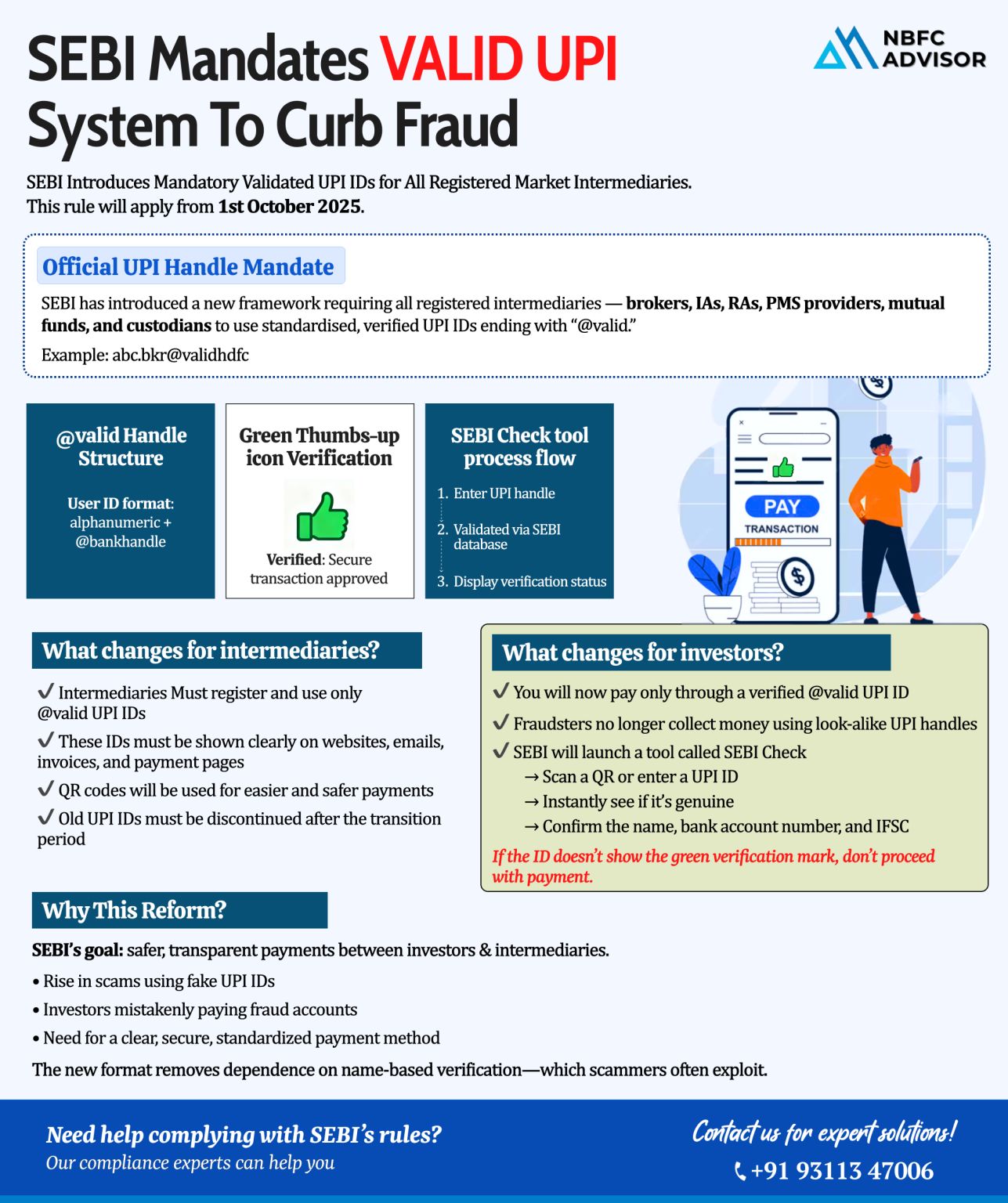

SEBI Introduces VALID UPI System: A Big Move to Protect Investors from Fraud

In a major regulatory development, SEBI has introduced the VALID UPI system, making it mandatory for all registered market intermediaries to use SEBI-verified UPI IDs onl...

