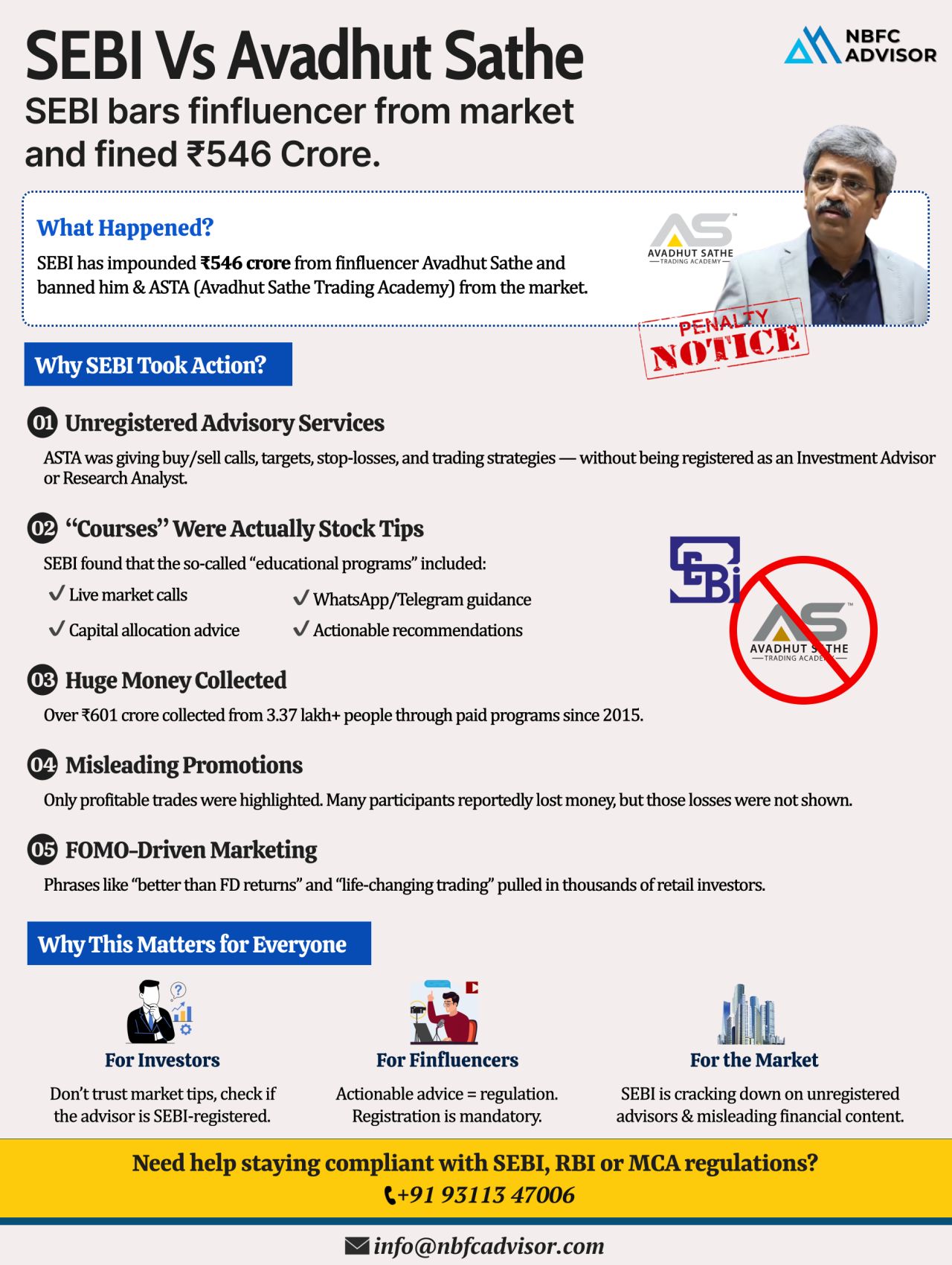

SEBI Froze ₹546 Crore Overnight! A Wake-Up Call for the Finance & Fintech Ecosystem

In one of its strongest enforcement actions to date, the Securities and Exchange Board of India (SEBI) has impounded ₹546 crore linked to finfluencer Avadhut S...

