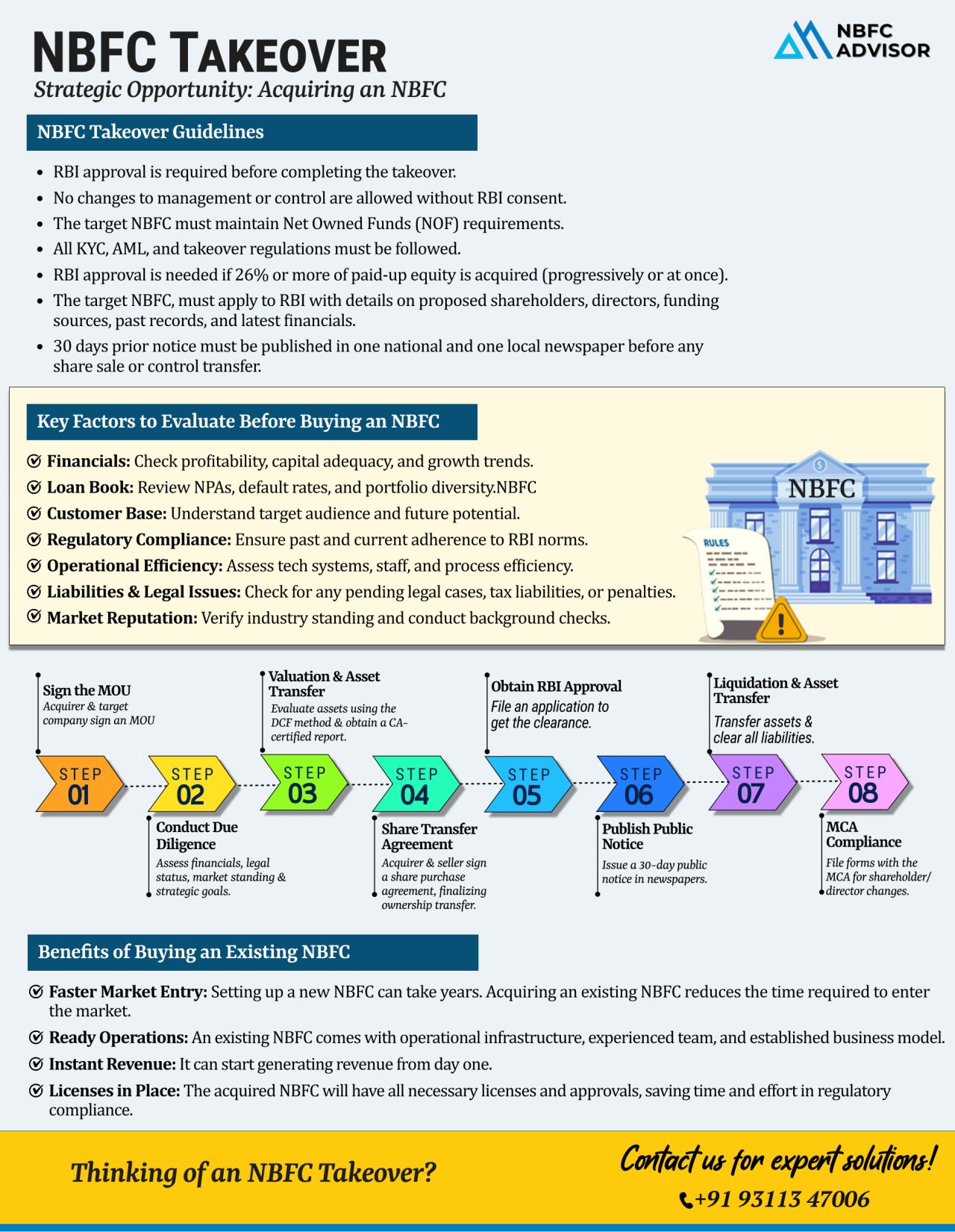

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

Looking to Acquire an NBFC for Sale? Here’s What You Must Know

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. However, buying an NBFC without proper checks can ex...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