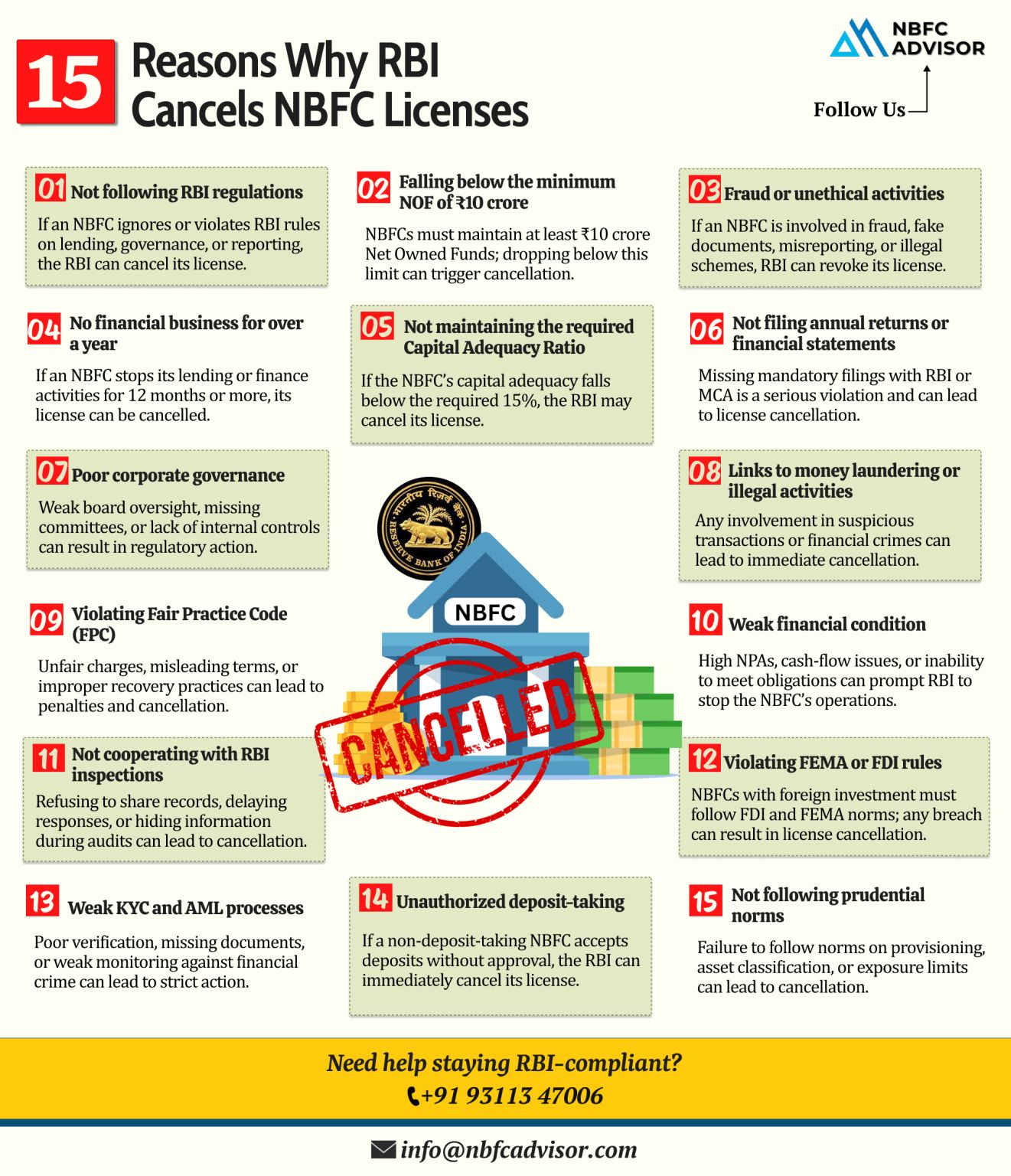

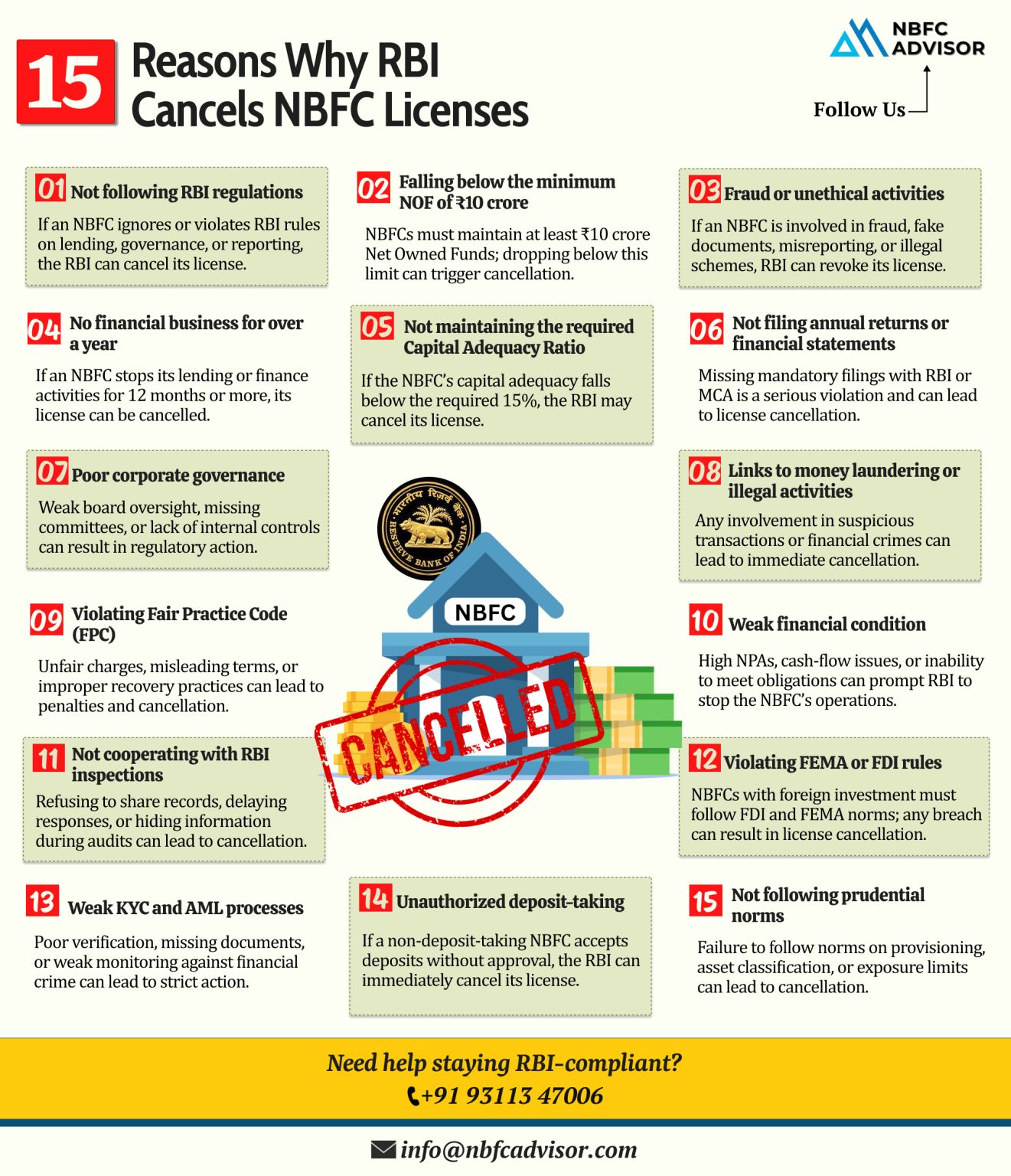

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

Is Your NBFC Still Running on Legacy Systems? It’s Time to Transform and Unlock Real Growth

In today’s fast-moving financial ecosystem, many NBFCs are still stuck with outdated systems that slow down workflows, inflate operational cost...

