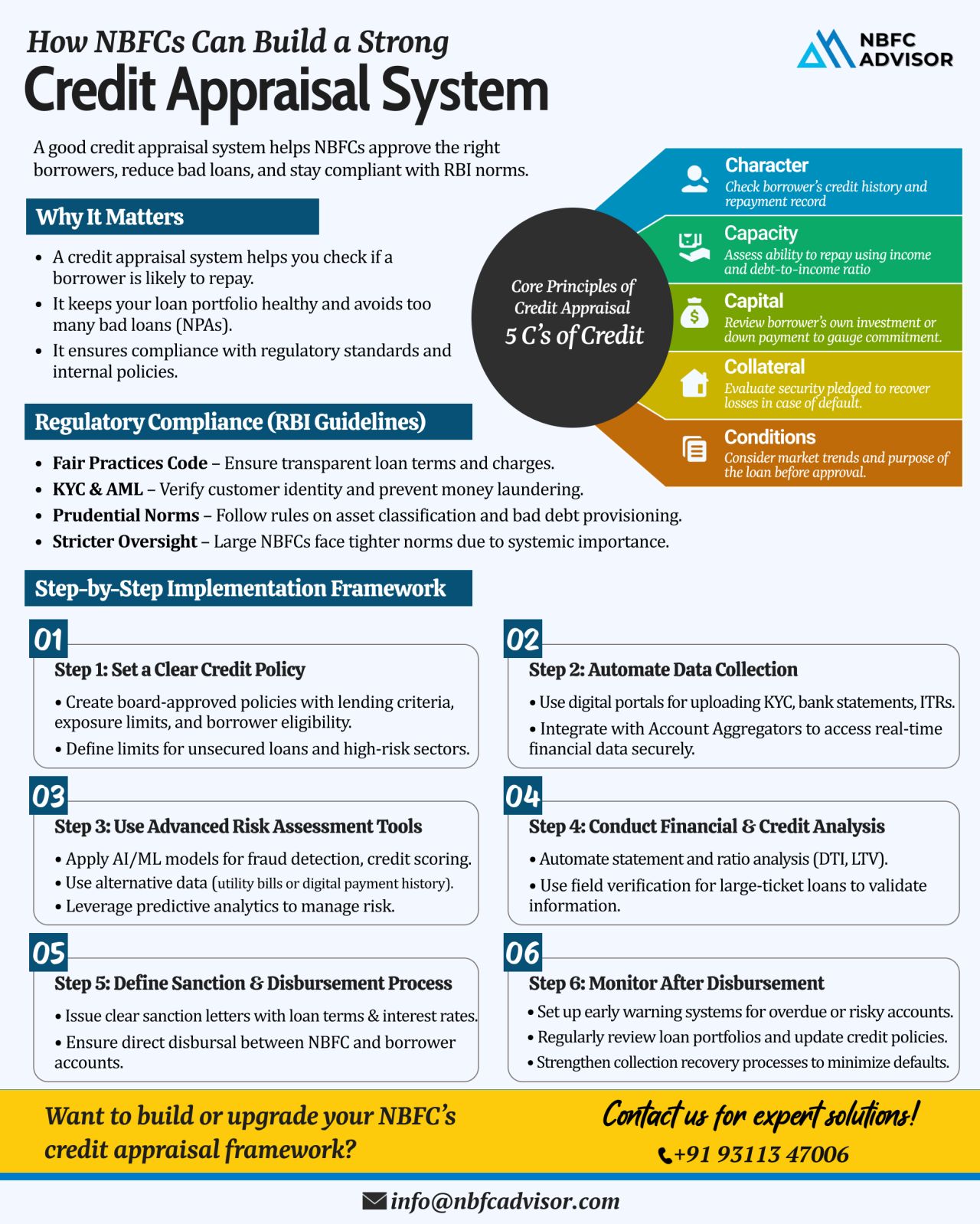

Want to Reduce Loan Defaults? Build a Strong Credit Appraisal Framework

In the fast-paced world of digital lending and NBFC operations, the biggest threat to long-term sustainability isn’t competition — it’s loan defaults.

Mos...