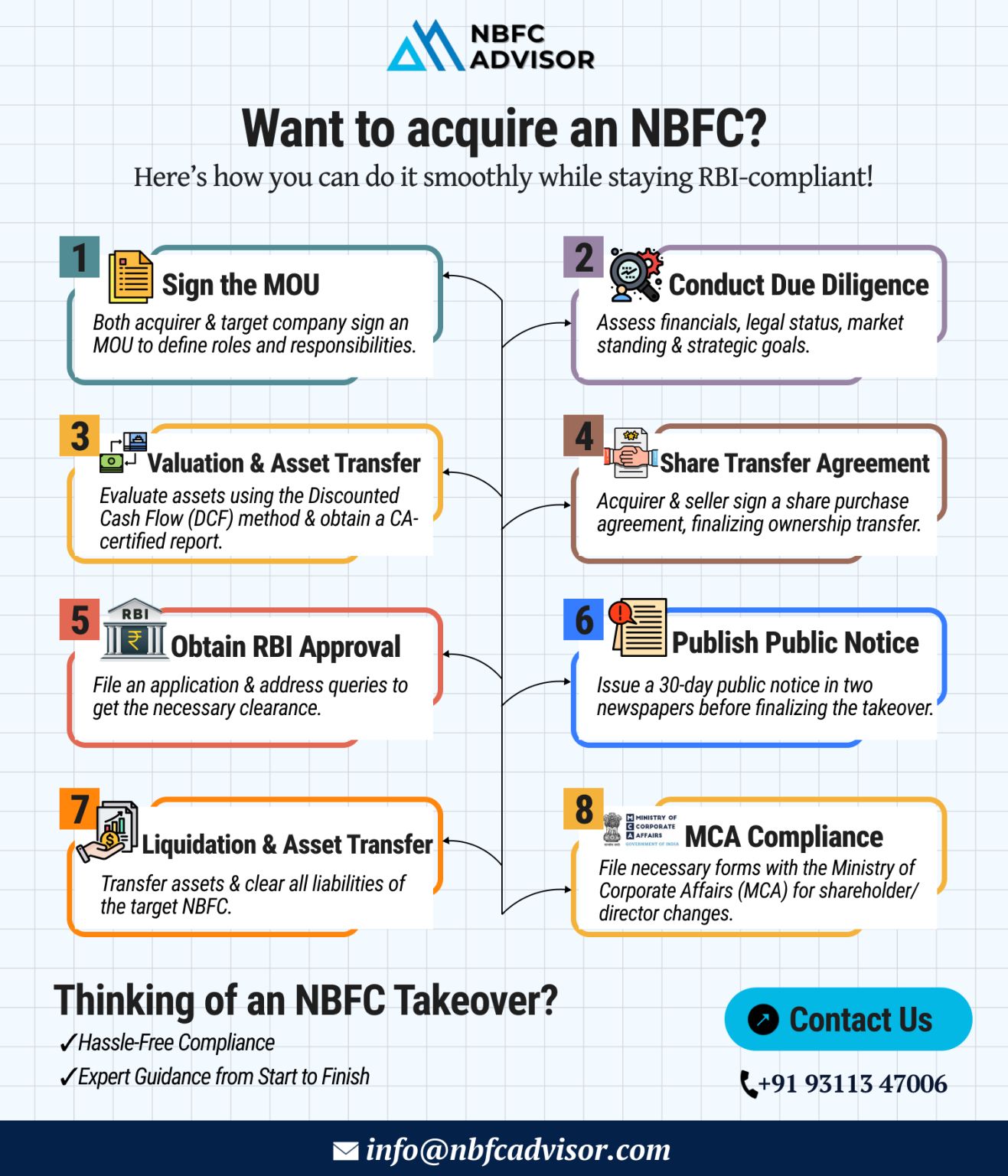

Looking to Acquire an NBFC for Sale? Here’s What You Must Check Before Buying

Acquiring a Non-Banking Financial Company (NBFC) is one of the fastest ways to enter India’s growing financial services sector. However, buying an NBFC witho...