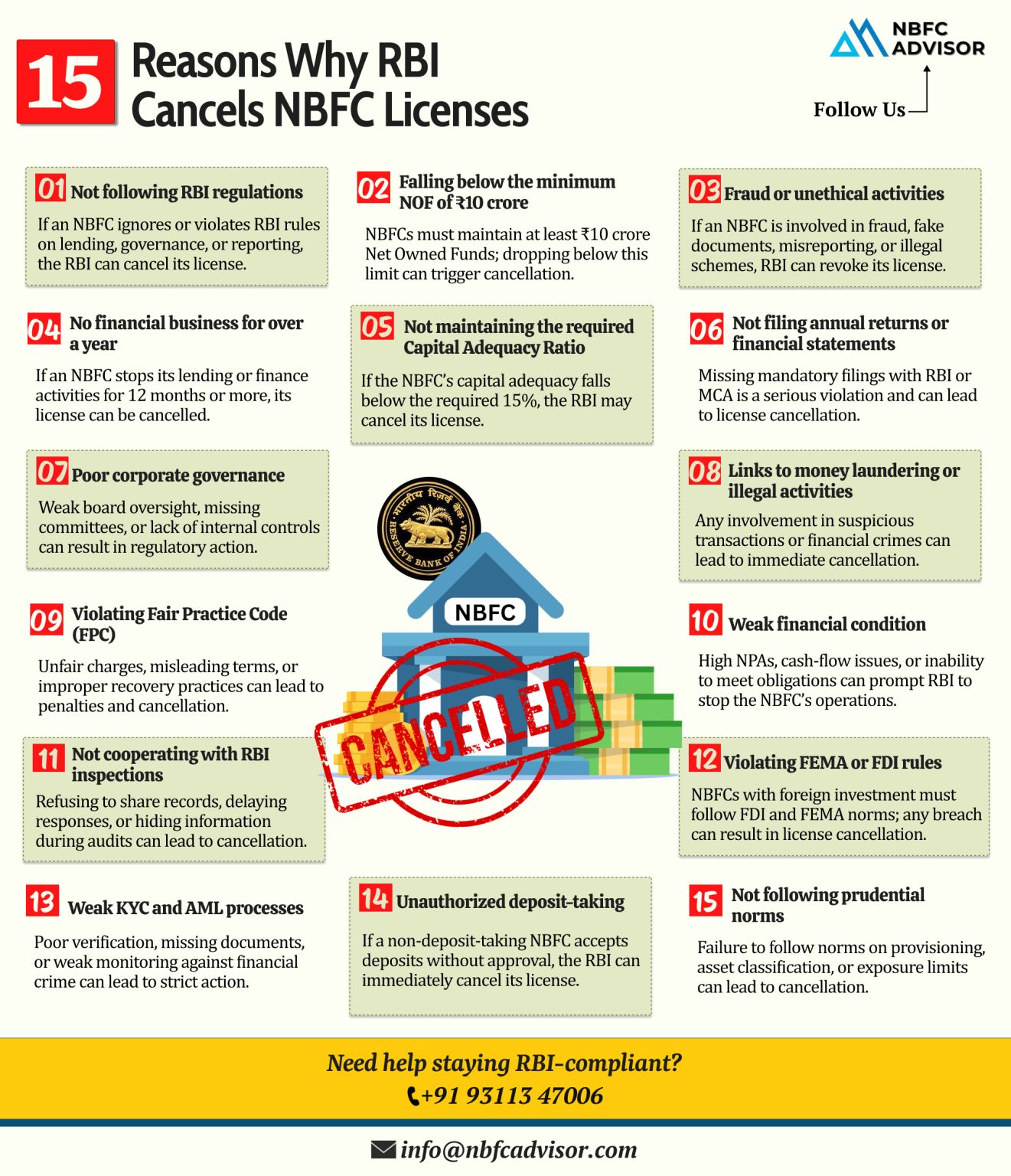

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

Many NBFC Applications Get Rejected by the RBI — Here’s Why! ⚠️

Avoid Costly Mistakes Before You Apply

Every year, the Reserve Bank of India (RBI) receives hundreds of applications for NBFC (Non-Banking Financial Company) registrati...