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

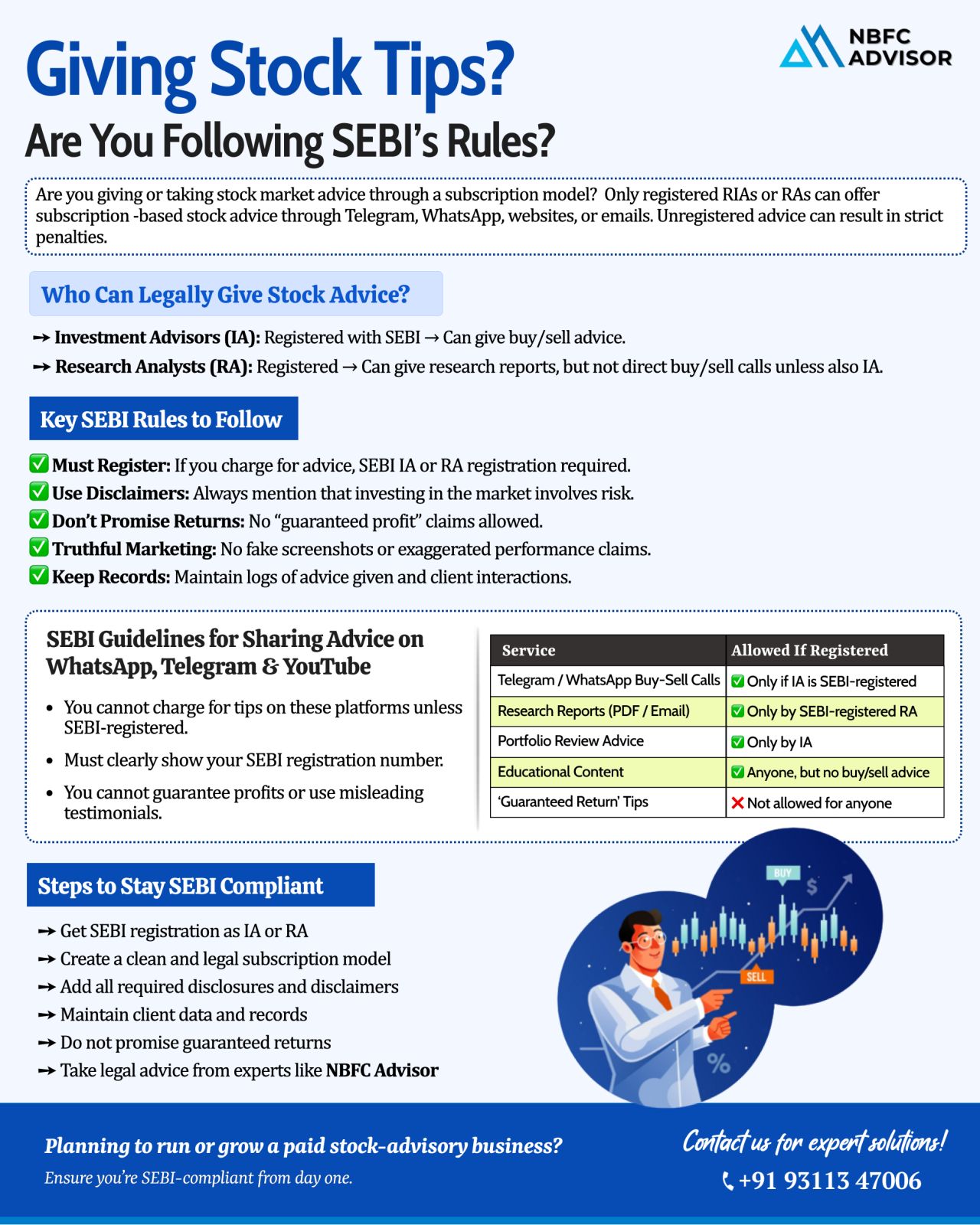

Selling Stock Tips on Telegram, WhatsApp, or Instagram? Read This Before You Start.

Social media is full of stock tips, buy/sell calls, and paid subscription groups. But many people don’t realise that SEBI has strict rules for anyone offerin...

Rising NPAs Are a Wake-Up Call for NBFCs

India’s NBFC sector is under pressure. The alarming rise in Non-Performing Assets (NPAs) is sending a clear signal—NBFCs need to act now.

From unsecured personal loans to SME and rural lendin...

RBI Tightens the Reins on NBFCs — Is Your Company Ready for Compliance Scrutiny?

India’s financial watchdog, the Reserve Bank of India (RBI), is stepping up its enforcement measures against Non-Banking Financial Companies (NBFCs). Rece...

RBI Set to Tighten Supervisory Norms for NBFCs in FY26: A Shift Toward Stricter Oversight

The Reserve Bank of India (RBI) is poised to implement tighter supervisory norms for Non-Banking Financial Companies (NBFCs) in FY26, with a particular focus...

🚨 NBFCs, Time to Gear Up for RBI’s Net Owned Fund (NOF) Deadline!

The Reserve Bank of India (RBI) has issued a clear directive, and the clock is ticking for all NBFCs!

As per the Master Direction – RBI (NBFC – Scale Based Reg...

❌ Top Reasons Why NBFC License Applications Get Rejected

1. Weak Business Plan and Unrealistic Projections

The RBI expects applicants to submit a well-defined, sector-focused business plan backed by in-depth market research and practical financia...