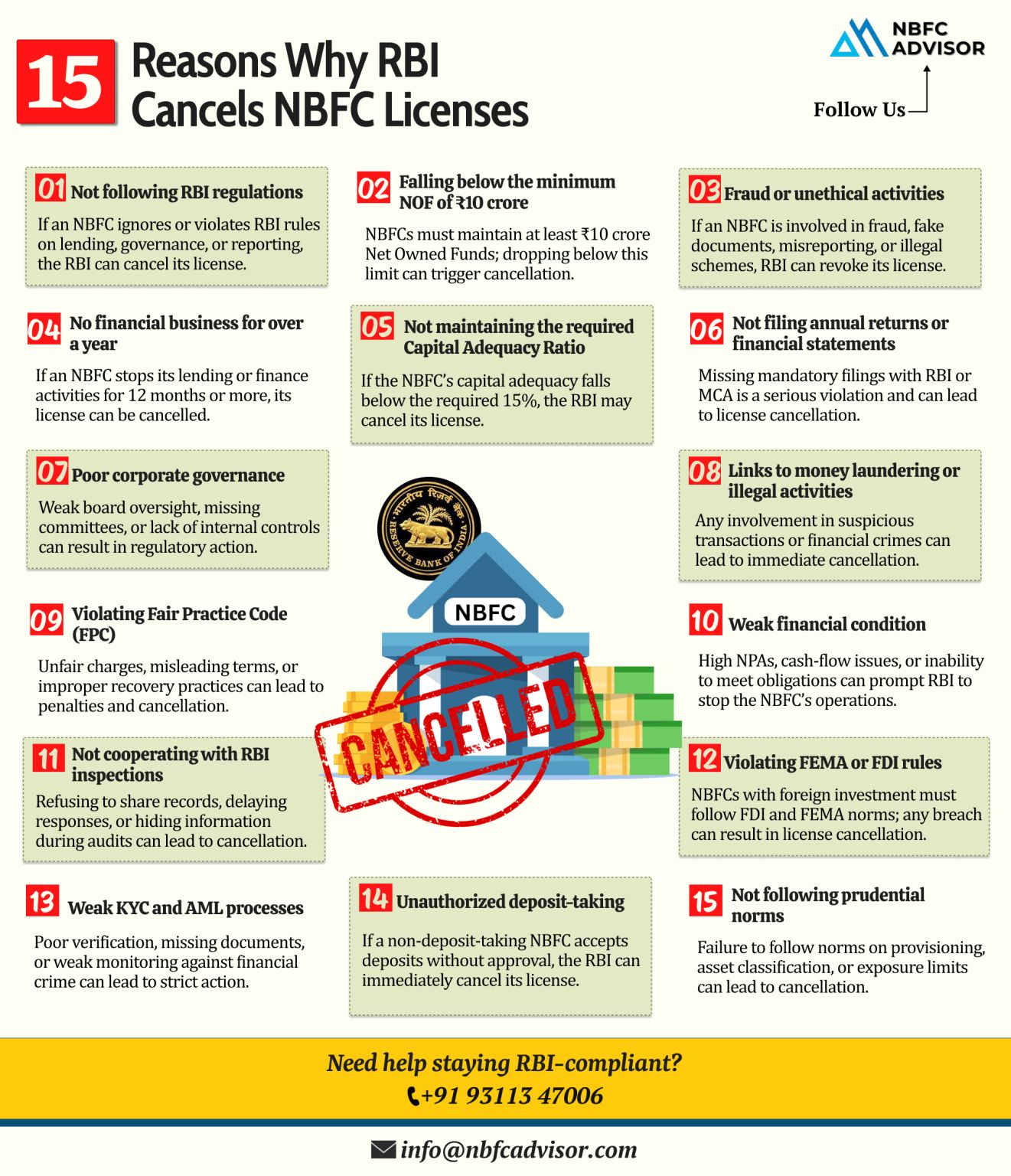

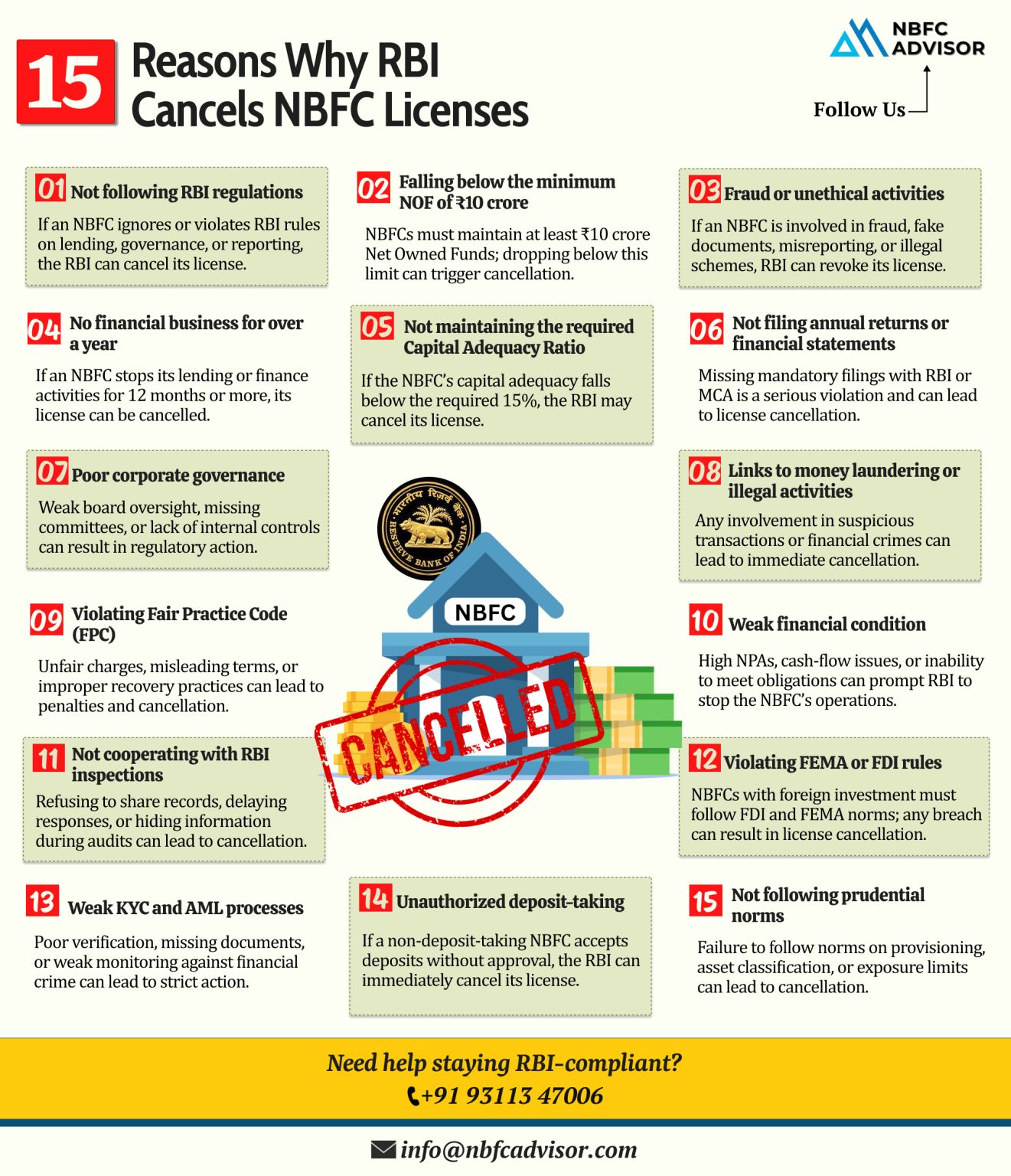

RBI Can Cancel an NBFC Licence — And Many Reasons Are Avoidable

An NBFC licence issued by the Reserve Bank of India (RBI) is not permanent. RBI has the power to cancel or revoke an NBFC’s Certificate of Registration (CoR) if regulatory...

RBI Can Cancel an NBFC License — Here Are the Key Risks You Must Avoid

Running an NBFC comes with immense responsibility. The Reserve Bank of India (RBI) closely monitors the functioning, governance, and financial stability of every NBFC in ...