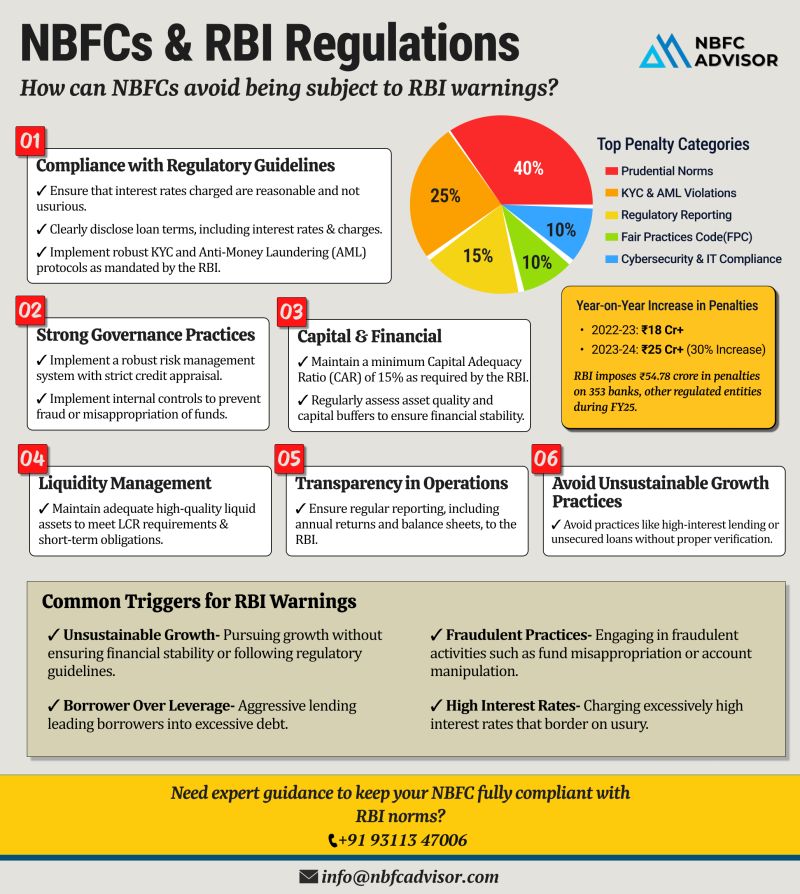

RBI Penalties on NBFCs Jumped 30% in Just One Year — Is Your NBFC at Risk?

The Reserve Bank of India (RBI) has intensified its oversight on financial institutions — and the numbers speak for themselves.

In FY 2022–23, RBI impo...

