Thinking of Buying an NBFC? Here’s How to Do It Right

Buying a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s financial services sector. Instead of going through the long and complex process of fresh N...

NBFC Takeover Procedure in India – Complete Regulatory Guide

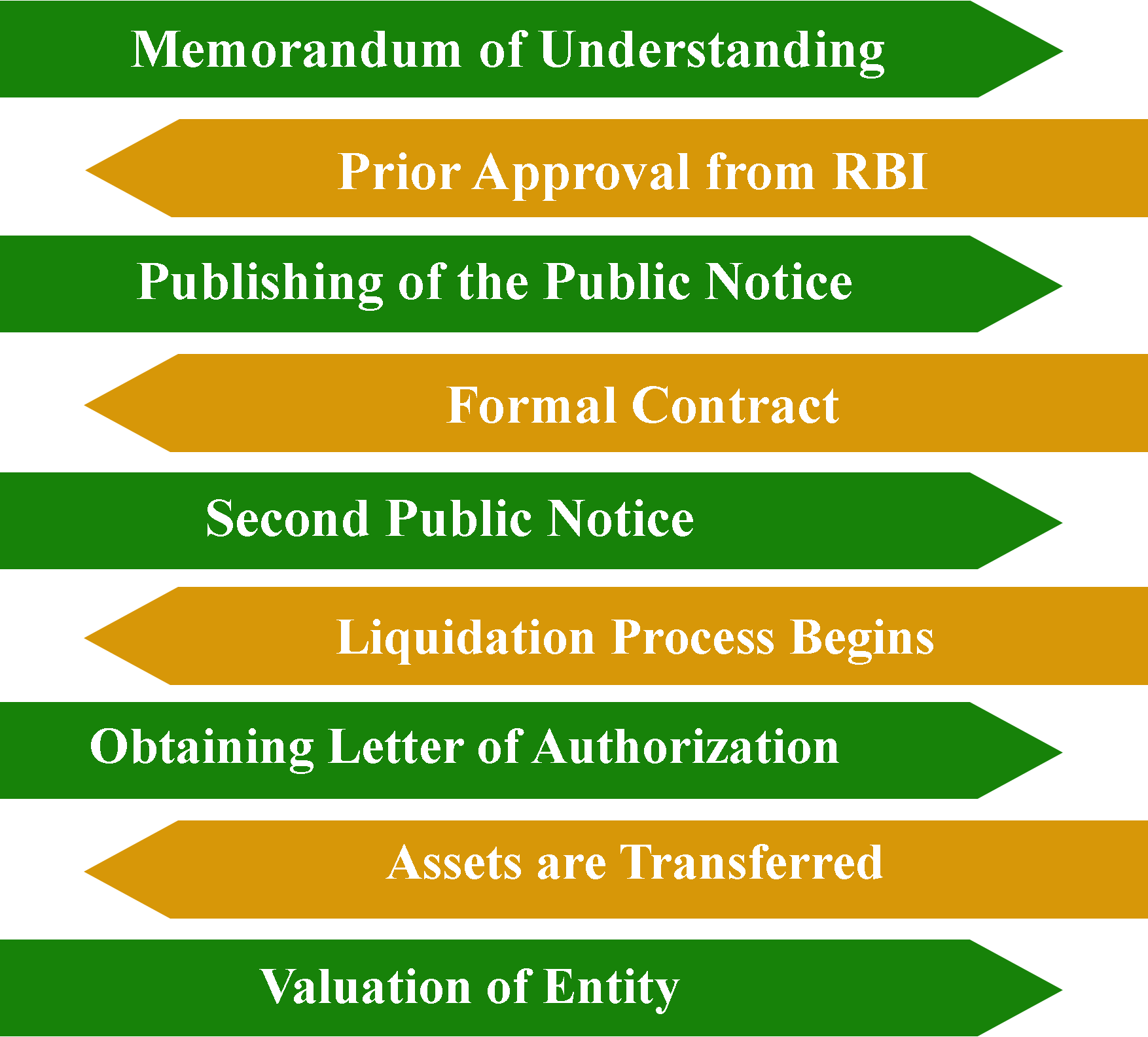

A takeover of a Non-Banking Financial Company (NBFC) is a strategic move for investors and businesses seeking a faster entry into the financial services sector. However, due to str...