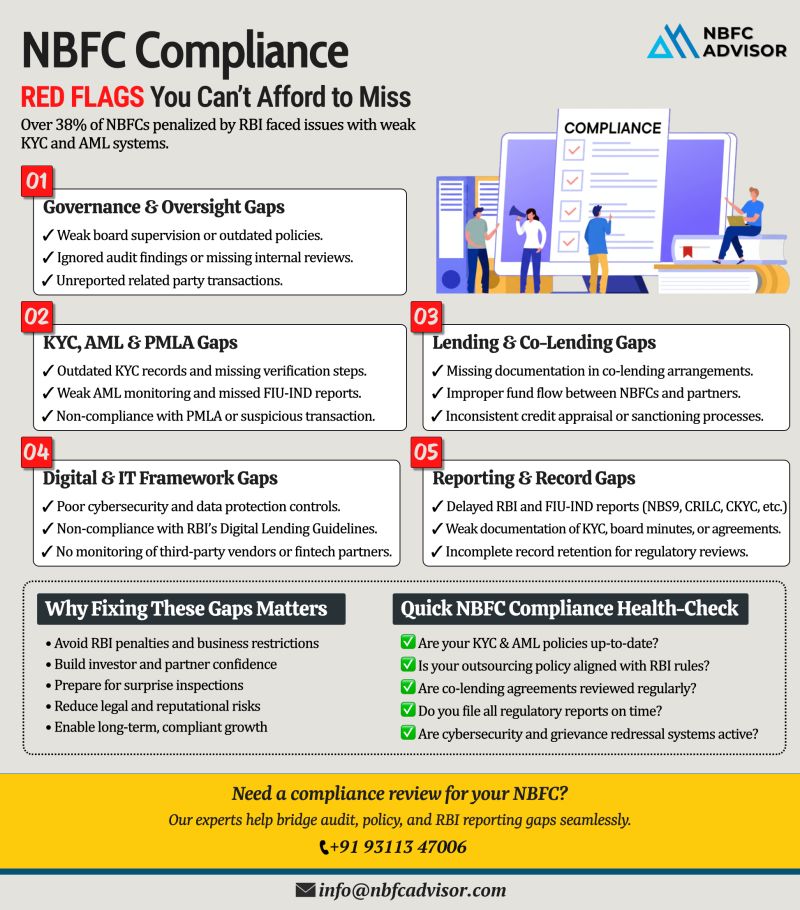

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

NBFC Takeovers: A Fast Track to Enter India’s Booming Digital Lending Market

India’s digital lending industry is witnessing an unprecedented surge, with projections suggesting it will touch $515 billion by 2030. From P2P lending platfo...