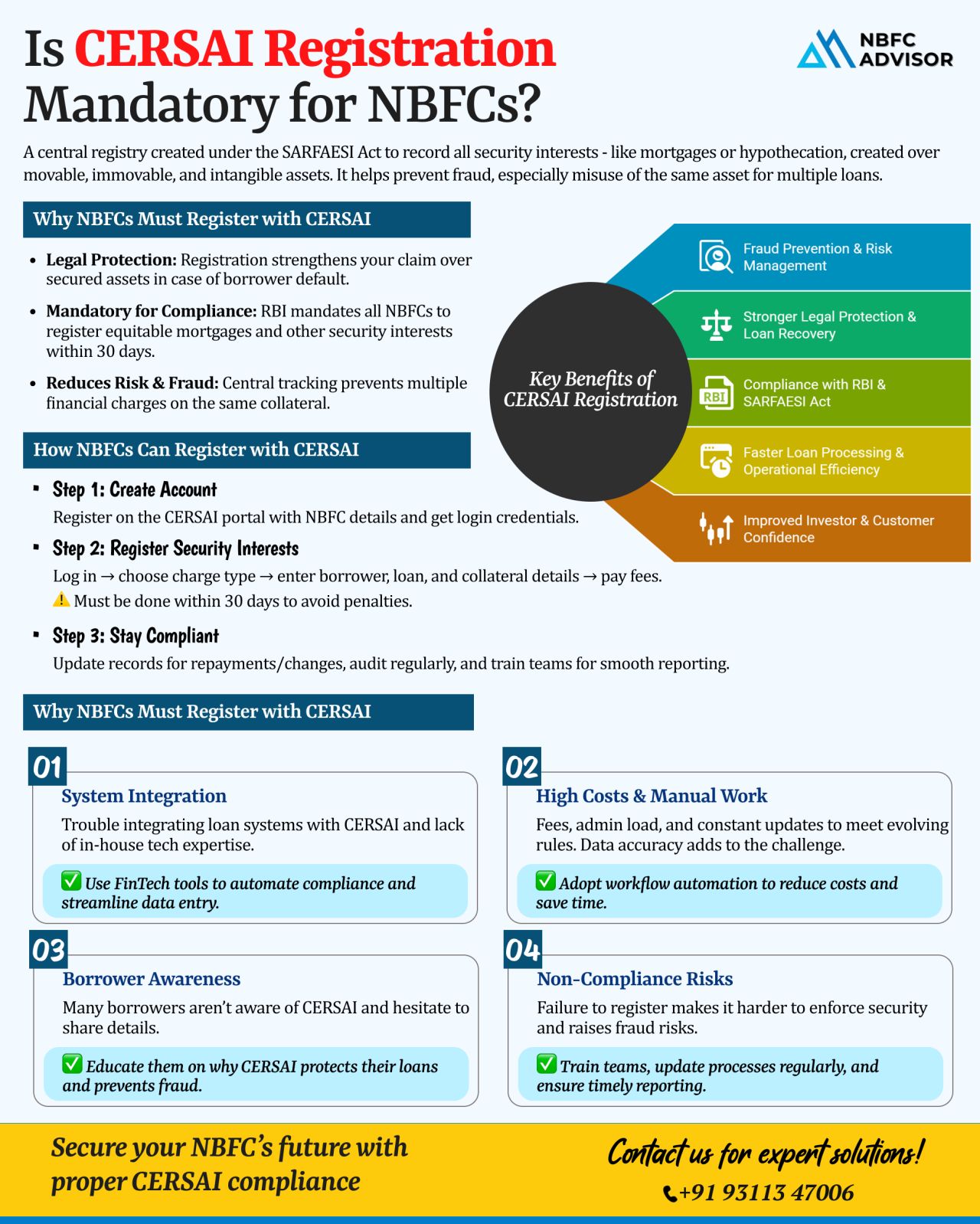

Is CERSAI Registration Mandatory for NBFCs?

One of the most common mistakes many NBFCs make is overlooking CERSAI registration. While compliance with RBI guidelines and customer onboarding processes get due attention, CERSAI often slips under the ...

Want to Enter India’s Booming Lending Sector—Without Waiting Years?

India’s lending market is expanding at an unprecedented pace—driven by fintech innovation, rising credit demand, and digital-first borrowers. But setting u...