NBFC Takeover Procedure in India – Step-by-Step Guide

Non-Banking Financial Companies (NBFCs) play a vital role in India’s financial ecosystem by providing credit, investments, and financial services outside traditional banking. With c...

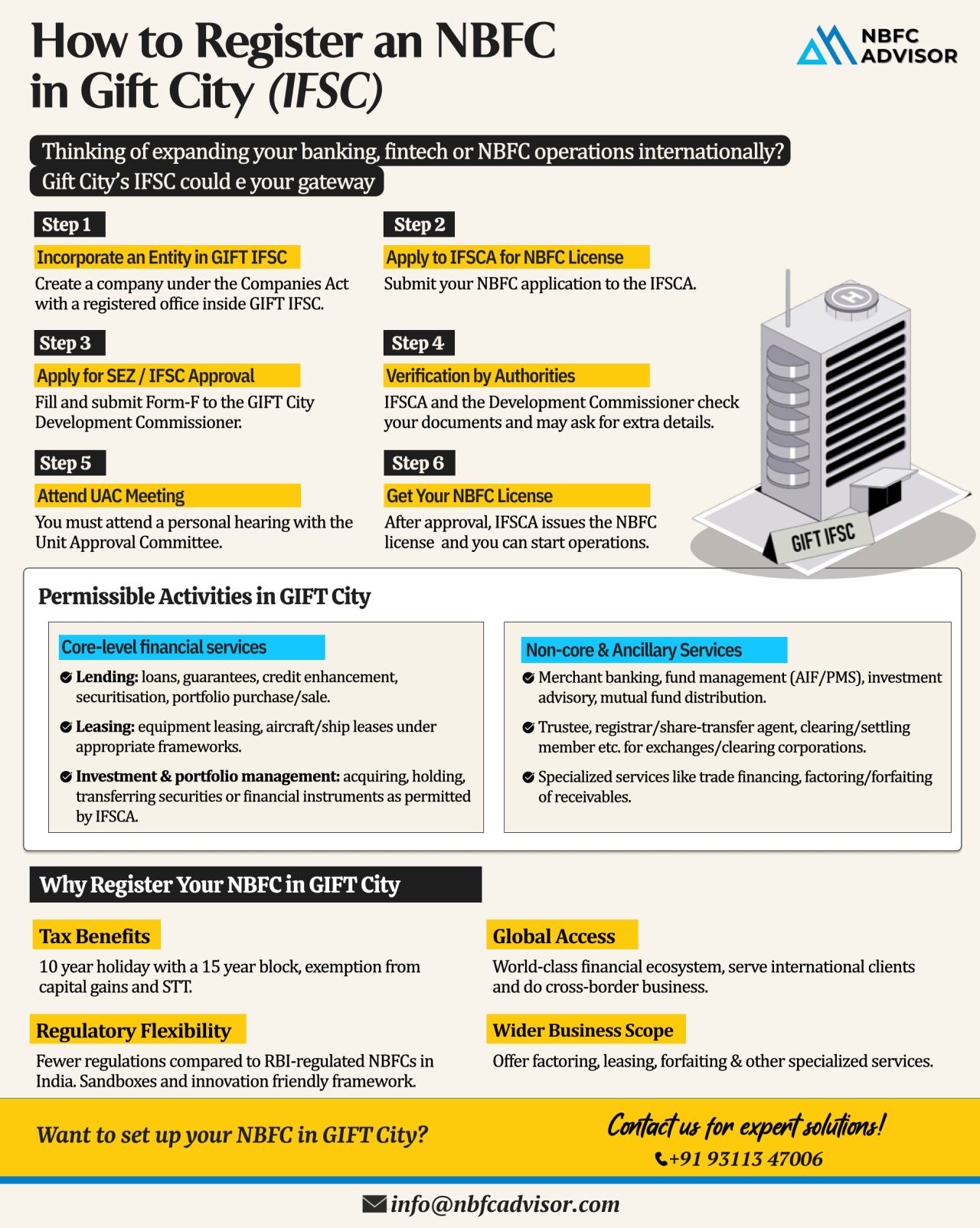

Why GIFT City?