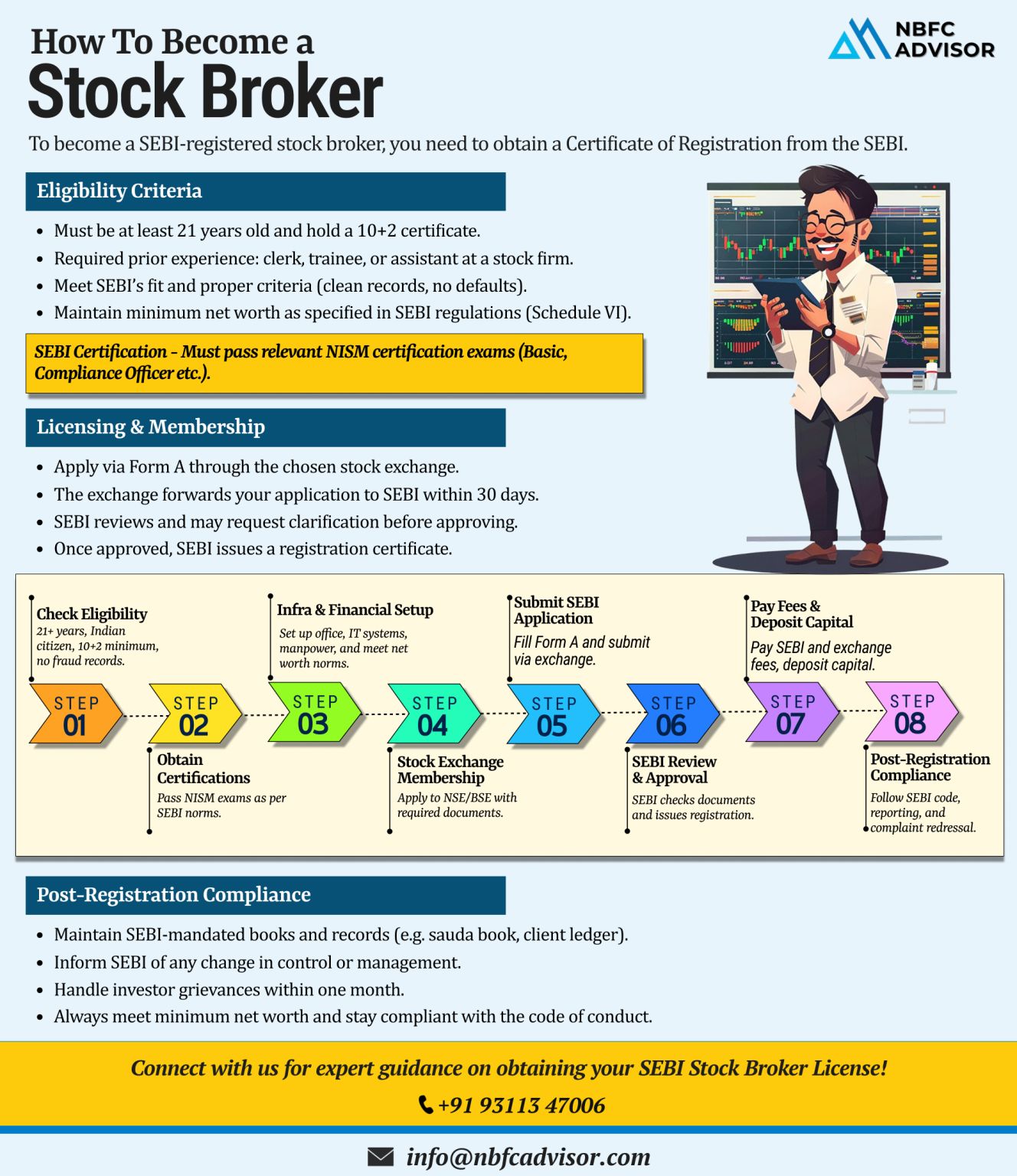

Thinking of Becoming a SEBI-Registered Stock Broker?

A SEBI-registered stock broker license opens the door to operating legally in India’s capital markets. Whether you plan to trade in equities, derivatives, or other securities, you must mee...

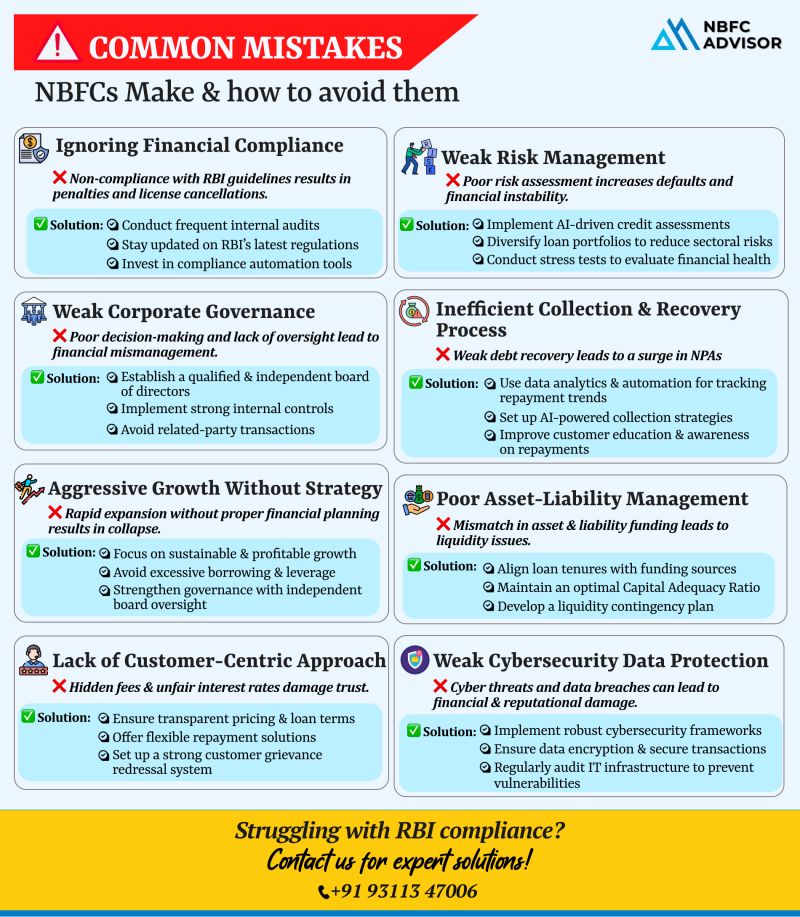

Is Your NBFC Making These Costly Mistakes?

In recent years, the Non-Banking Financial Company (NBFC) sector in India has witnessed rapid growth—but also increased regulatory scrutiny. From RBI license cancellations to skyrocketing NPAs, many...

Avoid These 10 Common Mistakes When Registering an AIF

Registering an Alternative Investment Fund (AIF) with SEBI is a crucial step for fund managers and institutions looking to enter India’s alternative investment space. However, the regist...