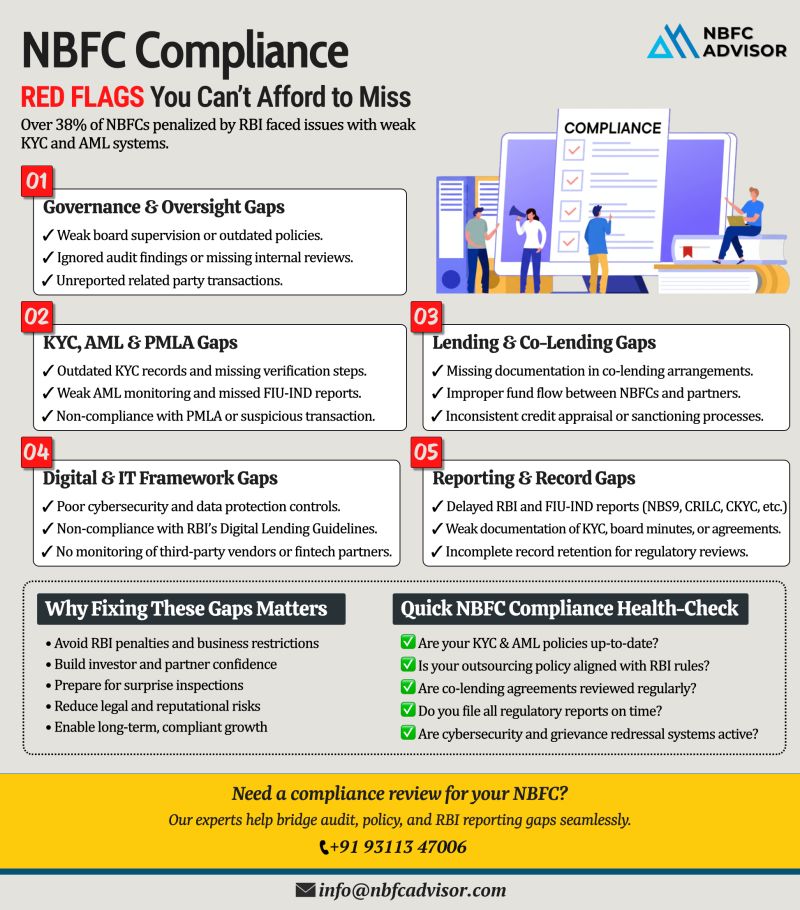

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

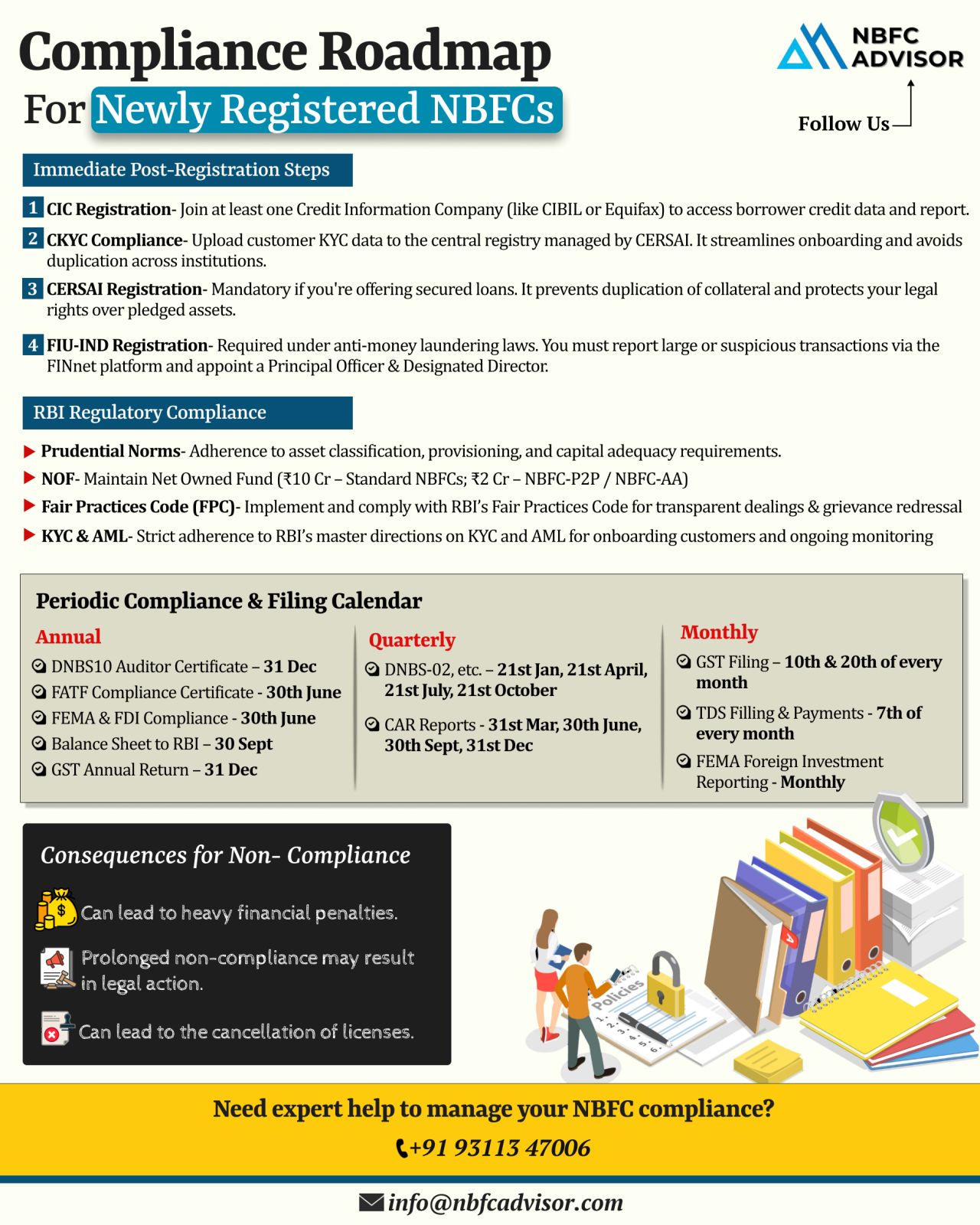

Newly Registered as an NBFC? Here’s What You Need to Know About Compliance

Getting your RBI license is a milestone worth celebrating—but it’s only the beginning of your NBFC journey. The real challenge starts with regulatory comp...