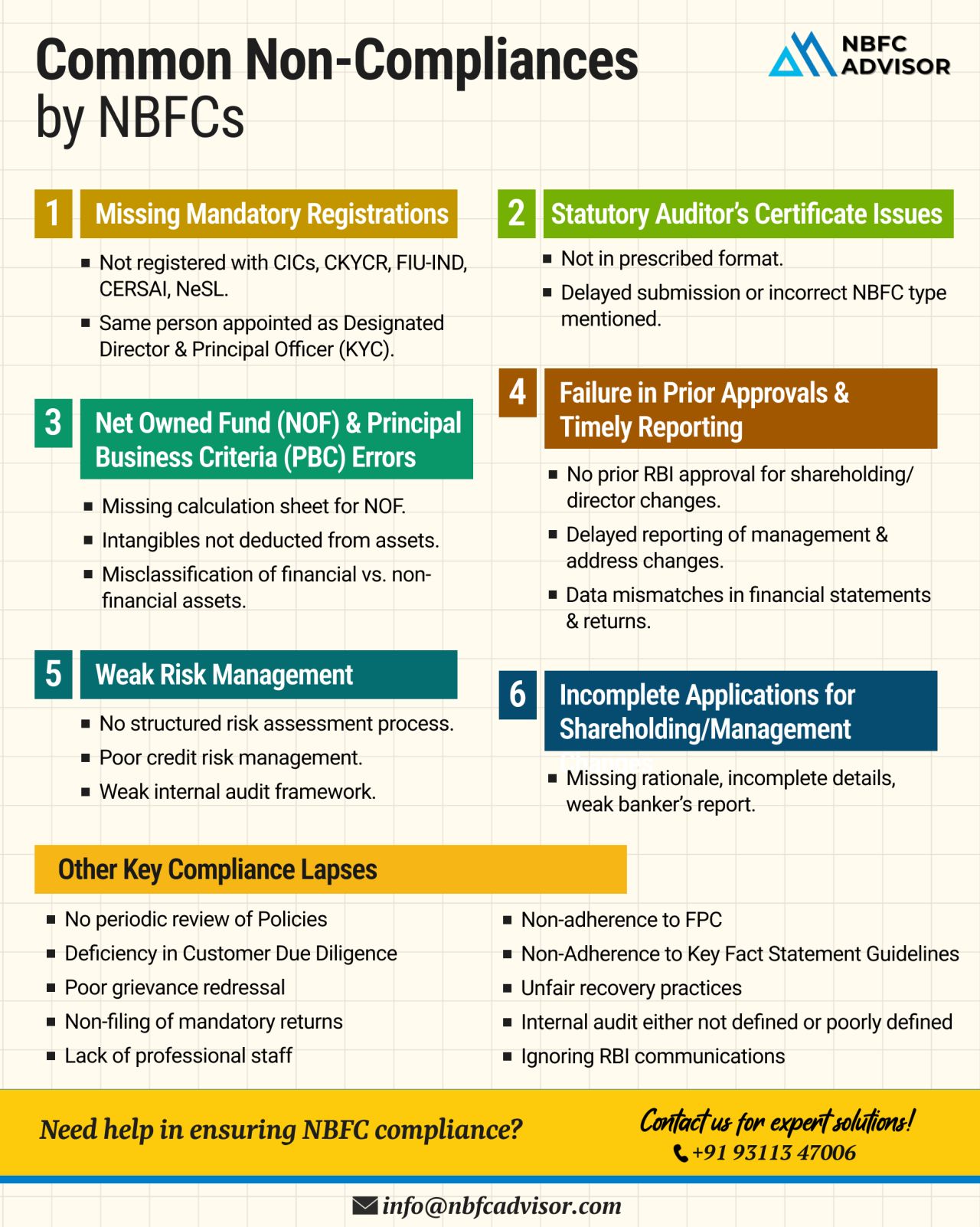

⚠️ Is Your NBFC Prepared for RBI Scrutiny?

The Reserve Bank of India (RBI) has intensified its oversight of Non-Banking Financial Companies (NBFCs), and non-compliance—whether intentional or not—can lead to serious repercussions.

Fr...