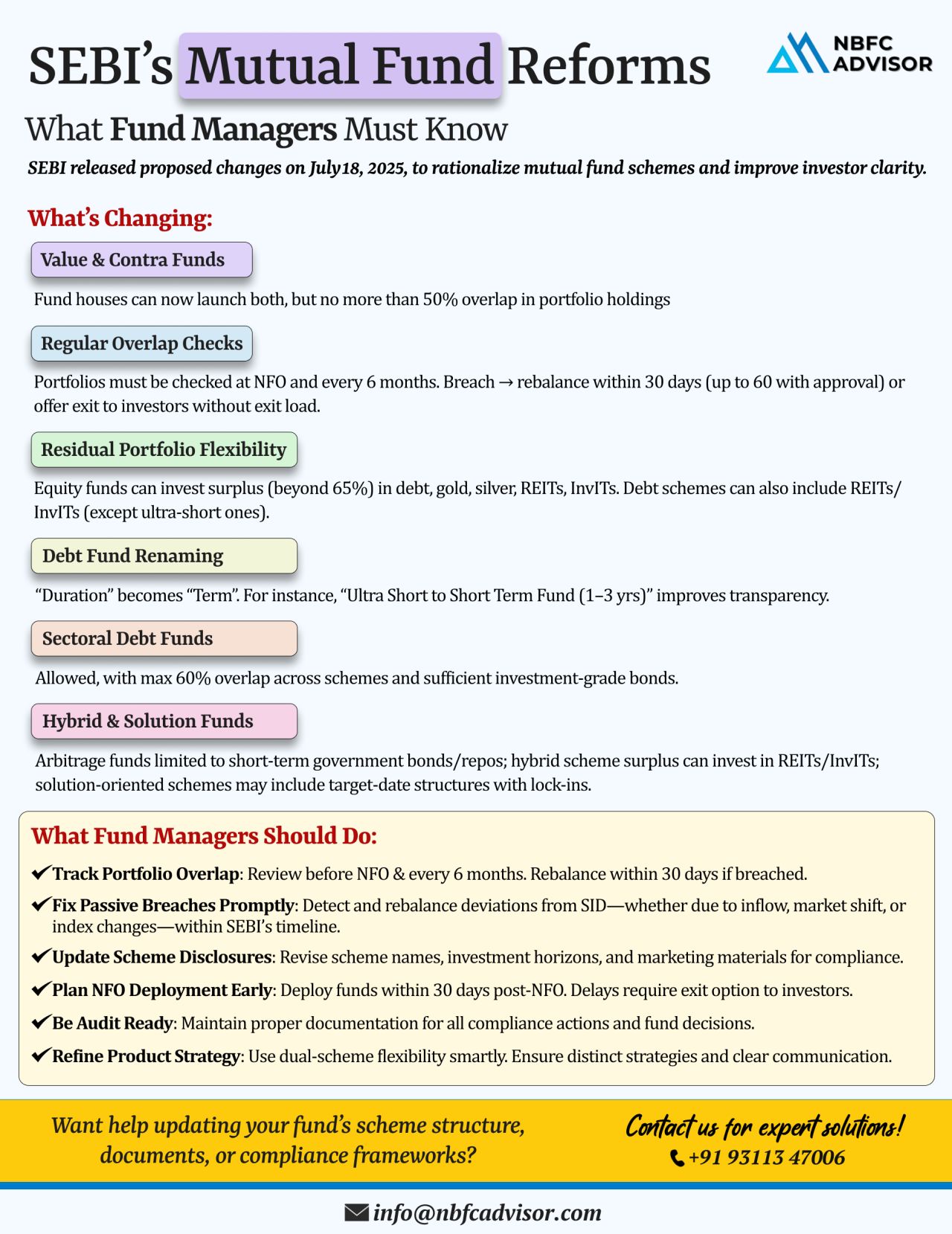

🧭 Enhancing Clarity, Transparency & Flexibility: SEBI’s New Era of Mutual Fund Reforms

In a move to simplify mutual fund structures and protect investor interests, the Securities and Exchange Board of India (SEBI) has proposed a set of ...

📰 SEBI’s New Mutual Fund Reforms: What Investors & Fund Managers Need to Know

The Securities and Exchange Board of India (SEBI) has proposed sweeping changes to the mutual fund framework to enhance transparency, reduce overlap, and ensu...