India’s financial landscape is undergoing a major shift, and GIFT City (Gujarat International Finance Tec-City) is at the center of this transformation. Designed as India’s first International Financial Services Centre (...

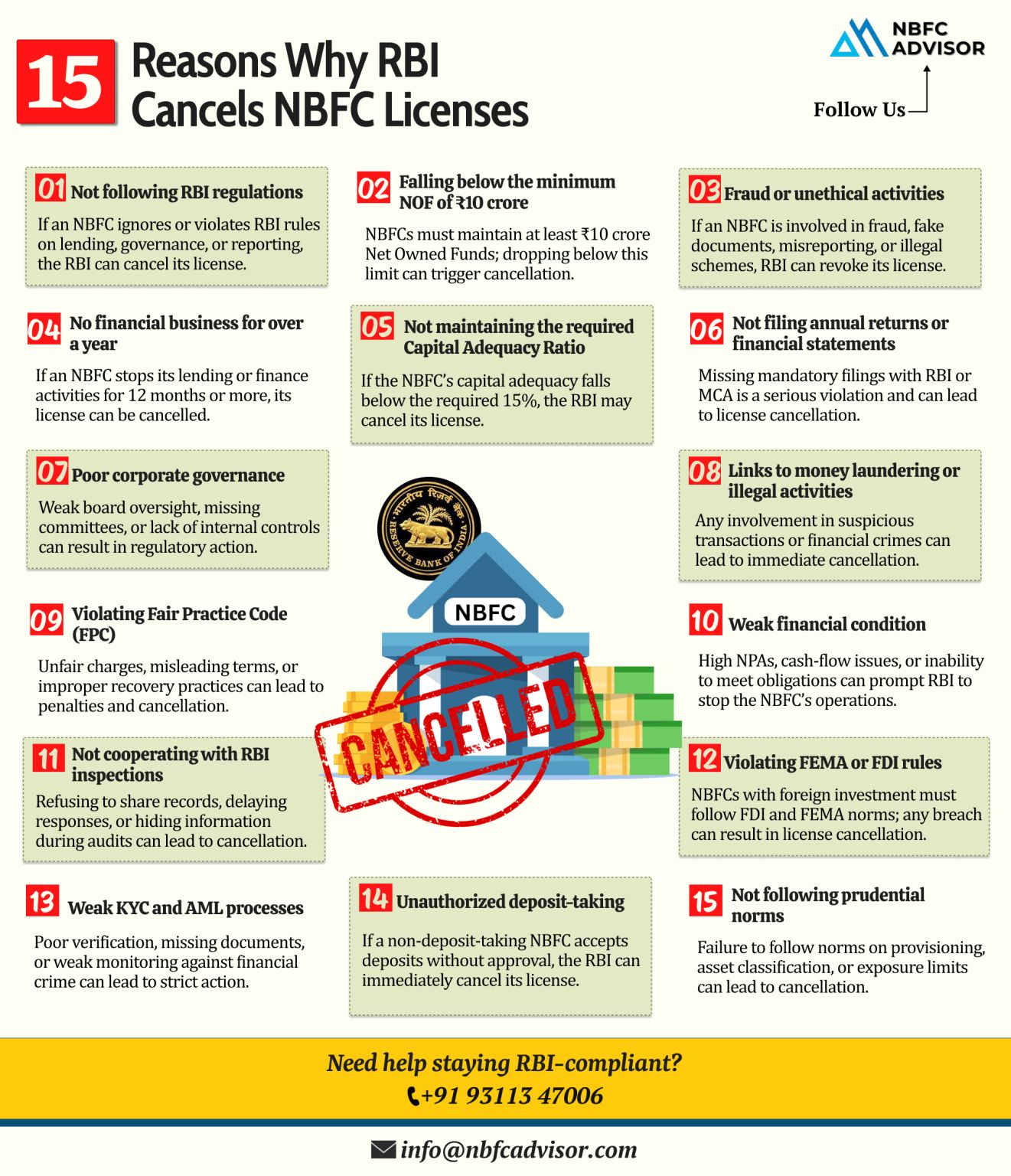

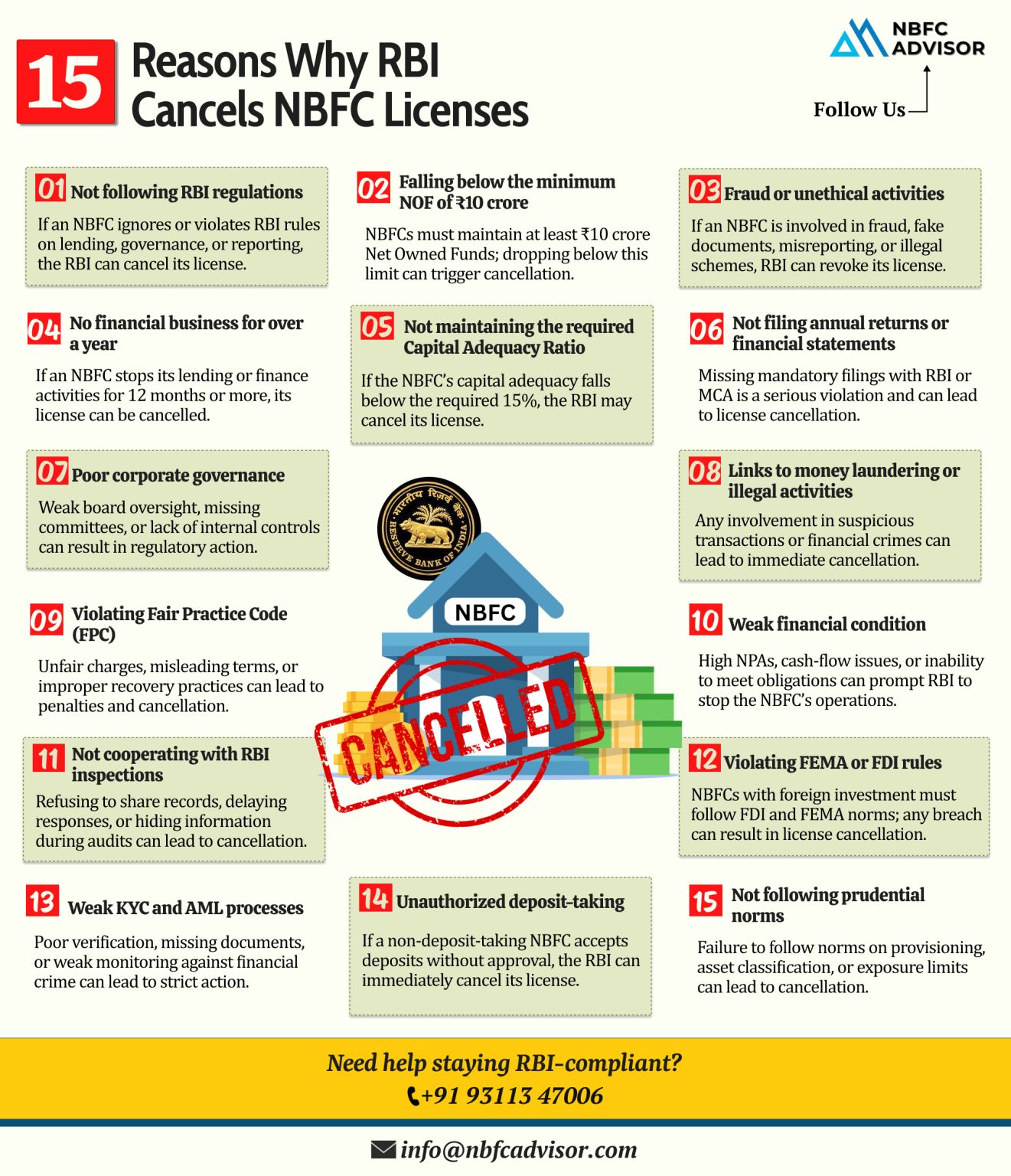

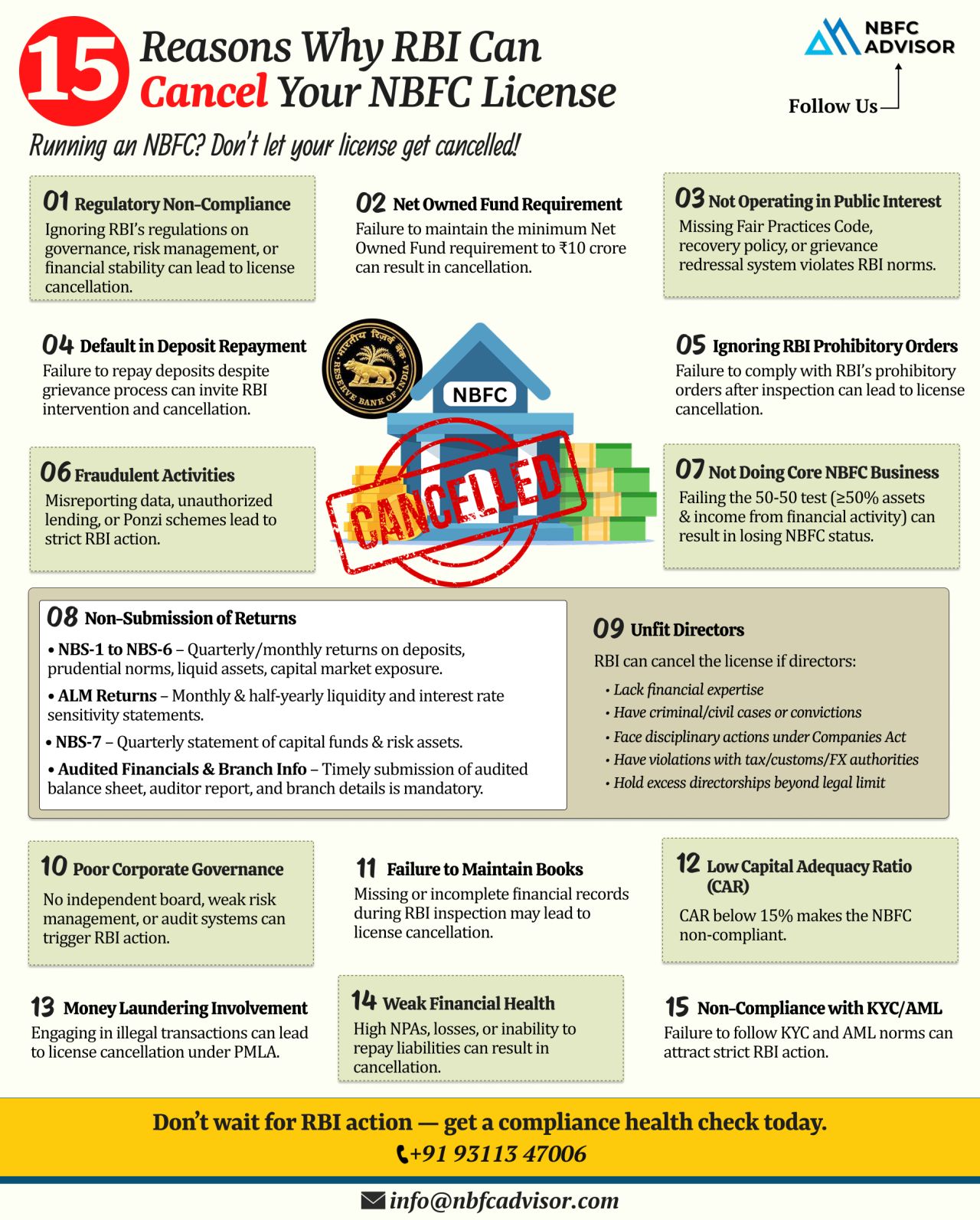

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

15 Red Flags That Can Shut Down Your NBFC

Every year, the Reserve Bank of India (RBI) cancels licenses of several Non-Banking Financial Companies (NBFCs). Surprisingly, most cancellations are not due to fraud, but rather due to missed compliance, ...

Why are Fintechs Growing Faster than NBFCs?

The financial sector is undergoing a massive transformation, and fintechs are leaving traditional NBFCs behind. The primary reason? While NBFCs continue to rely on conventional, paper-heavy systems, fint...

❌ Top Reasons Why NBFC License Applications Get Rejected

1. Weak Business Plan and Unrealistic Projections

The RBI expects applicants to submit a well-defined, sector-focused business plan backed by in-depth market research and practical financia...