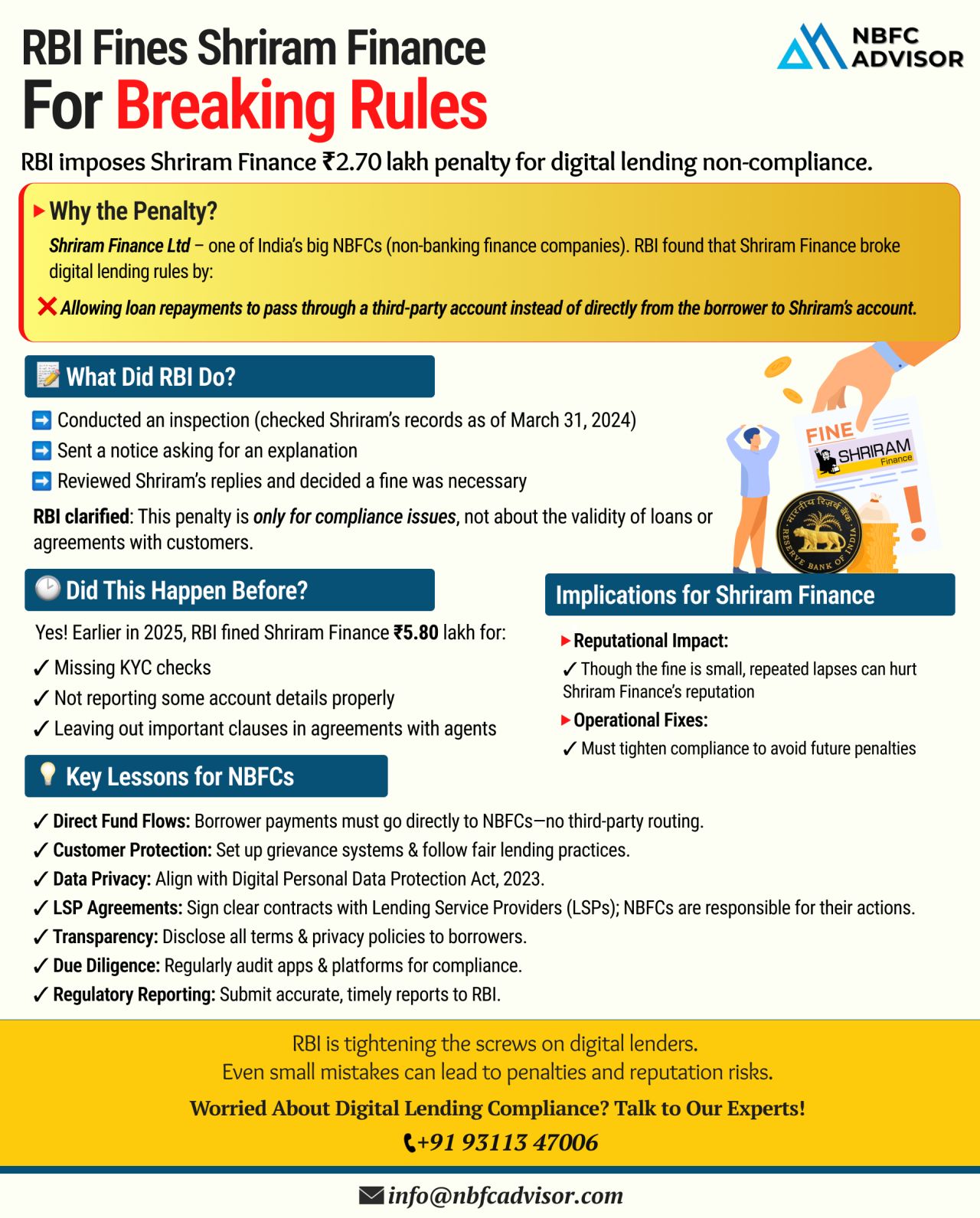

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

𝘎𝘰𝘵 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊 𝘓𝘪𝘤𝘦𝘯𝘴𝘦? 𝘛𝘩𝘢𝘵’𝘴 𝘖𝘯𝘭𝘺 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Receiving your NBFC license is an exciting milestone — but it’s far from the finish line. In fact, it’s just the start of your complia...

❌ Top Reasons Why NBFC License Applications Get Rejected

1. Weak Business Plan and Unrealistic Projections

The RBI expects applicants to submit a well-defined, sector-focused business plan backed by in-depth market research and practical financia...

🚀 The NBFC Sector in India is Experiencing Unmatched Growth! 🚀

Are You Ready to Seize the Opportunity?

India’s Non-Banking Financial Company (NBFC) sector is growing at an extraordinary pace, driven by rising demand for digital lending,...