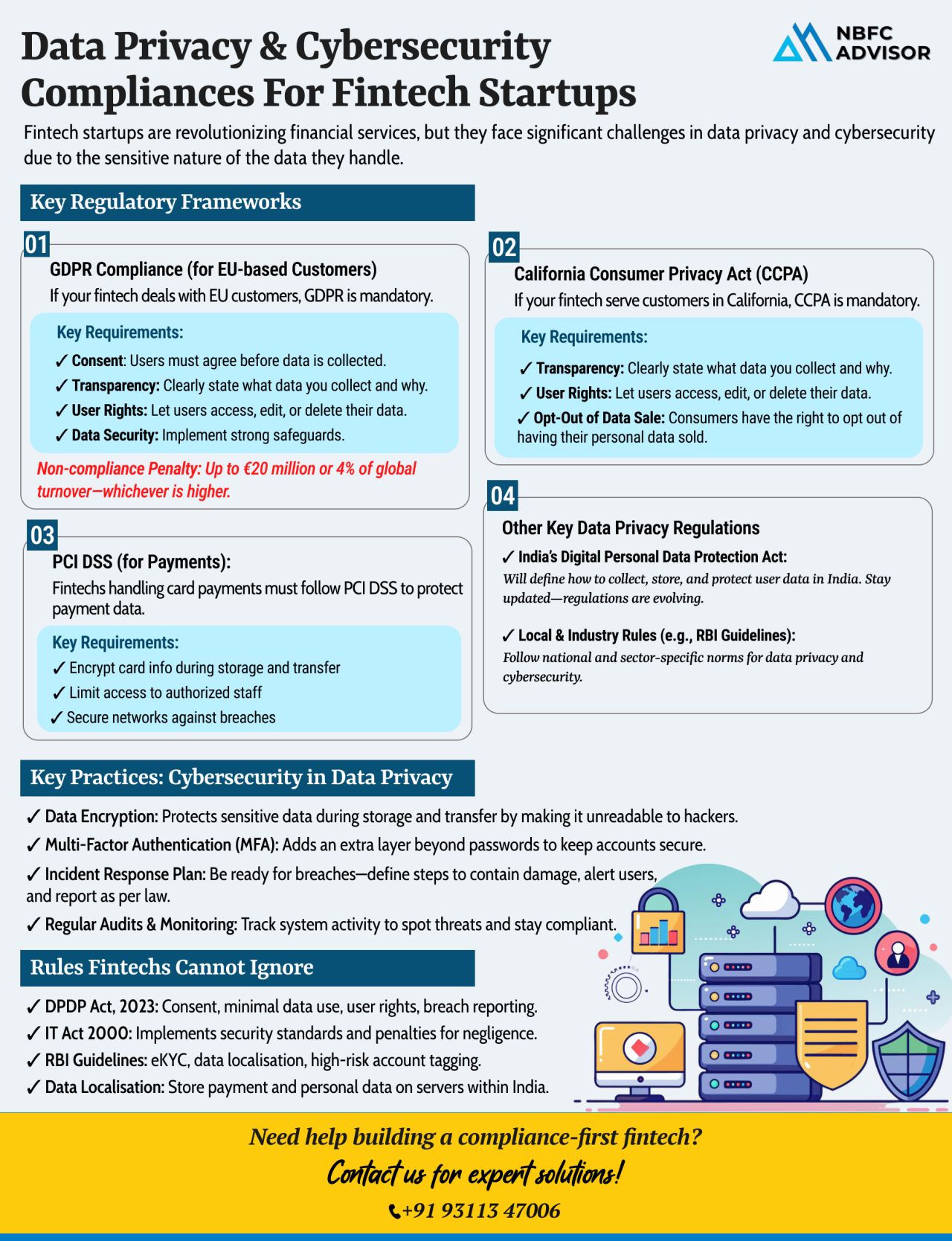

Building a Fintech? One Data Leak Can Destroy Everything

In today’s digital-first world, launching a fintech startup is an exciting venture—but one security misstep can bring it all crashing down. Whether you're building a lending ...

Thinking of Buying an NBFC? Here’s How to Do It Right

Acquiring a Non-Banking Financial Company (NBFC) can be a strategic move that opens doors to new business opportunities, especially in lending, fintech, and microfinance sectors. But here...

RBI Set to Tighten Supervisory Norms for NBFCs in FY26: A Shift Toward Stricter Oversight

The Reserve Bank of India (RBI) is poised to implement tighter supervisory norms for Non-Banking Financial Companies (NBFCs) in FY26, with a particular focus...

Non-Banking Financial Companies (NBFCs) are essential players in India's financial ecosystem. They provide crucial financial services such as loans, credit facilities, asset financing and investment services, often reaching segments of the popula...

The financial services sector in India is vast and multifaceted, with Non-Banking Financial Companies (NBFCs) playing a crucial role in providing credit and investment solutions. With their increasing presence and significance in the economy, NBFC ta...

In recent years, the Non-Banking Financial Companies (NBFC) sector in India has experienced considerable growth, playing a critical role in providing financial services such as loans, credit and investment. As a result, NBFC takeovers have become inc...