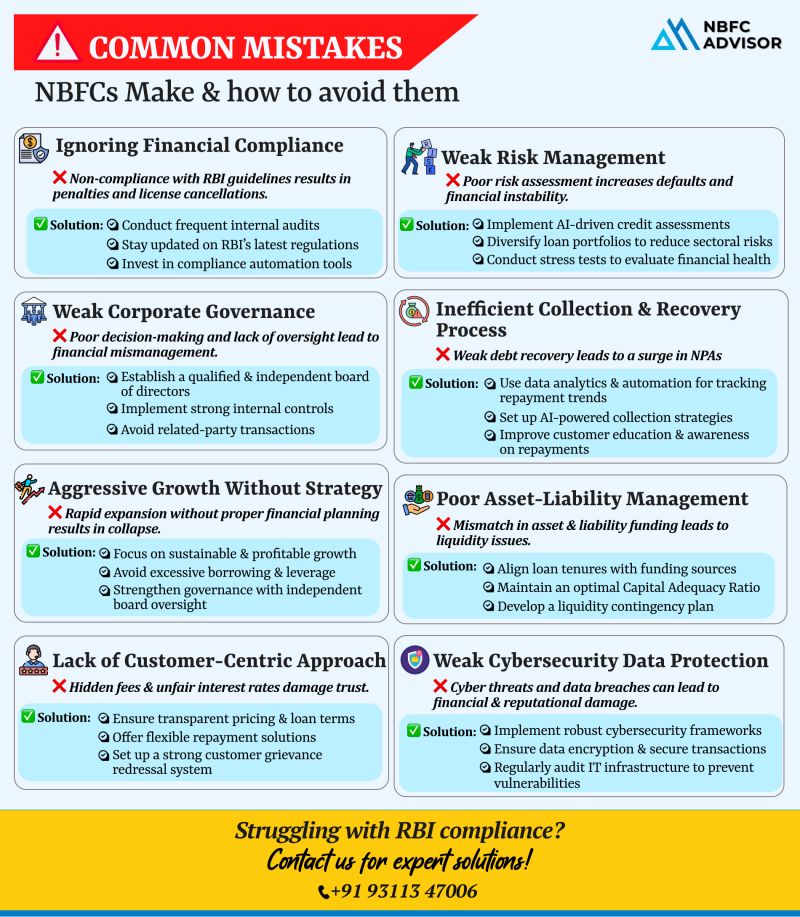

Is Your NBFC Making These Costly Mistakes?

In recent years, the Non-Banking Financial Company (NBFC) sector in India has witnessed rapid growth—but also increased regulatory scrutiny. From RBI license cancellations to skyrocketing NPAs, many...

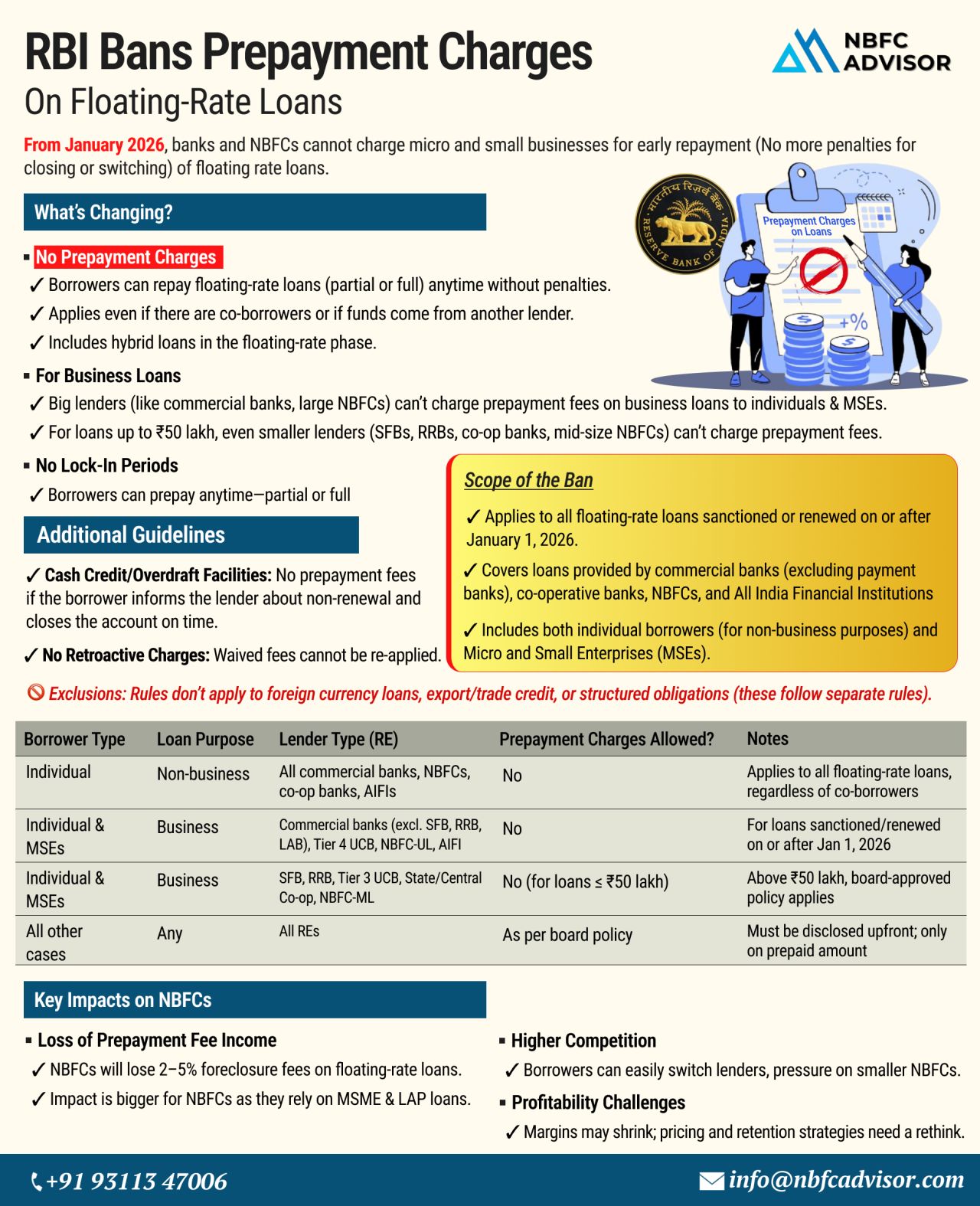

RBI Bans Prepayment Charges on Floating-Rate Loans

What It Means for NBFCs Starting January 2026

The Reserve Bank of India (RBI) has rolled out a major regulatory change aimed at giving borrowers more freedom. From January 1, 2026, no prepaymen...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

❌ Top Reasons Why NBFC License Applications Get Rejected

1. Weak Business Plan and Unrealistic Projections

The RBI expects applicants to submit a well-defined, sector-focused business plan backed by in-depth market research and practical financia...

🚀 The NBFC Sector in India is Experiencing Unmatched Growth! 🚀

Are You Ready to Seize the Opportunity?

India’s Non-Banking Financial Company (NBFC) sector is growing at an extraordinary pace, driven by rising demand for digital lending,...